Robert Way/iStock Editorial via Getty Images

Investment Thesis

NIKE, Inc. (NYSE:NKE) has reported exemplary growth in revenues and profitability in the past three years. However, the time of deceleration is already here, based on its earnings in the past three quarters. With rising inflation and record high oil/ gas prices globally, consumers have been tightening their belts over discretionary spending, similarly reported by many global retail companies. Combined with NKE’s elevated inventory levels and the potential recession weakening future sales, we may, unfortunately, see a further correction in its stock valuations ahead.

Historically, the NKE stock had also fallen by -37.8% during the previous recession, between September 2008 and March 2009. The company also reported a minimal 2.9% YoY growth in revenues, with a massive -21.2% decline in net incomes and -13.9% decline in Free Cash Flow (FCF) generation in FY2019.

Keen investors should pay attention to the August inflation rate, which should be announced by next week. That would provide the critical indicator for the Fed’s upcoming interest rate hike on 20 September, which could likely be another 75 basis points based on Powell’s hawkish commentary on 26 August 2022. Thereby, pointing to further pain ahead for NKE. We shall see.

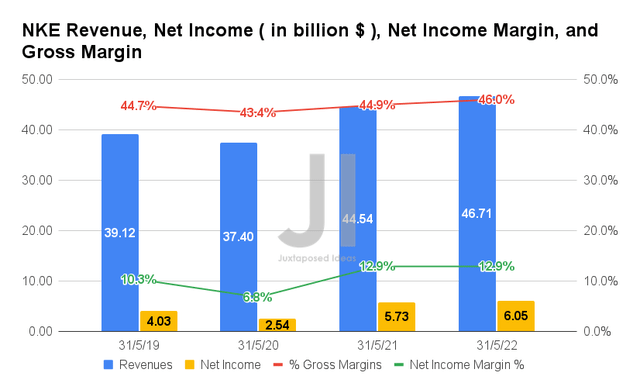

NKE Similarly Reported Deceleration In Growth

In FY2022, NKE reported revenues of $47.61B and gross margins of 46%, representing a remarkable YoY growth of 4.8% and 1.1 percentage points, respectively, despite the rising inflation, global supply chain issues, and tougher YoY comparison. This has directly improved its profitability, with net incomes of $6.05B and net income margins of 12.9% for the latest fiscal year, representing an increase of 5.5% and inline YoY, respectively.

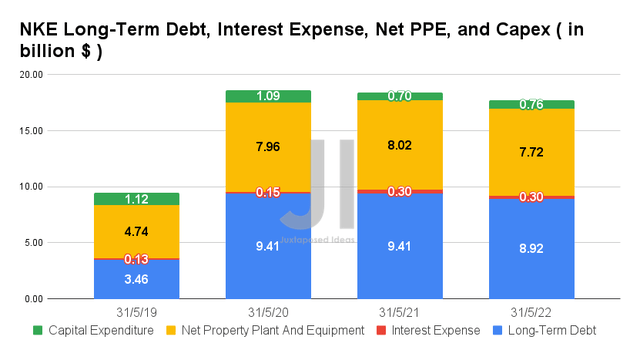

NKE has also shown much prudence in its operational costs of $14.8B, which accounted for 31.6% of its growing revenues and 68.9% of its gross profits in FY2022. In the meantime, the company reported moderate rationalization in its net PPE assets to $7.72B, representing a decrease of -3.7% YoY, while maintaining its capital expenditure at $0.76B in FY2022.

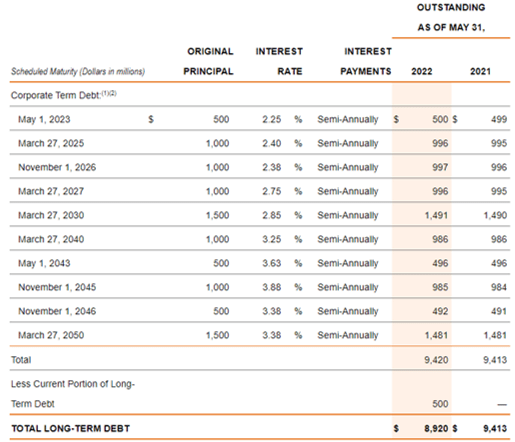

NKE Long-Term Debt Maturity

S&P Capital IQ

It is also commendable that NKE deleveraged to $8.92B by the latest quarter, indicating a notable decrease of -5.2% YoY though still a massive increase of 257.8% from FY2019 levels. However, if we were to take a close look at its long-term debts, it is evident that the maturities are well planned for and appropriately staggered through 2050. With only $0.5B due in 2023, NKE investors have nothing to worry about, given the company’s robust profitability and growing war chest of cash and equivalents. Thereby, pointing to the management’s highly capable capital allocation.

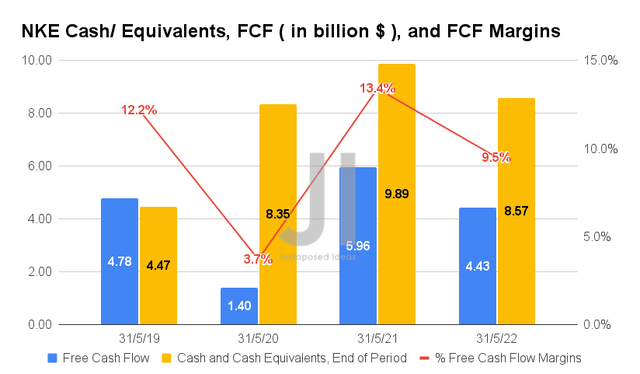

Unfortunately, NKE reports a lower FCF generation of $4.43B and a FCF margin of 9.5% in FY2022, representing a decline of -25.6% and -3.9 percentage points YoY, respectively. However, we must also highlight that these levels are similar to the company’s previous FCF generation in FY2019, since the company also reported an elevated inventory level of $8.42B at the moment, compared to $6.85B at the end of FY2021.

Furthermore, NKE still boasts robust cash and equivalents of $8.57B on its balance sheet by the end of FY2022, which is more than sufficient to pay down its current portion of long-term debts and dividends payouts, while funding its growth moving forward. The company would also be entering the economic downturn with a healthier balance sheet compared to the previous recession in 2008, thereby, speculatively placing the stock in a better position for the next few quarters. Only time will tell.

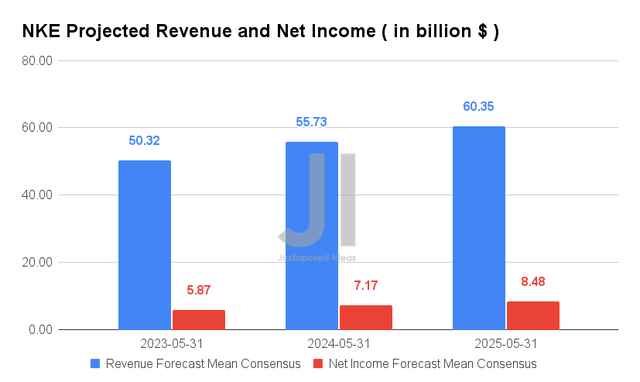

Over the next three years, NKE is expected to report revenue and net income growth at a CAGR of 8.92% and 11.97%, respectively. It is apparent that the company is expected to grow its top line even faster than during the height of the pandemic, compared with its previous 3Y revenue CAGR of 6.09% and net income CAGR of 14.53%. Investors must also note the massive improvement in NKE’s net income margins, from 10.3% in FY2019 to 14.1% in FY2025. Thereby, potentially triggering a long-term stock recovery once the macroeconomics improves by the end of 2023.

In the meantime, NKE is expected to report revenues of $50.32B and net incomes of $5.87B for FY2023, representing an increase of 7.7% though a decrease of -2.8% YoY, respectively, due to the tougher YoY comparison. However, we remain optimistic about its forward execution, given its strong balance sheet. Naturally, this is assuming similar prudence and cost efficiencies during the economic uncertainties ahead.

So, Is NKE Stock A Buy, Sell, or Hold?

NKE 5Y EV/Revenue and P/E Valuations

NKE is currently trading at an EV/NTM Revenue of 3.37x and NTM P/E of 28.93x, lower than its 5Y mean of 3.74x and 32.93x, respectively. The stock is also trading at $108.48, down 39.4% from its 52 weeks high of $179.10, nearing its 52 weeks low of $99.53.

NKE 5Y Stock Price

Nonetheless, consensus estimates remain relatively bullish about NKE’s prospects, given their price target of $129.46 and a 19.34% upside from current prices, especially given the drastic correction the stock has had in the past eight months since December 2021. The NKE stock is currently trading at a normalized level to its post-pandemic highs, making it attractive for those who have been patient in the past three years, given the impressive growth the company has had.

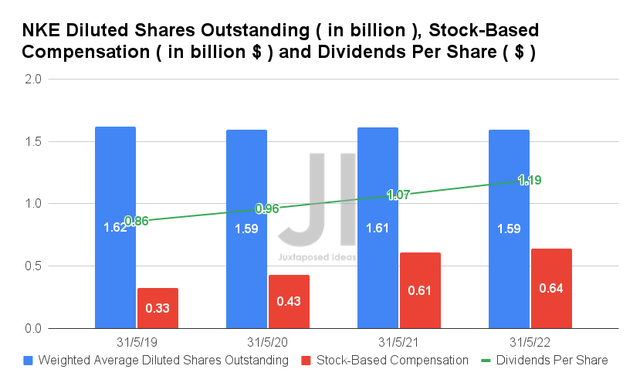

Though NKE pays a relatively low dividend at $1.19 per share with a 1.12% dividend yield, we must also highlight the fact that its stock count has remained relatively stable thus far at 1.59B diluted shares outstanding in the latest quarter. This is despite the Stock-Based Compensation of $0.64B in FY2022, thanks to the company’s latest upgrade of its share buyback program worth $18B over the next four years.

Combined with the stock’s 5 Year Total Price Return of 118.4% and 10 Year Return of 388.9%, long-term NKE investors can be relatively rest assured of decent, sustainable returns over the next few years. However, the happy news ends here, since we expect further declines in its stock performance in the short term, due to the above reasons and the erratic geopolitical issues from Russia and China.

Though investors may be tempted to add here, we would like to advise caution given the two major events in September, i.e. the Fed meeting and NKE’s FQ1’23 earnings call. It would be wise to gather more information about its performance thus far, since its previous guidance does not sound promising.

Therefore, we rate NKE stock as a Hold for now.

Be the first to comment