sofirinaja/iStock via Getty Images

Thesis

The Invesco Bond Fund (NYSE:VBF) is a CEF from the Invesco family. The vehicle has income as its primary objective, and holds investment grade U.S. debt. The fund initially IPO-ed in 1970, and has a substantial track record.

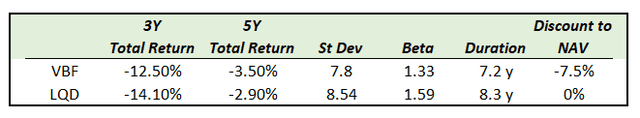

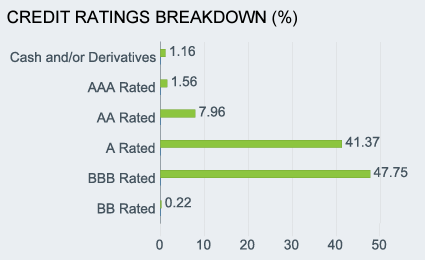

VBF is overweight U.S. investment grade bonds, and it immediately reminded us of the iShares iBoxx Investment Grade Corporate Bond ETF (LQD). The two vehicles are very similar, albeit VBF is a CEF while LQD is an ETF. Let us have a closer look at the two funds:

Table (Author)

We can see the two vehicles have very similar total return profiles on 3- and 5-year lookback periods, and surprisingly VBF has a lower standard deviation (which is a measure of volatility). The main difference between the two funds (outside the structure) is the fact that VBF has a 20% bucket with below investment grade bonds. We would have expected this slicing to give VBF a higher volatility. Do note that VBF does not have any leverage currently.

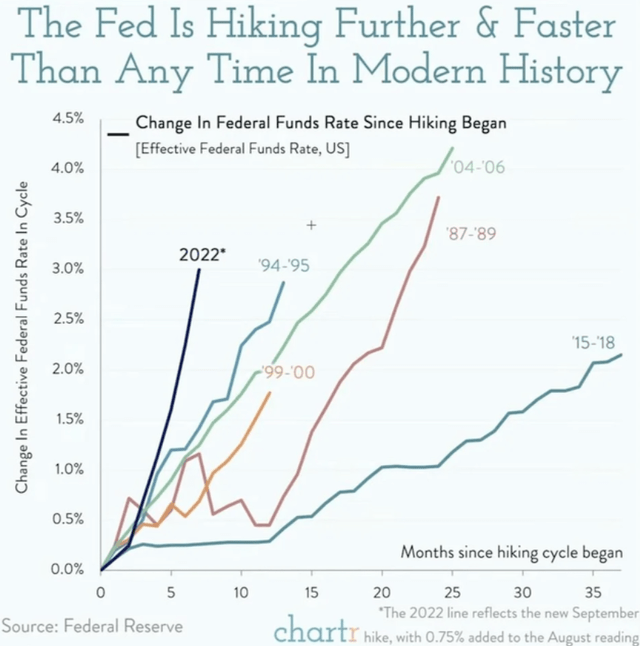

This year has seen a massive re-pricing of rates, with the Fed rising the Fed Funds rate the fastest in history:

Fed Funds History (Federal Reserve)

The current levels and where the market is pricing the terminal rate has now allowed investment grade bonds to be “back in the game” by exposing attractive yields. Many market analysts are now commentating how investors are nowadays asking more questions around bonds than equities. Somehow it is to be expected, after a decade of barrel bottom yields.

VBF is an interesting structure, which exposes a very similar build to LQD, and very similar analytics. VBF however is trading at a -7.5% discount due to the fact that it is a CEF and the market has sold-off bonds in 2022. We expect a stabilization of rates into year end and a narrowing of the VBF discount into 2023 as the market normalizes. We find VBF to be a clear cut alternative to LQD, where an investor can count on a 4% “boost” in 2023 from the discount to NAV narrowing. The only downside risk to the VBF portfolio is a severe and protracted recession that can actually cause defaults in its portfolio, which is more credit risky when compared to LQD.

Holdings

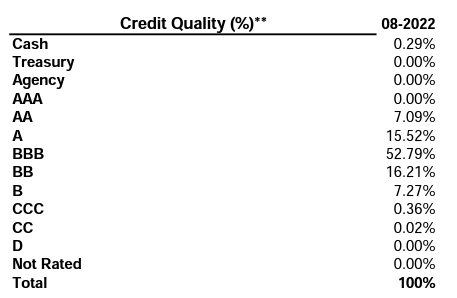

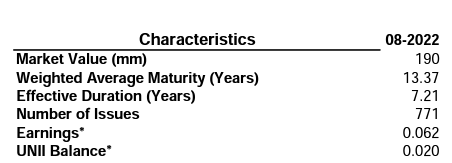

The fund holds primarily investment grade bonds, with a small bucket comprised of junk bonds:

Ratings (Fund Fact Sheet)

Since the fund’s primary focus is investment grade debt, we presume some of the high yielders are “fallen angels”, i.e. securities that were downgraded from investment grade.

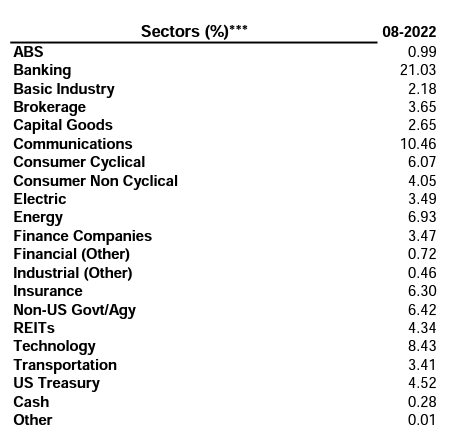

From a sectoral standpoint the fund is well diversified, although banking has a high allocation, above our preferred 15% threshold:

VBF Sectors (Fact Sheet)

We can see that the next largest industry group is comprised of Communications bonds.

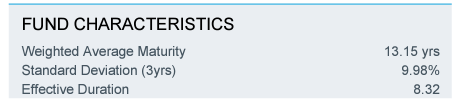

The fund has a 7.2 years duration:

VBF Details (Fund Fact Sheet)

When compared to LQD, our main take-aways for VBF are:

- similar duration profiles (7.2 years for VBF vs 8.3 years for LQD)

- similar weighted average rating profile (~50% buckets for BBBs, but LQD has no junk bonds)

- both funds have no leverage

LQD Summary (LQD Fact Sheet)

LQD Ratings (LQD Fact Sheet)

Performance

VBF is down -25% year to date:

YTD Total Return (Seeking Alpha)

The CEF underperformed LQD in 2022 due to its high yield bucket. However, on a 3-year time horizon, both funds post similar results:

3Y Total Returns (Seeking Alpha)

The story is similar on a 5-year basis, although VBF exposes more volatility:

5Y Total Returns (Seeking Alpha)

Let us have a look at risk/reward metrics:

- Standard Deviation (5Y): 7.8 for VBF versus 8.54 for LQD

- Sharpe Ratio (5Y): 0 for VBF versus 0 for LQD

- Beta (5Y): 1.33 for VBF versus 1.59 for LQD

Distributions

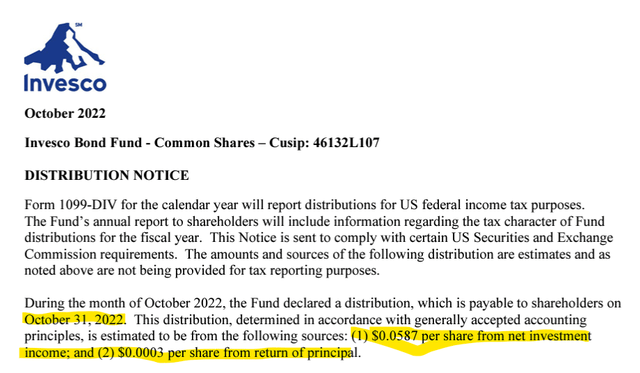

The fund tends to utilize mostly assets’ cash-flows for its distributions:

October Distribution (Section 19a)

The fund currently has a 5% yield versus a 5.8% SEC yield for LQD.

Premium/Discount to NAV

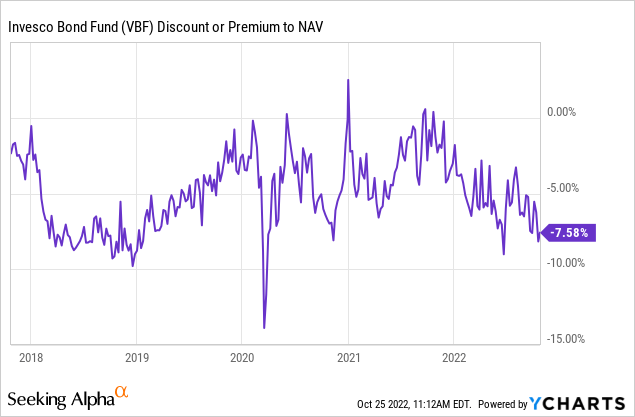

VBF is structured as a CEF, hence its collateral value does not always trade at the same level as its share price:

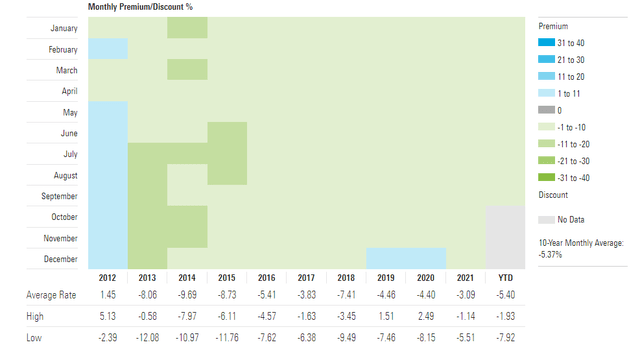

Premium / Discount to NAV (Morningstar)

We can see from the above table, courtesy of Morningstar, that VBF usually trades at a 3% to 4% discount to net asset value. The discount widens out during market risk-off bouts:

We can see that substantial move during the Covid crisis, as well as the leg down this year in June. That is one of the main differentiators between ETFs and CEFs: by their structure ETFs trade their shares and collateral throughout the day, while CEFs only trade shares.

If an ETF’s shares are trading at a premium to its NAV, the dealers in the ETF can buy the ETF’s underlying securities, supply them as a creation basket to the ETF issuer, receive ETF shares in return and sell them in the market for a risk-free profit. These transactions have the overall effect of bringing the ETF’s secondary market price back into line with its NAV. Conversely, if an ETF’s shares are trading at a discount to its NAV, the dealers can sell the ETF’s constituent securities, buy ETF shares in the open market, exchange the ETF shares for the redemption basket and again end up with a risk-free profit. In turn, the ETF’s price is brought back into line with its NAV, this time from below.

Conclusion

VBF is a fixed income CEF focused on U.S. investment grade bonds. The vehicle has a very similar build and risk/reward metrics as the much larger and well-known ETF iShares iBoxx Investment Grade Corporate Bond ETF. The two vehicles have almost identical 3- and 5-year total returns, and have been both pummeled by higher rates in 2022. The main difference is the fact that VBF is currently trading with a -7.5% discount versus its NAV, whereas LQD, as an ETF, is trading at net asset value. We believe we are going to get a stabilization in rates going into 2023, and moreover we are going to see the VBF discount to NAV narrow next year. We are now seeing attractive all-in yields for investment grade bonds, and expect positive returns for both vehicles in 2023, with an outperformance by VBF.

Be the first to comment