Diego Thomazini/iStock via Getty Images

One of the most important developments of the income market over the last few months has been the interrelated dynamics of relatively persistent inflation, an increasingly hawkish Fed and the associated sharp rise in short-term rates.

In this article, we highlight preferred securities that are expected to take advantage of this sharp rise in short-term rates. We do this by identifying attractive securities with relatively high reset yields. Investors who want a quick refresher on the different types of preferred stock yields can have a look at our earlier article.

Quick Reset Yield Review

A reset yield is simply the expected stripped yield of the stock on its first call date when its coupon switches to a floating-rate, if left unredeemed by the issuer. For example, the Zions Bancorporation 6.3% Series G (ZIONO), which trades at the stripped price of $25.22, carries a fixed coupon of 6.3% which switches to 3-month Libor + 4.24%, if unredeemed in March of 2023.

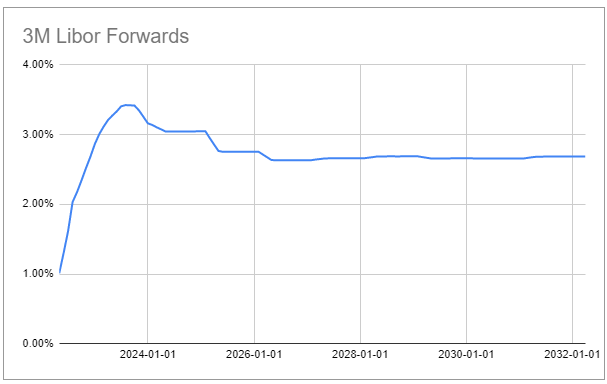

This is what market expectations of 3-month Libor are expected to be.

Systematic Income Preferreds Tool

To calculate the reset yield of ZIONO, we need to first see what the floating-rate coupon is expected to be on the stock’s first call date (i.e. when the coupon first switches to a floating-rate of 3-month Libor + 4.24%). 3-month Libor is expected to be around 3.2% at that time (this is based on “Libor forwards” – a bog-standard way of calculating market estimates of interest rates in the future). So, we just add the Libor estimate of 3.2% to the spread of 4.24% to come up with a coupon of 7.44%. A coupon of 7.44% in March-2023 on a stripped price of $25.22 equates to a stripped yield of 7.38% which is the ZIONO reset yield.

A Few Caveats

Four points are worth making here. First, the 7.38% is not, in any sense, guaranteed for two reasons. First, actual 3-month Libor in March of 2023 could, very well, be different. Libor forwards simply provide unbiased estimates of what future Libor is expected to be based on the current shape of the yield curve. If actual Libor is lower, then the reset yield will be lower as well and vice-versa.

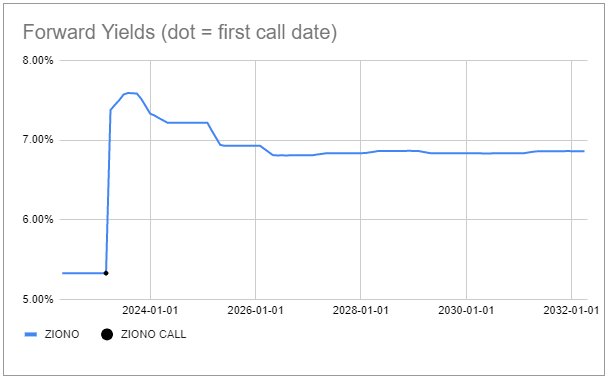

Two, the stock’s coupons will change over time as Libor changes. This means even if the currently expected Libor of 3.2% as of March-2023 is correct, it will invariably change as market expectations of the Fed policy rate shift and as the Fed itself changes its policy rate in response to macro conditions. The chart below shows how the ZIONO yield looks like leading up to the first call date (the flat line prior to the black dot), and after the first call date, if left unredeemed. The yield after the first call date jumps higher because the coupon is expected to increase from 6.3% to 7.44% and slopes lower because Libor is also expected to move lower.

Systematic Income Preferreds Tool

Three, investors need to use some caution in comparing reset yields because different first call dates equate to different levels of Libor forwards. For example, if ZIONO had a first call date in March-2024 rather than in March-2023 its reset yield would be substantially lower for the simple reason that Libor in March-2024 is expected to be significantly lower than in March-2023.

And finally, the stock could be redeemed by the issuer before the coupon floats. We address this point in a bit more detail below.

Some Ideas

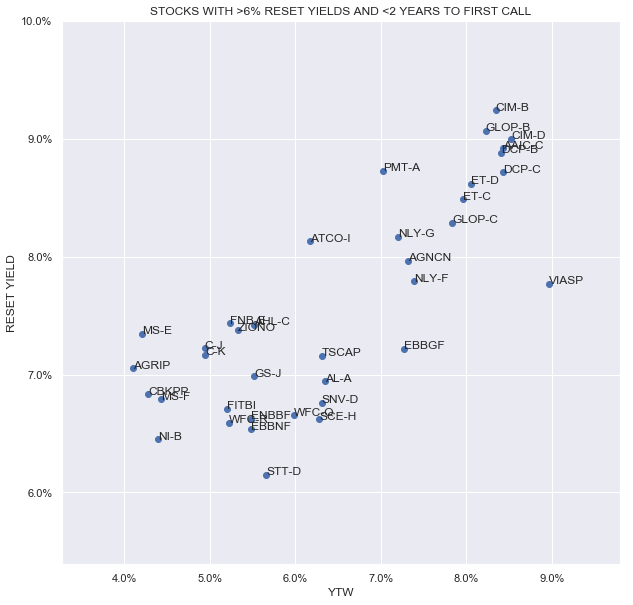

We start off with identifying the broader pool of potentially attractive securities from our investor Preferreds Tool by first selecting preferreds with less than 2 years to their first call date (as there is little reason to look at a 2028 first call date preferred as we can have no confidence on what short-term rates will be at that point) and reset yields above 6%.

The scatter plot below shows these stocks. The y-axis shows the reset yield and the x-axis shows the yield-to-worst (i.e. the yield leading up to the first call date).

Systematic Income

Within this population we would highlight the following securities:

- K1-issuer MLP DCP Midstream 7.875% Series B (DCP.PB), trading at a $23.42 stripped price with a 8.41% YTW / 8.88% reset yield with a first call date in June-2023.

- K1-issuer MLP Energy Transfer 7.375% Series C (ET.PC), trading at a $23.15 stripped price with a 7.97% YTW / 8.49% reset yield with a first call date in May-2023

- mREIT AAIC 8.25% Series C (AAIC.PC), trading at a $24.49 stripped price with a 8.42% YTW / 8.92% reset yield with a first call date in Mar-2024.

- mREIT CIM 8% Series B (CIM.PB), trading at a $24 stripped price with a 8.34% YTW / 9.24% reset yield with a first call date in Mar-2024.

On the higher-quality side we also like:

- California Utility SCE 5.75% (SCE.PH) trading at a $22.9 stripped price with 6.3% YTW / 6.62% reset yield with a first call date in Mar-2024.

- Zions Bancorporation 6.3% Series G (ZIONO), trading at a $25.22 stripped price with a 5.33% YTW / 7.38% reset yield with a first call date in Mar-2023.

In case of redemption, the yield-to-call of these securities is at least as high as their YTW (yield-to-worst defined as the minimum of stripped yield and yield-to-call). For securities trading below $25 in stripped price terms, the yield-to-call is above the YTW mentioned above.

What If They Just Get Redeemed?

A common criticism of Fix/Float securities is that they may get redeemed before the holder is able to take advantage of the shift from a fixed-rate to a floating-rate coupon, foregoing the potential increase in yield.

First, this is not necessarily true. Just because a stock’s floating-rate coupon steps up to a higher level than its fixed-rate coupon doesn’t mean the issuer will automatically redeem the stock. This is because the issuer will still need to refinance the stock (few issuers will have tens of millions of dollars of spare change lying around), and refinancing fees are not cheap. And two, because a company that refinances from floating-rate to a fixed-rate coupon loses the potential benefit of a lower coupon once the Fed begins to cut rates (in the scenario the economy moves into a recession, for example).

Second, with many preferreds trading below their liquidation preference (typically $25), it means that a redemption would be a good result for investors since the yield-to-call is often very high. For example, the yield-to-call or YTC of DCP.PB is 13.72% while its reset yield is 8.88%. All but one of the stocks mentioned above has yield-to-call in excess of its YTW or yield-to-worst. And while it’s true that the YTC is a one-off, it can still typically provide additional returns to reallocate into other outstanding attractive stocks to further compound returns.

That said, it is clearly possible for the issuer to redeem the stock – the issuer is within their rights to redeem the security after its first call date (i.e. when the coupon switched from fixed to floating). However, this has the obvious side benefit that it will keep the price of the preferred much more resilient leading up to the first call date and, likely, not that far from $25 than it would be otherwise. There are many examples of good-quality fixed-rate preferreds that don’t have this feature that are now trading more than 20% below their level at the end of last year. In short, even if holders don’t benefit from the floating-rate coupon, they do benefit by having their capital allocated to a more resilient security.

Finally, it’s important to point out that Libor is going to go away – interested readers may want to review our recent take. The key point is that the economics of the floating-rate coupon are expected to remain pretty much the same even if the underlying base index will change to SOFR.

Takeaways

High reset-yield preferreds remain attractive in the current market environment of persistent inflation, hawkish Fed and rising short-term rates. These stocks can provide potentially attractive yields if reality of future short-term rates is anywhere near current expectations. They can also prove to be more resilient relative to their fixed-rate counterparts in investor portfolios, anchored by the redemption possibility and high floating-rate coupons past redemption. Judging by the basic composition of the preferreds space, most preferred investors are overweight fixed-rate preferreds and securities mentioned in this article may offer a good dose of both income upside and diversification in the current market environment.

One risk to keep in mind is that the Fed overtightens, causing demand to weaken considerably, pushing the US economy to enter recession and causing inflation to drop. This will likely cause the Fed to push its policy rate back towards zero, causing reset yields to move significantly lower before investors are able to enjoy them. This is why, in our view, high reset yield Fix/Float securities should be held alongside longer-duration Fixed-rate securities which should benefit in this scenario.

Be the first to comment