kynny

Barnes Group (NYSE:B) is a producer of high-precision components for numerous end markets, including industrial equipment and aerospace. It was recently reported that activists are pressuring the company. Irenic Capital Management has built an undisclosed position in the company and is pushing for management changes and a strategic review, including a potential company/asset sale. The activist has noted that the company is grossly undervalued and might be worth $60/share in a sale – close to double the current market price.

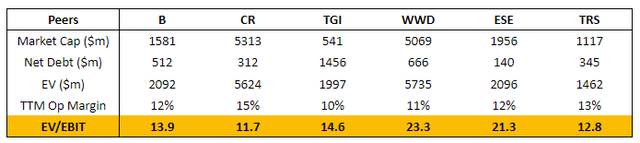

Irenic Capital Management has suggested that the higher-margin Aerospace segment (29% of revenues) might be worth the entire market cap of the company. Such a claim sounds quite reasonable and would require the segment to be valued at 25x TTM EBIT multiple. This is in line with larger peers that have material exposure to aerospace – e.g. WWD and ESE with 44% and 63% of revenues from aerospace respectively trade at 21x-23x TTM EBIT multiples. Smaller peers with much more limited exposure to the Aerospace industry (CR, TGI, TRS) trade at lower 12x-15x TTM EBIT multiples. The remaining Industrial business is also worth close to the current market cap if valued at 17x multiple where the recent industry transactions were completed (see below). With total company net debt at $0.5bn, the SoTP valuation would point to at least 50%+ upside from the current prices.

Activist pressure comes at an opportunistic time: (1) at 7-year low share prices driven by Barnes Group’s weak recent operational performance, as well as (2) recently launched operational improvement initiatives. Facing macroeconomic headwinds, including war in Ukraine and weakness in automotive end-markets, the Industrial segment has significantly underperformed, leading to an overall slow recovery from the pandemic slump. The aerospace segment performed much better but still needs to reach pre-pandemic levels. The company had to cut 2022 guidance – organic sales growth is now expected at 5-6% YoY compared to 8-10% forecasted in Q1’22. Recently, however, management has started to initiate changes to integrate operations and reduce costs. In July 2022, the company announced the closure of its automotive component manufacturing facility while simultaneously planning to expand facilities serving its higher-margin and better-performing aerospace business. The company will also close its internationally-located automation centers, given the weak performance of the automation business. Barnes Group seems to be in the early stage of operational turnaround, and the company’s longer-term earnings power might be materially higher compared to TTM earnings used above to sense-check activists’ valuation claims.

Irenic Capital Management is a newly established activist hedge fund co-founded by Elliott Investment Management’s veteran Adam Katz. At Elliott, Katz previously successfully led several high-profile activist campaigns, including at Alcoa (AA) and Arconic (ARNC) and B will be the first campaign for his new fund.

Business and Financials

B operates two segments – Industrial and Aerospace:

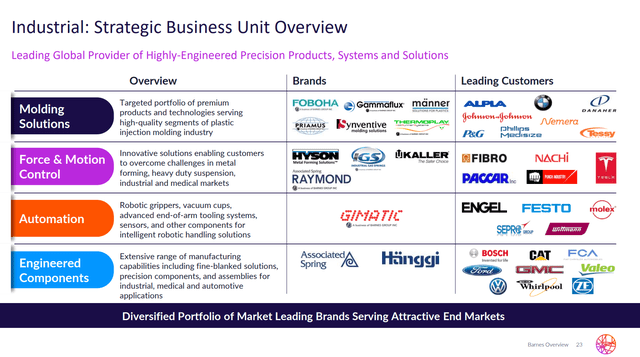

- Industrial segment design and assembles highly-engineered components/products/systems for diverse end-markets, including mobility, industrial equipment, automation, packaging and electronics. B further sub-divides Industrial into Molding Solutions, Force & Motion Control, Automation and Engineered Components.

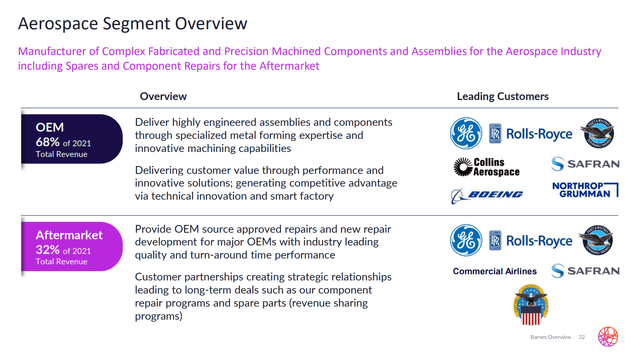

- Aerospace segment manufactures complex fabricated and precision-machined components for turbine engines, nacelles and defense aircraft. Notably, 55% of aerospace’s revenues come from General Electric (GE). Aerospace is sub-divided into Aftermarket and OEM divisions.

B Investor Presentation, July 2022 B Investor Presentation, July 2022

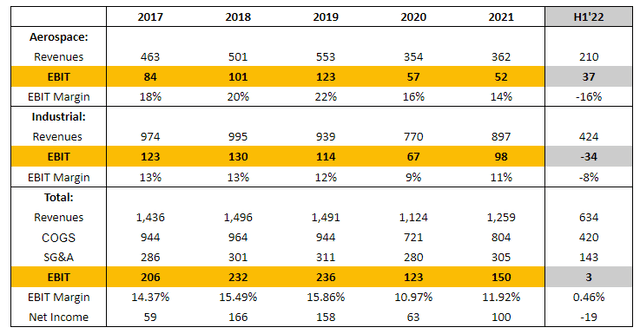

An important distinction here is that Aerospace business is higher margin than Industrial. Adjusted operating margins for Industrial segment have ranged from 11% to 14% in recent years, and the management has guided for 8-9% in 2022. Meanwhile, Aerospace segment boasts margins of 15-22%, with 17.5-18.5% expected in 2022. Notably, Industrial segment is heavily exposed to Europe (37% of sales) and automotive markets (28%) – both geographies/segments have clearly suffered from recent macroeconomic tailwinds. On the contrary, the Aerospace segment has picked up since 2020 given its exposure to travel recovery, however, revenue/EBIT are still below pre-pandemic levels.

Segment financials are provided below:

Note: Industrial segment’s EBIT for H1’22 includes a goodwill impairment charge of $68.2m related to Automation business.

Valuation and Other Industry Transactions

Relative valuation is provided below:

Recent transactions suggest that a 12x-15x TTM EBIT multiple for the Industrial segment is quite conservative:

- In August ’21, Danfoss completed the acquisition of Eaton’s industrial/mobile hydraulics business (which, similarly to B, served large OEMs, among other clients) for $3.3bn or 17.7x 2020 EBIT.

- In February ’22, Amentum acquired PAE for $1.9bn or 18.4x TTM EBIT. Notably, PAE is a defense contractor for the US government – thus not directly comparable – however, the company operated with significantly lower margins (3.5% TTM EBIT margins).

Irenic Capital Management

Irenic was established in 2021 and has to date raised about $500m. The fund focuses on activism in small to mid-cap companies. Among other activist campaigns, Irenic’s co-founder and former Elliott executive Adam Katz has successfully worked on Elliott’s activism at Alcoa. In Nov’15, Elliott disclosed a 6.4% stake in Alcoa, an aluminum producer, arguing that the company has room to improve its profit margins which were suppressed by a global aluminum glut. Notably, Alcoa was then in the process of separating its fast-growing plane/car parts and traditional smelting operations. The spin-off eventually occurred in Nov’16. Interestingly, post-transaction Elliott continued to act as an activist in the spun-off aerospace/automotive business Arconic, pushing for a strategic review. Elliott subsequently launched a proxy contest in Jan’17, arguing for management changes (including firing the CEO). Eventually, the CEO resigned and Elliott came to terms with the company, agreeing that the activist would appoint three directors to the board. Interestingly, several years later Elliott orchestrated the company sale to Apollo, however, the deal fell apart at the last minute. Eventually, Arconic announced that it would spin-off its engineered products business Howmet Aerospace. Elliott currently holds a 9% stake in Howmet Aerospace.

Meanwhile, Irenic’s co-founder Andy Dodge has led Indaba Capital Management’s investments in ClubCorp Holdings. Since initiating a position in 2014, Indaba has increased its stake to as much as 11% (at $17-$19/share range). Notably, ClubCorp’s stock jumped materially in 2015 to as much as $24/share and Indaba exited the position, suggesting the activist cashed out on significant returns. Interestingly, the activist re-entered the position in 2017. ClubCorp was eventually acquired by Apollo in September ’17.

B Ownership

B’s management owns 5.1%. 5 largest institutional shareholders, including BofA, Vanguard, BlackRock and Dimensional, own a combined 43% stake. It is worth noting that most of these equity holders previously acquired their stakes at prices below the current share price, suggesting they would cash out with a substantial profit in a company sale scenario (though with a long holding period).

Conclusion

At current price levels, B presents a potential high-reward special situation opportunity. The company seems undervalued despite the fact that the management has already started initiatives to enhance operating performance. Given the reputation and track-record of Irenic’s founders, I expect significant shareholder value to be realized here through either a company/segment sale or continuing strategic initiatives.

Be the first to comment