PeopleImages/iStock via Getty Images

Investment Thesis

In my previous article on Casella Waste Systems, Inc. (NASDAQ:CWST), I came to the conclusion that the company has a good business model and a moat. However, I also argued that the stock was expensive, trading at that time at 42x forward earnings. You can read about it here. Since then, CWST lost ~4% vs. a loss of ~8% for the S&P 500 and has outperformed the market. The company recently reported solid Q2 FY22 results, posting a ~31% YoY revenue growth above analysts’ estimates. However, I continue to believe that buying CWST today is a risky bet given where we are in the business cycle and how that could impact the company’s profitability, and ultimately, its valuation. I maintain my $52 per share price target which assumes a 16% annual growth rate and an 8% discount rate.

Recent Developments

The firm published Q2 FY22 results on July 28th, 2022. Overall, the results were solid, above analysts’ forecasts. In the most recent quarter, sales increased by 31.4% YoY to $283.7 million. The results were bolstered by CWST’s growth-through-acquisitions strategy. It’s important to remind investors that CWST spent over $170 million in FY21 on M&A deals, which is a significant amount for a company with an equity value of $457.6 million on the balance sheet. Management closed over 11 acquisitions in the first seven months of 2022 for an estimated $47 million in annualized revenues which shows that the current growth model is here to stay.

Finally, I’d like to highlight our capital allocation and growth strategy. We continue to have success executing our growth strategy. We have now closed on 11 acquisitions year-to-date with approximately $47 million in annualized revenues. The team continues to do a great job, maintaining a disciplined approach in terms of focusing on deals with the right strategic fit and return profile and ensuring that we complete integration to achieve the expected return. Of the 11 acquisitions, five closed since our last earnings call, including two in the second quarter and three in the month of July.

John Casella – Chairman and Chief Executive Officer – Q2 FY22 Earnings Call

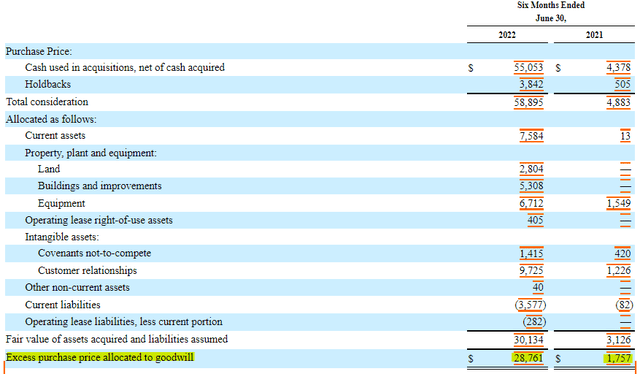

However, I think it’s important for investors to pay attention to how costly these acquisitions are. The recent goodwill amount allocated to these transactions surely raises some eyebrows as it represents nearly half of the amount paid by the company to acquire the various targets. It’s also important to add that goodwill is increasing faster than total assets at this point. Goodwill as a percentage of total assets now stands at roughly 19% versus 16% a year ago.

The different segments reported strong results and management seemed pretty confident that business activity will remain strong, despite recent PMI and manufacturing data pointing to softer economic conditions. If we look at landfill operations, both volumes and pricing were higher compared to last year thanks to a tougher winter and higher inflation. Similar factors are impacting the collection business, and management specifically stated that they are very keen on mitigating inflationary pressures, particularly higher fuel costs.

First, as it relates to our landfill operations, in the quarter we experienced positive volumes and positive price. Landfill tonnages were up in the quarter as we had increased volumes after a tough winter. The economy in the Northeast remains strong. Our expectation is that landfill volumes will be positive through the remainder of the year with increased volumes remain focused on both our landfill operating and pricing programs. From a pricing perspective, we continue to improve the quality of revenue through customer mix. We measure this through our average landfill price per ton statistic and in the quarter it was up over 6%.

Moving to the collection business. We posted strong adjusted EBITDA growth and margin expansion year-over-year above budgeted levels. This achievement is twofold. We start the year with a concerted effort to reevaluate budgeted pricing programs given the environment. To date our core pricing is working well to mitigate inflation and our fuel cost recovery fee program is working well to recover higher fuel costs. From an operational standpoint, second quarter results demonstrate strong operating leverage.

John Casella – Chairman and Chief Executive Officer – Q2 FY22 Earnings Call

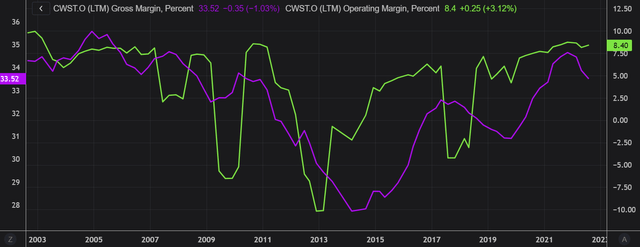

Despite management’s best efforts, it’s hard to believe that margins will remain constant or increase in this environment. In fact, I believe that the gross margin peaked during FY21 and subsequent quarters will show lower profitability. While the operating margin remains stable at 8.4% for now, it’s hard to believe that it will stay at the same level going forward.

After all, CWST’s business is not entirely shielded from the economic reality and a portion of it remains cyclical. During the last recession, things turned very ugly for shareholders when the economy turned south and CWST recorded a more than 5% decline in annual revenues. To be fair, the company is now in a better position to withstand a recession thanks to a stronger balance sheet and a lower level of leverage but I still think it’s important for investors to get some perspective on where we are in the cycle and how things can unfold.

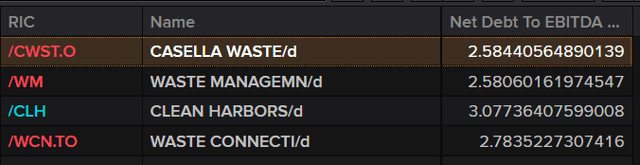

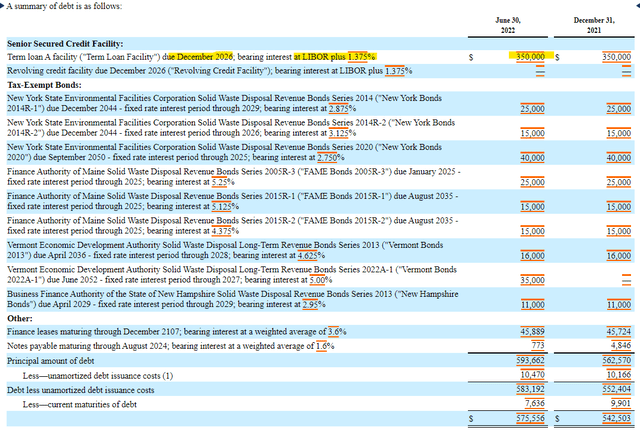

Speaking of leverage, CWST finished the quarter with ~$583 million of total debt, which translates into a net debt/EBITDA ratio of 2.6. While the amount of dollar debt continued to climb higher since 2018, the net debt/EBITDA ratio decreased and is now aligned with peers.

Refinitiv Eikon Refinitiv Eikon Refinitiv Eikon

On top of that, over 90% of the company’s loans are maturing after 2026, which gives it time to maneuver any short-term cash flow mismatches. That said, it’s important to highlight that over 50% of CWST’s total debt bears a floating rate and is directly impacted by higher interest rates. While the company has implemented a hedging strategy using interest rates forwards, it doesn’t cover these liabilities in full and a portion of the floating rate outstanding debt remains vulnerable to changes in interest rates.

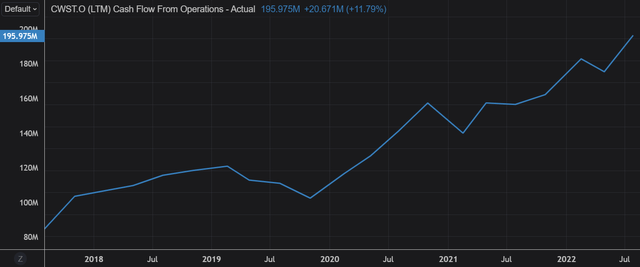

All in all, the company had a good quarter as illustrated by the total amount of cash created. Over the last 12 months, cash from operations reached nearly $200 million, a new record high which represents a ~90% increase compared to FY17. That said, investors need to pay attention to margins going forward as inflation continues to be a problem in the current market environment. On top of that, declining economic activity is also another topic of concern today that is likely to negatively impact operations.

Valuation

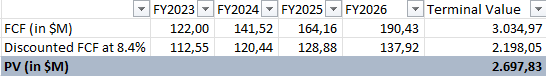

In my previous article on CWST, I have come up with an intrinsic value of $52 per share. We remain far above that target. Based on 52 million shares outstanding, the company has a market cap of approximately $4.3 billion. In this part, I have updated my DCF model to reflect some of my latest assumptions:

- Estimated free cash flow for FY23 of $122 million – ~$4 million higher compared to my previous estimate. The amount is based on the median Wall Street estimate.

- A growth rate of 16% until FY26 – revised upward from 12.5% to reflect price increases not previously incorporated in my model.

- A 2% terminal growth rate – unchanged.

- An 8.4% discount rate – 40 basis points higher in line with the company’s updated WACC.

Author’s DCF Model

Based on my inputs, I believe the fair value of the stock is still around $52 per share. Given the fact that the current market price is well above my estimate, I considered that CWST is in overvalued territory and investors will be better off waiting for a pullback.

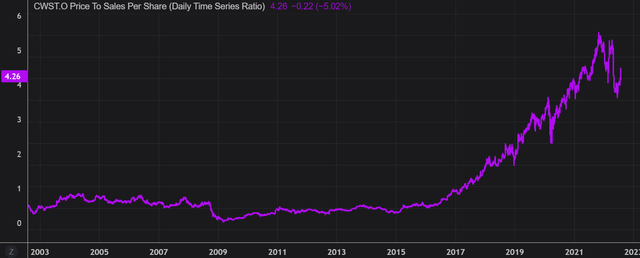

The price-sales ratio (“P/S”) is another good indicator to determine if CWST is expensive. The current value of ~4.3x is well above the 20-year average. If this multiple normalizes to a value of 2x sales, investors are facing a ~53% decline in the stock price which is something to keep in mind.

Key Takeaways

The firm recently posted strong Q2 FY22 results, exceeding analysts’ projections. Thanks to its M&A strategy, the company is growing faster than its competitors and still has a long way to expand given its relatively small market capitalization. However, CWST remains expensive, especially if you factor in an economic downturn and profitability crunch. Based on my DCF model, I maintain my $52 per share price target, which I believe provides a conservative estimate of what the business is worth today.

Be the first to comment