Sundry Photography

Thesis

Snowflake Inc. (NYSE:SNOW) heads into its FQ3’23 earnings release on November 30, as SNOW has struggled to regain momentum toward its August highs.

SNOW bulls could argue that the worst is likely over for the cloud data company. Notwithstanding, we believe the market has positioned Snowflake cautiously heading into its earnings release.

The recent uncertainties over further cuts in enterprise cloud spending could impact consumption-based models like Snowflake. Notwithstanding, a better-than-expected Q3 report from CEO Frank Slootman & team could lift buying sentiments given the cautious positioning.

We discuss why we think a material re-rating in SNOW is unlikely in the near term. Despite SNOW’s significant growth projections, its valuation remains too expensive to justify an aggressive position at the current levels. Therefore, Snowflake needs to demonstrate robust market share gains while charting a clear path toward profitability.

Despite that, we discuss why investors should remain on the sidelines for now. Maintain Hold.

The Market Is Likely Anticipating Weak Guidance

Cloud computing companies have had a difficult Q3 release. Enterprise spending was anticipated to remain robust, but cracks appeared in the hyperscaler business. Notably, Amazon (AMZN) and Microsoft (MSFT) both reported a discernible deceleration in their cloud segments, as we discussed in recent articles (here and here).

Twilio’s (TWLO) recent earnings showed that the consumption-based model is under further threat as companies rationalize their spending behavior. Likewise, Palantir’s (PLTR) earnings release accentuated the significant growth deceleration in its commercial business, even though its government business showed an inflection.

Therefore, we believe the market is positioning for Snowflake to deliver a less remarkable Q3 release, coupled with relatively tepid guidance. Thus, the market seems less enthusiastic about following the optimism of the Street analysts.

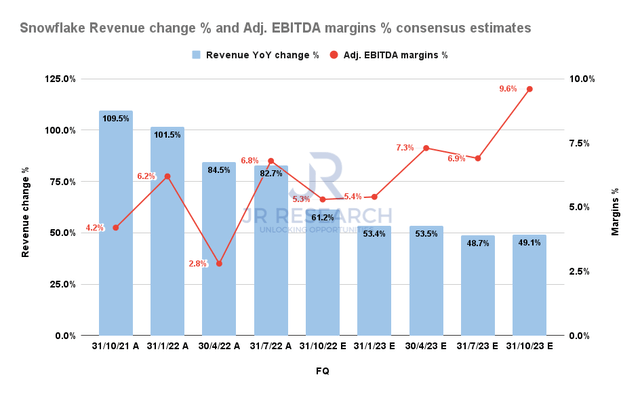

Snowflake Revenue change % and Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

As seen above, Wall Street projected Snowflake to post revenue growth of 61.2% in FQ3, up from September’s estimates of 60.6%. It also expects Snowflake to deliver guidance of at least 53.4% growth in Q4 to finish FY23, up from September’s 52.5% growth estimates.

Therefore, the bar has been lifted for Snowflake to cross, which doesn’t bode well in the current macro environment. As such, we believe the recent de-rating in its valuation from its August highs is justified to reflect higher execution risks.

But, the question is whether SNOW’s valuation is reasonable enough to consider taking exposure now.

SNOW Remains Very Pricey

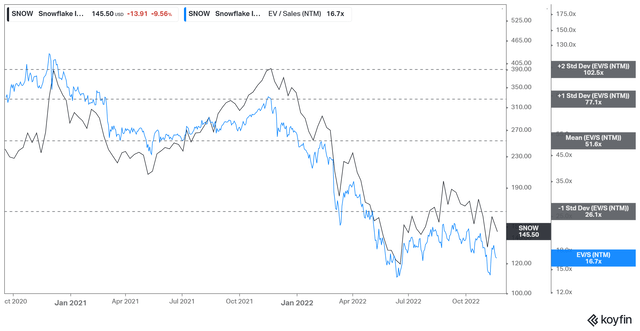

SNOW NTM Revenue multiples valuation trend (koyfin)

SNOW last traded at an NTM revenue multiple of 16.7x, pretty close to its all-time lows in June of about 14x. However, it’s still much higher than its high-growth SaaS peers (although Snowflake doesn’t consider its business a traditional SaaS model). As modeled by Public Comps, it’s still way above its high-growth peers’ median of 7.2x.

Notwithstanding, Snowflake’s operating model has significant operating leverage potential, as highlighted at the company’s Investor Day in June. Hence, we urge investors to consider modeling SNOW’s valuations based on its profitability metrics to assess its operating leverage.

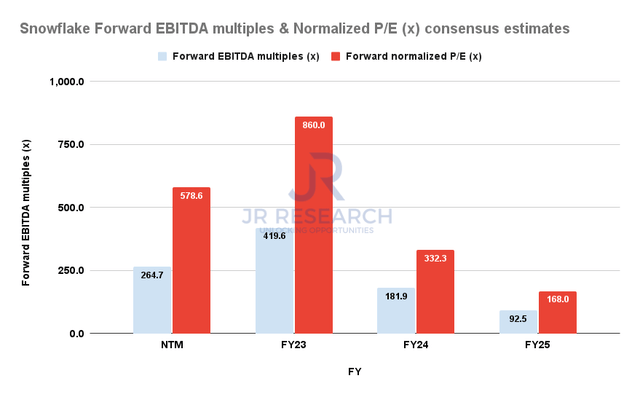

SNOW Forward Adjusted EBITDA multiples consensus estimates (S&P Cap IQ)

SNOW last traded at an FY25 (ending January 2025) EBITDA multiple of 168x, or FY25 normalized P/E of 92.5x.

Therefore, despite the significant operating leverage gains through the end of 2024, we believe considerable optimism has been reflected in its valuation. However, compared to the Software industry’s 10Y average P/E of 36x (according to S&P Cap IQ data), we find it highly challenging to justify SNOW’s embedded growth premium.

Is SNOW Stock A Buy, Sell, Or Hold?

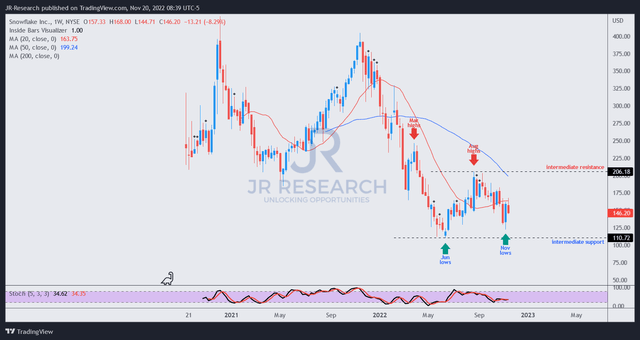

SNOW price chart (weekly) (TradingView)

SNOW remains nearly 30% below its August highs, reflecting the market’s caution given the slew of relatively weak earnings releases from its enterprise SaaS and cloud computing peers.

However, buyers appeared to have returned to support its November lows, which is constructive to defend its intermediate support zone. Therefore, we believe the worst seems to be over for SNOW, and we don’t expect much further downside from the current levels. The market appears ready to undergird its pricey valuation.

However, its August highs are a significant impediment to its potential re-rating. Therefore, while we think the worst could be over for SNOW, we postulate a near-term re-rating is unlikely in the current macro environment, coupled with its significant growth premium.

Hence, we believe SNOW could remain in a consolidation zone for now. Maintain Hold.

Be the first to comment