i_frontier/iStock via Getty Images

Earnings of Associated Banc-Corp (NYSE:ASB) will likely dip this year due to lower provision reversals relative to last year. On the other hand, strong loan growth and margin expansion will support the bottom line. Overall, I’m expecting Associated Banc-Corp to report earnings of $1.93 per share for 2022, down 12% year-over-year. Compared to my last report on Associated Banc-Corp, I have significantly revised upwards my earnings estimate because I have slashed my net provision expense estimate and increased my estimate for net interest income. The year-end target price suggests a high upside from the current market price. Therefore, I’m upgrading Associated Banc-Corp to a buy rating.

On-ground Reality for Loan Growth Better than Expected

The recently released second-quarter update presentation shows that the loan portfolio is growing better than I previously expected. Management has also revised upwards its targets for loan growth in the latest update presentation due to the on-ground reality. Management has increased its targets for both the auto-finance and the commercial loan segments by around $100 million. It now expects the auto-finance portfolio to balloon by around $1.3 billion, and the commercial loan portfolio to surge by between $850 million to $1.1 billion in 2022.

Apart from the on-ground reality witnessed so far in the second quarter of the year, the outlook for the remainder of the year also appears bright thanks to recent trends. As mentioned in the first quarter’s conference call, Associated Banc-Corp has added $0.5 billion in unfunded commitments in the commercial real estate segment. Management expects to see this amount funded over the next 18 months. To put this amount in perspective, $0.5 billion is 2.0% of the existing gross loans.

Further, the commercial loan pipeline is 40% higher in April compared to the end of 2021, as mentioned in the presentation. As for the open lines of credit, the commercial line utilization is still below the historical average line utilization. The actual line realization stood at 39.3%, as opposed to the average of 42.9%, as mentioned in the presentation. This slight under-utilization indicates that there is still room for loan growth.

Moreover, Associated Banc-Corp has been busy transforming its digital capabilities. The company is now on track for a full rollout of its digital platform in the summer of 2022, as mentioned in the presentation. The resultant ease of access to financial products is likely to provide further impetus for loan growth.

Considering these factors, I’m expecting the loan portfolio to increase by $2.6 billion in 2022 or 10.6%. In my last report on Associated Banc-Corp, I estimated loan growth of 8.2%. I have now revised upwards my growth estimate partly because of the updated management guidance and the on-ground reality.

Meanwhile, deposits will likely grow somewhat in line with loans. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 20,519 | 22,702 | 22,620 | 24,068 | 23,945 | 26,494 | |||

| Growth of Net Loans | 3.8% | 10.6% | (0.4)% | 6.4% | (0.5)% | 10.6% | |||

| Other Earning Assets | 6,971 | 7,638 | 6,077 | 5,577 | 7,576 | 7,754 | |||

| Deposits | 22,786 | 24,897 | 23,779 | 26,482 | 28,466 | 30,735 | |||

| Borrowings and Sub-Debt | 4,074 | 4,527 | 4,195 | 2,435 | 2,225 | 2,321 | |||

| Common equity | 3,078 | 3,524 | 3,665 | 3,737 | 3,832 | 3,883 | |||

| Book Value Per Share ($) | 20.0 | 20.8 | 22.5 | 24.3 | 25.5 | 25.8 | |||

| Tangible BVPS ($) | 13.6 | 13.4 | 14.7 | 16.7 | 17.8 | 18.1 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Revising Upwards the Net Interest Margin Estimate

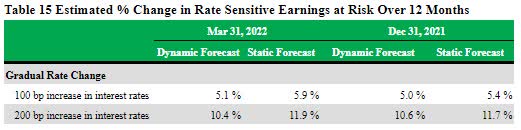

Both the loan and the deposit mixes of Associated Banc-Corp are quite diverse. Due to the asset and liability positioning, the net interest margin is quite sensitive to interest rate changes. Management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200-basis points increase in interest rates could boost the net interest income by 10.4% over twelve months.

1Q 2022 10-Q Filing

I’m expecting the federal funds rate to increase by a further 100 basis points in the remainder of this year to end 2022 at 2.0% (the upper limit of the target federal funds rate). Mostly based on the interest rate outlook and management’s interest-rate sensitivity analysis, I’m expecting the net interest margin to increase by twenty-eight basis points in the last nine months of 2022. Compared to my last report on Associated Banc-Corp, I have revised upwards my margin estimate because of recently released economic data that has made my interest rate outlook more hawkish than before.

Slashing the Provision Expense Estimate Following First Quarter’s Performance

Associated Banc-Corp reported a net provision reversal of $4 million in the first quarter of 2022, which beat my expectations. Due to significant provision reversals in the last five consecutive quarters, the allowance level has declined relative to nonaccrual loans. The allowances-to-nonaccrual-loans ratio dipped to 221.92% by the end of March 2022 from 247.23% at the end of March 2021, according to details given in the 10-Q filing. Following the decline in the relative allowance level, I’m expecting the heightened provision reversals to taper off in the year ahead.

Meanwhile, the loan additions discussed above will require a normal level of provisioning for expected loan losses. Overall, I’m expecting the provision expense, net of reversals, to remain at a normal level in the last three quarters of 2022. Combined with the first quarter, I’m expecting the full year’s net provision expense to make up around 0.05% of total loans. In comparison, the net provision expense averaged 0.07% of total loans from 2017 to 2019.

In my last report on Associated Banc-Corp, I estimated a net provision expense of $48 million. I have now slashed this estimate to $14 million partly because the first quarter’s provision reversal exceeded my expectations.

Revising Upwards the Earnings Estimate

In my last report on Associated Banc-Corp, I estimated earnings of $1.67 per share for 2022. I have now decided to revise upwards my earnings estimate mostly because I have slashed my net provision expense estimate. Further, I have revised upwards both the loan growth estimate and the net interest margin estimate.

Overall, I’m expecting Associated Banc-Corp to report earnings of $1.93 per share in 2022, down 12% year-over-year. The anticipated earnings decline is mostly attributable to lower net provision reversals this year relative to last year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 741 | 880 | 836 | 763 | 726 | 840 | |||

| Provision for loan losses | 26 | – | 16 | 174 | (88) | 14 | |||

| Non-interest income | 333 | 356 | 381 | 514 | 332 | 288 | |||

| Non-interest expense | 709 | 822 | 794 | 776 | 710 | 738 | |||

| Net income – Common Sh. | 220 | 323 | 312 | 286 | 334 | 290 | |||

| EPS – Diluted ($) | 1.43 | 1.90 | 1.91 | 1.86 | 2.18 | 1.93 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes.

Upgrading to Buy

Associated Banc-Corp is offering a dividend yield of 3.8% at the current quarterly dividend rate of $0.20 per share. The earnings and dividend estimates suggest a payout ratio of 42% for 2022, which is higher than the five-year average of 35% but still easily sustainable. Therefore, the earnings outlook poses no threat to the existing dividend payout. However, there is a chance that Associated Banc-Corp will pause its decade-long tradition of an annual dividend hike.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Associated Banc-Corp. The stock has traded at an average P/TB ratio of 1.45 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 13.6 | 13.4 | 14.7 | 16.7 | 17.8 | |

| Average Market Price ($) | 24.5 | 25.6 | 21.0 | 15.0 | 21.3 | |

| Historical P/TB | 1.80x | 1.91x | 1.43x | 0.90x | 1.20x | 1.45x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $18.10 gives a target price of $26.20 for the end of 2022. This price target implies a 25.9% upside from the June 3 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.25x | 1.35x | 1.45x | 1.55x | 1.65x |

| TBVPS – Dec 2022 ($) | 18.1 | 18.1 | 18.1 | 18.1 | 18.1 |

| Target Price ($) | 22.6 | 24.4 | 26.2 | 28.0 | 29.8 |

| Market Price ($) | 20.8 | 20.8 | 20.8 | 20.8 | 20.8 |

| Upside/(Downside) | 8.5% | 17.2% | 25.9% | 34.6% | 43.3% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.9x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 1.4 | 1.9 | 1.9 | 1.9 | 2.2 | |

| Average Market Price ($) | 24.5 | 25.6 | 21.0 | 15.0 | 21.3 | |

| Historical P/E | 17.1x | 13.5x | 11.0x | 8.0x | 9.8x | 11.9x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.93 gives a target price of $22.90 for the end of 2022. This price target implies a 10.0% upside from the June 3 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.9x | 10.9x | 11.9x | 12.9x | 13.9x |

| EPS 2022 ($) | 1.93 | 1.93 | 1.93 | 1.93 | 1.93 |

| Target Price ($) | 19.0 | 20.9 | 22.9 | 24.8 | 26.7 |

| Market Price ($) | 20.8 | 20.8 | 20.8 | 20.8 | 20.8 |

| Upside/(Downside) | (8.5)% | 0.7% | 10.0% | 19.2% | 28.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $24.50, which implies a 17.9% upside from the current market price. Adding the forward dividend yield gives a total expected return of 21.8%.

I have not changed my target price much from the previous target price given in my last report on Associated Banc-Corp. However, the current upside is much higher than the implied upside I estimated at the time of my last report. This is because the stock price has plunged since the issuance of that last report. I believe the recent stock price correction is unwarranted, and I’m still positive about the company. As a result, I’m upgrading Associated Banc-Corp to a buy rating from my previous rating of hold.

Be the first to comment