Andrii Yalanskyi/iStock via Getty Images

Adecoagro S.A. To Hedge Against the Next Expected Recession and More

Among the consumer staples stocks, that is, US-listed stocks that sell goods and services that people buy regardless of the cycle, Adecoagro S.A. (NYSE:AGRO) is an interesting investment proposition to hedge against the next expected recession as a probable result of the US Federal Reserve’s hawkish stance.

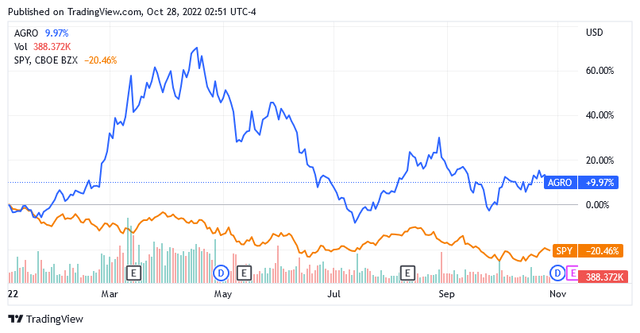

As the chart below shows, the shares of Adecoagro S.A. are up 10% so far this year while the US stock market is down about 20%. The SPY SPDR S&P 500 Trust ETF (SPY) is the benchmark for the US stock market.

Based in Luxembourg, Adecoagro S.A. is an agro-industrial company active in South America through its two business segments Farming & Land Transformation and Sugar, Ethanol & Energy.

A Look at The Financial Results for The Second Half Of 2022

In terms of adjusted EBITDA [excluding corporate expenses] of $217.2 million in the first part of 2022 [H1 2022], the Farming & Land Transformation business segment accounted for 25.6% of the total while the Sugar, Ethanol & Energy business segment accounted for 74.42% of the total.

Net of corporate expenses of approximately $12.4 million, Adjusted EBITDA was nearly $205 million, down 2.7% compared to the H1 in 2021.

Lower Adjusted Net EBITDA was dragged down by a sharp 37.3% year-over-year decline in the Farming & Land Transformation business segment, as this was not offset by the Sugar, Ethanol & Energy business segment, which rose but showed a lower growth rate of 22.7%.

For the period in question, Adjusted Net Income was $58.7 million [up 44% YoY] or $0.53 per share [up 50.8% YoY] for an Adjusted Net Income Margin of 10.25% of total net sales of $573.05 million versus an adjusted net income margin of 9.1% for the prior-year period.

The total Adjusted EBITDA Margin was 35.74% of total net sales for H1 2022 compared to an Adjusted EBITDA Margin of 46.89% of total net sales for H1 2021.

Net sales for the first half of 2022 increased 27.6% year-on-year to $573.05 million.

As of June 30, 2022, the company owned a total of 291,843 hectares of agricultural land [up 11.3% YoY] and a total of 188,560 hectares of sugar cane plantations [up 3% YoY].

Farming & Land Transformation segment: Current Conditions and Their Possible Development

Costs:

The decline in the Farming & Land Transformation segment profitability was due to higher production costs and an unfavorable combination of yields and prices, which weighed on the crops and rice businesses. But not because of the dairy business, which continues to develop well instead.

The galloping rates of inflation affecting economies around the world have also caused several agricultural inputs to surge in US markets. This means that the procurement of fertilizers, electricity, fuel and the use of transport for Adecoagro S.A. and other farms were quite expensive, as the company complained in its last earnings report.

However, these costs are likely to fall if the economy slides into recession as a result of aggressive global monetary policies to curb the rapid growth in prices and services. The recession will result in reduced demand for goods and services [but not for Adecoagro’s resilient agricultural products], so a lower need for production inputs will impact the price of these procurements.

In addition, the war in Ukraine could drag on for a long time, but this will not raise concerns about energy supply shortages from Russia, which have so far provided strong speculative headwinds for gas and oil prices.

Europe is on track to achieve a much higher degree of energy self-sufficiency thanks to effective and concerted policies to diversify and manage energy sources, making its economy less vulnerable to volatility in fossil fuel markets. This will be crucial for lower energy prices on a global scale.

Fertilizer costs have risen dramatically recently as many European world producers have had to raise the price of their nitrogen products to cover higher production costs due to expensive natural gas. Now European operators are also global with operations abroad as well as in Europe.

So they solve the problem of high operating costs by replacing expensive domestic production with imports from their foreign branches, and this is the solution until fossil fuel markets return to pre-energy crisis levels. Such a decision by major European producers of nitrogen products should influence future fertilizer prices and lead to lower levels, as the European Union accounts for a significant 9% share of world fertilizer production.

Yields:

Business success depends on the prices at which grain, soybeans, crops and other agricultural products are sold. But success also depends on yield, which is how much crop one hectare of land can produce at the end of a seed-to-harvest cycle. Crop yields are influenced by meteorological factors.

If the season is too rainy or there is too little humidity in the air, or if the temperatures are too high or other climatic conditions favor the occurrence and spread of plant diseases, the success of a good harvest in quality and quantity, as well as the company’s balance sheet, can be adversely affected.

In H1 2022, especially in spring, some areas in the northern provinces of Buenos Aires and Entre Ríos and some central areas in Santa Fe province were drier than usual, affecting crop and rice yields. These were partially offset by solid, high-yielding crops in other areas that instead had more favorable moisture conditions, such as some western, southern and southeastern regions of Buenos Aires Province and Southern Santa Fe Province. The company has agricultural interests in these regions.

With an effective strategy, Adecoagro S.A. demonstrated that the impact of the uncontrollable factor of climate on plants can be limited. Adecoagro S.A. has managed to reduce this risk by sowing particularly resistant plant varieties and thanks to the geographical diversification of the areas earmarked for cultivation.

The ability to exploit large acres of farmland was also crucial as it provides more room for crop rotation. In this regard, the rice business will benefit from the recent purchase of nearly 12,000 hectares for rice cultivation [15% of total rise hectares] between Argentina and Uruguay, known as the Viterra rice operations.

The deal should significantly increase crop yield as Viterra averages 7.3 tons per hectare [Tn/Ha], while the company’s overall campaign averaged 6.9 Tn/Ha in H1 2022.

Prices:

Aside from prices of cotton [less than 2% of total farming], which are expected to trade lower, Adecoagro’s agricultural products’ prices are widely viewed as rising on a favorable combination of macroeconomic, geopolitical and bright weather forecasts.

For cotton, supply continues to outpace demand amid fears of an expected recession.

Over the next 52 weeks, the following farm products are expected to grow from current levels as follows:

- Rise [25% of total farming] up 9% to $17.43 per hundredweight [/CWT].

- Soybeans [25% of total farming] up 10.5% to $1,525.06 per bushel [/BU].

- Corn [14% of total farming] up 55% to $1,000.60/BU.

- Wheat [17% of total farming] up 18% to $980.12/BU.

- Sunflower oil [less than 10% of total farming] has also been on an uptrend since the start of the year, gaining 1.46% to $20 a ton.

- Finally, Peanut [8% of total farming] has been showing a lower yield for about a year.

Sugar, Ethanol & Energy segment

The Frost Was A problem, But the Company Repaired The Situation:

Part of 2022 hasn’t been easy for the ethanol and energy businesses, but it has nonetheless responded positively in terms of adjusted EBITDA expansion.

Let’s see what happened first. The company struggled with limited sugar cane production through mid-March 2022 as plantations suffered from frost damage in 2021. As volumes returned to pre-frost levels, the company accelerated the pace of crushing operations to counter the slow start to 2022. So, a record in tons of crushed sugar cane was set at Mato Grosso do Sul Cluster in July 2022.

In July alone, 1.5 million tons of sugar cane were crushed, resulting in an annualized amount of 18 million canes crushed per year, compared to 5.6 million tons per year at the Angelica mill and 7.4 million tons per year at the Ivinhema Mill, both located in the Mato Grosso do Sul cluster.

The other crusher is located at Monte Alegre Mill, Minas Gerais, with a capacity of 1.2 million tons of processed sugar cane per year.

Higher crushing speeds have allowed the business not to lose ground in terms of profitability, but the following factors have also been critical in repairing the effects of frost damage.

The company was able to control production efficiently, identify the best sales markets and act rationally in the commercial area. The segment also benefited from the use of hedging strategies, sales of carbon credits and a gain on the valuation of uncollected sugar cane on the expectation that yields and prices would rise in the future.

Costs:

Without galloping inflation and expensive supplies of energy, fuel and raw materials, management’s strategy to absorb the effects of the frost would have been even more effective.

However, costs will not remain high as central banks intervene through aggressive monetary policies and the European energy crisis is on the way to a resolution. It is only a matter of time, but if 2023 is the year of recession, a slowdown in demand for goods and services should be accompanied by a fall in the prices of fossil fuels and other commodities.

The Location of Sugar Cane Operations and Ethanol Conversion:

The Brazilian province of Mato Grosso do Suland Minas Gerais and Rio Grande do Sul, where Adecoagro S.A.’s sugar cane operations are located, offers favourable climatic and soil conditions to achieve an excellent yield with low production costs. Thus, the year 2021, which has proved particularly hostile to the cultivation of sugar cane, can be classified as exceptional.

The company harvests and crushes sugar cane year-round as this allows it to maximize operations while achieving industrial efficiencies.

The company maximizes operations by using every by-product of the process to produce sugar cane and ethanol to increase the profitability of the operation. Bagasse, a by-product of crushing sugar cane, is used to generate and sell bio-electricity. Vinasse and the filter cake are used as bio-fertilizers, reducing the expenditure on fertilizers. Fixed assets are managed according to the business principle of achieving the greatest possible result with the least amount of effort.

Sugar is marketed and sold in domestic markets and overseas. The ethanol is marketed and sold to dealers in Brazil as it is used by Brazilian motorists in the form of gasoline additives [anhydrous ethanol] or in its pure form in vehicles with specifically modified engines [hydrous ethanol].

Pending Legislation in Favor of Ethanol, The Company Is Not Idle:

Gasoline became relatively more attractive than hydrous ethanol after the Brazilian government agreed in June to reduce the tax burden on fossil fuels by the end of 2022. Later, two amendments in favor of hydrous ethanol were passed by Congress, but it is not known when or how these will be applied.

The company sold all ethanol inventory and production through April 2022. So the amount sold was a record, valued at an average price of 26.4 cents per pound of sugar equivalent. The company avoided falling prices in the market.

Indeed, prices then fell.

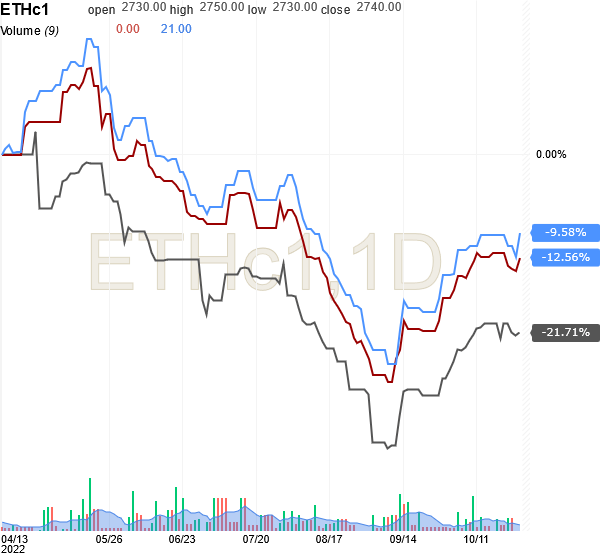

Since mid-April, Hydrous Ethanol Futures – Dec 22 (ETHc3) is down nearly 10%, Hydrous Ethanol Futures – Nov 22 (ETHc2) is down 12.6% and Hydrous Ethanol Futures – Oct 22 (ETHc1) is down over 20%, as below chart of Investing.com illustrates.

investing/commodities/ethanol-futures-advanced-chart?cid=964525

Out of the blue, the hydrous ethanol scenario became uncertain, forcing the company to take some countermeasures.

As commonly expected, demand for anhydrous ethanol started to grow and to take advantage of the rising price [15% and 20% higher than hydrous ethanol in August 2022], Adecoagro has an ace in the hole. Mato Grosso do Sul produces anhydrous ethanol too.

With a technical gimmick, the production capacity of anhydrous ethanol could be significantly increased. As a result, up to 20% of the total production of the raw material could be exported to Europe. The organization is well connected to overseas markets and Adecoagro is now effectively benefiting from the higher prices in the European markets compared to hydrous ethanol in the Brazilian markets.

Also, the storage capacity is so large that the production of hydrous ethanol can continue until the above Brazilian amendments come into effect, providing an opportunity to take advantage of the price increase when the supply of raw materials in Brazil has become scarce.

Forward Prices:

While sugar futures are expected to fall 3.7% to $17.04 a pound over the next 52 weeks, ethanol is expected to follow the opposite trend, rising 16% to $2.86 a gallon.

Share Buyback Program and Payment of Dividends

The company promised to buy back more shares after the 2.7 million shares it repurchased during the January-July 2022 period at an average price of $7.96.

On May 17, the company paid its first semi-annual dividend to stockholders of approximately $0.1571 per common share. The next semi-annual payment of the same amount should be sent to shareholders sometime in November 2022.

The payment leads to a forward dividend yield of about 3.7% versus S&P 500’s yield of 1.72% as of this writing.

The company’s payout policy requires a minimum payout of 40% of adjusted free cash flow generated from the previous fiscal year’s operations.

The Stock Price Looks Cheap

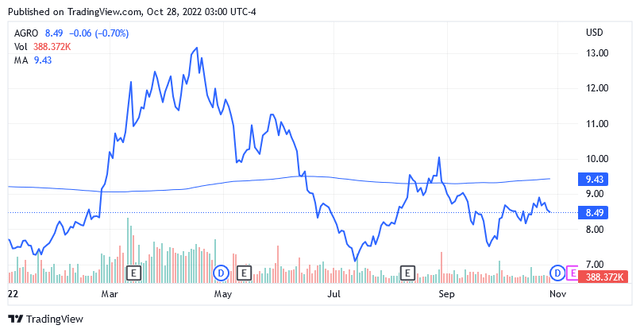

The stock was trading at $8.49 per share as of this writing for a market cap of $971.96 million and a 52-week range of $6.78 to $13.55.

The share price is trading below the middle point of $10.165 of the 52-week range and below the long-term trend of the 200-day simple moving average of $9.43.

Based on these comparisons to recent market valuations, the share price is currently not high, suggesting a favorable opportunity to benefit from a number of growth catalysts such as expected higher prices for several foodstuffs and for ethanol, for which the company has a competitive advantage. Plus, improving margins on declining costs.

The stock appears to be an opportunity to be seized as the financial indicators below also suggest.

P/E GAAP [FWD] is 6.43x versus the sector median of 20.21x, and the EV / EBITDA [FWD] is 4.72x versus the sector median of 11.63x. Also, the Price / Book [FWD] is 0.84x versus the sector median of 2.85x.

With many operating expenses on the way to a decline, the benefit of higher profit margins may not have been valued in the financial metrics. A significant part of the US market is struggling to analyze the current macroeconomic situation and how it might evolve.

Conclusion – A Cheap Solution Against a Possible Recession and How Many Opportunities to Grow…

This stock could offer a good hedge against headwinds should global monetary tightening trigger a recession.

During a recession, demand for many companies’ products will fall significantly, but not for Adecoagro S.A. and other staples stocks, affecting the business and potentially the prices of many on the US stock market.

This stock has several growth catalysts, including expected higher prices for many foodstuffs, as well as a competitive advantage in the ethanol market. While many local competitors cannot operate in multiple ethanol markets, Adecoagro S.A. switches to serve one instead of the other depending on which market offers the best pricing terms.

This business segment, which accounts for three-fourths of the company’s total EBITDA, is set to become increasingly interesting going forward. Bio-fuels are being phased in as there is this global effort to reduce carbon and greenhouse gas emissions that scientists believe are responsible for climate change.

The protection of the balance sheet of Adecoagro S.A. against headwinds from uncontrollable meteorological factors will increase as the company continues to reap the benefits of the ethanol market.

In addition, the use of bio-fuels, together with other measures in the global strategy to combat global warming as a cause of climate change, aims to reduce the intensity and occurrence of particularly adverse weather conditions responsible for poor crop yields.

Be the first to comment