Buena Vista Images

One thing that I tell friends who invest is that whether the stock price goes up or down, they may be disappointed, in different ways. That’s because if the stock price goes down, one may have wished they waited, while if price goes up, they may wish that they had bought more.

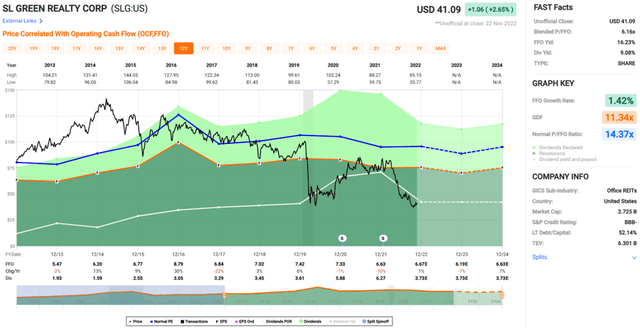

That’s why a stagnating share price, especially on a high yielding stock may not be a bad thing. This brings me to SL Green Realty (NYSE:SLG), which hasn’t really done much of anything since I last visited the stock in early April, rising by just 0.5% over this timeframe, all while continuing its robust payout. This article highlights why SLG remains a bargain basement opportunity for those investors with a bit more risk appetite, so let’s get started.

Why SLG?

SL Green Realty is well-known in the real estate industry as being New York City’s largest owner of office real estate. It’s an S&P 500 company and is focused on owning, managing, and developing properties in Manhattan. At present, it has an interest in 62 properties totaling 33.6 million square feet.

SLG’s stock continues to trade weakly and hasn’t much participated in the recent market rally, providing investors with conviction on the stock plenty of opportunities to layer in. As shown below, SLG has fallen by 44% over the past 12 months and currently trades at less than half of its 52-week high achieved earlier this year.

Meanwhile, SLG had a busy third quarter, signing 32 Manhattan office leases covering 930K square feet. This brings total year to date activity to 108 Manhattan office leases signed covering 1.9 million square feet as of the end of September. While same-store cash NOI declined by 0.5% YoY during Q3, it’s still up by 5% for the first nine months of the year. Also encouraging, it appears that the market is rather amenable to high quality spaces, as same-store occupancy increased to 92.1%.

It’s worth addressing that office properties have seen plenty of headline risk over the past two and half years. That’s because hybrid and remote work have taken off during this timeframe, and questions remain on workers’ willingness to return to the office, despite many employers pushing for either full-time in-person or hybrid work arrangements. Nonetheless, demand remains strong for high quality office properties with modern amenities, as the CEO of peer City Office REIT (CIO) recently noted during an earnings call.

Moreover, it appears that the New York economy is recovering well, as supported by the number of jobs added in recent months. This was highlighted by management during the recent conference call:

Notwithstanding the current interest rate environment, the underlying New York City economy is still chugging along based on employment data showing that NYC added 24,000 private sector jobs in August and is now 100,000 jobs ahead of New York City OMB’s original 2022 forecast. More to the point, 22,500 office using jobs have been created in just the last three months reported now bringing the total office using jobs recovery to 104% of pre-pandemic high watermark.

The numbers confirm what we feel that New York City is finally back to normal. The roads, sidewalks and commuter trains are packed and the subways are coming back. Tourism and hospitality are near pre-pandemic levels. Residential rental market remains tight and the enablement of conversion of office to resi to help solve this problem is gaining momentum at the state and city levels. Meetings, conferences, parties, they fill the calendars and the rhythm of New York social life has returned.

SLG maintains reasonable leverage, with a BBB- rated balance sheet and a long-term debt to capital ratio of 52%. It currently yields an impressive 9.1%, and the dividend is well covered by a 56% payout ratio, based on the FFO per share of $1.66 generated during the third quarter.

Lastly, there’s no denying that SLG is dirt cheap at the current price of $41.09 with a forward P/FFO of just 6.2, sitting far below SLG’s normal P/FFO of 14.4 over the past decade. Analysts have an average price target of $49.39, implying potential for strong double digit annual returns including the dividend.

Investor Takeaway

SL Green is an attractive buy, given its current deep discount to fair value and attractive and well-covered dividend. The company has proven resilient with its high-quality office portfolio and should continue to benefit as New York City continues to recover with workers returning to offices. As such, I find SLG to be a solid option for risk-tolerant income investors in a well-diversified portfolio.

Be the first to comment