Dilok Klaisataporn

CFA, MBA, PhD – Not Needed

I am not smart and am too young to have gained much experience, so I must rely on others, or simple data metrics, to keep my money safe. This article will discuss the five leading investments where your hard-earned money will be left in the smartest hands (four securities investments and one investment/savings account). There is no singular way to determine “smarts”, but in my five examples, each investment is the epitome of their own unique smart qualities.

‘Good atmosphere and smart people can accomplish a lot.’ – Jim Simons

With the backing of my own biased, but data-driven, opinion, I honestly believe these five companies are the smartest in their prospective field. I also do not focus on a singular area of the market, or one individual measurement, and this helps to negate the effect of company size or industry. However, I will also introduce peers that come close, but fail to reach the same level. The list of tickers, in no particular order, is as follows:

- Alphabet (GOOG) (GOOGL)

- JPMorgan Chase (JPM)

- Exponent, Inc. (EXPO)

- Houlihan Lokey (HLI)

- Berkshire Hathaway (BRK.A) (BRK.B)

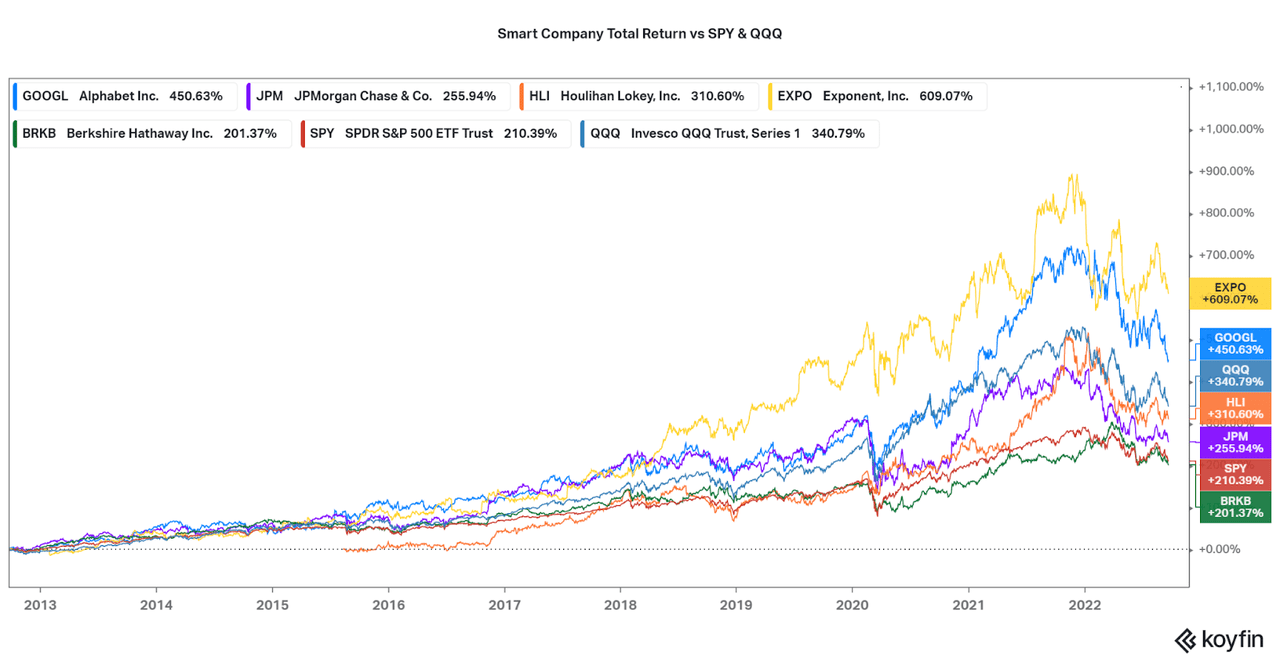

These five companies tick many key boxes for business and financial quality. While a few are very popular or renowned with the public, popularity is not a requirement. Rather, if customers, clients, and peers all respect these companies then they have my vote. To set the stage before discussing each, let’s compare total returns with SPY and QQQ below. As we can see, total return is not the goal, but factors such as longevity and safety are also important.

Koyfin

Alphabet – The Nurturing of “Other Bets”

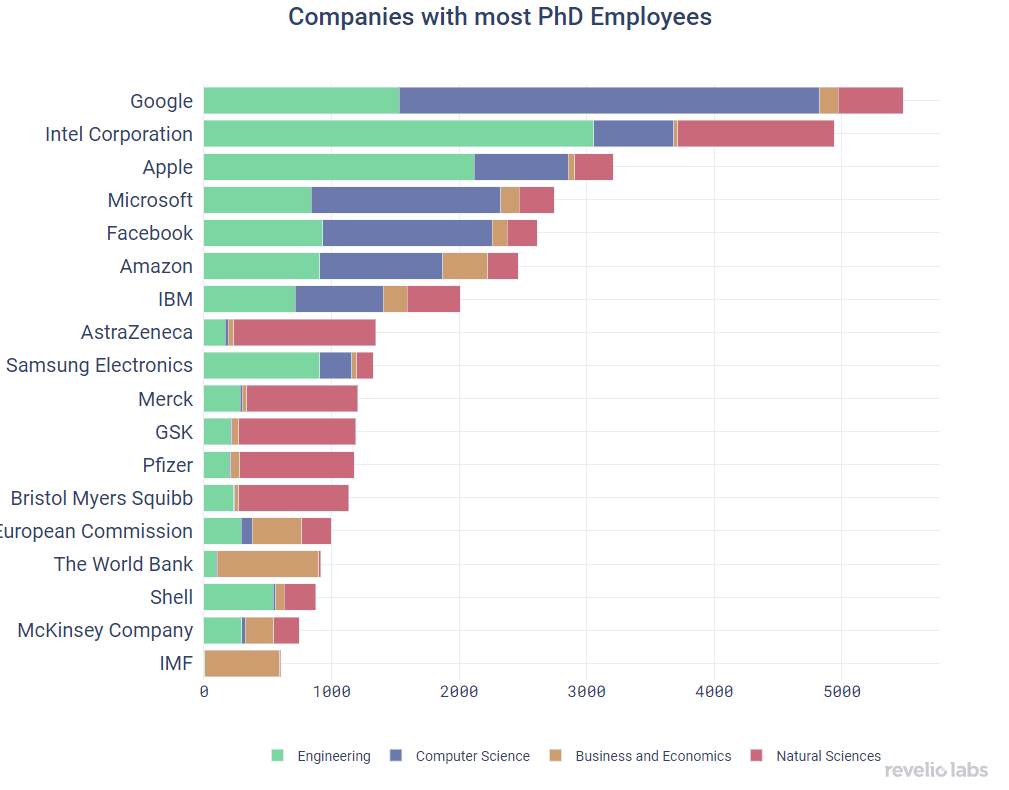

I am sure the first obvious way to determine the smartest company is by the number of PhD Employees. To do so, I looked at data provided by workforce analysts Revelio Labs. According to the firm, Alphabet currently employs over 5,000 PhDs, or ~3.5% of the total workforce. This is certainly not the highest percentage of the total workforce, as second place Intel (INTC) has over 4% PhD level staff, and many small biotechs or engineering startups could be over 10% PhD employees. What matters is how the financial performance is supported or influenced by these smart people.

Well, Alphabet has created a trillion-dollar business so I suppose things are going well! Intel on the other hand has other issues that their recent hiring should be attempting to fix. We should also be wary of relying on this data as names such as Facebook (META), IBM (IBM), and the Pharma companies have been performing far worse than Alphabet. Again, PhDs aren’t useful on their own, it is what you do with them!

Revelio Labs

The key influence for Alphabet in the future, contrary to first appearance, is their Other Bets segments. Although, these start-ups are only possible thanks to drop-outs and/or PhD level software/computer engineers developing a legendary search engine platform. The profitable Google Search, Ads, YouTube, Cloud, and other services are all creating significant cash flows that can fund speculative bets. Smart minds lead these speculative bets that Alphabet can afford to pay and fund their research (across multiple industries).

The prime example of this is DeepMind’s AlphaFold, a proprietary open-source drug discovery platform. I discussed the platform in depth in a prior article, but the main conclusion is that AlphaFold, and other speculative subsidiaries are all continual drivers of growth rather than net loss vehicles. As an example, if AlphaFold succeeds, the integration of the service into the Google Cloud platform will be a driver for customer acquisition and allow Alphabet to compete with other cloud providers such as Amazon (AMZN) and Microsoft (MSFT). Organic growth of this nature is important to survive weak economic conditions, and the moat of legacy Google assets will allow for continued profit creation, regardless of investor sentiment, inflation, etc. As such, I believe Alphabet is the smartest technology investment in the market.

JPMorgan Chase – Global Systematic Importance

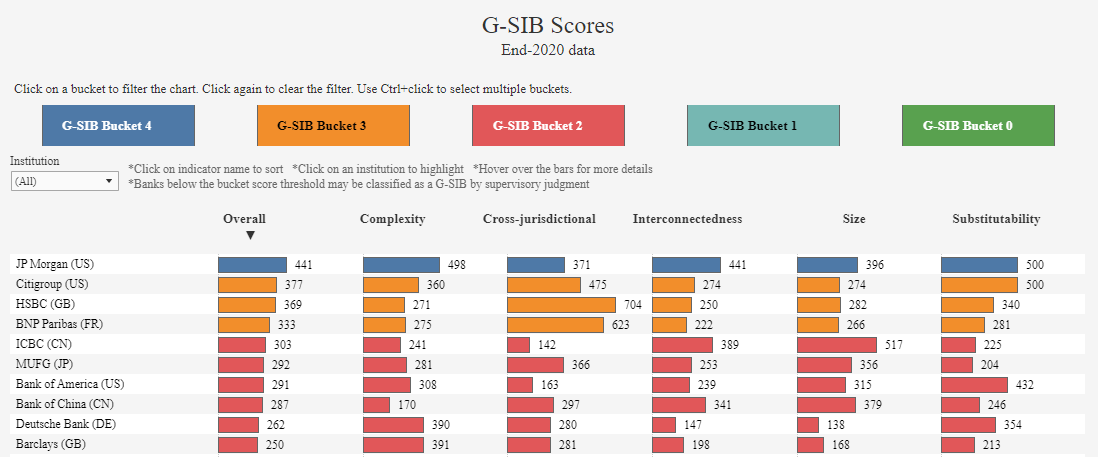

Another way to determine a smart investment is by determining how critical of a position smart leaders have created for said business. Often considered a “moat”, economy of scale, or other positive monikers, establishing the top position in a given sector or industry is no easy feat. I consider that smart, whether driven by PhDs or not. Every year, the central bank-funded Bank for International Settlements publishes a list of the top Globally Systemically Important Banks. Thanks to leadership across multiple financial sectors and global scale, JPM is by far the most important bank in the world since data collection began in 2014, and is ahead of peers Citi (C), HSBC (HSBC), and BNP Paribas (OTCQX:BNPQY)

‘The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.’ – Warren Buffett

With this data, JPM should always be the first place to consider when you need a stable place to park some excess cash, whether as an investment or in a savings account. Unfortunately, some risk points to consider are fluctuating investor sentiment, and in turn valuation/share price, due to economic factors. Also, no global bank has a perfect track record and one small risk may cause significant issues for world markets (a la 2008 and mortgage-backed securities). With further global regulations in place, risk management being practiced, and a broad lead in rank over peers, JPM still remains a smart investment in my eyes, but I would avoid the ticker and stick with the banking services.

BIS

Houlihan Lokey – Advising “Smart Money”

For those who are seeking an ever smarter financial investment, look no further than Houlihan Lokey. As my personal largest financial holding, my bullishness lies in the fact that HLI is the leading financial adviser across M&A, restructuring, and valuation fairness. Retail investors may be unfamiliar with the name as HLI predominantly serves the private and mid-cap or smaller markets. However, apart from leading in the number of transactions completed, HLI offers a stunning financial growth profile and this pattern is set to continue.

HLI Website

What makes HLI stand out as smart is the fact that the company backs up their financial advisory skill with a sector-leading financial performance. Clients are primarily in the institutional market, also known as “smart money“, rather than public corporations, highlighting the value of the provided services outside of the public eye. Also, HLI is keen to share their key financial insights across all market sectors based on their experience with various transactions and relationships. This helps make me a smarter investor, and I need as much help as I can get. See my Editor’s Pick on Healthcare Spin-offs to see the data at work.

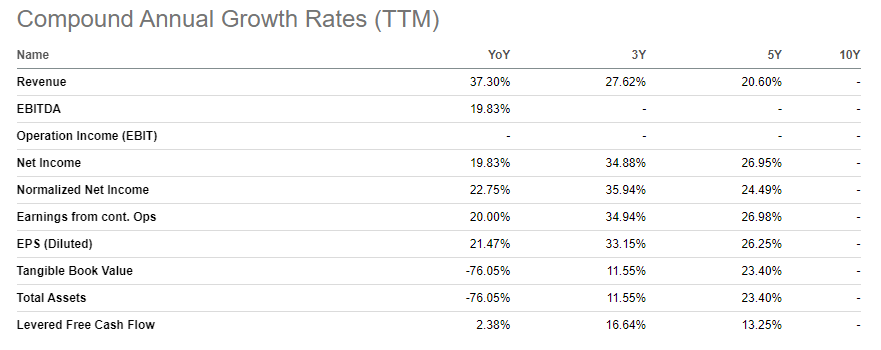

As is the pattern with HLI and the last two companies I will be discussing, smart is not just a label or rank, it can be proven through a business’ financial performance.

Seeking Alpha

Exponent – Selling Research Expertise

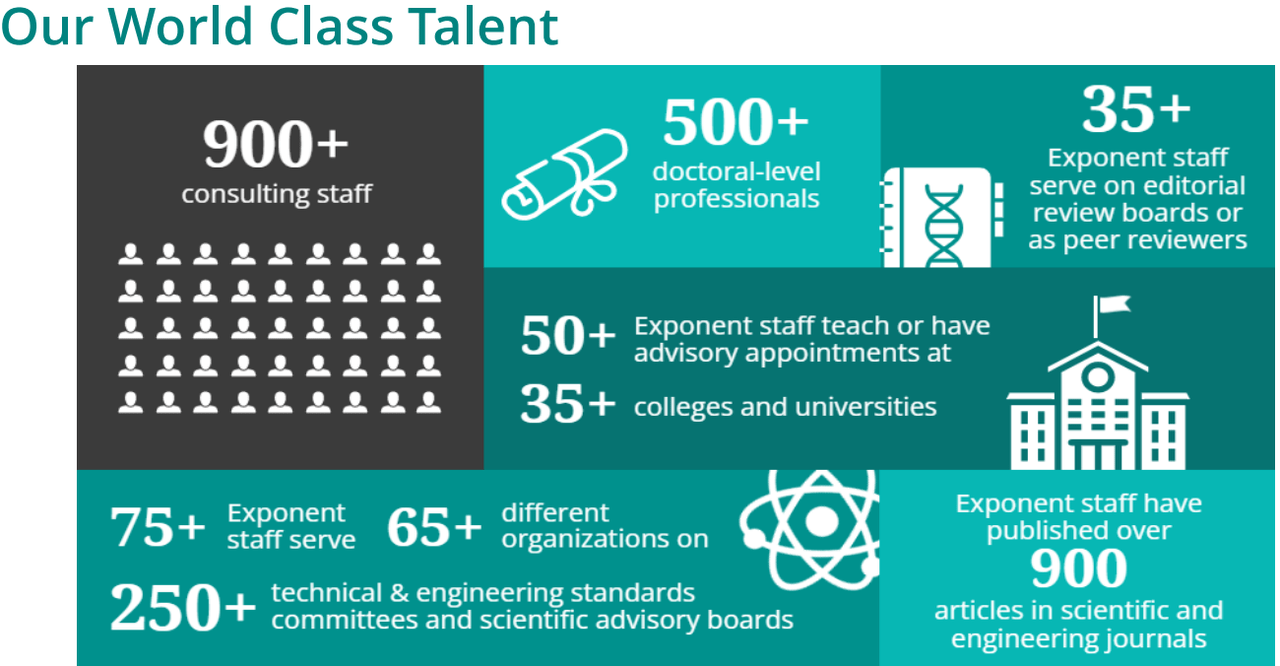

Another area of the market that investors should look to for smarts is the field of research and consulting. If other leading companies are willing to pay millions for the data and expertise that you can provide, then that is a great sign. Unfortunately, there are many companies within the industry that fail to offer a stunning financial profile to rely on. However, one STEM research and consulting firm, Exponent, is the clear leader in the segment thanks to their outperformance over the past three decades and more (and important PhD employee rate).

Exponent

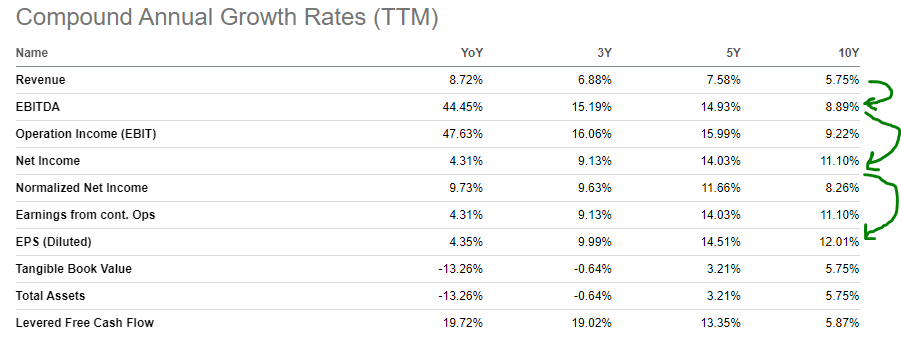

While moving at a measured pace, one of the best financial indicators of success is the step-like growth rate. Earnings per share are growing the fastest at over 12% per year thanks to buybacks and increased profitability even if revenues are only growing 6% per year. With the valuation also rising at a rapid clip, EXPO has been the top performer of this group over the past 10 years and more, highlighting their talent. They are not alone, and my other industry favorites include FTI Consulting (FCN), the redeemed KBR (KBR), and Stantec (STN). However, none can reach EXPO’s level of stunning growth over decades.

Seeking Alpha

Berkshire Hathaway – Aged Fine Wine

I will conclude by highlighting the best way to become smart: age and experience. No other company epitomizes this than Buffett and Munger-led Berkshire Hathaway. With over half a century of success under their belt and a group of experienced staff underneath them, I find little can go wrong with relying on BRK. As legendary data-driven investor Jim Simons puts it:

‘Past performance is the best predictor of success.’

As an individual investor, you yourself do not need to build a trillion-dollar internet empire, be the most systematically important bank in the world, or provide research and advice to the smartest people in the world. Instead, take the easy route and let others do the heavy lifting. As long as you can realize which companies are proving themselves financially, then you are all set. Do not forget all the little lessons, whether mistakes or successes you experience along the way.

‘Live a life full of humility, gratitude, intellectual curiosity, and never stop learning.’ – GZA

Going purely by current and historical financial data is an interesting thought because Warren Buffet has led Berkshire successfully for years, but often states that an investor should avoid investing in companies that you do not understand. Can a purely financial analysis provide enough detail to understand a business? In my eyes, yes, and it is what I plan to continue doing through my research.

Outperformance compared to peers, a long history of success, and continual profitability, and more, are all “smart” measures that allow investors to understand the true underpinnings of a company, rather than the technical details of their products or services. Whether or not the style is considered dated or behind-the-times, Berkshire Hathaway is a perfect example of what happens when you take this simple, quantitative approach to investing. We all know that Warren does not understand how to build an iPhone, but Apple (AAPL) remains his largest holding!

Takeaway

Whether you rely on others to be smart in managing your money, or you choose to take on the endeavor yourself, I hope this article begins to unveil the key indicators that may be hiding in plain sight. I also believe that ignoring short-term noise and focusing on the horizon is critical, as short-term weakness leads to long-term success. As I personally can’t predict the future, I will follow Buffett, Simons, Lynch, and other smart investors, who stand by leveraging the data points that are available instead.

Thank you for reading. What other companies, assets, or strategies do you find fit the bill as “smart” investments?

Be the first to comment