Evkaz

Two spots of the stock market that were once thought to be decent hiding places in a rising-rate environment with inflation were utilities and parts of real estate. After all, with market turmoil, investors often flock to boring and stable Utilities sector plays while rising consumer prices should be buffered against by real estate and other physical assets.

The Utilities Select Sector SPDR ETF (XLU) and the Real Estate Select Sector SPDR (XLRE) have been slaughtered in recent weeks with the latest jump in interest rates. While inflation continues to run hot, maybe this price action is indicative of a broader economic downturn and the reality that you can earn a solid yield by simply parking cash in a Treasury bill or even a money market. Why even take the risk in ‘Utes’ and the property market?

The iShares Mortgage Real Estate ETF (BATS:REM), according to the fund’s website, tracks an index composed of U.S. REITs that hold U.S. residential and commercial mortgages. The fund offers exposure to both real estate equities and real estate investment trusts (REITs). In terms of fund details, REM has a 0.05% daily intraday bid/ask spread, which is highly liquid, while its annual expense ratio is not all that low at 0.48%. Dividend-hungry investors will like REM’s current 30-day SEC yield of 8.7% and its trailing 12-month dividend rate of 7.54%.

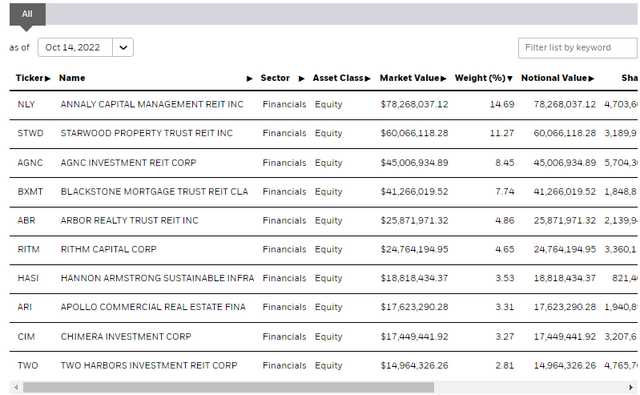

Holding just 31 securities, it’s not a very diversified fund and it is very volatile, with an equity beta near 2.0 as of the end of September. REM’s top 10 holdings total more than 60% of the portfolio, so it’s imperative that prospective and current investors understand the ETF’s biggest company positions.

REM: Top 10 Holdings

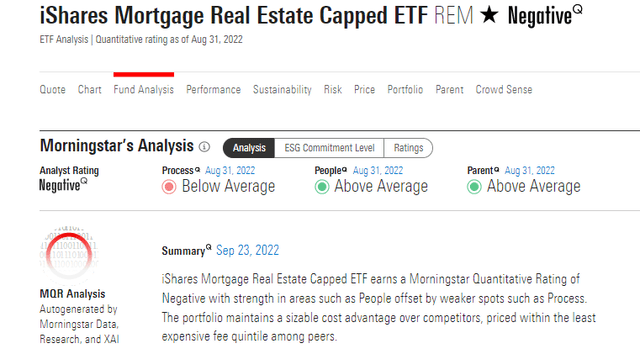

Residential mortgage and commercial real estate loans are highly dependent on the credit cycle, and tighter lending standards pose a significant risk for firms currently engaged in that business. The valuation might not be cheap enough given the environment. FactSet notes that the fund’s average P/E ratio is 13.75, though its price-to-book ratio is under 1 at 0.83. Morningstar has a negative rating on REM.

Morningstar: A Low Rating. Better Plays Available

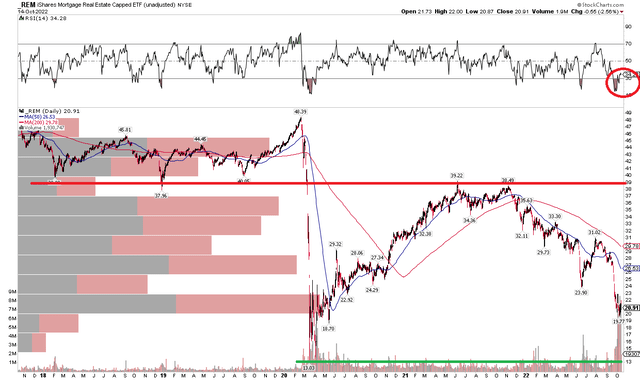

The Technical Take

The REM ETF rallied sharply off its Covid crash lows but encountered resistance at its late 2017 through 2019 range lows in a bearish double top pattern in 2021. The residential and corporate real estate niche topped well in advance of the broad equity market’s January 2022 peak – the bear market has been longer in both duration and magnitude. So far, the peak-to-trough drop in REM since last year’s high is a stunning 50%. Of course, the yield has cushioned the blow to a small extent.

The latest purge came on a massive selling volume spike, which could be signs of some capitulation. The daily chart below shows a high number of shares traded in the last month during its more than 30% drop from $29 in early September to last week’s low. Not surprisingly, REM’s RSI is in bearish territory. The Covid low of $13 could ultimately be in play with such a downward bias right now. On the upside, perhaps some momentum could build on a close above the $24 mark (the June low).

REM: Major Volume Spike in the Latest Downward Move

The Bottom Line

Only investors with a high risk tolerance and a long time horizon should have REM right now. While there are some technical signs of a selling climax, I would stick with lower-cost and more diversified real estate sector funds and REIT ETFs such as XLRE and the Vanguard REIT ETF (VNQ). The small-cap value fund could see further downside given its negative momentum.

Be the first to comment