da-kuk/E+ via Getty Images

It’s been just over two months since I published my latest cautious piece on MSA Safety Incorporated (NYSE:MSA), and in that time, the shares are down .25% against a loss of .7% for the S&P 500. The company has published full year financial results since, so I thought I’d check back on the name to see if it makes sense to buy in. I’ll make that determination by reviewing these financials, paying particular attention to the sustainability of the dividend. In addition, I’ll look at the stock as a thing distinct from the underlying firm as I usually do. Finally, in my previous missive on this name, I recommended people switch from shares to calls, and I want to review that trade.

Welcome to the thesis statement of the article, dear readers. If you’re the sort of person who hates spoilers, I would recommend that you avoid this paragraph and jump immediately to the “financial snapshot” section below. Some people like to follow the twists and turns of my arguments, I suppose, growing more enraptured by the unpredictable ups and downs of my rhetoric. If that’s you, leave this paragraph now, because I’m about to splash spoilers all over this virtual page. Ok. If you’re still here, I’m assuming you’re comfortable with me spoiling the surprise. I think MSA Safety’s financial performance in 2021 was terrible, and I think it reflects an ongoing problem the firm will face for the foreseeable future. That said, the dividend is well covered, since the firm doesn’t really have any substantial contractual obligations until 2026. The problem is that the valuation doesn’t reflect these risks in my view. The shares are too expensive relative to the cash flow generating capacity here. This is why I continue to recommend the September $135 call in lieu of shares. This trade has worked out reasonably well in my estimation in spite of the fact that it’s lost a significant percentage of time value. Here ends the “thesis statement”, and so it’s safe for the people who want to be enraptured by the unfolding drama to return.

Financial Snapshot

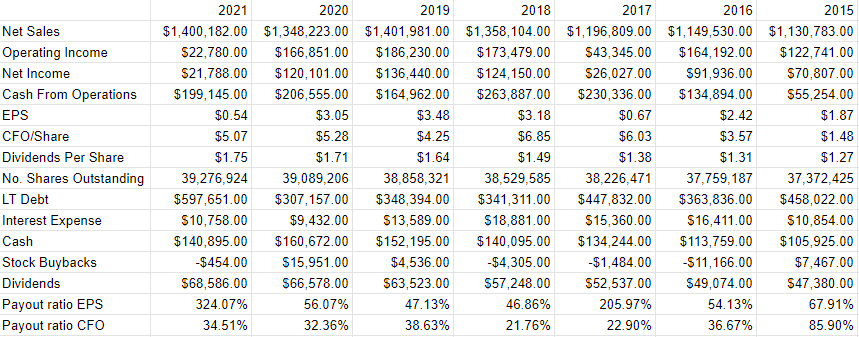

I’d characterize the financial performance in 2021 as being somewhat of a catastrophe. While revenue marched higher by about 4% from 2020, it was still slightly lower than it reached in 2019. Net income on the other hand collapsed in 2021, down fully 81.86% over the past year, and down about 84% from 2019. Why such a dramatic downturn?

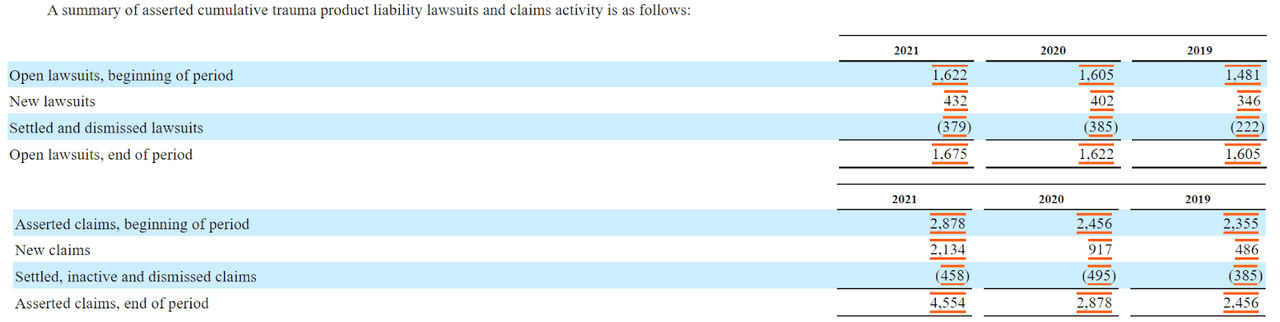

Please note that the collapse in net income in 2021 was a function of two things. First, there was a $45 million, or 14% uptick in selling, general and administrative expenses. This suggests to me that some portion of the reduction will be an ongoing event. Second, and far more dramatically was the $146 million uptick in product liability expenses. It seems that the number of claims against the company’s safety products increased by about 74% during 2021, per the following table plucked from Note 20 of the company’s latest 10-K

Latest Product Liability Table (MSA Safety 2021 10-K)

This sort of liability litigation is very unpredictable, and that risk needs to be reflected in the share price in my estimation. I think we’d be wise to note also that 2021 wasn’t some bolt from the blue. The year 2021 was noteworthy for the size of the product liability expense, but we should note that it was $39 million in 2020, and $28 million in 2019. This is an ongoing issue for the firm.

At the same time that the business was being buffeted by renewed claims against it, the capital structure was deteriorating, as long term debt had climbed by $290.5 million to $597.6 million. Just like with unpredictable liability risk, the risks associated with this added debt should be reflected in the share price.

Dividend Sustainability

Although the financial history here gives us some insight into what we can likely expect from the future of this business, I think it would be helpful to address the sustainability of the dividend for obvious reasons. Most importantly, the dividend gives investors some predictability in their cash flows. Also important is the fact that a dividend is supportive of the stock price, and if there’s a risk that the dividend gets cut, the shares will likely drop in price. For that reason, some discussion needs to be had on this topic.

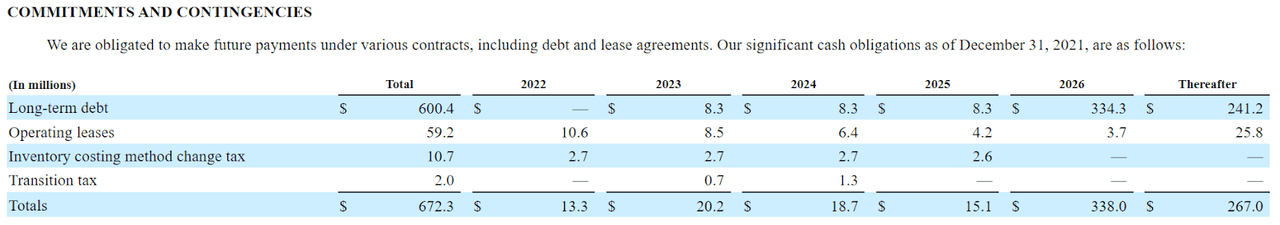

While I’m as much of a fan of accrual accounting as any other pompous windbag, I think that when it comes to dividends and their sustainability, we need to look at cash. In particular, I want compare the size and timing of future contractual obligations to the current and likely future sources of cash. First, the obligations. We see from the below table, coped from page 29 of the latest 10-K for your enjoyment and edification, that the company doesn’t have any significant contractual obligations until 2026, when they’re on the hook for ~$338 million.

MSA Safety Contractual Obligations (MSA Safety 2021 10-K)

Against these obligations, the company has about $141 million in cash on hand, and over the past three years they’ve generated an average of $190 million in cash from operations, while spending about $53.3 million in non-acquisition related CFI activities. All of this suggests to me that the dividend is well covered. I’d be certainly happy to buy this company at the right price, as long as the increased debt, and litigation risks were adequately reflected in share price.

MSA Financials (MSA Safety investor relations)

The Stock

The stock and the business are two distinct “things” in my estimation. In this case, the business is engaged in the sale of safety equipment for a profit. The stock is a reflection of the crowd’s mood about the likely future for the business. The stock is much more volatile than the actual business, and is driven by whim, levels of margin debt, membership in or removal from a benchmark etc. These things have little to do with what goes on at the business in a given period, so “the stock” gets its own, distinct section.

I’ll drive this point home by looking at MSA stock itself. The company released full year results on the 18th of February, and if an investor bought the stock on that day, they’re down about 3.3%. If the investor waited until March 11th, they’re up about 5.5%. Not enough happened at the firm to warrant a near 9% swing in performance in a month, so the variable returns for these two hypothetical investors came down entirely to price paid. The person who bought shares cheaper did better. This is why I try, though don’t always manage, to buy shares cheaply.

My regular victims know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship between price and some measure of economic value, like earnings, free cash flow, and the like. In case you don’t have your “Almanac of Doyle’s recommendations” near to hand, I’ll remind you that

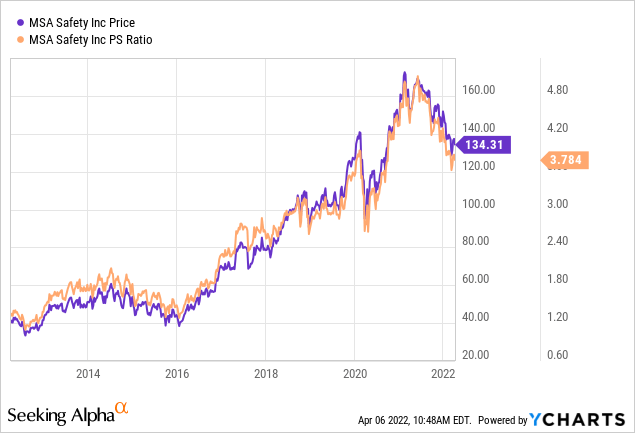

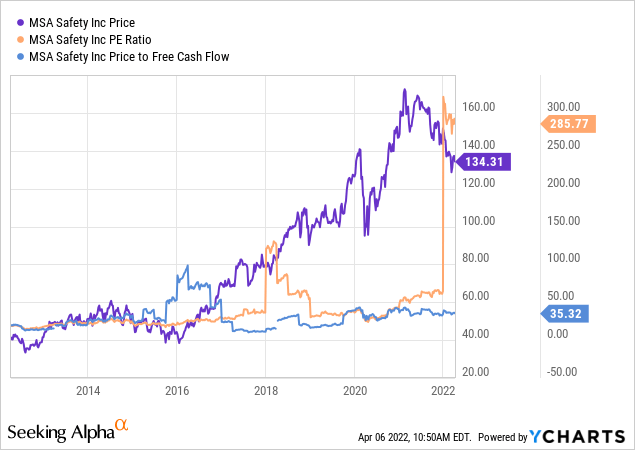

I recommended continuing to avoid the shares in my latest article, in spite of the fact that they were at that point even cheaper than they were previously. In particular, the price to sales was trading at a level of ~3.9 times, down from an even richer 4.5 times. Price to earnings, and price to free cash flow, too, were just under 58, and 31, respectively, or 5%, and 21% lower than they were in the article before last.

The shares are now 5% cheaper on a price to sales basis per the following, yet they remain near multi year highs:

Source: YCharts

As could be expected given the collapse in earnings, they’re now much more expensive on a PE basis, per the following:

Source: YCharts

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to MSA Safety at the moment suggests the market is assuming that this company will grow at about 7.5% over the long term. This is quite optimistic in my view, especially given the results of 2021. Given the above, I can’t recommend buying the shares at current prices.

Options Update

In my previous missive on this name, I think I was more magnanimous than usual when I suggested that it’s possible to simultaneously disagree with me, and be sane. In particular, I suggested that some people may want to remain long here for some reason. For those people, I suggested that a long position in the September call with a strike of $135 was a superior way to express that view than actual share ownership. I like this trade because call options give investors most of the returns “taste” for far less of the risk “calories.” The ask price of the September call was $13 per contract at the time. As of now, these have dropped to an ask price of $12.10, so the call buyer has certainly lost some money as the stock price has dropped, and more grains have flowed through the hourglass of time. I think it’s also worth noting that the calls are currently bid at only $9. I am still of the view that the call buyer is better off than the stock buyer, though, given the capital at risk. The call buyer has only 10% of the capital on the line as the stockholder. While it’s true that they miss out on the dividend, my regular readers know that I think there are many other great dividend stocks out there that can be purchased with the 90% of capital not employed in MSA Safety shares.

Given that, I’m still of the view that September $135 call options represent the best possible trade for people who insist on remaining long here. If you’re such a person, that’s the path I’d recommend. If you’re like me, I’d recommend continuing to eschew these shares until price falls further to match value.

Conclusion

I think the market is slowly, gradually, waking up to the fact that there’s much more risk here than is reflected in the current stock price. I would certainly be willing to buy, but not at current prices, because I think the evidence is that “price” and “value” can remain unmoored for some time. Sooner or later, they’ll meet, though. In my view it makes sense for investors to avoid these shares until price falls to more closely line up with value. If you insist on disagreeing with me, that’s your right I suppose. If you want to remain long here, I think call options are a much safer way to do it.

Be the first to comment