Financial markets, ETFs, and well… all of us have experienced a wild two months. Stocks are now rebounding and Coronavirus cases plateauing, though it’s still anyone’s guess as to the full extent of economic damage inflicted. A second wave of COVID-19 cases can’t be ruled out. While we collectively catch our breath, here are six ETF questions I’m pondering following the Coronavirus selloff:

1) Will bond ETF discounts dissuade future investors? 2019 was the year bond ETFs came of age. They vacuumed-up record investor dollars, with US bond ETFs taking in more money than US stock ETFs in a year where the S&P 500 was up over 30%! 2020 was primed to build on that success. Then Coronapocalypse hit and bond ETFs faced their biggest challenge since launching in 2002. Several of the most popular bond ETFs traded at meaningful discounts to their net asset values, sparking debate over whether the products were broken or, instead, a better representation of the true value of the underlying bonds held. I’m not going to relitigate the entire episode (suggest reading this and this), though I will pass along my favorite analogy of what we witnessed (courtesy of ETF Trends’ Dave Nadig):

“If you’re coming to this from the mutual fund world, you’ve been told over and over again that NAV is fair value, so you’ve learned to accept that. NAV isn’t fair value. NAV is a calculation which, in the bond space, is based on estimates and I think that’s really hard for people to grasp. The example that I’ve been using that I think has given a lot of people an ‘aha’ moment is, if you go to Zillow and you look up your house and it tells you it’s worth $500,000. You shouldn’t believe that number in the midst of a housing crisis. But if the guy next to you has to fire-sale his house for 50% less than he bought it for last year, your Zillow number is not immediately going to go down by 50%. It’s going to take months for Zillow to recognize that your local market has changed and your house is probably not worth what you thought it was worth. That’s exactly what’s going on in the bond market. A bond pricing service is nothing more than fancy Zillow.”

The question is whether these discounts impact investor appetite for bond ETFs moving forward. My two cents: I’d be shocked if bond ETF momentum slows. I think an argument can be made the crisis has only instilled more confidence in bond ETF investors. Bond ETFs experienced record trading volume in the most trying of times. Investors leaned hard on the structure and it didn’t crack. As for bond mutual funds, FactSet’s Elisabeth Kashner said it well:

“If you’re going to be a tactical trader or a panic-seller, you’re better off in a fixed income mutual fund than an ETF because the NAV staleness will work in your favor. If you’re a strategic investor, choose an ETF to avoid subsidizing panic sellers.”

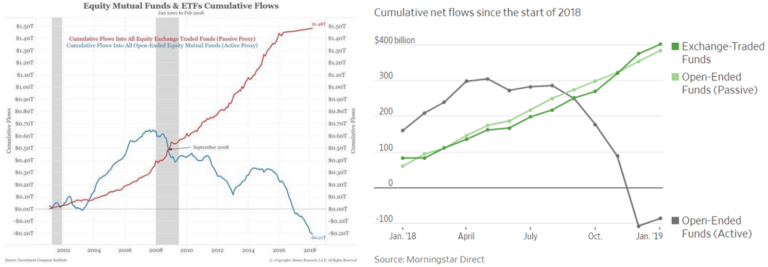

And, judging by flows, there were a lot of mutual fund panic sellers…

Source: Bianco Research

2) Will the selloff result in a flood of new money into ETFs? Somewhat related to the bond ETF story is what might happen with ETF flows overall. Bond ETF discounts aside (which, again, could be argued were justified), ETFs performed admirably during the selloff. During the preceding bull market, ETF naysayers were shouting from the rooftops that “ETFs aren’t battle tested” and that during the next downturn, “ETF investors will rush for the exit, causing a death spiral” or “ETF liquidity will dry up”. Then the S&P 500 nosedived 34% from its February 19th high.

What happened? Stock and bond ETFs saw record trading volume. Investors actually put near-record money into ETFs, not exactly rushing for the exit. There was no death spiral. Liquidity didn’t dry up. ETFs survived the battle. If history is any guide, there’s a high likelihood the recent selloff will only accelerate flows into ETFs.

Consider what happened during the 2008 financial crisis or the 20% stock market decline in the fourth quarter of 2018. Investors yanked money out of mutual funds and plunked it into ETFs.

Sources: Bianco Research; The Wall Street Journal

Why? Two main reasons:

->Investors realized their expensive mutual funds failed to protect them from the downturn (in fact, many actually underperformed).

->When investors are sitting on sizeable gains, they’re hesitant to sell and take a tax hit. When stocks are down substantially, it provides an opportunity to remove the mutual fund capital gains padlock. Investors can sell expensive, underperforming funds without paying Uncle Sam. This money then flows into lower cost investments such as ETFs.

Will this trend repeat after the latest market turmoil? I don’t see any reason why it wouldn’t and, as an added bonus, I think there are fewer ETF skeptics after ETFs proved their mettle.

3) Perfectly timed launch for non-transparent ETFs? A story flying under the radar during the recent selloff was American Century launching the first non-transparent ETFs. Nearly a decade in the making, non-transparent ETFs hope to leverage the benefits of ETFs (namely tax efficiency, lower costs, and intraday trading) while still protecting the “secret sauce” of active managers. Had these ETFs rolled out in January or February as expected, they would have faced tumultuous trading conditions and sharp losses. Instead, the two American Century products launched in early April, catching a swift rally. Trading has mostly gone without a hitch.

I’ve been skeptical of non-transparent ETFs. A fancier investment wrapper won’t magically turn underperforming active managers into superstar stock pickers. There also exists “smart beta” ETFs which offer active management without the human emotion and bias (and typically at a lower cost). And, oh yeah… there are transparent active ETFs. It still boggles my mind that not a single traditional, old guard mutual fund company has launched a flagship equity strategy (think Fidelity Contrafund) in an ETF wrapper.

Nevertheless, if asset managers believe it’s that important to protect their stock picks, then have at it. Now is the opportunity to shine. We have a volatile market environment and asset managers have access to the ETF wrapper they’ve been waiting for.

The launch of non-transparent ETFs appears perfectly timed, but can they stick the landing? It will come down to performance. If outperformance is there, add non-transparent ETFs to the list of reasons for continued ETF growth.

4) What’s next in ETF fee war? The perpetual ETF fee war shows no signs of ending. While everyone was busy worrying about the Coronavirus, several of the largest ETF players – Vanguard, Schwab, and iShares – were ruthlessly chopping fees. Not only that, the first truly free stock and bond ETFs debuted. BNY Mellon made a splashy ETF entrance, launching zero fee ETFs with no fee waivers or other restrictions.

Just when it seems the focus on ETF fees is dwindling, another round of fee cuts appears. ETF costs… JUST. KEEP. FALLING. That said, I think the conversation is beginning to shift from fees to value. What are you getting for what you are paying? That’s a healthy pivot. The Coronavirus-fueled stock market panic has investors reevaluating what they own. Saving a few bucks in fees doesn’t matter if you own the wrong fund.

It will be interesting watching the tug-of-war between fees and value. Investors are realizing that if they’re getting something for free, they’re not the customer – they’re the product. Fund companies are weighing whether to compete as a low-cost provider or a differentiator (and if they don’t differentiate, then they’re a commodity and will be priced accordingly even if not intending to compete in the low-cost space).

Post-Coronavirus selloff, I’ll be watching this battle closely.

5) A ray of sunlight for ESG? I’ve long questioned the value of ESG, or socially responsible, investing. In a recent interview, I explained why I believe ESG ETFs are more marketing than substance:

“We all want a better world. I have two young daughters. I want them to live in a world with cleaner air, fairer pay, more corporate diversity, better consumer protections, etc. I think most people feel that way. I’m just not sold this can be accomplished through an investment portfolio. I have a working hypothesis that financial markets are a natural ESG screener. Over time, companies not doing the right things according to society’s standards – whatever those are in aggregate – will see that reflected in their stock prices… I believe the financial markets, driven by active investors, are the judge and jury, not ESG committees.”

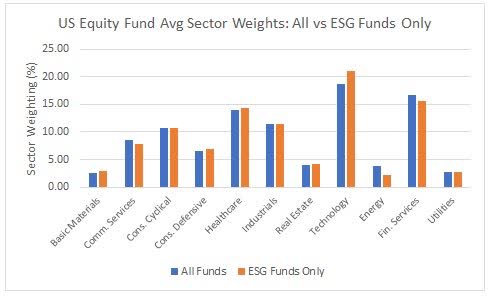

While I stand by that, I think Coronapocalypse has opened the door for ESG. The economic shutdown has crippled demand for oil, and energy stocks have been absolutely crushed. Guess what ESG funds tend to underweight? Energy stocks. What’s been one of the best performing sectors throughout the crisis? Technology stocks. Biggest overweight in ESG funds? You got it.

Source: Morningstar’s Jeffrey Ptak

Sacrificing performance has always been an investor concern with ESG. Whether by luck or design, ESG will now have a performance tailwind. Might that translate to more investor dollars flowing into the products? We’ll see, though initial signs are encouraging.

There’s another potential positive factor. The Coronavirus and associated economic shutdown have increased scrutiny over how companies treat employees and how companies conduct their affairs. The pandemic has shone a bright light on areas like work-from-home flexibility and other employee benefits, executive pay, stock buybacks, etc. – all areas that typical ESG funds like to take into consideration. Will more investors now seek companies that are “doing the right things”?

I still believe direct indexing is a better longer-term bet for ESG, but there’s no question recent events will prove beneficial for ESG ETFs over the shorter-term. Enough to make a real difference? I still lean towards no, but if ever ESG ETFs had a chance to shine, now is the time.

6) How can the ETF industry better educate investors? Perhaps the biggest ETF story this year involves the world’s largest oil ETF, the United States Oil Fund (NYSEARCA:USO). A combination of diminishing oil demand and too much supply (with nowhere to store it) has put oil prices in a tailspin. Naturally, some investors are bottom-fishing and trying to play an oil rebound. USO seems like an easy option. The problem? USO isn’t designed to track the spot price of oil (no investment does this). Instead, USO owns futures contracts. Investors plowing new money into the fund has created a host of issues in the fund’s ability to manage those futures. The short story is USO is down 80% this year. You can see Robinhood investors piling in as the fund dropped:

Source: Robintrack

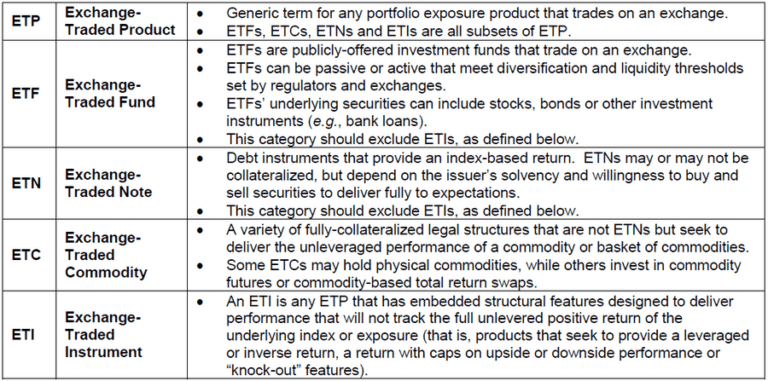

Some of these investors understand how USO works. Many don’t. I won’t get into the inner-workings of USO (you can do that here), but investors are receiving a harsh crash course on futures-based ETPs, negative roll yield, ETF creation/redemption, and premiums and discounts. So, is the lesson here “buyer beware”?

Well, yes, that’s one lesson. Investors should never buy an investment they don’t understand. But I wonder how many investors see “United States Oil Fund” and just assume it tracks the price of oil. I can’t say that’s a bad assumption. I think the ETF industry needs to do better. That involves proactive product education and more prominent risk disclosures.

A couple of years ago, the largest ETF issuer – BlackRock’s iShares – proposed better labeling for exchange traded products. The idea was that everything shouldn’t be called an “ETF”. In light of the USO situation, I think this should be given more consideration.

Source: iShares

However, more education and simply labeling USO as an “ETC” obviously isn’t going to solve the issue. I think the best solution is for brokerages to require investors in futures-based or leveraged ETPs to jump through the same hoops as if they were setting-up futures or margin accounts. Why should ETPs be any different?

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment