peterschreiber.media

Co-produced with Treading Softly.

I’ve lived through multiple market cycles, bear and bull, and I’ve seen the panic and euphoria it brings. Someone, regardless of market level, claims the market is too expensive and destined to fall further. Meanwhile, someone else says it is cheap and must climb higher from here!

Ironically, no matter how high we climb, or far we fall, those voices are ever-present. Others eschew the market altogether as gambling and would rather leave all their money in bank accounts earning next to nothing, but at least it’s “safe.” Well, safe enough, I guess. We’ve seen the dire predictions that banks are destined to collapse as well on Seeking Alpha recently – so I guess they’re risky too. Your mattress keeps looking safer and safer these days.

I don’t have a crystal ball, and tea leaves have never been my thing – I’m more of a coffee drinker, and no one has told me that coffee grounds can predict the future.

However, I am a student of history. I love to know why things happened and the likely causes, and evaluate how the events were perceived at the time they occurred and how the general perspective on the narrative has changed over the years.

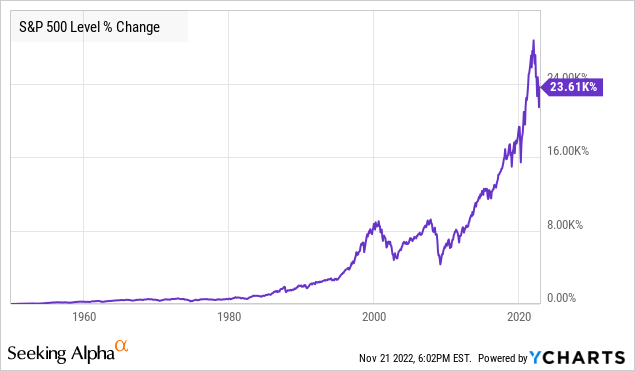

Looking at the market, those who perpetually are bullish have a lot to fall back on – namely, the market historically climbs higher and higher:

And while it has dips, drops, and epic falls over its entire history, it is a pattern of climbing higher. So I don’t doubt that it can and likely will move higher from here over the long haul.

The short term is largely anyone’s guess. Some ascribe to Elliot Wave Theory, while others love their 150-day moving averages or Fibonacci retracement. It’s all a method of attempting to predict the future by weighing different inputs and seeing what the tea leaves show. They try to be ahead of the curve, selling before the masses sell and buying back before the masses buy. Some have been very successful in doing so, and I’m happy for them. I have long taught my children that someone else’s success does not mean you are failing, especially if your goals are different.

I take a different approach. I am an income investor. I am a net buyer in most market environments, finding income opportunities in various sectors. I buy income, locking in dividends or interest for decades to come. I enjoy seeing it arrive in my account and often take a contrarian position from those who trade more frequently. My goal is not to sell shares for a higher price than I bought. I prefer never to sell shares at all. The “perfect” investment to me is one that I can buy, hold and collect income from for the rest of my life.

I want to present you two of my go-to income investments, which I routinely revisit and top off as more income comes pouring in.

Let’s dive in.

Pick #1: PTY – Yield 11.3%

Do you have one of those “go-to” menu options? When your significant other walks in and asks, “What’s for dinner?” and you give that blank stare. Was I supposed to make dinner? It’s the last minute, and you don’t know what you want, so you choose your “go-to” option. Something quick, easy, and tasty. In my household, the go-to is an omelet. We always have plenty of eggs, and you can throw almost anything into it or even just stick with cheese. It has everything you could want for a last-minute dinner: quick, easy, and satisfying.

Well, the market has those days too. You look at your screen, and everything is green. The market is rallying, and everyone is happy. Ugh. I feel like the Grinch, scowling at my portfolio. What do I buy? Everything is going up in price! Yet there you are with dividends that are sitting around being lazy. Nobody is allowed to be lazy in my household, especially not cash! I throw it into my go-to.

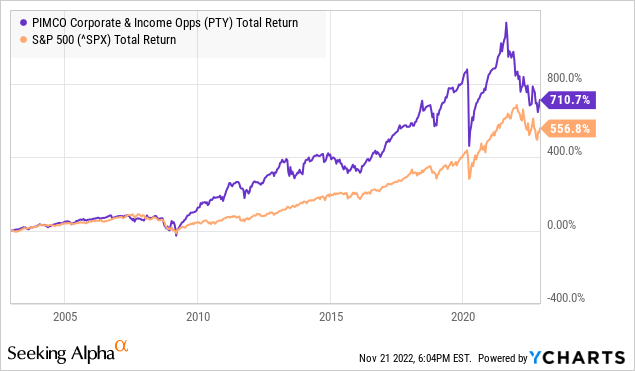

PIMCO Corporate & Income Opportunity Fund (PTY) is my go-to investment. Managed by one of the best bond fund managers in the world, PTY is a bond fund that has managed to outperform equity funds. I’ve bought PTY when it was “expensive,” I’ve bought it when it was cheap, I’ve bought in bull markets, bear markets, and even when the world was coming to an end. In short, when I’m staring at my screen and no great opportunities are jumping out at me, and I didn’t have a plan on where to deploy my excess dividends, PTY is my “go-to.”

PIMCO has shown an ability to make refreshing lemonade out of lemons. When other institutions were dumping mortgages at fire-sale prices, PIMCO was snapping them up for pennies on the dollar. A wise move that benefited investors for years following the Great Financial Crisis.

When distressed assets are going up for sale, more often than not, PIMCO is there shopping. Buying at a discount when others are seeking liquidity at all costs. So, when Credit Suisse Group AG (CS) is looking at offloading its structured credit group to resolve its liquidity concerns, it is no surprise to see PIMCO as one of the big parties involved.

PIMCO understands that when prices are low, it is the buyers that benefit. A simple truth of the market. So many will repeat the phrase “buy low, sell high,” but when it comes to buying low, they are all too often doing the opposite. They are too busy selling at fire sale prices to realize they should be buying.

As a result, PTY has outperformed equities and has left traditional bond funds in the dust.

Periods of distress have historically been opportunities that PIMCO has seized to buy cheap assets and outperform during the recovery. It did so during the GFC. It did it again during COVID. I am confident it will do so again.

PTY is my go-to bond fund. Buy a little here, a bit more there, and my income stream keeps growing because my capital is in good hands.

Pick #2: RQI – Yield 7.7%

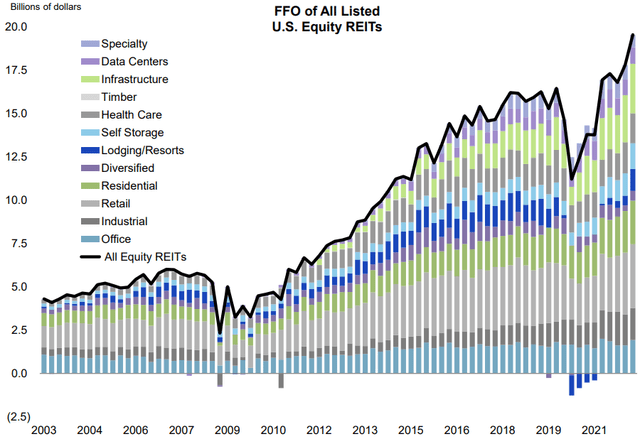

Property real estate investment trusts (“REITs”) find themselves in an interesting position. Fundamentally, earnings have been fantastic. REITs are making more money, many are hiking their dividends, and the future outlook is bright, with nearly 2/3rds of REITs raising their 2022 earnings guidance.

Now, some investors might think that because REITs are making more money, their share prices would be higher. In a rational market that was acting as the proverbial weighing machine, that would be the case. However, the market often does not act as a weighing machine. It is frequently a voting machine where the only barrier to voting is the ability to open a Robinhood Account.

So even though REITs have much higher earnings than they had last year, with FFO racing to all-time highs, share prices are a good bit lower. Source.

When earnings are up and expected to go higher, but prices are still down, it is a great time to buy.

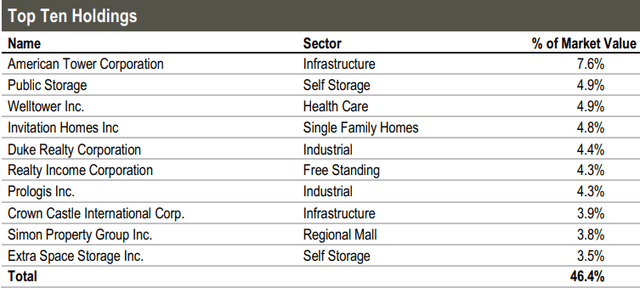

Cohen & Steers Quality Income Realty Fund (RQI) is a great option to gain leveraged exposure to the REIT sector. In 2022, RQI has concentrated its portfolio on quality. RQI’s top 10 holdings now make up 46% of its portfolio. This is more concentrated than RQI has been in the past. Source.

The Top 10 is a who’s who of what we would consider “blue chip” REITs. RQI recognized that quality was on sale and bought hand over fist.

Why are REITs out of favor? Interest rates. REITs tend to use a lot of leverage, so the market perceives rising interest rates as a threat to them. However, all of the REITs in RQI’s top 10 have very strong balance sheets and spent much of 2020 and 2021 refinancing debt at historically low-interest rates. They refinanced using fixed-rate bonds, often going out 10-15 years. As a result, it will be a long time before refinancing debt at higher rates becomes a headwind. Will interest rates still be high in 10 years?

In the meantime, REITs are benefitting greatly from inflation. During inflationary times, rents rise. This tailwind has been driving REIT earnings in 2022 and will accelerate in 2023 as leases reset at higher rents.

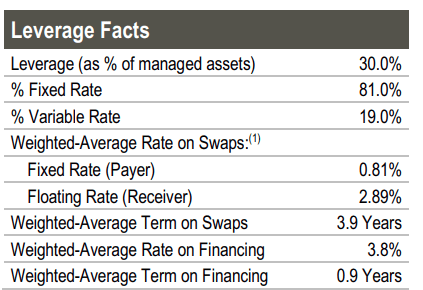

RQI itself also uses leverage, at approximately 30% of managed assets. RQI has shielded itself from higher rates with interest rate swaps, covering 81% of its debt. Source.

RQI Factsheet (Sept. 30)

REITs started rebounding after strong Q3 earnings, and recent inflation data has the market believing that the Fed will slow down on rate hikes, helping sentiment. As sentiment starts matching the actual results REITs are producing, RQI is positioned to rise. While we wait, we can collect a much higher dividend than we would get if we owned these holdings directly.

Conclusion

With RQI and PTY, I enjoy monthly solid income from two of my go-to sources for it.

This way, regardless of the man crying that the market will descend into a multi-decade collapse or the man crying that the future is bright and the best is yet to come, I can know that my portfolio generates great income and will continue to do so.

I cannot control the future, and the past is written but still a valuable educational resource. The present is in my hands. I can decide what to do with the time and money I currently have. So, I choose to invest in more income. Buying solid income-generating securities and letting that income arrive in my future.

These are just two picks in our High Dividend Opportunities Model Portfolio, which focuses on yields over 7% and has a target yield of 9-10%. These funds are go-to picks of mine to see great income.

Regarding retirement, as I get older, I find that I like what I know to be reliable. I like to keep things simple and retread paths I’ve walked down before. Why change if no change is needed? PTY and RQI allow me to do just that, keep it simple and easy.

That reduces stress and provides comfort – in the form of dollars pouring into my coffers! That’s the beauty of our Income Method.

Be the first to comment