VioletaStoimenova/E+ via Getty Images

Co-produced with Treading Softly

Recently, I was reminded of a motto heard in the film “The Patriot.” In it, a former war hero and now farmer played by Mel Gibson ambushes a group of British soldiers in the wood with two of his sons. He reminds them of a principle of aiming when he reminds them to:

Aim small, miss small

What does that mean? When it comes to accuracy, it’s better to aim at the smallest part of your target, that way if you miss it, you still hit the target in general. So you aim at the bullseye on a target, this way if you miss, you still hit the target.

When it comes to income investing, I suggest you aim high, miss high. That means you set your goal for income well above the annual income you need, that way if you miss your goal, you’ll still be well in the realm of a livable income from your portfolio.

Today, I want to help you ambush two excellent high yields. They’ll help your portfolio produce excellent income – even in small amounts. I like to think of them as income catalysts.

Let’s dive in.

Pick #1: PDO – Yield 8.3%

Many of the finest things in life are exceedingly rare. Rare things are usually very expensive. People will pay massive premiums for a rare bottle of wine, an ancient bottle of scotch, a unique gemstone, or a limited edition painting which are sought after by those with a lot of money to spend.

I like rare things too, but you won’t find what I’m looking for at a Sotheby’s Auction House, nor will you find me paying a lot for the rarities I seek out. One of my favorite rarities to buy is a PIMCO fund trading at a discount to NAV.

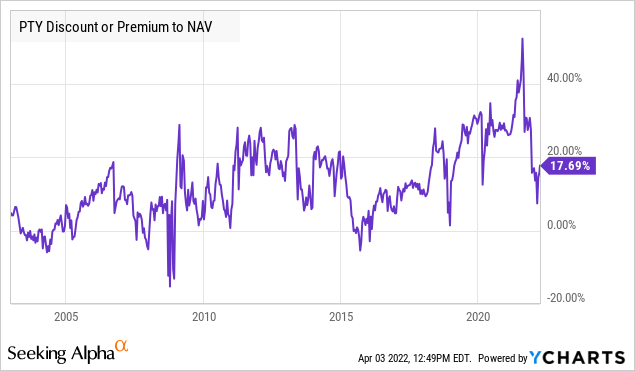

PIMCO Dynamic Income Opportunities Fund (PDO) is one of the newest members of the PIMCO family funds. PDO is now trading at a 5.4% discount to NAV. Likely, its youth is part of the reason. PDO in allocations is most comparable to PIMCO Corporate & Income Opportunity Fund (PTY), PIMCO’s best performing fund of all time. PTY has been operating for 20 years, and since inception, you can count on one hand the number of times it traded at a discount to NAV: Shortly after inception, during the Great Financial Crisis, in late 2015, and very briefly in March 2020.

Despite PTY being a bond fund that has outperformed the S&P 500 since its inception nearly 20 years ago, there are still plenty of doubters.

“But the leverage!!!” is the most common rallying cry of the bears. They claim that it’s super risky, yet PIMCO has operated with materially the same strategy for going on 20 years. Through the Great Financial Crisis, through COVID, the leverage that PIMCO employs on a routine basis did not have a crippling impact. Why?

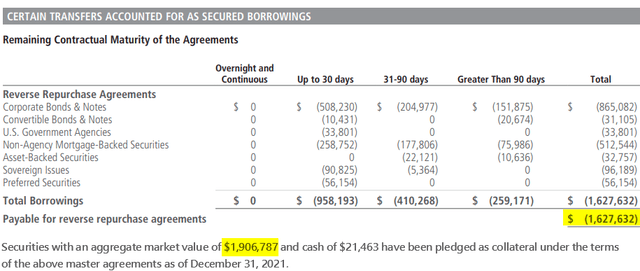

As a percentage of assets, the leverage is high, often over 40%. Though, CEFs are legally restricted to borrowing only 33% of NAV. The key is that PIMCO primarily utilizes “repurchase agreements.” These are non-recourse obligations where the securities PIMCO is buying are the collateral for the “loan,” this is a very common method to finance bonds and mortgages.

The key is that in the event of default, the lenders’ only recourse is to take the collateral. This is what keeps PIMCO from triggering the 33% debt limitation, because PIMCO’s equity at risk from the debt is quite low. Here is a screenshot from PDO’s semi-annual report:

PDO’s semi-annual report

There are two key highlighted numbers here. PDO owes $1.6 billion. This obligation is secured by collateral with a market value of $1.9 billion. Then, in the worst-case, end of the world scenario, PDO surrenders the collateral. Losing $1.9 billion in assets, and erasing $1.6 billion in debt for a net loss of $300 million. A total impact of $2.72/share is caused by the leverage which is approximately 15% of NAV. Consequently, the fund is no riskier than any other bond fund with modest 15% leverage.

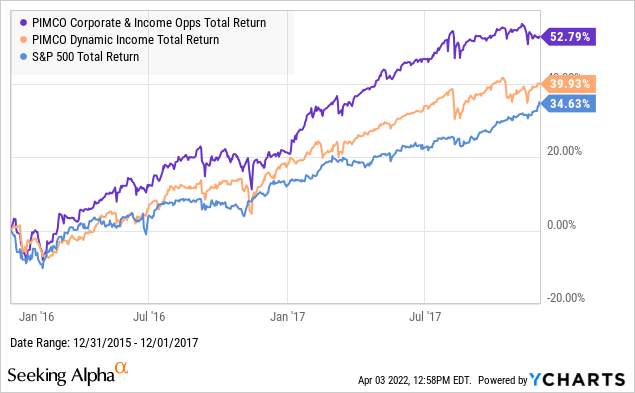

“What about rising rates?” is the next thing the bears will say. Well, what about them? Here’s PTY and PDI (PDI) the last time the Fed started a raising cycle. See that line on the bottom with the lowest total return? That’s the S&P 500.

Turns out that selling PIMCO funds to invest in equities because rates were rising wasn’t a very smart move.

Even seven years later, the market still hasn’t learned. It sells off the PIMCO funds because rates are rising and that is supposed to be “bad.” It created a fantastic buying opportunity back then, and it has created a fantastic buying opportunity again today.

I love several of the PIMCO funds, and it’s often difficult to choose between them. Yet today, PDO is trading at a discount to NAV, it’s headed by the same managers and has a very similar style as PTY yet trades at a hefty discount. Learn from history. When quality PIMCO funds are trading at a discount to NAV, buy them.

Pick #2: OXLC – Yield 12.6%

Oxford Lane Capital (OXLC) is a CEF that invests in CLOs (collateralized loan obligations). At HDO, we have been extremely bullish on CLOs coming into 2022.

CLOs are bundles of leveraged loans. These are loans, usually originated by banks to companies with B/B+ credit ratings. They are “senior secured” first-lien loans. These loans are at the absolute top of the capital stack. They’re senior to any other debt or equity the borrower has.

The CLO bundles these loans together and then sells “tranches” based on repayment seniority. With each payment the A-tranches have to be paid in full first, then the B-tranches and so on. OXLC focuses primarily on the “equity” tranche, this is the tranche that gets whatever is left.

Since the equity can’t collect a penny until the payments have been made to all the “debt” tranches, it is in a “first loss” position. If a borrower defaults, it’s the equity tranche that gets paid less.

So when we’re watching CLO equity positions, our primary concern needs to be default levels. How many borrowers will be unable to pay? How many borrowers must be making their payments to have a good return?

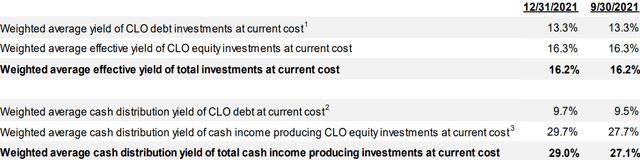

Keep in mind that OXLC is getting credit card type yields. As they reported in their Q4 Investor Presentation, OXLC’s cash yield on its investments is 29%.

Q4 Investor Presentation

In other words, if all of the borrowers paid as agreed, OXLC would be yielding 29%! Like a credit card company, you should assume that defaults will happen. OXLC collected a yield of 29% last quarter, but some of that will likely be offset by future losses if borrowers default. The “weighted average effective yield” is a measure that reflects the historical average default rates of a little under 3%, which is the effective yield that OXLC can expect to receive if default rates are average over the long haul.

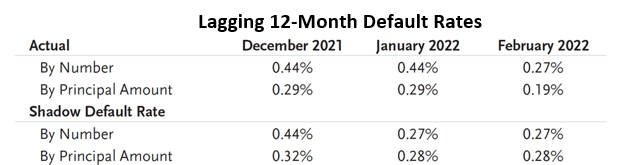

Right now, the default rate among leveraged loans is minimal. There hasn’t been a single default in 2022 and only three defaults in the past 12 months.

TCW

Default rates are at all-time lows, and just getting back to historical averages would require a dramatic increase. This means that the odds are high OXLC is going to earn substantially more than the “effective” yield indicates unless we see a significant spike in default rates.

Yet, despite cash flow being incredibly high, in February, equity tranche values declined to $59.60. In other words, there’s $100 in face value owed by the underlying borrowers and OXLC is paying under $60. These are incredibly low prices in the backdrop of default rates being near 0%.

Over the past year, OXLC has increased its CLO holdings by over 38%, it has recognized the incredible buying opportunity and backed up the truck. It had been retaining excess cash flow for reinvestment and selling shares at a premium to NAV to now buy up CLO equity positions as fast as it can.

Last quarter, OXLC produced GAAP earnings of $0.29. GAAP uses the more conservative “effective yield” described above. This covers OXLCs newly raised dividend by 128%. OXLC’s core earnings were much higher at $0.44, covering its dividend by 195%!

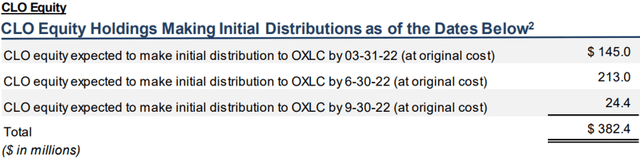

OXLC has great coverage, even though a very large portion of its portfolio is not yet producing any cash flow. As of December, $382 million of investments, approximately 30% of OXLC’s portfolio, had not yet made its first distribution. That cash flow will start coming in the next two quarters.

Q4 Investor Presentation

OXLC is yielding over 12.5% today, it’s covering its dividend by 128% by GAAP net income, and 195% by cash earnings, and its cash flow will be growing at a double-digit pace in the first half of the year. OXLC is an incredible opportunity to get such a high yield that is well-covered and has very high potential for more dividend growth.

This is why the CLO sector is one of our favorite opportunities of 2022.

Dreamstime

Conclusion

These two absurd and outstanding yields are available for you in the market today. It’s not often I can present to you a 12% yield or higher yield that has an extremely high level of coverage – OXLC is a real gem that if you don’t have you’re missing. Don’t let OXLC be your carbuncle and snap up this opportunity.

With PDO, its coverage was so strong that we got a great Christmas bonus via a special dividend. I expect PDO to continue to give me excellent income month after month. Many of my readers ask for great monthly picks, today, I give you two.

Monthly dividends are extremely nice as most of our bills and expenses recure on a monthly basis. Each cash dividend is an infuse of opportunities and flexibility into your bank account. I love having the flexibility in my life and portfolio. You can have it too.

Aim big, miss big, still end with an outstanding retirement. Welcome to income investing.

Be the first to comment