Hinterhaus Productions/DigitalVision via Getty Images

Investment Thesis

Back in Oct 2022, I wrote an update on RICK’s 2Q22 earning results, talking about the management’s great execution. However, I’d also like to do a deep dive into the company to share my thoughts on why I own shares, as well as a way to revisit my investment thesis.

My thesis is that RCI Hospitality (NASDAQ: RICK) is the prime consolidator of nightclubs due to its favorable capital structure, as it is the only publicly listed nightclub company and it owns the underlying real estate of its clubs. The sports bar and restaurant business, Bombshells, has an operating margin that has similar, or if not, higher than some of the established restaurant peers, and they continue to expand through building more units in class A locations and franchising.

RICK’s management has the perfect playbook to roll up the nightclub industry and expands its highly profitable Bombshells, resulting in an extremely cash-generative company best demonstrated by its growing free cash flow. With a long runway, cash is constantly reinvested to acquire more clubs and build more bombshell units, which also means there is little to no reinvestment risk. I believe the current valuation is priced attractively for long-term investors to consider.

Nightclubs

Rolling Up The Nightclubs Industry

In the U.S., it is nearly impossible for anyone to build new nightclubs as very few states issue any licenses, and the only way to own one is through acquisitions. To acquire one, one needs to acquire the club along with the real estate, as the grandfathered licenses are tied to real estate.

Owning the real estate with the licenses is a strong competitive advantage because – (1) there is little to no competition as you are the only sole operator owning the license, and (2) it is a hedge against inflation as high rental costs can be huge expenses for retailers, and (3) acts as a collateral to raise capital from the bank. Some of those clubs are established as early as the 1990s, so they are placed at excellent locations, and are proven and highly cash-generative. These are the kind of clubs RICK’s management is acquiring.

The internal motivation driving owners to sell their clubs is due to their old age, and they are heading for retirement. They are demanding large upfront cash payments and/or consistent, reliable annual payments, and a strong operator who knows how to manage a nightclub. As RICK is the only publicly listed company in the industry, it has access to capital that peers do not, including access to bank financing and equities. Whereas, other peers use mainly owner financing and put very little cash down, making it less enticing. Furthermore, with RICK’s CEO Eric Langan’s long history of being in the industry since he was 20 and the company’s strong revenue and free cash flow (“FCF”), all of these factors, collectively, make them the preferred acquirer. According to CEO Eric, peers like Deja Vu and Spearmint Rhino have started way earlier than RICK but are still the same size as they were before.

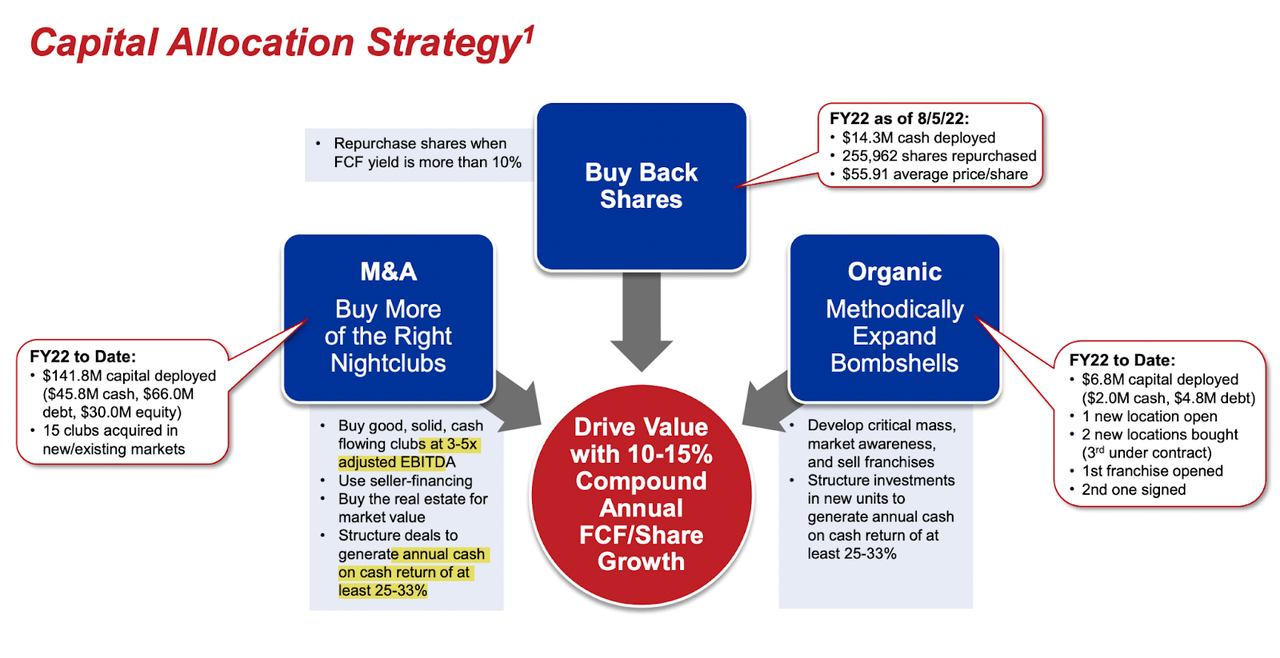

RICK 3Q22 Investor Presentation

RICK typically acquires clubs at 3x to 5x adjusted EBITDA (extremely low multiple), and these deals tend to generate an annual cash-on-cash return of 25% to 33%. What this typically means is that these acquisitions pay themselves in 3 to 4 years (1/25% or 1/33%), and in some cases, certain deals can generate 50% to 70% cash-on-cash returns.

The largest deal they did was the Lowrie deal, which was acquired at 5x adjusted EBITDA and it was financed using a mix of debt and equity. During the 2Q22 earnings call, an institutional investor of RICK, the company could not have gone through with the deal if the stock had not traded at a high multiple. Shares are an incredibly important currency, and since RICK is a sin stock, its multiples may be capped, and that could prevent such large acquisitions from going through in the future. This is something for investors to note.

Highly Profitable Clubs

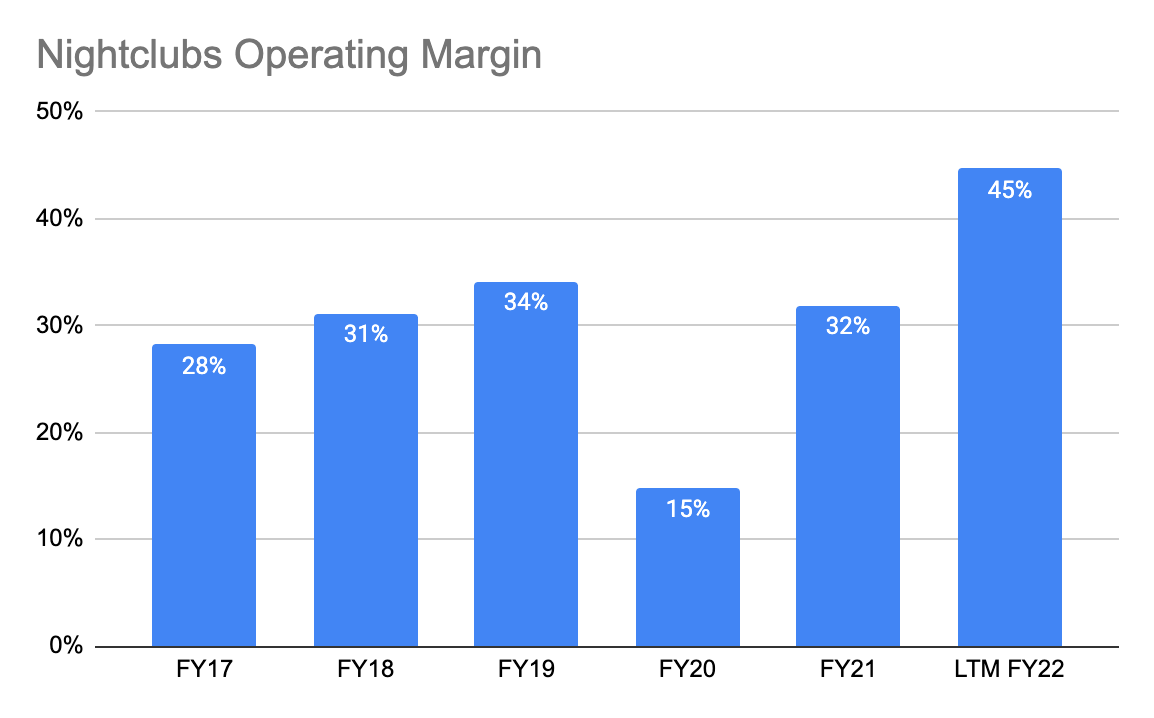

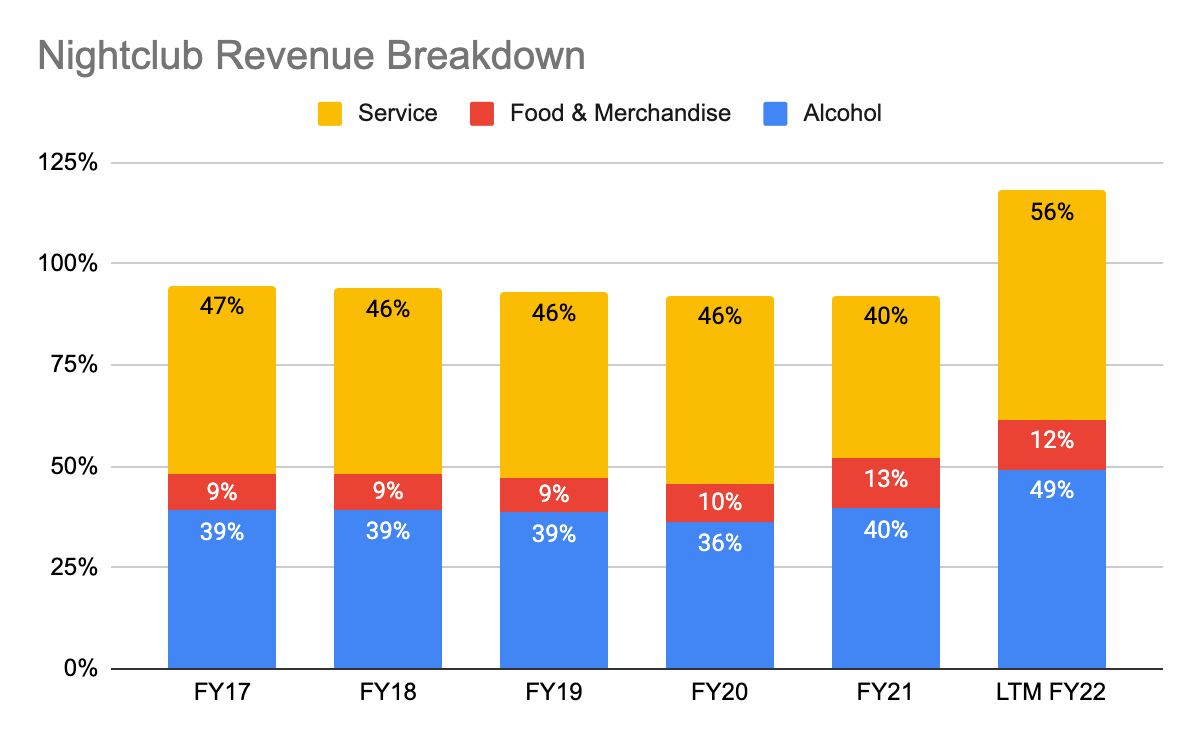

RICK 10-K & 10-Q RICK 10-K & 10-Q

Due to the nature of the business, nightclubs are extremely profitable with an operating margin of 45% as of LTM FY22 and 41.4% as of the latest quarter, 3Q22. This is because its high-margin service revenue, consisting of VIP spending, and high-margin alcohol revenue make up more than 80% of its total club revenue. It is also not expensive to keep a club running as capital expenditures such as carpets, chairs, and sound equipment typically do not require much maintenance. Moreover, upon acquiring new clubs, RICK’s management utilized their expertise to put in best practices, control systems, and processes to maximize the profitability of these clubs.

Long Runway To Grow

While RICK is well positioned to roll up the industry, one important question to ask is how long can RICK continue to grow. CEO Eric Langan stated there are 2,000 clubs in the U.S:

“…we expect to achieve significant growth acquiring more clubs now which estimate that there’s about 2000 legal clubs in the US…500 of those clubs meet our qualifications for acquisition it’s a very highly fragmented industry, and we are one of the largest player largest players, but our market shares and then Many club owners are at an age where do you want to sell and we believe that we are the fire of choice, we believe that we are the best-capitalized entity in the industry and we’re generally able to give sellers more upfront cash than our competitors.”

With RICK having a total of 49 clubs today or only making up 2% of the total clubs in the U.S., RICK has a massive opportunity to consolidate the fragmented industry, and the risk of running into reinvestment risk is incredibly low. This combination of being the preferred acquirer and long runway makes this a compelling investment in the long run. However, as RICK scales larger, it has to do larger acquisitions to maintain its growth rates, which represents execution risk.

Fairly Resilient Business Despite Poor Economic Outlook

During a recession, consumer discretionary spendings are likely the first few to be cut, and most would have assumed that RICK is to be affected. However, this does not seem to be the case for RICK as the nightclub’s traffic volume, revenue, and operating margins have recovered strongly post-pandemic (i.e. FY20 and FY21). In the past earnings calls, CEO Eric has reiterated multiple times that he has not seen consumers cutting back on spending.

In the most recent 3Q22 earnings call:

“…recession hit will be offset or more than offset by people’s returning to work and turning to the offices…right now, I don’t have an answer as to what we’re going to see…or when we’re going to see a recessionary effect…I’ve been on Twitter a lot, and I have seen some entertainers complaining about customer spend on the entertainers. We’re not seeing that in our dance dollar sales at our clubs…the girls that I talked to have been very happy, they’re making money, and we’re printing money as you can see from our financials.”

Bombshells

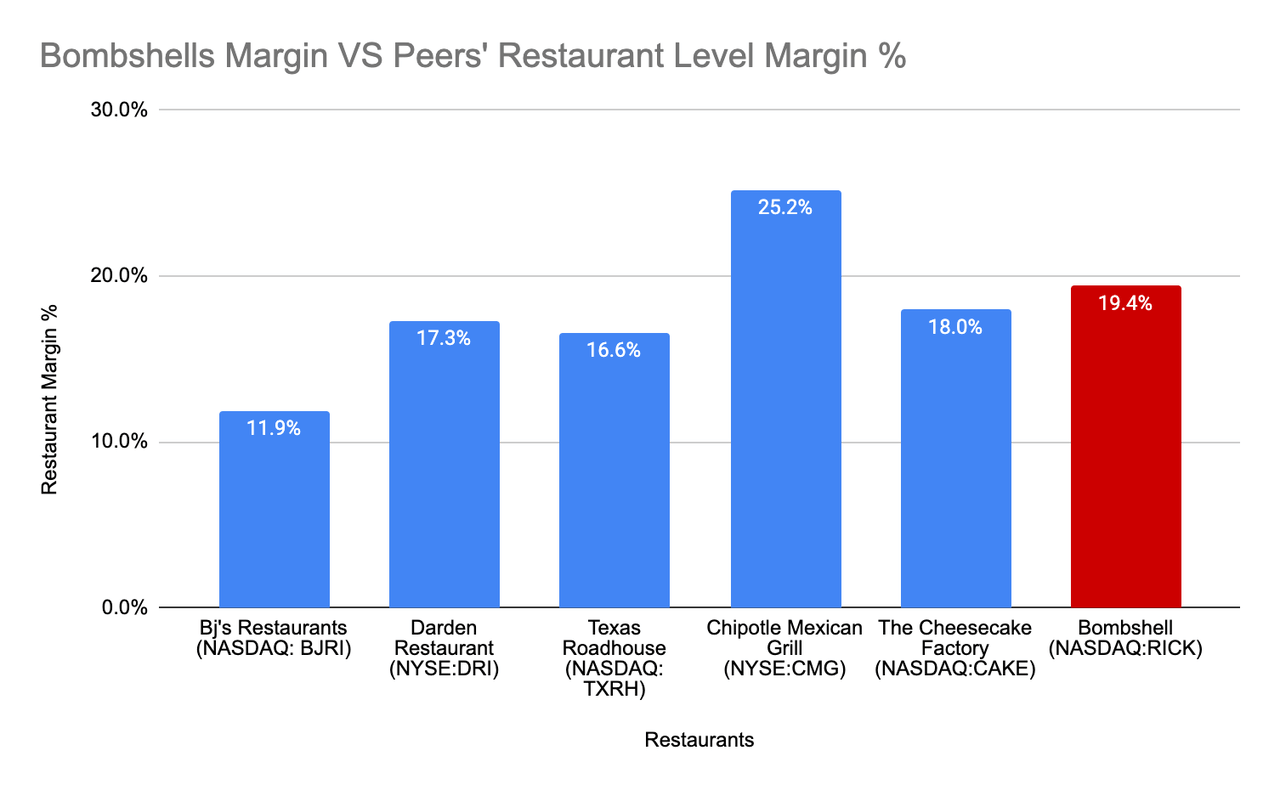

Bombshell 10-Q & Peers Press Release

Bombshells is a highly profitable sports bar and restaurant business, with an operating margin of 19.4% as of 3Q22. This is on par or higher than some of the established restaurant peers such as The Cheesecake Factory (CAKE) and Texas Roadhouse (TXRH).

Images From RICK

These Bombshells are placed at class A locations where they are surrounded by other restaurants and there are high traffic volumes. They are equipped with large patios and large-screen TVs which make up the overall concept of the business, and they are likely to benefit from near-term catalysts such as the upcoming 2023 world cup. Similarly, RICK also acquires the underlying real estate, insulating Bombshells from high rental costs.

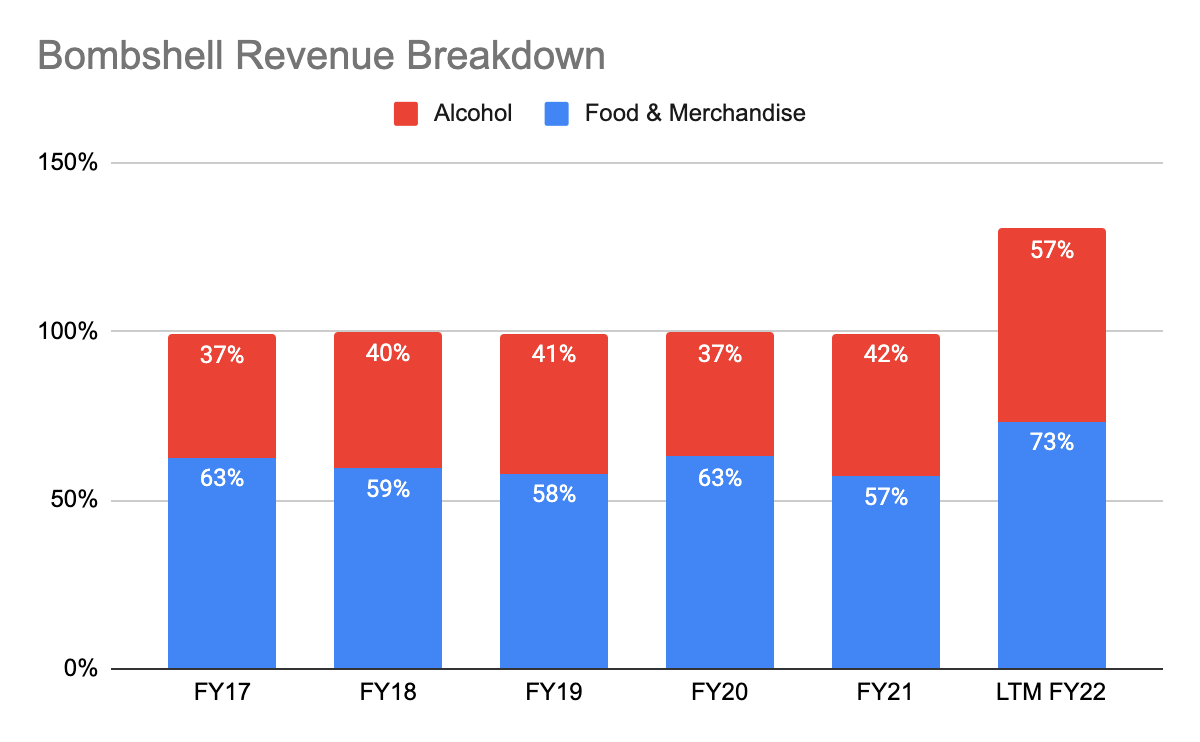

RICK 10-Q

The reason for margin is similar to that of nightclubs with high-margin alcohol revenue making up more than half of the total Bombshells revenue. For foods, RICK is also able to pass down price increases to customers in the form of higher prices. I also believe that Bombshells has benefitted from economies of scale from the cost of alcohol and food due to the synergy with nightclubs.

However, there are also risks as inflation continues to linger, consumers may choose to opt for cheaper alternatives, and price increases in raw materials may also delay the building of new units, putting pressure on Bombshells’ revenue and margins.

Aside from building its own units, RICK also does franchises in which it will receive a royalty fee of 5% from its franchisee. The franchise makes sense for a number of reasons – (1) scalable, (2) cheaper as they do not bear the cost of building the Bombshells, (3) helps Bombshells to spread brand awareness. Furthermore, RICK’s management is extremely rigorous in selecting partners that possess the know-how on how to run a restaurant business.

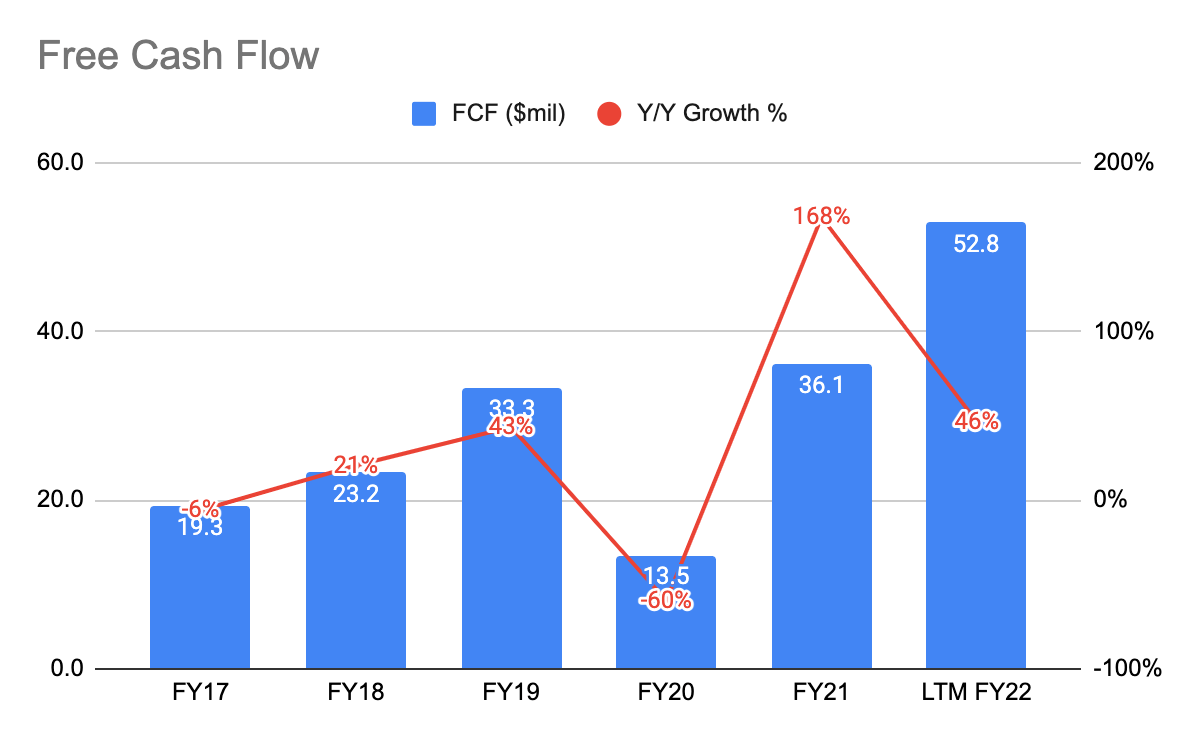

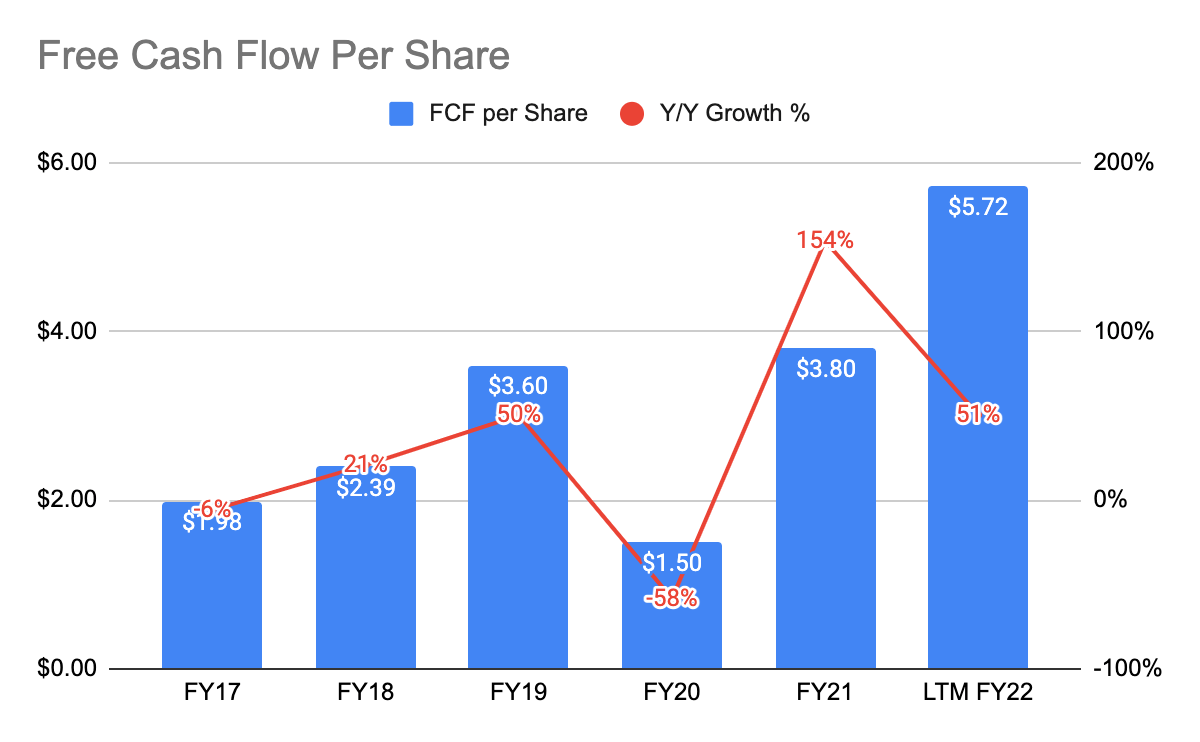

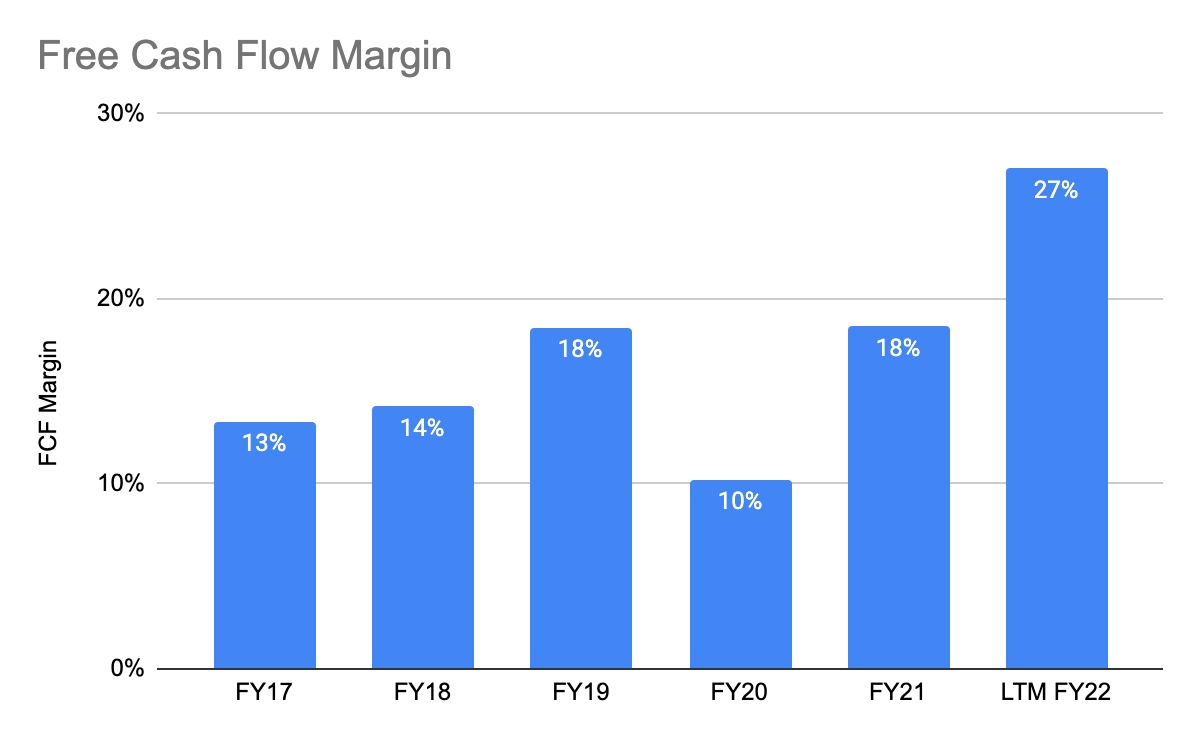

Free Cash Flow

RICK 10-K & 10-Q RICK 10-K & 10-Q RICK 10-K & 10-Q

The growing number of highly profitable nightclubs and Bombshells is best represented in the company’s increasing free cash flow (“FCF”) and FCF margin, and this is a testament to how cash-generative the overall company is. The year 2020 was an outlier for RICK as the nightclub’s operation was impacted by COVID, and revenue suffered as a result. And by the end of FY23, the management anticipates a 30% Y/Y growth in FCF.

Valuation

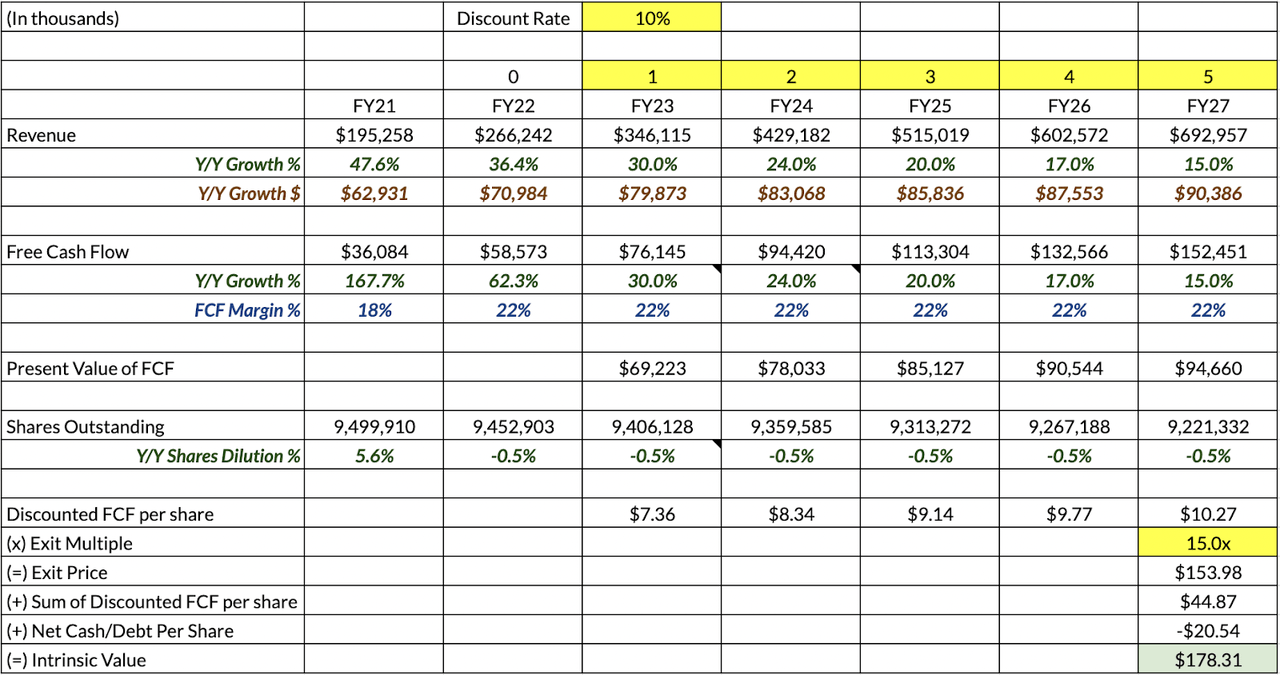

Author’s Estimates

This is the valuation that I laid out in my previous article, and my valuation remains unchanged. If you like to read into the assumptions I am making, I do encourage you to read the article. However, do also conduct your own due diligence and evaluate if my valuation makes sense.

Conclusion

In this article, I talked about how RICK is competitively positioned to roll up the industry, and with the sheer number of clubs in the U.S, there is a massive runway for the company to grow for years to come. Bombshells, the company’s sports bar and restaurant business, is a highly profitable business when compared to some of the most established restaurant companies. In my view, the management’s playbook to run both businesses, together with its current valuation, represents a compelling investment for investors to consider in the long term. In addition, I have also highlighted certain risks in the article that investors also should take note of.

Be the first to comment