NYCstock/iStock Editorial via Getty Images

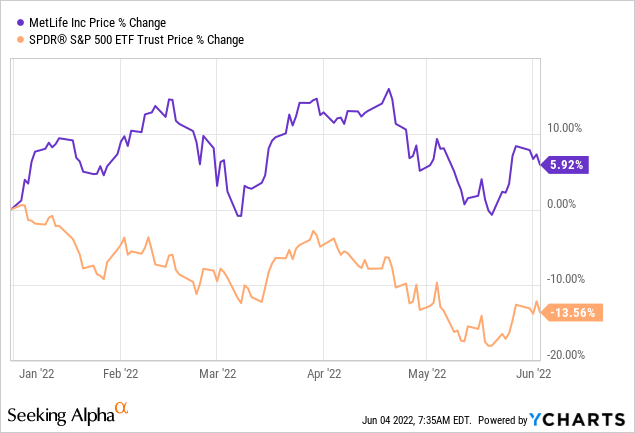

MetLife, Inc.’s (NYSE:MET) stock has performed extremely well lately, as it has outperformed the broader market by almost 20bps on a YTD basis.

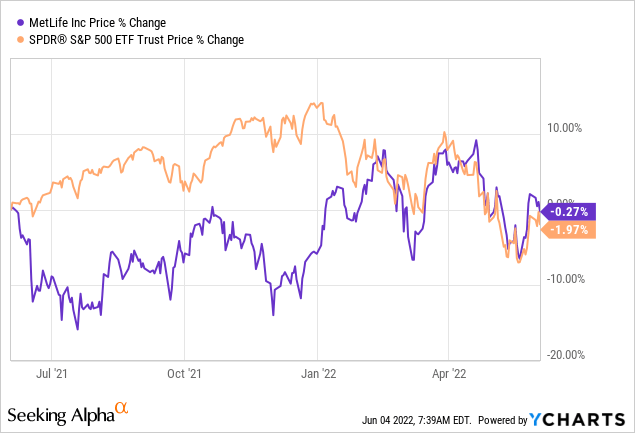

However, looking further back, MET shares have only slightly outperformed the broader market over the last year.

I believe the strong YTD stock performance for this company is a direct result of investor’s viewpoint that MetLife is in a great position for the current market dynamics but, in my opinion, it helps that the company’s Q1 2022 results show that the investment thesis for this global insurer remains intact.

The Latest, MetLife is Well-Positioned for 2022

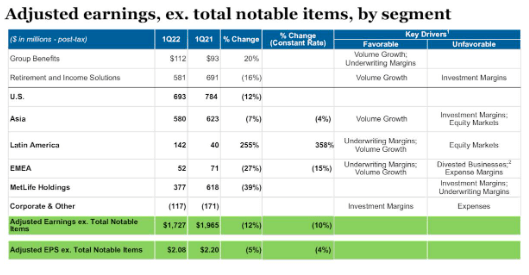

MetLife has reported strong operating results over the last few quarters, and Q1 2022 was no exception as the company reported Q1 2022 results that beat the consensus top- and bottom-line estimates. The company reported adjusted Q1 2022 EPS of $2.08 (beat by $0.45) on revenue of $17.7bn (beat by $910mm).

MetLife’s Q1 2022 Earnings Slides

The highlights:

- Quarterly adjusted premium, fees, and other revenue increased by 12% YoY (to $12.7bn).

- Quarterly adjusted net investment income decreased by 19% YoY (to $4.3bn) that was largely driven by lower variable investment income.

- Adjusted Book Value per share was $57.12 at Q1 2022 (compared to $53.16 at Q1 2021).

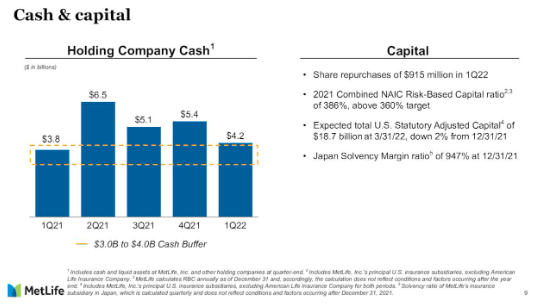

- Repurchased $915mm worth of shares during the quarter, and the board authorized an increase of $3bn to the company’s total buyback program.

The company’s strong Q1 2022 results were well-received by the market, but investors did seem to be more interested in management’s commentary on how MetLife is positioned for the second half of 2022, and rightfully so. Management was prepared for the discussion, and they did a great job highlighting the steps that have already been taken to deal with the economic uncertainty, starting with maintaining excess cash and building liquidity.

MetLife’s Q1 2022 Earnings Slides

Additionally, the management team noted that MetLife will receive proceeds from the sale of its Poland business (~$700mm) in Q2 2022, which will add to the company’s already solid cash position.

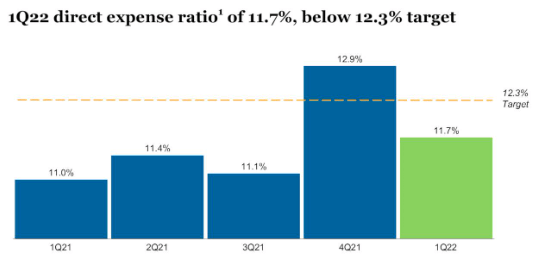

In addition, during the conference call, the insurer’s right-sized expense base was highlighted, which came as a result of management’s multi-year focus on streamlining operations and cutting out unnecessary expenses.

MetLife’s Q1 2022 Earnings Slides

As shown, direct expenses were well below the company’s target ratio for the most recent quarter, and management fully expects more of the same throughout the quarters ahead.

The company’s cash/liquidity position and improving expense base are good reasons to be interested in MetLife, but I would contend that the company’s capital return prospects should be viewed as one of the main reasons to like this global insurer in today’s market.

A Capital Return Story

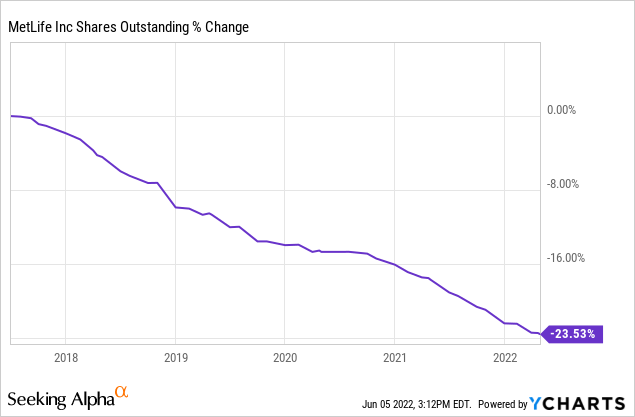

MetLife has been an extremely shareholder-friendly company. This company has greatly reduced its share count over the last 5 years.

It was a similar story in the most recent quarter, as management repurchased approximately $1bn worth of the shares outstanding during Q1 2022 and, as mentioned above, the company is still flush with excess cash. Therefore, investors should begin to bake in expectations for more shares to be repurchased through the next few years.

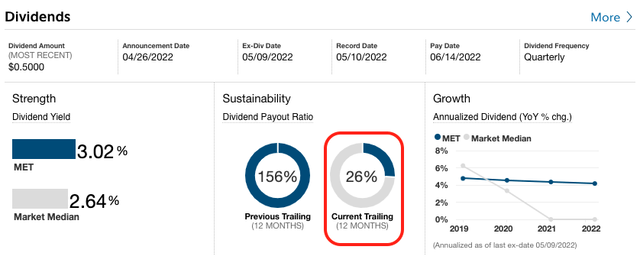

Plus, let’s not forget that MetLife has an above-average dividend, and it has enough wiggle room to grow the payout in the years ahead.

Note: The previous 12-month dividend payout ratio factors in a lot of noise, so investors should pay less attention to it.

At the end of the day, investors should expect for this capital return story to continue well past 2022.

Make no mistake about it, MetLife’s near-term business prospects will largely depend on management’s ability to squeeze out alternative investment returns, capitalize on the rising interest rate environment, and properly manage the company’s expense base, but in my opinion, returning capital is (and will continue to be) a significant component of the long-term investment thesis. And to this specific point, I believe MetLife is well-positioned for 2022 and beyond.

Valuation

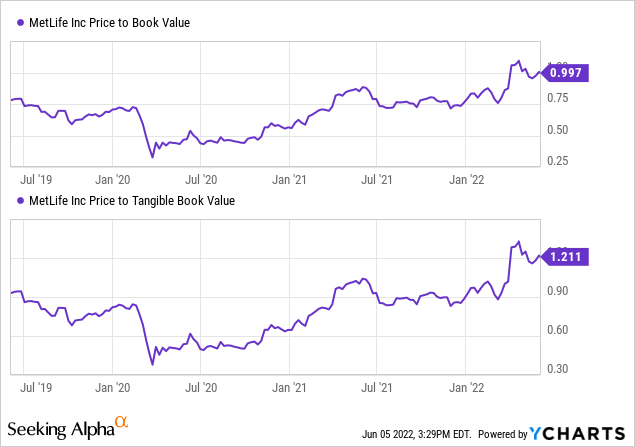

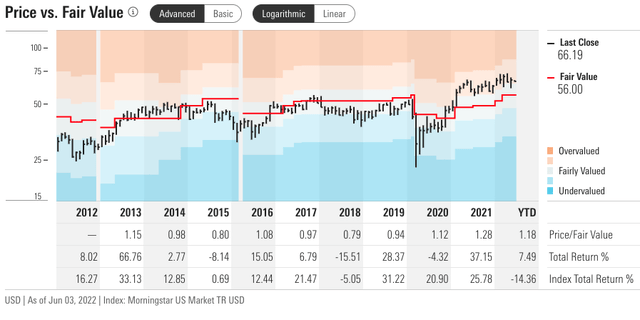

MetLife’s stock is currently trending above its own historical valuation metrics.

Additionally, the stock is trading well-above Morningstar’s fair value estimate.

While MetLife is not as attractively valued as it was a few years ago, I believe that investors are being paid to be patient as the company’s capital return story plays out. Plus, this is a case of you get what you pay for – MetLife is richly valued, but for good reason.

Risks

The biggest risk for any insurer, including MetLife, is the sufficiency of the company’s reserves. The company will likely have immaterial one-off reserve charges on a somewhat consistent basis, but any material adjustment could negatively impact the stock price.

The COVID-19-related impacts should be monitored, but investors should no longer view this as a major risk factor, at least for the time being.

Lastly, investors need to also consider what is shaping up to be a challenging macro environment. A deteriorating economy would eventually negatively impact the financial sector. As such, MetLife’s stock would likely be under pressure if the US entered a recession.

Bottom Line

The company’s Q1 2022 results were strong almost across the board, and most importantly, the earnings material and management commentary showed that the long-term investment thesis for MetLife remains intact.

Simply put, it appears that MetLife’s management team has the company properly positioned from both an operational and financial standpoint. The stock may experience volatility over the next few quarters due to broader market concerns, but in my opinion, investors with a long-term perspective should consider adding MET shares on any significant pullbacks.

Disclaimer: This article is not a recommendation to buy or sell any stock mentioned. These are only my personal opinions. Every investor must do his/her own due diligence before making any investment decision.

Be the first to comment