We may be getting close to the top in rates. Investors need to consider locking in generous yields while they still can. Torsten Asmus

Brian Dress, CFA – Director of Research, Investment Advisor

In 2022, it seems that investors have been deluged by bad news and the feeling that there is no light at the end of the tunnel. This week we saw a marked change in market sentiment, as we digested another key week of earnings reports, this time by many of the market’s most significant stocks.

Something certainly felt different over the last five days of trading. Of course, the biggest themes of this year have been persistent inflation, an aggressive Federal Reserve, and steadily rising interest rates. Finally this week, we saw a crack in the foundation of market pessimism, both because of some encouraging earnings reports, as well as because of a slight reversal in interest rates. With the Federal Reserve meeting looming on the horizon next week, there appears to be a growing sense that the Fed may slow down its aggressive path of rate hikes, which have weighed heavily not only on financial markets, but also other key markets like housing. As you will see in “What’s Working/What’s Not Working”, we saw some of the most downtrodden sectors of 2022 finding signs of life.

In this week’s letter, we are going to focus on two of our favorite topics of this year. Of course we will key in on the many important earnings reports of the week. In those reports we are beginning to see signs of market leadership shifting from the previous leaders (big cap tech) to other emerging sectors, like energy, health care, and financials. We will continue to drive home the point that a lot of investors need to hear after a decade of outperformance from megacap technology companies: when markets emerge on the other side of a bear market, they almost always find new sectors to lead them into the new bull market.

We know a lot of investors that made great money in the FANG+ names over the last decade are finding it difficult to move on and shift into new investment opportunities. We have seen persistent outperformance in the last few months from the small-cap Russell 2000, which continued into this week. We continue to divert our resources into studying opportunities in areas outside of megacap. In today’s letter, we cover one such name, which reported a strong 3rd quarter, this week.

The second theme we will cover for you here this week again is the fixed return space. Of course bond prices have fallen significantly throughout 2022, as interest rates have continued higher. But we think we are getting close to an inflection point in rates. If the Federal Reserve does, in fact, pause rate hikes at any time in the near future, we expect bonds to have a strong rally. The upshot of this is that we think investors need to approach the fixed income markets with some urgency, especially in investment grade high quality bonds where we are seeing the chance to lock in rates of 6-7% for 5-15 years. We don’t think the low prices on these bonds will last for much longer, so we believe it is time for many investors to take affirmative steps to add fixed income allocation to their portfolios before rates do reverse.

With that all being said, let’s get into it!

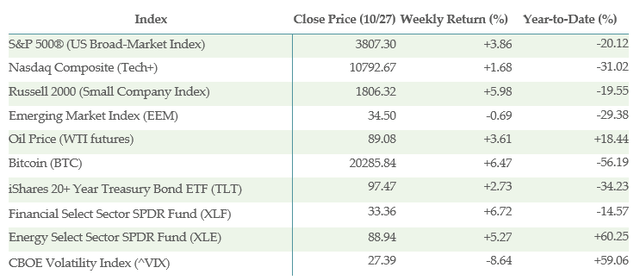

Below is the performance data of key indices, ETFs for the five trading days between 10/20/22 and 10/27/22:

What is/is Not Working?

Over the last five days of trading, we saw one of the best weeks in markets in all of 2022. The broad-market S&P 500 advanced by nearly 4% in the last week, only to be outdone by the small-cap heavy Russell 2000 at 6% and the Dow Jones Industrial Average, which gained roughly 5% in value. As you would expect, 10 of the S&P 500’s 11 sectors were higher for the week, led by Industrials (up 7.01%), Energy (up 6.64%), and Materials (+5.84%).

On the negative side of the ledger was Communications Services (-4.86% for the week). The second weakest sector was Information Technology (up 2.41%). Underperformance in these sectors was driven by middling to terrible earnings reports from some of the major players in the tech sector: Microsoft (MSFT), Alphabet (GOOGL), and Meta Platforms (META) – the artist formerly known as Facebook. On Thursday after the close, we saw a continuation of the theme, with a very disappointing earnings report from Amazon (AMZN). We think investors should consider other areas to invest outside of the megacap tech space, which appears to be decelerating palpably.

Interest rate-sensitive corners of the market have been consistently pummeled throughout 2022. With 10-year US Treasury rates dipping below 4% for the first time in weeks, we saw a strong reversal in those oversold rate-sensitive sectors. Among the best performing sector ETFs in our database of over 300 this week was cryptocurrency, such as Grayscale Ethereum Trust (OTCQX:ETHE), which gained nearly 25% in value over the past week. With rates higher this year and the economy on the brink of recession, we have seen profound underperformance by homebuilder stocks. We saw an incredible relief rally there, with the iShares U.S. Home Construction ETF (ITB), up more than 11% on the week. We also saw a nice reversal in a portfolio of Mortgage Real Estate Investment Trusts (REITs) for the week in iShares Mortgage Real Estate Capped ETF (REM), which added 10.5% this week.

Other notable gainers this week, all of which gained 8% or more, were the SPDR S&P Retail ETF (XRT), the ARK Innovation ETF (ARKK), and the ETFMG Alternative Harvest ETF (MJ).

We would be remiss if we didn’t note the continued strength in energy, both conventional and renewable. The SPDR S&P Oil & Gas Equipment & Services ETF (XES) was up by 13.6% over the week and, on the flip side, we saw a near 11% advance in the Invesco Solar ETF (TAN), driven by the blowout earnings of Enphase Energy (ENPH), which we will cover in the next section.

With markets so strong this week, not many notable names on the “What’s Not Working” list. Emerging markets were the key exception. With the Chinese Party Congress adjourning over the last week, we saw profound weakness in China-related shares, such as KraneShares CSI China Internet ETF (KWEB) and iShares MSCI China ETF (MCHI). The week’s action reiterates our view that we prefer not to invest directly in Chinese stocks.

Earnings Bonanza; Spotlight: Enphase Energy

If you have followed the financial press this week, you will know that the major story of earnings has been the abysmal business performance of megacap technology companies. As we dug through earnings calls this week, we note that growth is certainly decelerating many of these businesses, including Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN), and, most notably, Meta Platforms (META). We noted problems not only from the revenue side, but also from the point of view of expenses. Many of these firms created bad habits during the good times, leading to bloated headcounts and out of control expense trajectories. This theme was particularly present in the GOOGL and META earnings reports. At META, CEO Mark Zuckerberg continues to spend huge sums on capital expenditures related to the company’s pivot to the metaverse. While this may ultimately be the right long-term plan for the business, this initiative is weighing heavily on profitability and investors are punishing the stock harshly. We saw more than a 20% drop in share price right after the earnings were released!

As always, we shift our gaze to the corners of the market where we see revenue and profit acceleration. In the near to medium-term, we will be moving swiftly away from companies like Amazon and Meta, where we see deteriorating fundamentals. We see much better opportunities in small and mid-cap, as well as the lower echelons of large-cap. One company that fits that bill for us has been a favorite for some time: Enphase Energy.

For those unfamiliar with Enphase, the company produces microinverters, necessary to convert direct current from solar panels to the alternating current necessary to power homes and businesses. In recent years, Enphase has gone beyond its original product line to selling batteries, software, and comprehensive power management systems. This has allowed the company to build its revenue base and raise gross margins, as the new product lines are more profitable than is the production of microinverters.

This week we heard received the 3rd quarter earnings from Enphase. Yet again, this company was able to outperform already lofty expectations. Q3 revenues came in at a company record $635 million, up some 80% versus the prior year quarter. At the same time, gross margins expanded from 39.9% in Q3 2021 to 42.2% in the most recent quarter. Despite rising prices and inflation, the company remarkably was able to increase profitability.

Analysts had expected a company revenue forecast for Q4 at $663 million. CEO Badri Kothandaraman surprised with Q4 guidance for revenue of $680-720 million. Badri noted that there are several winds at the company’s back in the coming years. First, Enphase is seeing rapid growth in European sales, as consumers in that region struggle to cope with energy supply problems related to the war in Ukraine. In the US, the recently passed Inflation Protection Act carries provisions that incentivize manufacturing of solar equipment. As a result, Enphase plans to open a number of new factories over the coming quarters. As the company onshores manufacturing capacity, Enphase will depend less on components coming from China and will be able to serve customers more efficiently.

Over the last year, we have seen stocks selling off sharply, even of the strongest businesses. Enphase has been a notable exception, with the stock rising by more than 60% year-to-date, as you can see in the chart below. Couple that with the profound business momentum in place here, along with regulatory tailwinds at the company’s back, we think this is one of the premier stocks available. With a market cap of $40 billion, Enphase is technically a large cap, but it has the rapid growth rates indicative of small and mid-cap stocks that we tend to favor in the current market. The impressive 3rd quarter results have done nothing to shake our confidence in Enphase Energy.

More Bond Talk: Time to Get Off the Sidelines

We talk to investors daily here at Left Brain. We know that many people are getting tired of the volatility in their portfolios and are seeking low-risk opportunities in which they can park their money. With certificates of deposit (CDs) yielding in the range of 4% at some select banks, we have been hearing chatter that investors are looking to go that route. We continue to argue that investment grade corporate bonds are a more advantageous way to seek out fixed return streams. We see high quality bonds yielding between 6-7%, certainly in excess of CD rates, but in liquid securities that don’t carry penalties for selling that CDs do, should an investor need to raise cash quickly.

In this space over the past weeks and months, we’ve chronicled a number of bonds with these characteristics. Our CEO Noland Langford continues to unearth attractive bond opportunities week by week. When the summer began, we had fewer than 500 bonds in our database. As interest rates have risen, we have built our database of bonds to nearly 950 at last count, and we no longer need to look to high yield bonds to lock in attractive yields.

Before the last decade of near-zero interest rates, high quality corporate bonds were often a component of a well-balanced portfolio. Over the last decade, with investment grade bonds yielding in the neighborhood of 3%, it was no wonder that investors decided to skew their portfolios toward stocks-only. Rates are elevated now and there is a chance to lock in a nice bond portfolio of 6-7% for the next 5-15 years if you choose the right bonds. But once there is a sense that inflation is pulling back and that the Federal Reserve may slow down on raising rates, we think the opportunity will have passed to lock in these generous revenue streams. With that said, we think investors need to act with some urgency to get some of these credits in their portfolios before the opportunity passes.

This week we wanted to share yet another bond with you that we think fits the bill for investors looking to lock in passive streams of income. Not only is this attractive for investors in or near retirement, but also for investors in accumulation phase. If we lock in bonds with high yields and interest rates fall, we will have the opportunity for capital gain, in addition to income. The bond we are featuring this week is the Tapestry 3.05% 2032 bonds.

Tapestry is the parent company of a number of well-known luxury brands, including Coach, Stuart Weitzman, and Kate Spade. The company carries an investment grade credit rating at BBB- and has a solid balance sheet. They have paid down debt from $3.4 billion in 2020 to a current figure of $2.9 billion. Meanwhile, last quarter the company reported 16% sales growth and is solidly profitable.

We like this bond for the capital appreciation opportunity. The 3.05% coupons are taxable at ordinary income rates, but the money an investor can make from buying at 74 cents on the dollar and receiving $1 at maturity date is taxable at your lower capital gains rate. We love the opportunity here to lock in nearly 7% yield for the next 10 years, so long as Tapestry remains in business. This, coupled with the tax benefit, makes TPR bonds attractive in the current environment. It sure beats the 4% on offer from a 1-year CD!

FINRA Trace

Takeaways from this Week

Earnings have started to pour in and we are able to start drawing conclusions. Megacap tech companies that drove market performance over the past decade are beginning to lose steam, both from a business and a stock price perspective. As a result, we continue to look for companies that are performing despite a different environment. Enphase Energy fits the bill.

Meanwhile, as investors seek ways to lock in fixed streams of passive income, we are looking past bank CDs to investment grade corporate bonds. Especially as these bonds keep trading at discounts, they offer superior return profiles, while also creating an incremental tax benefit. Tapestry 2032 bonds are just another fixed rate security that we think deserves consideration for investors looking for income and for capital gain opportunity.

DISCLAIMER: This report contains views and opinions which, by their very nature, are subject to uncertainty and involve inherent risks. Predictions or forecasts, described or implied, may prove to be wrong and are subject to change without notice. All expressions of opinion included herein are subject to change without notice. Predictions or forecasts described or implied are forward-looking statements based on certain assumptions which may prove to be wrong and/or other events which were not taken into account may occur. Any predictions, forecasts, outlooks, opinions or assumptions should not be construed to be indicative of the actual events which will occur. Investing involves risk, including the possible loss of principal. The opinions and data in this report have been obtained from sources believed to be reliable; neither Left Brain nor its affiliates warrant the accuracy or completeness of such, and accept no liability for any direct or consequential losses arising from its use. In addition, please note that Left Brain, including its principals, employees, agents, affiliates and advisory clients, may have positions in one or more of the securities discussed in this communication. Please note that Left Brain, including its principals, employees, agents, affiliates and advisory clients may take positions or effect transactions contrary to the views expressed in this communication based upon individual or firm circumstances. Any decision to effect transactions in the securities discussed within this communication should be balanced against the potential conflict of interest that Left Brain, its principals, employees, agents, affiliates and advisory clients has by virtue of its investment in one or more of these securities.

Past performance is not indicative of future performance. The price of securities can and will fluctuate, and any individual security may become worthless. A high or favorable rating, rating outlook, gauge, or similar opinion is not indicative of future performance, and no user should rely on any such rating, rating outlook, gauge, or similar opinion to predict performance or potential for return. Future performance may not equal projected or forecasted performance or potential for return. All ratings and related analysis, as well as data, statistics, analysis and opinions contained herein are solely statements of opinion and are not statements of fact or recommendations to purchase, hold, or sell any security or make any other investment decisions.

This report may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will materialize. Reliance upon information herein is at the sole discretion of the reader.

THE REPORT IS PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS WITHOUT REPRESENTATION OR WARRANTY OF ANY KIND. Left Brain Investment Research LLC DISCLAIMS ALL EXPRESS AND IMPLIED WARRANTIES WITH RESPECT TO THE REPORT, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

The Report is current only as of the date set forth herein. Left Brain Investment Research LLC (LBIR) has no obligation to update the Report or any material or content set forth herein.

LBIR is an affiliate of Left Brain Wealth Management LLC, an investment advisor registered with the Securities and Exchange Commission. LBIR is an affiliate of Left Brain Capital Appreciation Fund, L.P., Left Brain Capital Appreciation Offshore Ltd, and Left Brain Capital Appreciation Master Fund, Ltd., all of which are hedge funds managed by Left Brain Capital Management, LLC. The general partner of these hedge funds, Left Brain Capital Management, LLC, is an affiliate of LBIR.

© 2022, Left Brain Investment Research LLC. All rights reserved. Reproduction in any form is prohibited.

Be the first to comment