Jose Luis Pelaez Inc

Risk-off sentiment continues to dominate global markets. Although there have been hints that the worst of the selling has passed, there’s still plenty of room for skepticism, based on trends for key markets via a set of ETF pairs for prices through Thursday’s close (Nov. 17).

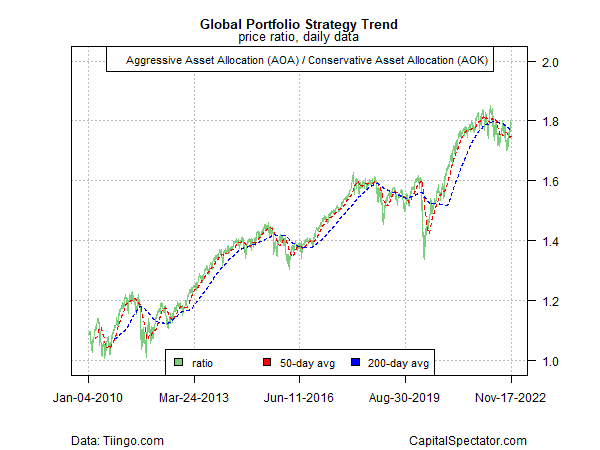

Let’s start with the ratio of an aggressive asset allocation strategy (AOA) to conservative (AOK). Although the trend for this proxy has popped lately, the downside bias remains intact, based on 50- and 200-day moving averages, and so it’s premature to assume that the bear market has been exhausted.

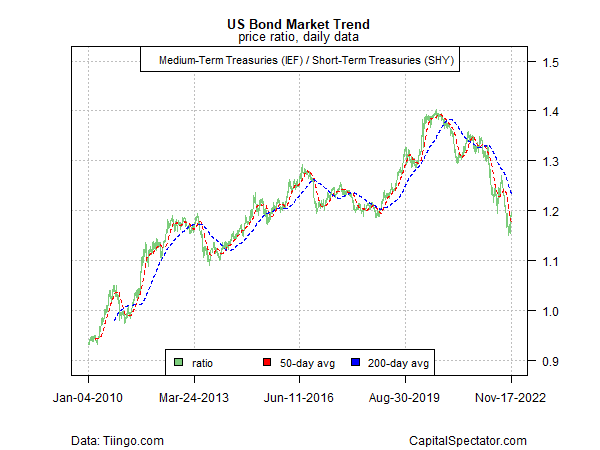

The downside bias for medium-term Treasuries (IEF) relative to short-term Treasuries (SHY) certainly hasn’t changed, which suggests that the appetite for safety remains strong.

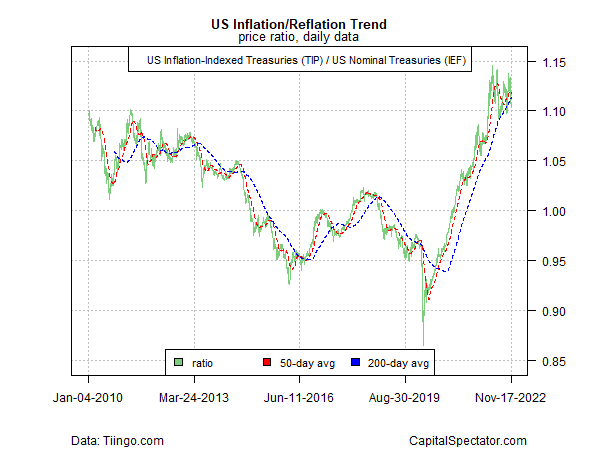

Risk-on for the inflation/reflation trade continues to hold its ground, based on the ratio for inflation-indexed Treasuries (TIP) vs. their standard counterparts (IEF), but the trend is looking tired and is vulnerable if the economy continues to weaken.

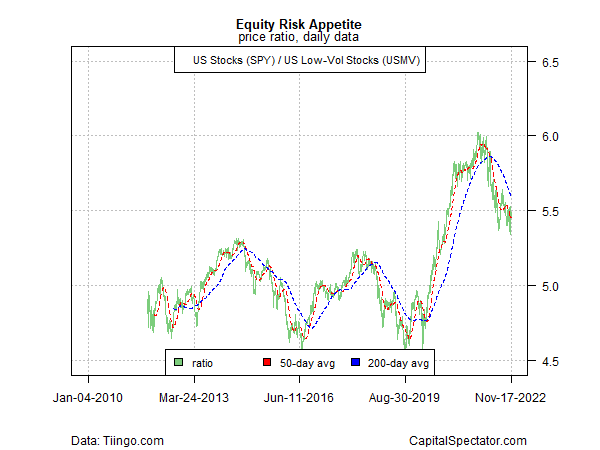

Estimating the risk appetite for US equities (SPY) relative to a portfolio of low-volatility shares (USMV) continues to signal risk-off.

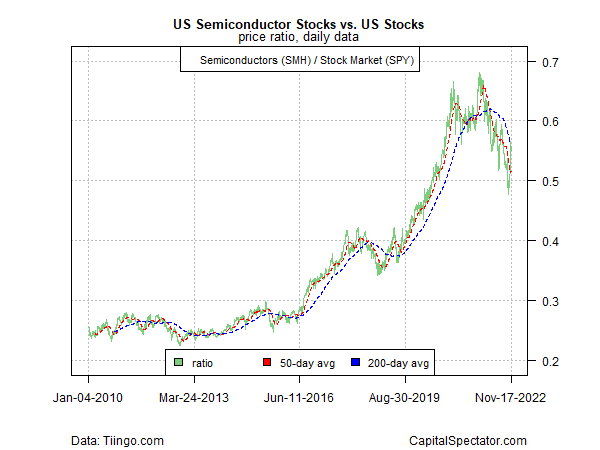

A proxy for economic activity – semiconductor stocks (SMH) vs. equities overall (SPY) – has enjoyed a relief rally lately, but it’s too early to say that the bearish trend for this proxy has ended.

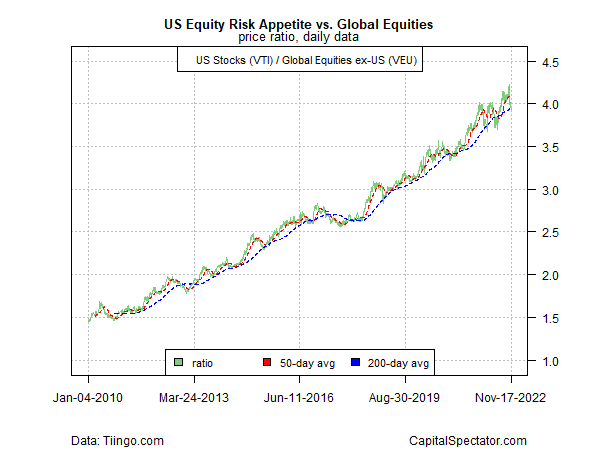

Despite the bearish bias for stocks generally, the appetite for US equities (VTI) over foreign stocks (VEU) persists.

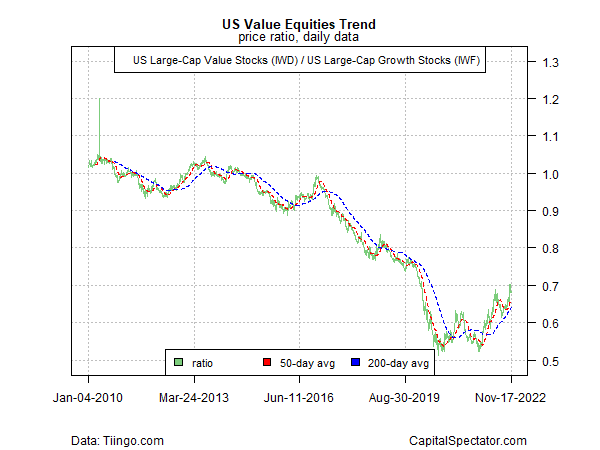

Finally, relative strength for value stocks (IWD) vs. growth stocks (IWF) continues to run. The logic is the widely held view that value shares tend to outperform when interest rates are rising. On that basis, expectations that the Federal Reserve will continue to hike rates in the near term imply that value will continue to outperform.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment