JHVEPhoto/iStock Editorial via Getty Images

I’ve written about Invesco (NYSE:IVZ) before. The bottom has dropped out of the market since then, which means that Invesco, along with most other things, has dropped significantly. The end result here has been a decline – at least for now.

But we’re now in a better position with a better yield – and that is what we’re taking a look at.

So let’s see what the business can offer us at this juncture.

Invesco and its future – revisiting the company

I actually wrote about Invesco the last time before the Ukraine war. Since that time, things have obviously changed a great deal. We have a bit of “perfect storm” of a combination of negative effects that are currently wreaking havoc on the entire market.

This warrants changing targets and expectations – which is exactly what I’m going to do here for Invesco.

As I wrote in my initial article on this business, Invesco is an investment management company out of Atlanta, GA. Aside from its American operations, it has branch offices found in 20 different countries worldwide and operates brands such as Invesco, Trimark, Invesco Perpetual, PowerShares, and others. The company has been around for over 40 years and was originally the spin-off of a bank’s money management operations. A few mergers and acquisitions later, the company bought Morgan Stanley (MS) retail units, including the Van Kampen Investments, for $1.5B.

When it comes to COVID-19, Invesco saw perhaps some of the most significant impacts of all due to the mortgage capital arm handling REITs/mREITs when they announced they were unable to meet margin calls due do dramatic overvaluations.

The effects were predictably catastrophic for the share price. At one point, it had seen some recovery from this – but this has more or less gone back down again, with the company now trading at low multiples due to macro factors.

The company has over 8,000 employees worldwide and spells out pricing and quality as its primary differentiating factors.

Like some of its peers, the company does both institutional and retail funds in a variety of categories. It prides itself on being one of the more diversified fund managers around, with a 70/30 retail/institutional split, coming to a total AUM up just around $1-1.3T depending on the market. As the markets have declined, the company’s AUM has also gone down.

Fundamentals are sound. Despite the issues in one of its investment arms, the company holds a BBB+ credit rating and only 37% long-term debt to capital. Its dividend, due to the decline, is now up to 4.65% – and that dividend, based on projected and actual earnings, is extremely well-covered.

We may not be looking down the sights of an undervaluation as high as we’ve seen during the COVID-19 lows – that one was much lower. But IVZ is still a company that’s trading at extremes now, and whenever that happens, I become interested.

Recent results were so-so – and by that, I mean, the recent results don’t exactly capture what has happened from March until now.

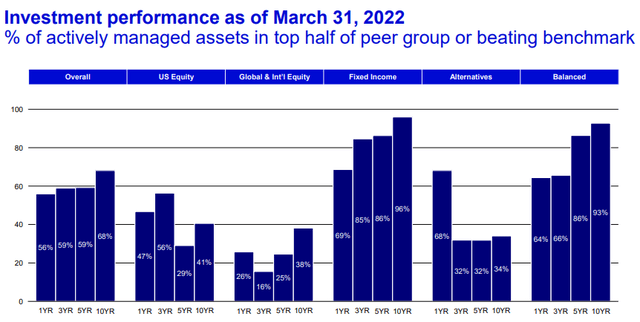

IVZ presentation (IVZ IR)

Still, first-quarter results were far from a negative experience for the company. IVZ still recorded net inflows of close to $20B and saw increased market share in both ETF AUM and Fees. The company continued to push bank loan product growth in the private markets and saw record inflows in active fixed income, and inflows in China as well. All in all, it was $17.2B of collective, company-wide net inflows, reflecting annual growth of 5.8% YoY.

The company also managed close to 100% of the annualized targeted net savings and goes into 2Q22 with a well-laden balance sheet with $1.3B in available cash. This allowed $200M in buybacks, early redemptions of notes, and a dividend increase of around 10%.

IVZ did well – the problem (and why it’s trading down) is what’s happening now. We can expect the fund flows to, if not reverse, at least completely shift or drop. But when a situation like this appears, we want to focus on the fundamentals.

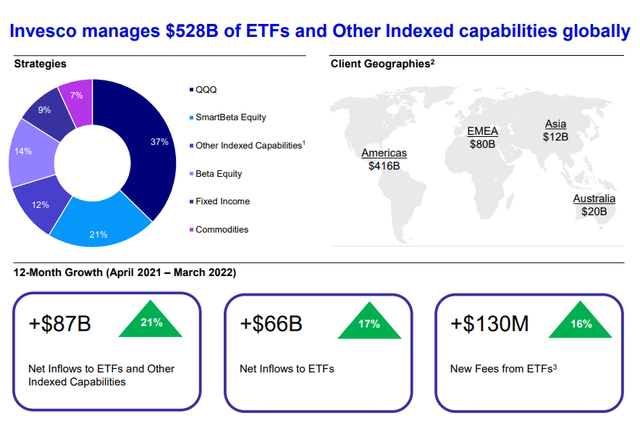

IVZ presentation (IVZ IR)

Those are fundamentals. And so are these.

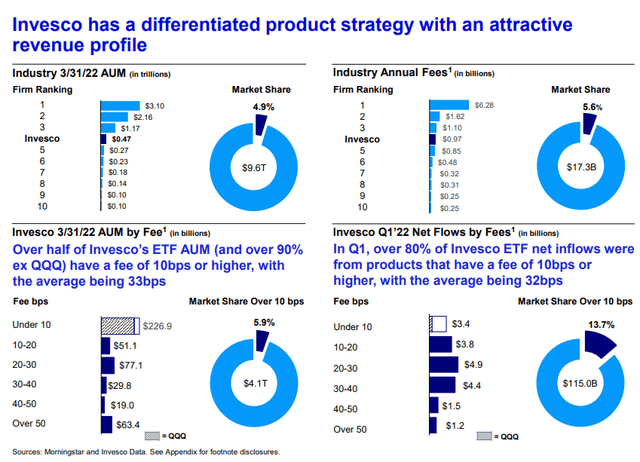

IVZ presentation (IVZ IR)

In a market so rife with chaos and panic, it’s easy and understandable to lose sight of what matters long-term. What matters long term is not what share price a company has on day X. It’s whether that represents any sort of the fundamental change in the actual earnings capability and cash flows of that company – its ability to pay you, the investor.

I would say that for IVZ, there’s some of this coming, given that this is a player that’s reliant on an attractive market to invest in, as it affects fund flows. But I do believe that its earnings are far from as crippled as the current market action would suggest.

I direct your attention to IVZ’s historical performance, specifically during times of downturns back in 08-09. While the company’s EPS dropped by around 20-40% on a year-over-year basis, it also grew by 77% followed by 22% in 2010 to 2011. In short, this company goes down, but it goes back up. Additionally, it hasn’t dropped below $1.9/share in EPS in the last 10 years, with a recently-bumped dividend that consumes around $0.79 on a per-share basis per year. This is good dividend coverage and safety and precludes any notion that Invesco is in any sort of mortal danger.

Let’s look at valuation.

Invesco Valuation

Invesco’s valuation comes in at a very interesting current level because the company trades below 6X P/E. At any time, if Invesco was bought at below 6X P/E, your returns would have been at the very least 200% in 12 years or 8.4% annually. Again – the minimum.

Had you bought the company as a COVID-19 discount, your returns even after this crash would have been 120% in less than 2 years, or 47% per year.

Again, the key is what you pay.

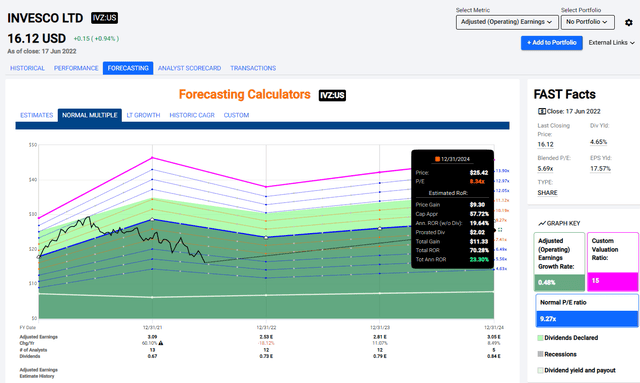

This is a very simple case. The company typically, over the past 10 years, trades at close to 10-12X P/E. That’s more than twice what it’s currently trading at. The company is expected to see an EPS decline this year, and I consider this forecast accurate, but I also consider the company very undervalued when it approaches these multiples. Even if we ignore the fundamentals, which by the way include a BBB+ credit rating, the upside on an 8-9X P/E on a 2024E basis is more than 20% annually.

Invesco Upside (F.A.S.T Graphs)

That’s a pretty hefty upside for a yield of 4.65%. The likelihood of you beating inflation with this investment is pretty high as I see it. The company could keep trading at 5-6X P/E, and you’d still walk away with more or less double digits under these forecasts.

Investing in opportunities like this is what has allowed me to outperform the market YTD, and for the past 1, 3, and 5 years if looking at broader indexes. I didn’t go into this crash with a tech exposure, which means I was saved from the worst of the fall. I also didn’t go into COVID-19 with a massive undervaluation exposure. Why?

Because I pick things that are cheap, with an upside, with safety, and that most people consider unattractive at the time. That’s what contrarian investing is about.

Well, IVZ is my contrarian pick for you today. This company hasn’t shown signs of fundamental deterioration in its earnings capability – only issues that come with changes like the ones we’re currently seeing. Based on that, I’m pretty positive about the company and would consider it an interesting “BUY” at this time.

Other analysts would tend to agree with such an assessment. Even following significant target declines, almost 33% lower on an average basis from a year back, the upside to the S&P Global average from a range of $20 low to $27/share high, is an average of $22/share, implying an upside of 36% here. Still, it bears mentioning that only 4 of the analysts following the company (out of 12) actually hold a “BUY” or “Outperform” on the business, implying a relatively low conviction despite not a single analyst considering the current price warranted.

I’ll put my PT at $20/share, discounting it to around an 8X 2022E P/E, and calling it a good “BUY” here.

Thesis

My thesis for IVZ is simple.

- This company is a good, but not class-leading investment/asset manager that’s trading at a significant discount to most of its peers.

- It yields a nice 4.6% and further dividend cuts seem unlikely at this point, given the recent bump. Credit is solid despite the mortgage problems, and the upside even on a flat forward basis is market-equivalent.

- Based on this, I’m reiterating “BUY” with a PT of $20/share. You can buy the company here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Invesco is currently in a position where #1 is possible in my process, through #3 and #4.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment