JHVEPhoto

Introduction

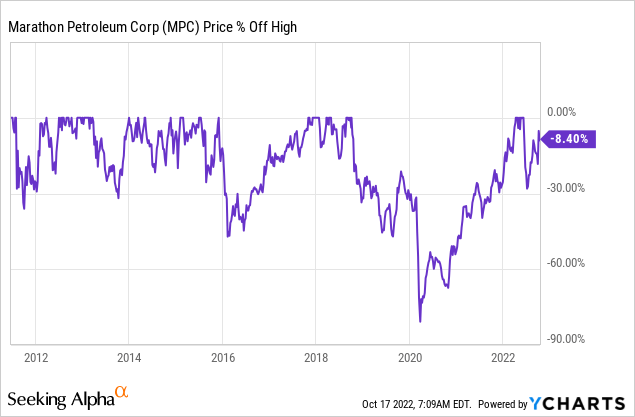

Someone should tell Marathon Petroleum (NYSE:MPC) that the economy is headed for a recession. Apparently, its stock didn’t get the memo as the company is up 63% year-to-date and just 9% below its all-time high. I have been a fan of the company for a while, as I wrote bullish articles like this one. While the company’s performance is remarkable, it’s not based on a miracle. The Findlay, Ohio, based refinery giant benefits from high industry margin and its own ability to turn this into shareholder value. While its dividend yield isn’t anything to write home about, it’s rapidly rising and backed by aggressive buybacks, a healthy balance sheet, and a valuation that hints at more long-term upside potential.

In this article, we’re going to discuss the bigger picture and dive into MPC’s ability to deliver shareholder value.

Serious Macro Issues Benefit Marathon Petroleum

Marathon Petroleum is one of the world’s largest refinery companies with a market cap of $51.9 billion.

I know that some people keep confusing certain things (even people on business TV), let me once again mention that Marathon Petroleum does NOT produce oil. Not since it was spun off from Marathon Oil (MRO). MPC buys crude oil through long-term contracts and spot market purchases. It does not produce its own feedstock like some of its competitors with drilling capacities (i.e., Exxon Mobil (XOM)).

The company operates 13 refineries across 12 states with a capacity of 2.9 million barrels per calendar day of crude oil refining capacity. It also has a majority stake in MPLX, which covers its midstream operations through 112 terminals with 11 billion cubic feet per day of processing capacity.

Marathon Petroleum

The company also has retail operations through its Marathon and Arco brands, which non-US investors may be unfamiliar with. These operations cover 7,100 locations.

Essentially, MPC sells energy – to put it very bluntly. The only reason I’m putting it this way is that this makes MPC incredibly cyclical. As much as I love refinery stocks, they tend to get hammered during recessions.

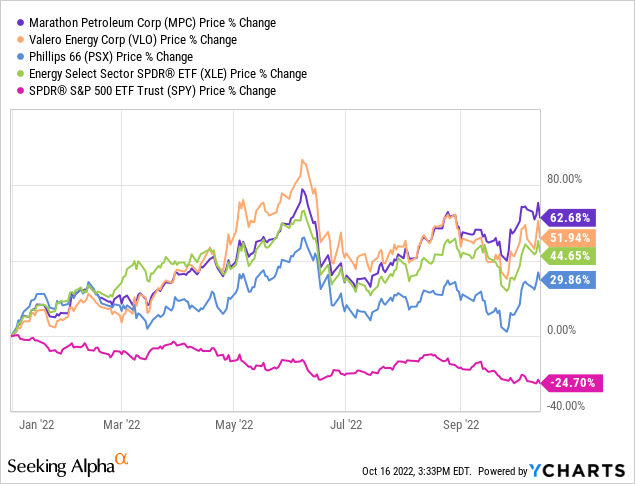

Currently, that’s clearly not the case as MPC and its peers Valero Energy (VLO) and Phillips 66 (PSX) are outperforming both the energy ETF (XLE) and the market by a rather large margin. Although PSX isn’t outperforming the XLE ETF.

Well, here’s the thing. This is what economic growth expectations look like:

Wells Fargo

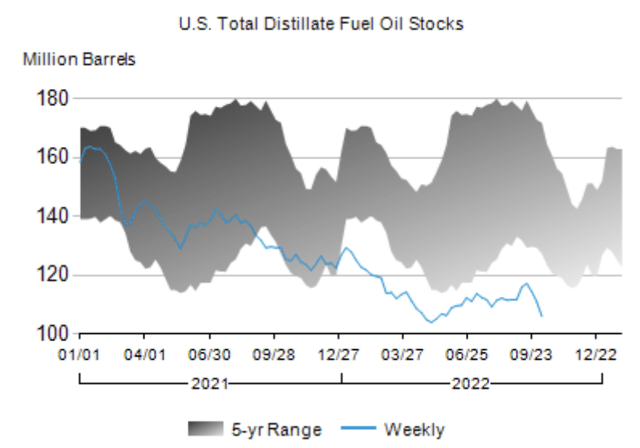

Meanwhile, U.S. total distillate fuel oil stocks are plummeting from already very low levels. That’s not at all typical for a (looming) recession.

Bloomberg hit the nail on the head in a recent article as it showed how bad the situation is. Imagine if export stops had happened in a scenario where fuel inventories overseas (i.e., in Europe) are even worse due to the war in Ukraine and the inability to produce sufficient fossil-fuel-based energy.

“Product stocks are already very low, especially diesel,” said Amrita Sen, co-founder and director of research at London consultancy Energy Aspects Ltd. “We have not managed to build going into the winter. A hurricane would have made a bad situation worse.”

Fuel stocks are so low that if a major hurricane had struck along the Gulf Coast, the “US would have stepped in and banned” product exports, Sen said. The White House is already weighing restrictions on overseas sales of gasoline, diesel and other refined products as a way to boost US stockpiles and force retail prices lower.

It also doesn’t help that Strategic Petroleum Reserves are at a 38-year low. There is simply no room for errors with inventories this tight.

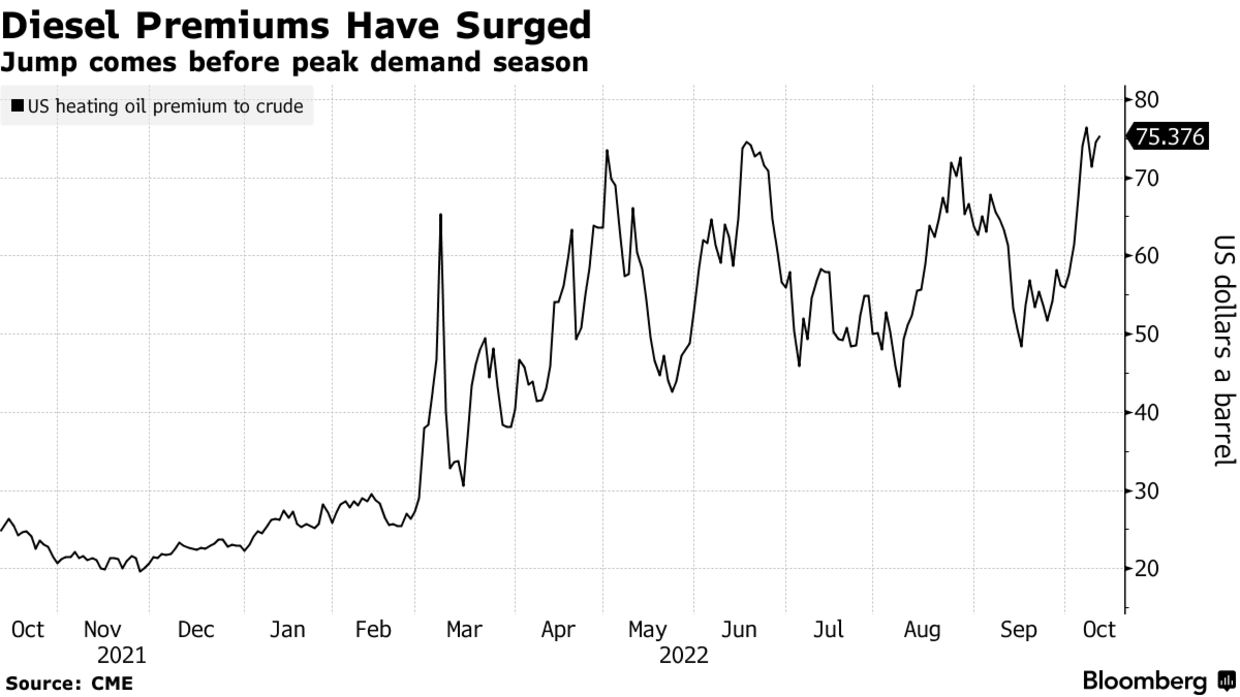

Adding to that, and looking at Diesel, premiums are spiking as Europe is in desperate need of exports while the US (a leader in exports) is not in a good spot to boost shipments.

Bloomberg

It should also be mentioned that a big part of France’s refinery capacity was offline due to strikes, which forced the government to use strategic reserves.

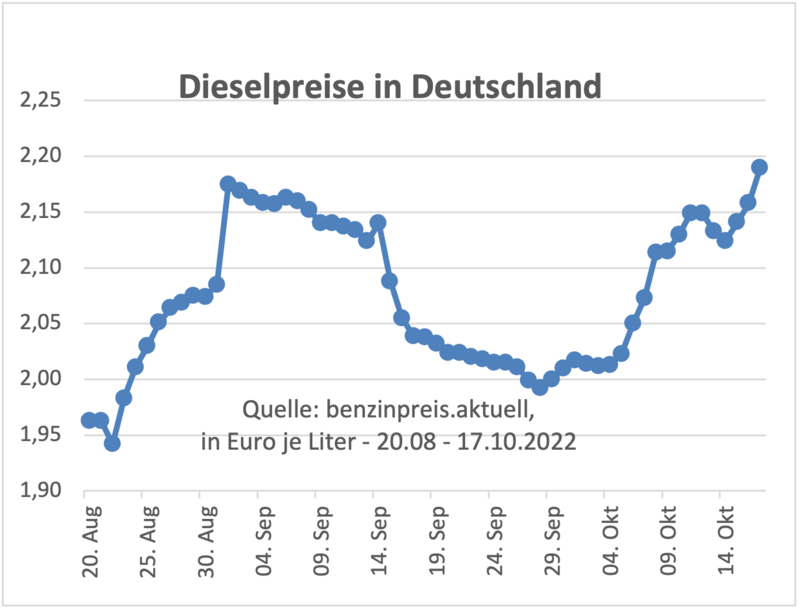

This is what German diesel prices look like (despite economic weakness):

Benzinpreis.aktuell (Via Agrarheute.de)

Moreover, despite sluggish and further slowing economic growth, it is unlikely that higher exports from China and the US can fill the supply/demand gap. If we add to this that supply is under pressure in North America, we get a situation where margins remain quite strong.

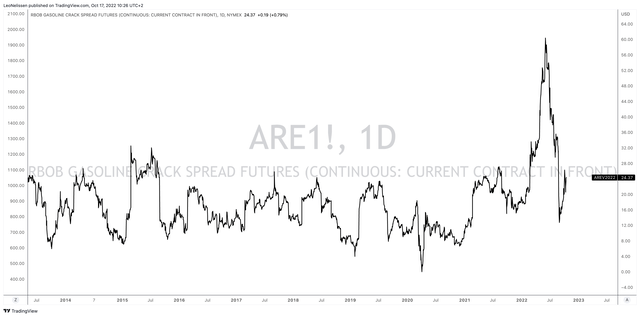

In addition, one of my favorite indicators, the RBOB gasoline crack spread (NYMEX ARE futures) has come down from recent highs. However, that makes sense as these highs were not sustainable. The decline was fueled by recession fears. Yet, the crack spread has come up again. It’s now at $24.4, which is one of the highest numbers in recent history – ignoring the 2021 rally.

These levels are highly supportive of refineries, which also explains why they are trading like they couldn’t care less about the looming recession.

What This Means For Marathon Petroleum

Just recently, Marathon Petroleum was the biggest buyer of oil from the nation’s strategic reserves. Eight companies were awarded a total of 10.15 million barrels of high-quality, low-sulfur oil in a move that almost everyone believes to be purely political. Lowering strategic reserves may have a short-term impact on gasoline, however, it doesn’t change the fact that the US is lacking refinery capacity because of underinvestment and that strategic reserves will have to be bought back at some point, tightening supply again.

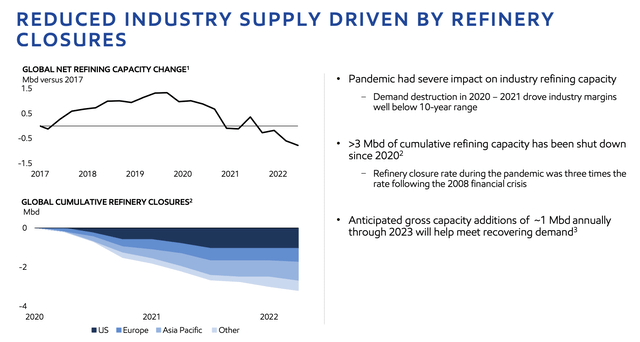

The chart below shows what the development of refinery capacity looks like. The pandemic caused closures in all major regions. This also explains why slower economic growth isn’t able to crush margins the way it did prior to the pandemic.

In November, Marathon will receive 2.35 million barrels of oil, which makes it the largest winner of the SPR storage sale.

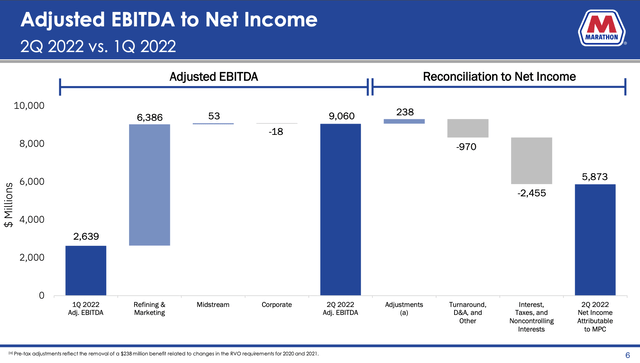

What makes MPC so special is its ability to make money in this environment. In the second quarter, the company ran at full utilization to meet demand, generating more than $9.0 billion worth of adjusted EBITDA.

The company pumped more than 2.9 million barrels of crude through its 13 refineries. This is expected to have fallen to 2.7 million barrels in the third quarter. That’s not bad news, but a step in the right direction. A utilization rate above 95% will result in too much stress on equipment. Lower utilization allows for maintenance, which is what the company is now doing.

As the overview below shows, it’s all about refining and marketing. In 2Q22, it provided the company with a $6.4 billion boost in adjusted EBITDA, which is more than twice what it did in 1Q22.

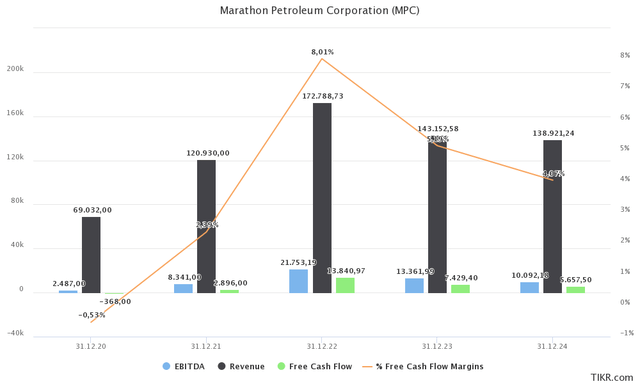

With that said, analyst estimates have come down just a bit. In 2023, MPC is expected to produce $7.4 billion in free cash flow. That’s down just $200 million since August when I wrote my most recent article covering this company.

If we ignore 2022 for a moment, both 2023 and 2024 are expected to remain stellar years. The company is expected to maintain average revenues close to $140 billion with a free cash flow of at least $5.6 billion. That’s based on a free cash flow margin of almost 5.0%, even in 2024.

In this case, it’s important to put these numbers into perspective. $7.4 billion in expected 2023 free cash flow is roughly 14.3% of the company’s $51.9 billion market cap. As free cash flow is basically net income adjusted for non-cash operating items and capital expenditures, it’s cash a company can distribute through dividends and buybacks. This means there is a lot of room for the company to pay a juicy dividend – on top of buybacks.

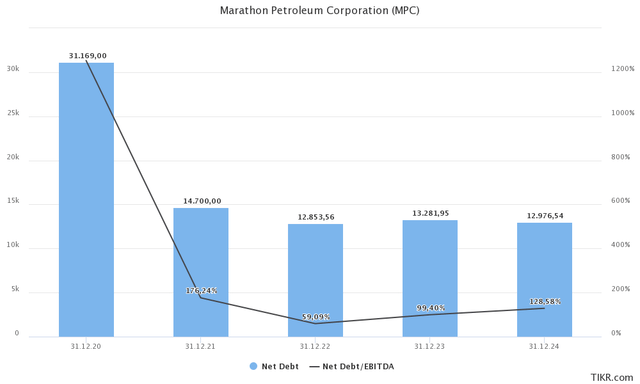

Before we discuss shareholder distributions, it is important to mention that the company has reached a point where its balance sheet is supportive of its actions. Total net debt (gross debt minus cash) is expected to plateau close to $13.0 billion, which is close to 1x EBITDA, depending on the strength of the economy. The company has a BBB credit rating. The outlook is stable.

I’m not only bringing this up because it’s important, in general, but also because this means that the company does not need to prioritize financial stability over shareholder distributions.

Dividends & Buybacks

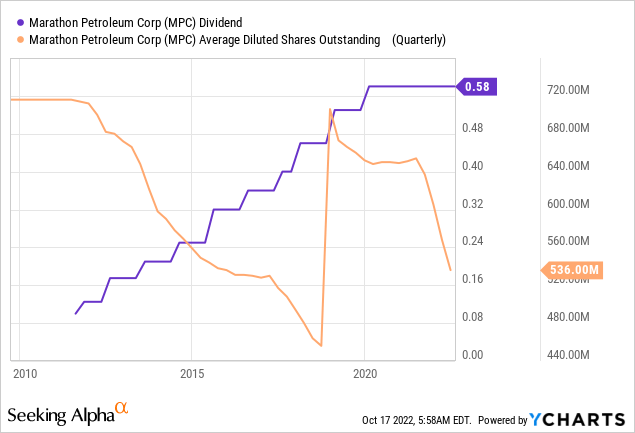

Let’s start with the bad news. MPC shares pay a $0.58 per quarter dividend. That’s 2.2% per year. That’s not necessarily bad news, but it will keep a lot of people from buying the stock. After all, most buy energy stocks for a high yield.

However, that’s also where the bad news ends.

As the expected free cash flow graph already implied, the payout ratio is really low. Using earnings per share expectations for the next twelve months ($12.77), the company has a payout ratio of a mere 18.2%.

Hence, the company’s dividend growth is everything except disappointing. Over the past 10 years, the average annual dividend growth rate is 15.5%.

15.5% average annual growth is impressive. However, it gets better as the company hasn’t hiked dividends since the start of the pandemic. The most recent hike was 9.4% in January 2020. A month before everyone knew that there is a Chinese city named Wuhan. This means that average dividend growth in the years prior to the pandemic exceeded 15.5%.

Despite zero dividend hikes, investors still benefited. Since March 31, 2021, MPC bought back 24% of its shares outstanding. None of these sentences include a typo. It’s really that wild.

These buybacks didn’t hurt the balance sheet (MPC actually reduced net debt) as it was funded by a $15.0 billion buyback program, a separate $5.0 billion buyback program, and the $21 billion sale of Speedway last year. In other words, funding came from free cash flow and non-core divestitures. At the end of 2Q22, MPC had $2.9 billion left under its buyback program. 3Q22 earnings will reveal a lot more about future buybacks.

While these buybacks don’t end up in your bank account the way dividends do, they are responsible for a big part of the company’s stock price outperformance.

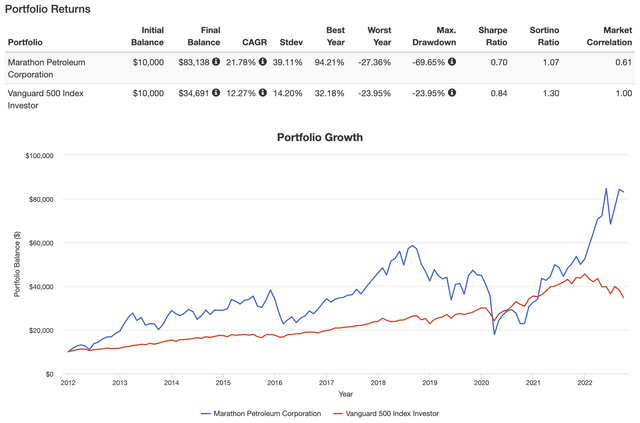

Looking at the bigger picture, we see that MPC shares have outperformed the market since the 2012 spin-off. The annual compounding return is 21.8%, which beats the market by almost 10 points – per year. However, the standard deviation is almost 40%, which is extremely high. Investors need to be aware of that. Owning MPC (and energy, in general) can be highly profitable. But it also comes with high volatility.

With that said, this is what the company commented on the timing of its buyback program and its dividends:

[…] we remain committed to a secure, competitive and growing dividend. Our objective has been to complete the $15 billion repurchase program no later than the end of this year. We remain on track to meet this commitment. Upon completion of the program, we will reassess our dividend level.

This is what I wrote in August (in light of the quote above):

While I cannot promise anything, I expect a juicy dividend hike in 1Q23 and long-term dividend growth to be in the high-double-digit territory. After all, the company makes too much money to keep saving money. Its balance sheet is healthy and comparing its 2.6% yield to a double-digit FCF yield means there is plenty of upside potential, which will be good news for the total return as excess FCF will be used for buybacks.

Valuation

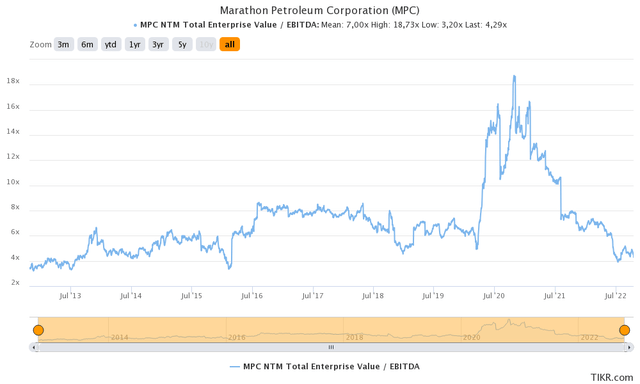

Just looking at the bare numbers, MPC is cheap. The company has a $73.4 billion enterprise value consisting of its $51.9 billion market cap, $13.0 billion in net debt, $7.4 billion in minority interest, and $1.1 billion in pension-related obligations.

That is roughly 5.5x 2023E EBITDA.

I believe that under normal circumstances, the stock should be able to advance another 30-40% over the next two years.

However, the macro environment is vicious. A lot of stocks that should be trading much higher are down a lot. Economic weakness is doing a number on pretty much every asset class, and I wouldn’t be comfortable advising people to take a big stake in refinery stocks. As bullish as I am on a long-term basis, if the Fed continues to hike, demand could get so weak that margins drop. Once the demand comes back, I expect margins to accelerate again. However, I cannot rule out that there could be some short-term pain in the months ahead.

Hence, the best way to play this company is to buy a small position now and add gradually to the position over time. In general, I think that’s the best way to approach any dividend growth stock.

Takeaway

The economy is slowing. Yet Marathon Petroleum is trading close to its all-time high after rallying more than 60% since the start of the year.

That’s no surprise. Refinery supply remains a big issue as a lot of capacity has come offline after the pandemic. It’s slow to come back and the energy crisis in Europe doesn’t help as it requires higher exports from both North America and Asia.

As a result, and despite economic weakness, refinery margins remain very high, which is supporting MPC’s income in 2022 and beyond.

In this article, we discussed the impact this has on MPC’s business. The company remains attractively valued as revenues, EBITDA, and free cash flow are expected to remain elevated in the years ahead.

This is great news for dividend (growth) investors. The company is aggressively buying back shares using excess free cash flow. After all, its balance sheet is healthy, allowing management to prioritize shareholder distributions over debt reduction.

Moreover, in its upcoming earnings call, management is expected to reveal more details regarding its dividends, which I expect to be hiked quite aggressively starting in 2023. The payout ratio is very low, allowing management to accelerate dividend growth in the years ahead. It’s also rather important as its yield has come down based on no hikes since 1Q20 and its stellar stock price performance.

So, long story short, I believe that MPC is a much better stock than its yield suggests. Given the ongoing economic weakness and its attractive valuation, I advise investors to accumulate shares on weakness.

(Dis)agree? Let me know in the comments!

Be the first to comment