Ivan Zhaborovskiy/iStock via Getty Images

Introduction

Advantage Energy (OTCPK:AAVVF) is one of my favorite natural gas producers in Canada as I am very charmed by the company’s low production cost and low sustaining capex. This enabled the company to report strong earnings and cash flows. These cash flows allow Advantage to invest in oil-focused production expansion while rapidly strengthening the balance sheet. Meanwhile, Advantage is still unlocking the value of the Entropy business.

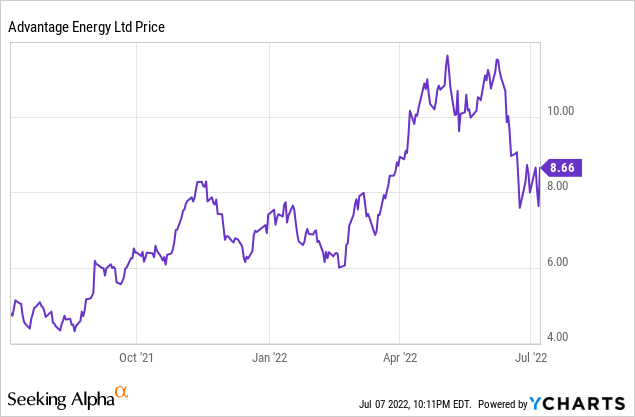

As Advantage is a Canadian company focusing on its Canadian assets, I would strongly recommend trading in the company’s securities using the Canadian listing where Advantage is trading with AAV as its ticker symbol. The average daily volume is approximately 1.1 million shares per day. With a current share count of 190.8 million shares, the market capitalization comes in at C$1.65B.

The first quarter was strong and Q2 will likely be even better

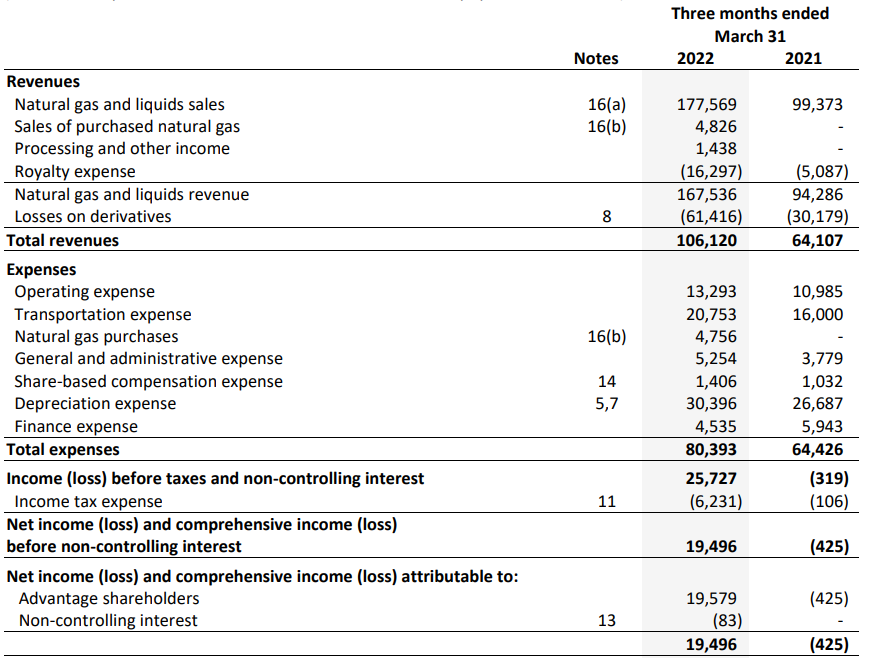

In the first quarter, Advantage was able to lock in a substantially higher natural gas price as the realized price increased from C$3.07 to C$5.04 while the average price for the liquids increased by in excess of 70%. The combination of both price increases caused the average price per barrel of oil equivalent sold to $37.26 (before taking the losses on the hedging positions into account).

The total revenue came in at C$167.5M after taking the royalty expenses into account. However, the company also deducts the losses on derivatives from the revenue (rather than considering these to be a finance expense) and the ‘total’ revenue reported by the company was C$106.1M.

Advantage Energy Investor Relations

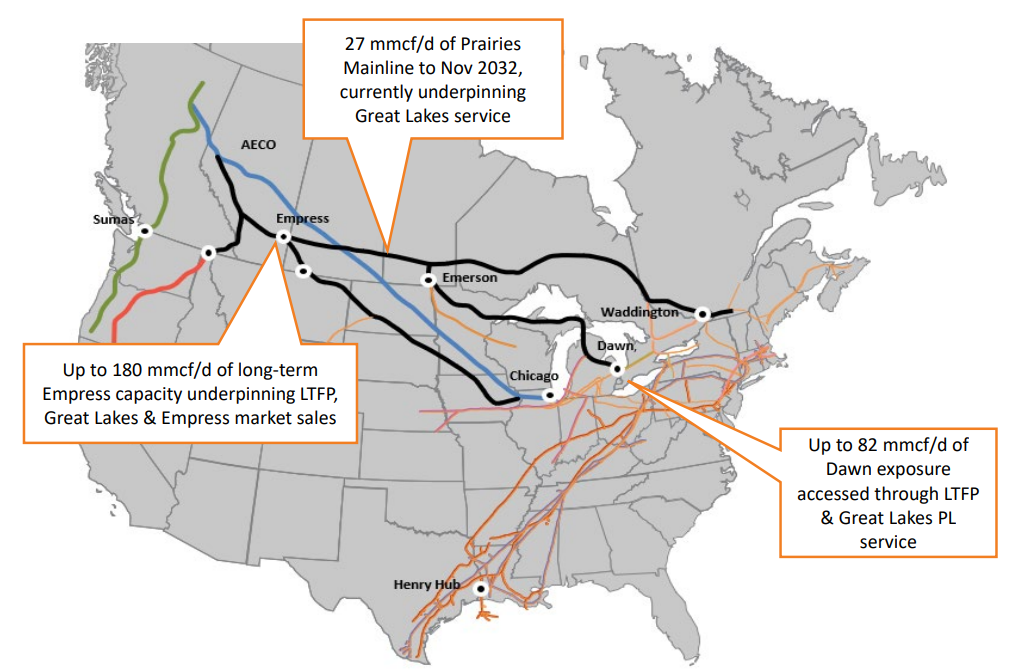

As you can see above, the transportation expenses are higher than the operating expenses which further emphasizes the low-cost nature of Advantage and one of the main reasons why the transportation expenses are this high is Advantage’s focus on diversifying its selling points. Rather than just relying on the local AECO natural gas price in Canada, Advantage actually sends natural gas all the way to Chicago and the Canadian East Coast.

Advantage Energy Investor Relations

The bottom line shows a net income of C$19.5M or C$0.10 per share but, keep in mind, this includes C$61.5M in realized and unrealized losses on the hedge book. The majority of those losses are unrealized, and just about C$10M were actually realized during the quarter. As an unrealized hedging loss isn’t a cash element, the operating cash flow posted by Advantage Energy is much stronger than the net income may make you think.

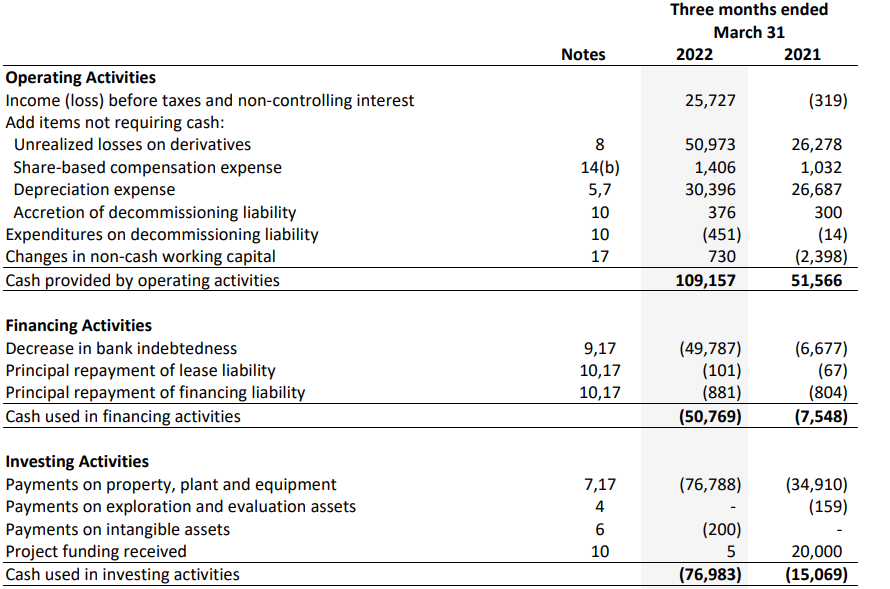

As you can see below, the reported operating cash flow was C$109.1M and after deducting the C$0.7M contribution from the working capital position and after deducting the C$0.1M in lease payments, the adjusted operating cash flow was C$108.3M.

Advantage Energy Investor Relations

The total capex was just around C$77M resulting in a positive free cash flow of C$31M. Not only is that already more than 50% higher than the reported net income, keep in mind Advantage has been investing pretty aggressively in the first quarter. The total capex was almost C$77M which is more than 2.5 times higher than the depreciation expenses.

As explained in my previous article, the sustaining capex is approximately C$75M per year. Even if I would use C$25M per quarter, the underlying free cash flow would be around C$83M or C$0.43/share. So on an annualized basis, the free cash flow per share is approaching C$1.80 on a sustaining basis. And that excludes any value that could be given to the Entropy subsidiary which focuses on the carbon capture and storage sector. The company has started commissioning the first project at the Glacier Gas plant in Alberta.

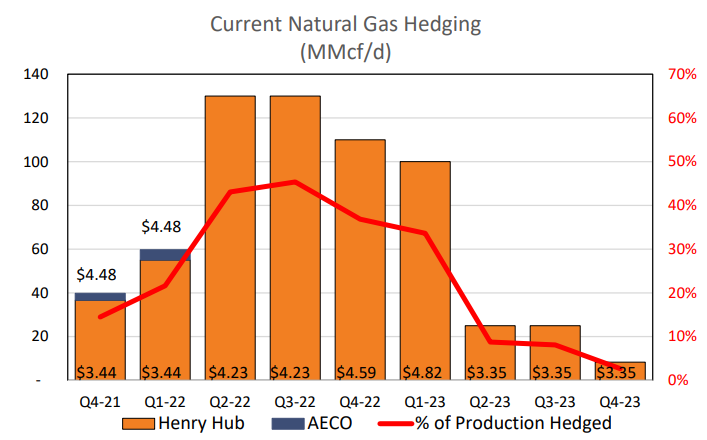

The full-year capex is estimated at C$170-200M, so Advantage has definitely front-loaded this year’s capex. For 2023, the company is already guiding for a higher capex spending as it wants to take another important step forward to further boost its production rate. Meanwhile, the investments in the first quarter are paying off as Advantage confirmed it produced in excess of 60,000 boe/day in the second quarter, which is approximately 15% more than in the first quarter. With 89% of those oil-equivalent barrels consisting of natural gas, I expect Advantage to post an excellent financial result in Q2 as the average natural gas price should also exceed the average realized price in the first quarter. Additionally, the average hedging price in the second quarter was higher than in Q1, so I’m not expecting too much of an issue in terms of realized and unrealized hedging losses.

Advantage Energy Investor Relations

In 2023, Advantage wants to grow by an additional 10-15% and now expects to spend C$225-275M to complete the expansion program. Seeing how the quarterly operating cash flow already exceeded C$100M in Q1 2021, Advantage can easily self-fund its expansion program while also kicking off a share buyback now its lenders have removed a few elements from the debt agreement.

Investment thesis

I tried to pick up more shares this week as Advantage’s share price fell back into the C$7 range which I think provides excellent value. I am hoping the share price will retreat again, but if that doesn’t happen, I may have to pay over C$8 to add to my position. Together with Spartan Delta (OTC:DALXF), Advantage Energy is my favorite player in the Canadian natural gas space as it combines a low-cost production with a strong balance sheet that will likely move into a net cash position by the end of this year.

Be the first to comment