Wolterk/iStock Editorial via Getty Images

Motorola Solutions (NYSE:MSI) is a Chicago-based provider of communications tools and analytics solutions to over 100 companies around the globe. Its range of products, used as security tools, includes radio communication devices, video cameras, and corresponding software and accessories for analysis and support. The company is divided into two segments, dealing with both the hardware and software elements of the company. The company was once a leader in supplying mobile devices of all kinds before a spin-off that founded Motorola Solutions, which remains a well-known brand name. However, with regards to providing security tools needed on both a large and small scale, the company remains prevalent and continues to produce excellent products and services.

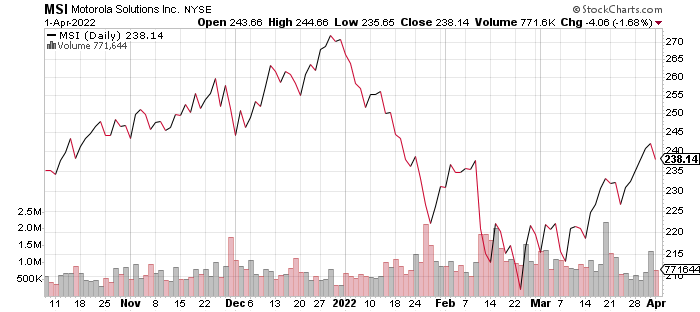

stockcharts.com

As Motorola Solutions continues to build itself through its formidable reputation, we will look at the company’s recent finances and noteworthy news that provides crucial information on the efficiency of its strategies. Quality should be a priority in any industry, making it the critical determining factor for success, and Motorola Solutions is a prime example of that.

Overview & Risks

Motorola Solutions operates under the Products and Systems Integration and the Software and Services segments. This division has allowed Motorola Solutions to focus entirely on its specific brand of security-based products and software for analysis. There are two major types of risks that could affect the company’s growth in the coming months. The first has to do with global and geopolitical turmoil, which could affect anything from the ability to deliver on time and obtain necessary supplies and reduced demand in emerging economies that have suffered the most from the pandemic. Secondary to this is more area-specific challenges, such as the need to either increase vendor financing according to regulations set in certain developing economies or otherwise risk losing sales to competitors. Security is also a big issue in such emerging economies, with populated regions like Asia providing excellent business opportunities. These are not concerns Motorola Solutions will easily dismiss. Suppose the company wishes to experience continued growth. In that case, it will need to address these and prove capable of supplying the global market’s demands as well as navigating the rules and regulations of different governments.

Industry & Recent Developments

Motorola Solutions made a few acquisitions during 2021 and added to its total asset value. The company announced mid-year that it had acquired Openpath Security for an undisclosed sum. The purchase further expanded the company’s portfolio and ability to offer video and remote access control. In November, the company also announced the acquisition of Envysion, a leader in video security and business analytics through cloud-based solutions. Details of the acquisition were also not disclosed. Moving into 2022, the first quarter saw the acquisition of Ava Security Limited, also undisclosed, adding a cloud-based solution with visibility and analytics, further adding to a growing portfolio. This growth will help place Motorola Solutions as one of the leaders in the telecommunications equipment market.

The telecom equipment market is experiencing steady growth, with a projected 11.23% compound annual growth rate (CAGR), from 2019 to 2025. This growth is primarily driven by the growth of evolving equipment related to communications. 5G networks and the corresponding equipment able to use evolving tech will mean more and more products will continue to be put out. A growing population and demand for tech used for work, education, and leisure, further propel growth in the sector. The dependency on technology will continue to grow in the next few years, and a number of devices will be needed to assist in all possible areas. The market is expected to grow at a 10.5% CAGR in the US alone during the same period. China remains the largest market, though the US still boasts substantial growth, and a growing rift between the two sides may indicate less independence from each other.

Among the most significant threats that could offset the market’s growth include the global shipping crisis and global semiconductor shortage. While the former is expected to be mostly resolved by the end of 2022, as both ease in restrictions and alternative solutions are provided, it remains to be seen how the chip shortage crisis is being handled as companies are still rushing to provide these crucial components quickly.

Finances

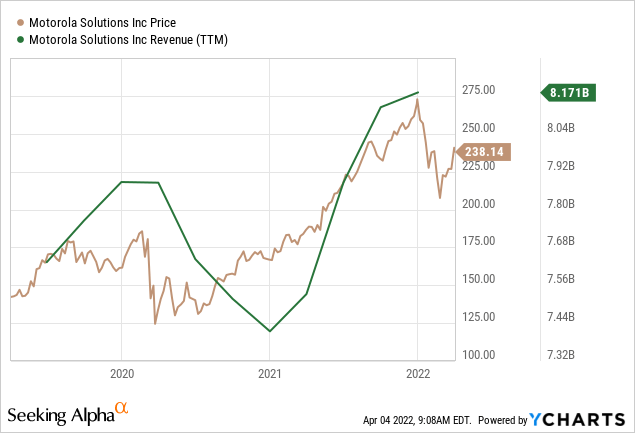

ycharts.com

Motorola Solutions reported total sales revenue of $8.2 billion in 2021. This represented a 10% growth from the year before, when the company reported $7.4 billion in revenue. The Software and Services division of the company reported the largest year-on-year growth. The 13% growth registered mainly was attributed to sales in video security software, LMR services, and command center software. Products and Systems came second in growth, seeing an equally positive 9% year-on-year growth, primarily due to video security, public safety LMR products, and PCR. Growth in both segments is good for the company as it validates the decision to divide and focus on both components. The company reported a total backlog of $13.6 billion, adding $1.3 billion to the figure reported the year before, most of which came from the $886 million increase in Software and Services alone. GAAP operating margin also saw an increase, with the company reporting 20.4% of sales, up from the 18.7% operating margin reported in the previous year. Going on what was seen in the previous year, revenue can be expected to increase throughout 2022 at a similar rate of approximately $200 million per quarter.

Motorola Solutions started the year with $1.77 billion in revenue at the end of the first quarter. By the final quarter, the company reported $2.32 billion in sales, growing at slightly over half a billion in that period. By the end of the quarter, software and Services continued to lead the way, with Products and Systems declining slightly as they felt the effects of the supply chain crisis. Such factors may not have prevented growth over the past year, but they directly affected how much the company could have grown and the profits made in the same period.

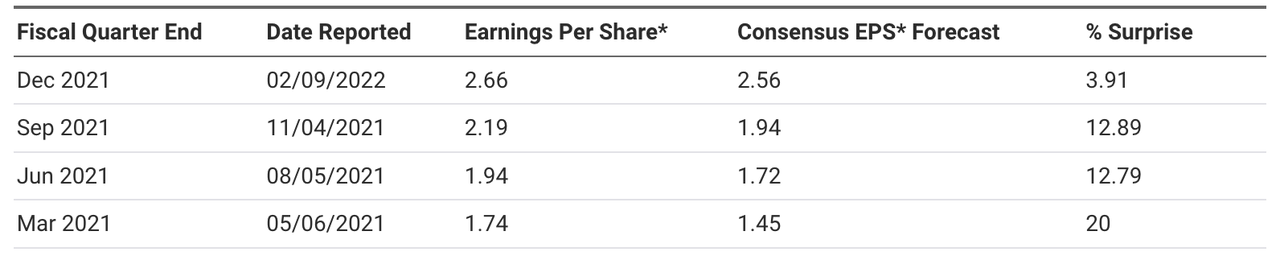

nasdaq.com

Taxes also saw an increase and limited cash flow to $200 million in annual growth, reporting at $1.8 billion, as opposed to the operating cash figure of $1.6 billion in 2020. The company will be encouraged when looking at the repurchasing of stock that occurred throughout the year. The total sum of $528 million the company spent on repurchases overshadows the $457 million spent in acquisitions over the year. This means the company was more willing to invest in itself rather than looking for external investments that may not add value to its portfolio. Quarterly earnings per share steadily rose in each quarter of the last year, finishing above estimates and with the final quarter at $2.66. The consensus is that the company will report a quarterly EPS below any in 2021 in the first quarter of the current year. While there may be some basis for this, due to the COVID-related headwinds, the final quarter is expected to present overall year-on-year growth.

Outlook

The end of the first quarter of 2022 is fast approaching, and there are already some expectations presented by Motorola Solutions in what to expect. Revenue is expected to register a moderate 3% growth in 2022 compared to Q1’21, and EPS could dip to anywhere between $1.53 to $1.59. Slowed growth can be expected as the company continues to find solutions to global problems. In the meantime, demand can also be expected to increase exponentially, and with that, the company’s ability to generate steady income. Despite the expected limited growth during the current year, there nevertheless will be positive growth when not comparing quarter by quarter. Motorola Solutions has proven its ability to deliver, and as a result, investors can confidently take a bullish stance on this experienced company.

Be the first to comment