The Good Brigade

Introduction

Opendoor (NASDAQ:OPEN) is fundamentally a real estate acquisition company that flips residential real estate using a proprietary algorithmic model. As a real estate investor with experience in the private residential and commercial markets, Opendoor caught my eye as it now appears to be trading at a discount to its underlying net asset value (“NAV”) or its theoretical liquidation value.

In the public markets, my preferred investment style is to purchase shares of cash-flow positive companies at substantial discounts to liquidation value.

Valuation Method & Filtering Out Extraneous Information

In reading through previous analyses of Opendoor, I have seen a number of valuation methods that, in my view, have no relevance to Opendoor. As a real estate holding company, the company ought to be valued by the value of its underlying net assets as well as its ability to grow those assets.

NAV/NCAV Assessment

At $2.44 a share, OPEN now trades at a 29% discount to NCAV (net current asset value) of $3.44 a share, implying 41% upside to NCAV. A breakdown of the balance sheet and NCAV is below.

| Cash and short-term investments | $2.472B |

| Real estate inventory (Q2, at cost) | $6.628B |

| Restricted Cash | $628M |

| Other current assets | $218M |

| Total Current Asset Value | $9.945B |

| Total Liabilities | $7.78B |

| NCAV (theoretical liquidation value) | $2.165B |

| NCAV per share | $3.44 |

| Theoretical upside to NCAV | 41% |

Source: Author’s calculations

However, you shouldn’t buy a stock just because it is trading below its NCAV. There are 2 elephants in the room. The first is mark-downs on real estate inventory with the slowing real estate market, and the second is cash burn and carrying costs that could rapidly erode NCAV over time, particularly for a highly levered company like OPEN.

Assessing Real Estate Mark-Down Scenarios

In Q2 there was an $82M recorded valuation adjustment on real estate inventory. In their Q2 2022 open letter to shareholders, management confirmed that they are currently adjusting list prices on real estate inventory to account for market movement.

To navigate this market movement, our game plan is to move quickly and with discipline… We are prioritizing inventory health by reducing the price of our existing inventory in line with the market.

They did not mention inventory valuation adjustments in their Q1 2022 shareholder letter, but still ended up with an $82M valuation adjustment come time to report Q2 earnings. The fact that they are now choosing to telegraph a Q3 valuation adjustment to investors leads me to think that inventory adjustments will be substantially higher than $82M in Q3. Below are a few mark-down scenarios and their impact on NCAV.

| Real estate value decline | Real estate mark-down | Affected NCAV | Affected NCAV per share |

| 5% | $331.4M | $1.834B | $2.91 |

| 10% | $662.8M | $1.50B | $2.38 |

| 15% | $994.2M | $1.17B | $1.86 |

| 20% | $1.326B | $839M | $1.33 |

Source: Author’s calculations

At the current stock price, there is some cushion built in for inventory mark-downs, with a 10% decline bringing us to an NCAV of $2.38, just slightly lower than the current price of $2.44.

$920M a year Cash Burn Run Rate

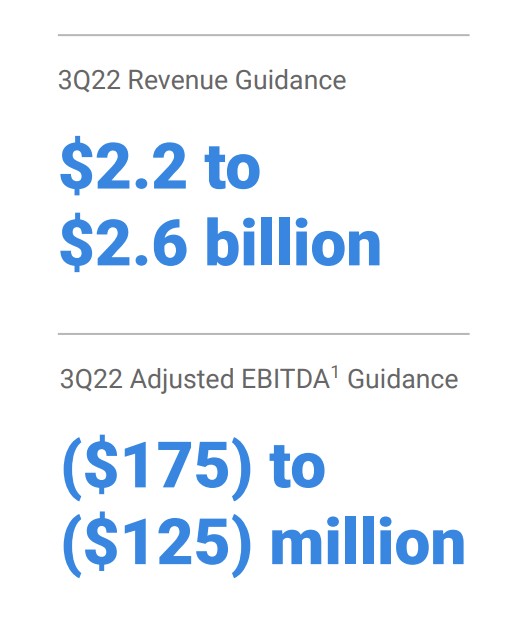

In their Q2 letter to shareholders, management provided guidance for Q3 financial results from which we can impute cash burn. The midpoint revenue guidance is $2.4B, down 43% from Q2’s revenue of $4.2B. Midpoint Adjusted EBITDA guidance is negative $150M, down $368M from a positive Adjusted EBITDA of $218M in Q2.

Q2 Shareholder Letter

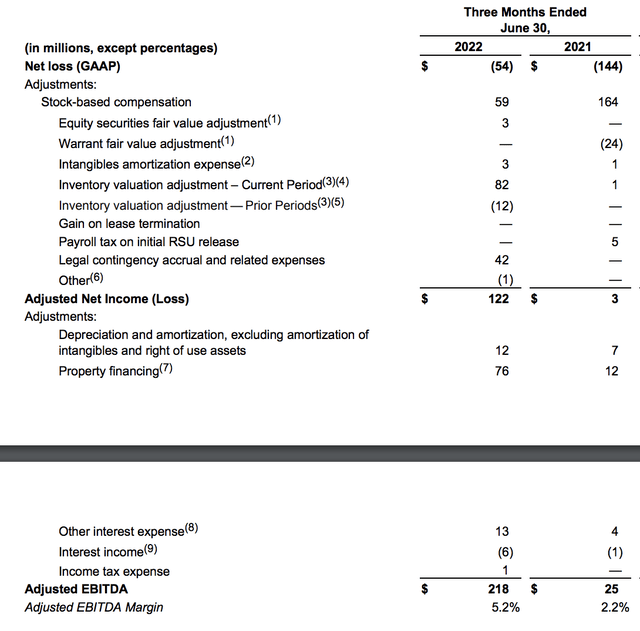

We can look at the “adjustments” made in calculating Adjusted EBITDA for Q2 to arrive at an estimated Q3 cash burn number. Below are the adjustments made to get from Net income to Adjusted EBITDA.

Valuation adjustments are included in the calculation of net income and are added back to reach “adjusted net income” and Adjusted EBITDA. There are three notable adjustments, two of which are non-cash expenses and therefore do not hit our cash burn number. Stock-based compensation of $59M is significant and affects dilution of shareholders by expanding the shares outstanding number, but is a non-cash expense so it doesn’t hit our cash burn number. The valuation adjustments are also a non-cash expense that would be realized in future quarters’ P&Ls. The third adjustment is property financing, which is a crucial expense in the real estate business and needs to be subtracted from EBITDA to reach a cash burn figure

Property financing expense should expand slightly quarter over quarter given increased interest rates and holding times. I am assuming a 5% increase in property financing cost from $76M in Q2 to $80M in Q3. Subtracting $80M in property financing expense to the midpoint Adjusted EBITDA guidance of negative $150M gives us a cash burn figure of $230M a quarter, or $920M a year. This amounts to $1.46 a share in annual projected cash burn.

Combining Mark-downs with Cash Burn Results in Significant Losses to NCAV in All Scenarios

The following is NCAV based on a series of different possible cash burn and mark-down scenarios.

| $0.5/share cash burn | $1/share cash burn | $1.5/share cash burn | $2/share cash burn | |

| 5% mark down | $2.41 | $1.91 | $1.41 | $0.91 |

| 10% mark down | $1.88 | $1.38 | $0.88 | $0.38 |

| 15% mark down | $1.36 | $0.86 | $0.36 | -$0.14 |

| 20% mark down | $0.83 | $0.33 | -$0.17 | -$0.67 |

Source: Author’s calculations

My view is that the most likely scenario is the $1.5/share annual cash burn scenario based on the calculated cash burn from management’s Q3 Adjusted EBITDA guidance, combined with mark-downs in the 5-10% range. This would result in an NCAV of $0.88-$1.41 range 1 year from now, or 36%-58% of the current stock price.

Substantial Shareholder Dilution Ahead

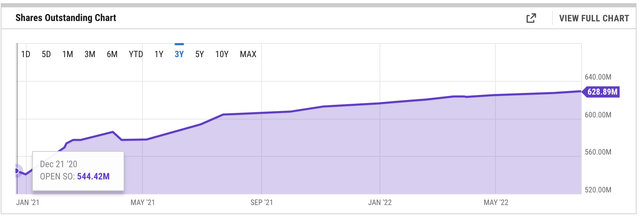

OPEN management have been notorious for diluting shareholders via large stock-based compensation packages. Over the past 3 years, shares outstanding have increased by 84.48M shares or 15.5%.

While this is already pretty strong dilution, it looks like dilution will only get worse with the stock price so beaten down. Management reported in the Q2 Letter to Shareholders that guidance for Q3 stock-based compensation is in the range of $60-65M, implying an annual run-rate of $250M in stock-based compensation. At the current price of $2.44, the company would have to issue another 25.6M shares per quarter, or 102.4M shares per year, to provide this stock-based compensation to management.

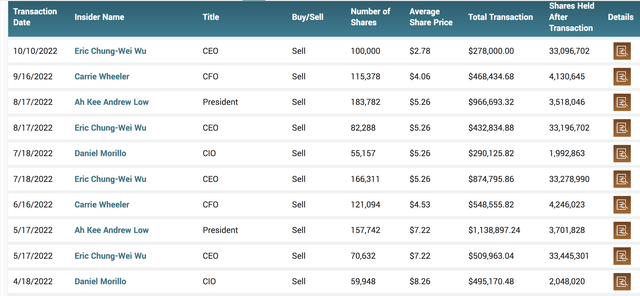

Insiders are Selling, Nobody is Buying

Insider buying is typically a strong signal that management believes the stock is undervalued. Insiders do still own millions of dollars of stock, so insider selling is not necessarily a red flag.

However, I do find the lack of insider buying to be concerning. The stock is down 90% on the year, and still no insiders have bought.

Opendoor Has a Broken Business Model

A report on Opendoor real estate transactions came out on September 19, reporting that OPEN lost money on 42% of its transactions in August 2022 versus 10% in August 2021. Management claims that their home flipping algorithm works regardless of market conditions. We will see if that’s true over the coming year, but initial results and Q3 guidance is showing that OPEN cannot perform outside of a housing bull market.

The fact of the matter is that OPEN was founded in 2014, and has only experienced bull markets so far in its existence. The true test of its algorithm lies ahead.

1) Revenue in the Flipping Business is Non-Recurring

If you ask a home flipper how much they make, they will have a hard time answering you. The business is highly cyclical, and what they made last year may be much higher or much lower than what they will make this year. If a single flipper cannot forecast their earnings, how can you forecast the earnings of a company that flips houses and is much less selective with what they purchase?

2) Is the End State of OPEN really desirable?

OPEN is projecting long-term contribution margins of 4-6% per transaction, which means net margins will be even lower after factoring in overhead/SG& expenses. For context for those not in the real estate space, most flippers won’t get out of bed for a deal that does not have at least a 20-25% margin. Ultimately the end state that management is pushing for is to become a low-margin high-volume home flipping company, while maintaining all the risk of owning the assets on the balance sheet with leverage.

I would argue that this akin to an insurance company, taking on low-margin premiums in exchange for managing high-profile risks. The difference is that insurance companies have been functioning well since the early 1900s with an established actuarial science that can accurately underwrite and forecast risk, whereas the iBuying concept is a recent and relatively untested high-risk development.

On a unit-economics basis, real estate brokerages make a similar 3-6% range on a transaction without taking on any of the risk. I fail to see how the Opendoor model is attractive in the short-term or in the long-term.

I have seen a number of investors focus on revenue based metrics when looking at Opendoor. I would advise investors to be particularly careful of how revenue is booked from an accounting sense, as well as the nature of the revenue itself.

3) You Cannot Win in Real Estate with Only One Exit Strategy

Generally it is very hard to lose money in private real estate. However, if you buy non-income producing real estate with the sole intent of selling it for a higher price to the greater fool, you open yourself up to the serious risk of loss. A key aspect to a successful real estate transaction is having a back-up exit strategy.

If there’s a chance you can’t find a buyer for your flip, then you should make sure the deal should also work as an income-producing rental. If the economics make sense only as a flip, but not as a rental, then you end up in a precarious position when the market turns against you.

4) Part of Real Estate Success is Knowing When Not to Swing

OPEN management likes to brag about their 35% conversion rate on their first offers. If a real estate investor/flipper told me they had a 35% conversion rate on their first offer, I would know for a fact that they don’t know what they’re doing. Seasoned investors will tell you that most real estate deals are bad deals, and that they end up looking at 100+ deals before swinging on 1.

On a more macroeconomic level, REITs generally have a pulse on the market and have a sense of when to accelerate and decelerate buying. OPEN, on the other hand, seems to have no pulse on the market, and seems to always be on full-blown acquisition mode. Despite seeing the signs of a slow-down in the market and forecasting lower Adjusted EBITDA for Q3, they are still targeting new acquisitions instead of focusing on reducing inventory levels.

A Final Word

I would not recommend short-selling OPEN, but if you are long I would recommend that you exit the position as there are far better opportunities in the market, including others trading substantially below liquidation value with positive cash flow.

Be the first to comment