All_About_Najmi

Co-produced by Austin Rogers for High Yield Investor.

In 2021, renowned hedge fund manager Ray Dalio repeatedly made the case that “cash is trash.” He said it over and over again in the media and TV interviews.

In September 2021, as stocks and cryptocurrencies were surging, Dalio again repeated the idea that “cash is trash” while pitching crypto as a good alternative to holding cash.

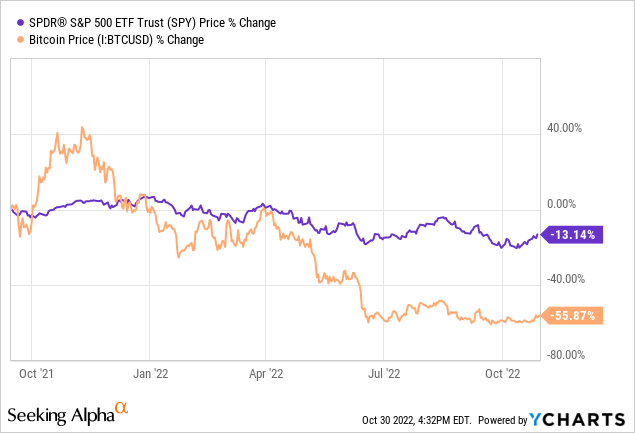

We hope anyone who took Dalio’s advice only did so as a short-term trade, selling their Bitcoin a few months later, because since that Dalio statement in mid-September 2021, both have declined meaningfully. Bitcoin (BTC-USD) in particular has performed abysmally:

Later, in May 2022, Dalio altered his stance a bit. Even after a 15% drop in stocks (SPY), cash remained trash, but stocks were even trashier.

And now, in early October 2022, Dalio has shifted again, citing Keynes’ famous saying, “When the facts change, I change my mind.”

With short-term interest rates higher, Dalio now says it’s a pretty good idea to keep money in some sort of interest-bearing savings vehicle.

But with what cash? If someone had followed Dalio’s advice, they would have no cash available to put into interest-bearing savings accounts or money markets. They would have to sell stocks after suffering 20%+ declines YTD or cryptocurrencies after suffering 50%+ losses in order to have any money to put into these interest-bearing cash equivalents!

At High Yield Investor, we like cash, because it gives us the ability to seize on great buying opportunities when they come. But what we like even more is cash flow.

This is a double entendre, meant to refer to both our portfolio holdings’ cash flows at the company level and our (the shareholders’) cash flows via dividends. During periods of economic turmoil, the safest place to be is in companies that can reliably generate cash and distribute a reasonable portion of that to shareholders.

With that in mind, here are two cash-rich, high-yield stocks that are worthy of consideration.

Kinder Morgan, Inc. (KMI)

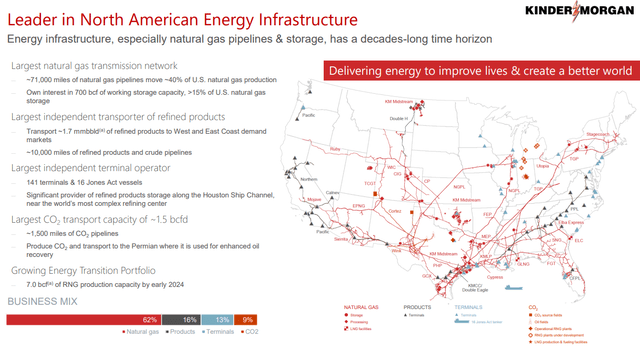

KMI is the United States’ industry leader in infrastructure for the transportation, storage, and processing of natural gas. About 40% of the natural gas produced in the U.S. moves through KMI’s pipelines or other midstream infrastructure, which includes storage facilities, export terminals, and seafaring vessels for domestic transportation.

Though the vast majority (~94%) of KMI’s cash flows are fixed based on take-or-pay, hedged, or fee-based contracts, the midstream company sees ample growth opportunities surrounding the liquified natural gas (“LNG”) export growth trend.

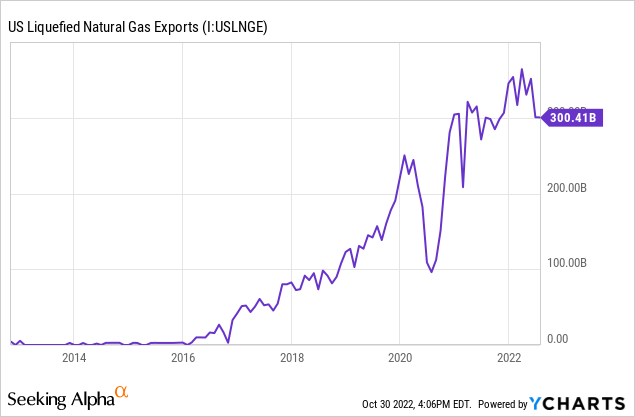

U.S. LNG exports have soared in the last eight years, dipping this year only because of a disruption at the export facility in Freeport, Texas.

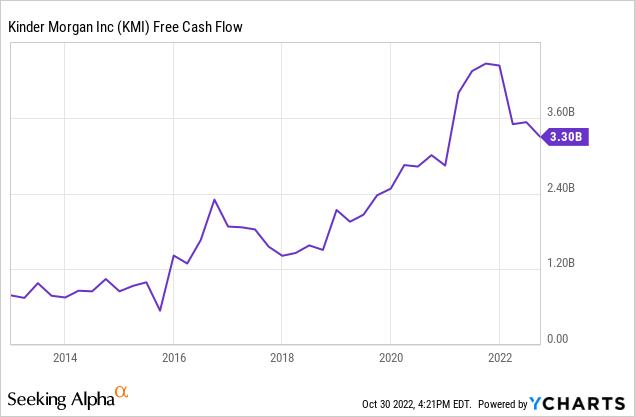

Considering the fact that KMI’s infrastructure moves about half of the gas that ends up being exported as LNG, KMI’s free cash flow (“FCF”) has surged during this period as well, allowing the company to take steps to deleverage while continuing to grow.

Comparing KMI’s estimated $3.4 billion in FCF for 2022 against its market cap of $39.9 billion, we find that the company boasts an FCF yield of 8.5%.

During these last six years, KMI has self-funded 100% of its capital expenditures and dividends with operating cash flow, leaving some extra cash to spare for growth investments, deleveraging, or buybacks.

The surge in LNG exports is expected to continue steadily, as Europe and Asia are both increasing their appetite for American natural gas. In fact, as export facilities are built or expanded in the years ahead, U.S. LNG export capacity is expected to double from 11 Bcf/day in 2022 to 22Bcf/day in 2027.

Management says they see $150-$300 million of pipeline expansion opportunities ahead, including to connect major interstate pipelines to export facilities. Moreover, KMI could eventually expand its own Elba LNG export facility in Georgia, potentially tripling its export capacity.

Though KMI will by no means become a high-growth stock anytime soon, the point is that it is cash-rich in a recession-resistant industry with a well-covered, 6.25%-yielding dividend and enough growth opportunities to keep that dividend growing by 3-4% for the foreseeable future.

Medifast, Inc. (MED)

MED sells premium diet and weight loss products through its Optavia brand. The vast majority of its sales are facilitated by its growing base of “coaches,” who are mostly former Optavia customers themselves.

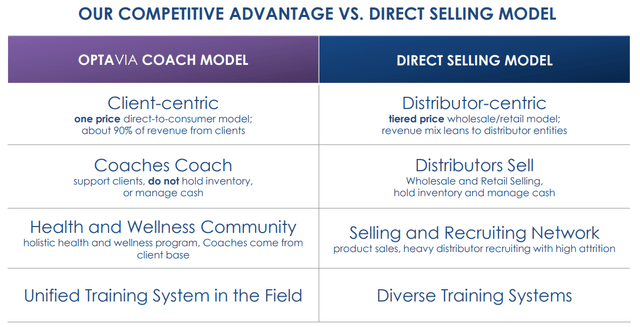

MED’s business model is often compared to a multi-level marketing scheme, since coaches have a role to play in the process of selling the product, but this program is really more of an incentive structure for those who have used the products and believe in them to market the products on their own. It’s a replacement for other types of marketing that MED would otherwise have to do to sell their products.

Moreover, it’s a direct-to-consumer model, meaning that coaches carry no inventory themselves and do not have to worry about handling cash. The consumers of the product are the customers in MED’s model, compared to the sellers of the products being the customers in a MLM model.

MED boasts that 77% of its customers purchase products at least a second time, and 49% of customers have made purchases four or more times.

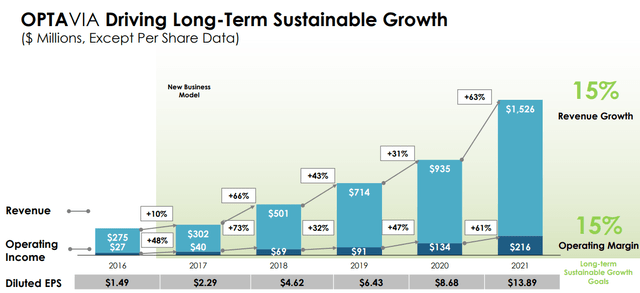

This combination of high-quality diet products and coach-led marketing has produced tremendous growth in the past five years.

In the first half of 2022, MED enjoyed further revenue growth of 18.5% year-over-year as well as ~15% growth in its active earning coaches, but operating income fell primarily because of higher Sales, General, and Administrative (“SG&A”) costs. Why the uptick in SG&A? Here’s the Q2 earnings report to explain:

The increase in SG&A was primarily due to higher OPTAVIA Coach compensation expense, donations made to support the Ukrainian relief effort (“Donations”), incremental costs related to continued investment in information technology and distribution infrastructure, and increased credit card fees resulting from higher sales.

In the second half of this year, however, that growth trajectory has stalled.

MED has suffered from soaring input costs and weakening consumer demand this year, along with so many other consumer discretionary companies. Between softening sales, driven by inflation eating into consumers’ paychecks and making them unable to afford premium products like Optavia, and rising input costs pressuring margins, the current situation is uniquely bad for MED.

That bad situation will probably persist for as long as the economic environment remains unchanged.

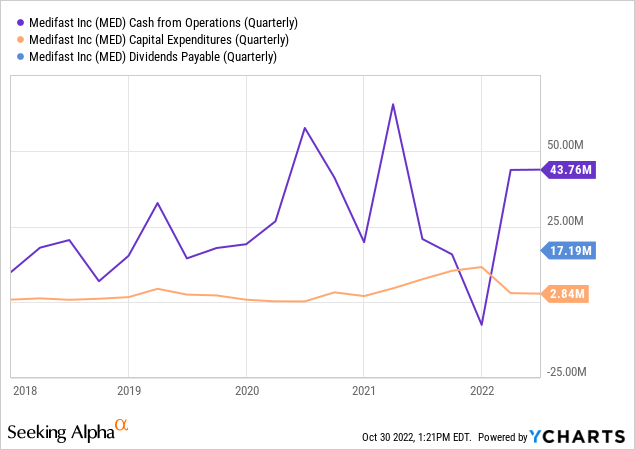

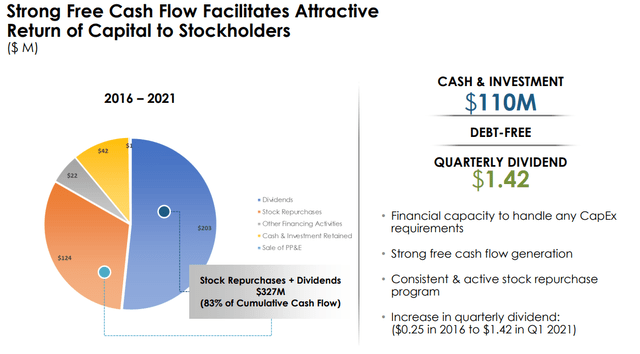

But there is good news. In past years, MED has been a phenomenal generator of cash, including plenty of free cash flow with which to buy back stock and pay a fast-growing dividend.

And that cash generation continued through the first half of 2022, during which operating cash flow covered capital expenditures and dividends with plenty of room to spare.

For the full year of 2022, MED expects to generate around $13.40 in EPS (midpoint of guidance), which would still give the $6.56 annualized dividend a payout ratio slightly under 50%.

As of the end of June, MED had zero long-term debt and only $27 million drawn on its credit facility. Moreover, net debt is negative, because MED also ended the second quarter with $61.1 million in cash.

In short, though MED has certainly entered a rough patch as far as the macro backdrop is concerned, the company is well-prepared financially to weather the duration of it.

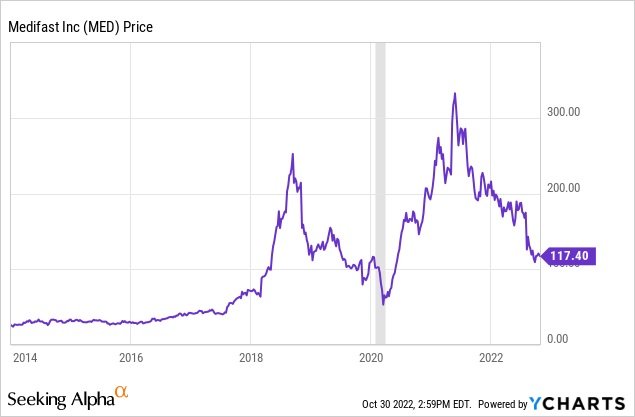

This makes the stock’s massive selloff – the second since current CEO Dan Chard took over in October 2016 – look like an attractive entry point.

When growth stocks like MED come back into vogue and inflation eases up to allow margins to rebound and consumer pocketbooks to be less stretched, we believe MED could easily double from here. In the meantime, today’s buyers can enjoy the 5.6%-yielding dividend.

Bottom Line

Bear markets present all kinds of opportunities, and lots of various kinds of stocks are discounted right now. But investors should be cautious about what they buy in today’s market.

By many measures, the U.S. economy has not officially slipped into a recession yet. And though stock prices do tend to bottom before the economy does (because stock prices are forward-looking), it’s entirely possible that stocks have not seen their lowest lows for this bear market yet.

While we at High Yield Investor are value-oriented investors, we also believe cash flow is king. Companies with reliable cash flow streams and comfortable cash cushions offer some of the best places to hide amid the current economic uncertainty.

Be the first to comment