Justin Sullivan

The sudden and mind-boggling spike in energy costs has been the story of 2022, and oil firms have not benefitted from such high prices in years.

Having said that, upstream-focused energy businesses such as Chevron Corporation (NYSE:CVX) are expected to see a decrease in profits and free cash flow as crude oil prices return to their long-term trading range.

The current pricing power is unlikely to endure, which presents risks in the stock that I do not believe are worthwhile.

Crude Oil Prices Have Peaked: Say Goodbye To Record Profits

Chevron stands to benefit greatly from a rise in crude oil prices in 2022. Crude oil prices rose the most in years as a result of Russia’s invasion of its eastern neighbor, Ukraine. With crude oil prices surging beyond $120 per barrel in March and remaining considerably above the long-term average, Chevron faces increased downside risk.

With the exception of 2014 and 2020, when crude oil prices moved above $100 per barrel or as low as $20 per barrel, crude oil prices have been range-bound for the most of the last decade. The WTI crude oil price has typically drifted between $40-60 per barrel over the last decade, with only a few short-term exceptions, putting the current WTI price of $95 per barrel well above the long-term trading range.

Crude Oil Prices (Chevron Corporation)

Because economic indications such as inflation point to a recession, a consolidation in energy markets is to be expected, which will result in lower realized prices per barrel of crude oil sold for Chevron.

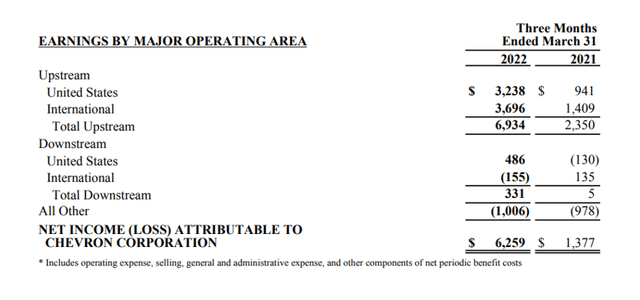

Chevron’s profits have increased due to a favorable pricing increase in 2022. The company’s first-quarter profits increased 355% YoY to $6.3 billion, and the upstream business deserves full credit. Chevron’s upstream profits increased from $2.4 billion to $6.9 billion YoY. The reason is almost always greater prices.

Earnings (Chevron Corporation)

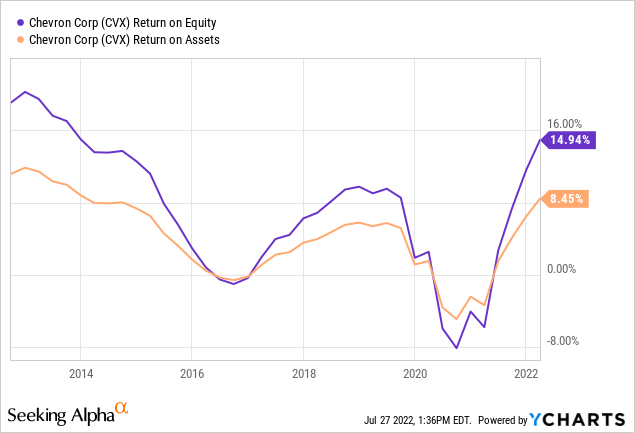

In the recent decade, Chevron’s profits have been unpredictable and varied significantly with the broader trend in energy markets. Strong WTI crude oil prices resulted in record profits, such as in 2014 and 2022, while weak WTI crude oil prices resulted in record losses, such as in 2020.

Because Chevron’s current profits are more than what the corporation could reasonably expect to make in normal circumstances, the probabilities point to a cyclical drop in profitability. Chevron’s return on equity, which has been as volatile as its net income, reveals a similar picture.

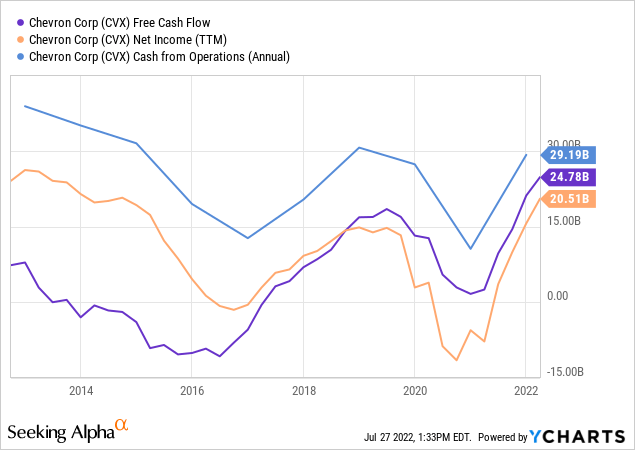

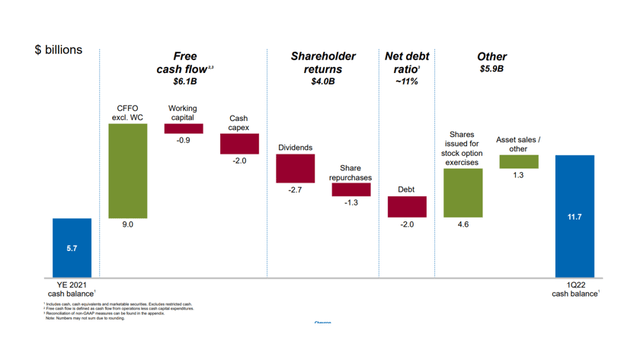

Free Cash Flows Currently Elevated By 2x

High-priced markets result in brief times of extremely high revenue and free cash flow. Chevron generated $6.1 billion in free cash flow in 1Q-22, when crude oil prices surged. After adjusting for the net increase in working capital, Chevron’s free cash flow (minus working capital) was $7.0 billion, more than double the amount produced in the previous quarter ($3.4 billion) when oil prices were in the $60-70 range per barrel.

Free Cash Flow (Chevron Corporation)

We Are Nearing A Recession

In June, inflation reached a fresh four-decade high of 9.1%, and the central bank is becoming more proactive in raising interest rates. More aggressive interest rate hikes increase the possibility of the economy entering a recession, lowering energy demand and WTI crude oil prices.

With prices continuing much above the ten-year trading range, which is closer to $60-70 per barrel, I believe we will see additional consolidation pressure. This will result in significantly decreased sales, cash flows, and profitability for Chevron, notably in the upstream segment.

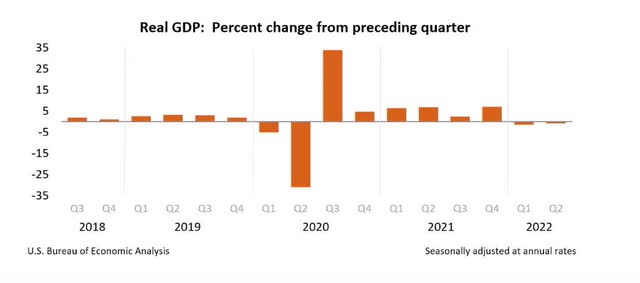

According to the Bureau of Economic Analysis, the United States’ economy contracted at an annualized pace of 0.9% in the second quarter, following a 1.5% decrease in the first. This technically places the U.S. economy in a recession, because recessions are often characterized by lower energy costs and decreased economic activity.

As a result, the second-quarter GDP growth rate indicates increased discomfort for U.S. energy giants like Chevron, who are still benefiting from abnormally high crude oil prices.

A more severe recession with sharper GDP drops in the second half of 2022 could result in much worse profitability and free cash flow prospects for Chevron and the energy industry.

Percent Change In GDP From Preceding Quarter (U.S. Bureau Of Economic Analysis)

Why Chevron Could See A Higher Valuation

There is one basic reason why crude oil prices could rise despite rising indicators that the economy will enter a recession in the not-too-distant future. Russia is limiting natural gas deliveries to Europe, escalating the ‘energy conflicts’ between Russia and Europe. With winter and peak demand season approaching, crude oil prices may rise again.

Chevron could possibly see a better valuation if the economic impact of a recession is milder than expected, but I wouldn’t bet on it. As demand dries up and crude oil production becomes less lucrative, recessions are generally followed by significantly decreasing energy prices. Chevron risks needing to cyclically alter its production, which will almost probably result in higher profit concerns.

My Conclusion

The chances of crude oil prices rising or remaining stable at approximately $95 per barrel for WTI are exceedingly low. What is more plausible is that crude oil prices will continue to decrease and return to the trading range that has existed for the last ten years.

More data pointing to an impending recession would almost certainly result in even lower realized prices. Chevron’s profitability is expected to fall cyclically as price risks rise.

Be the first to comment