hatchapong

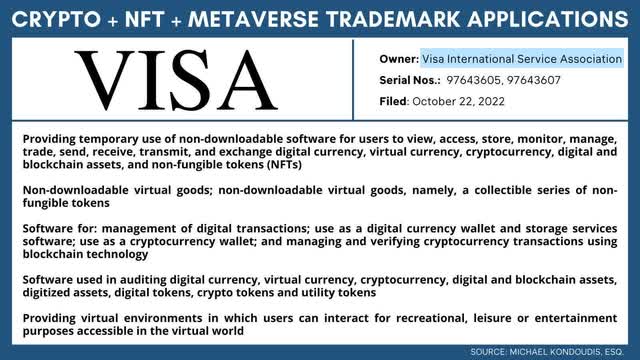

Visa (NYSE:V) is a global payments titan which has the most popular card processing network in the US, as you can see from the graphic below. The company has a high-quality business model, which takes a percentage of every transaction in which the Visa network or its cards are used. This has resulted in extremely high-profit margins, high returns on capital, and strong network effects. The company has recently announced strong earnings as it beat analyst estimates for both top and bottom-line growth despite economic headwinds. The company is also poised to benefit from Crypto tailwinds as it has partnered with over 60 crypto firms, such as Coinbase (COIN) for its card, which enables crypto to be spent anywhere which accepts Visa. Thus, in this post I’m going to break down Visa’s fourth quarter results in granular detail and reveal its valuation, let’s dive in.

Strong fourth Quarter

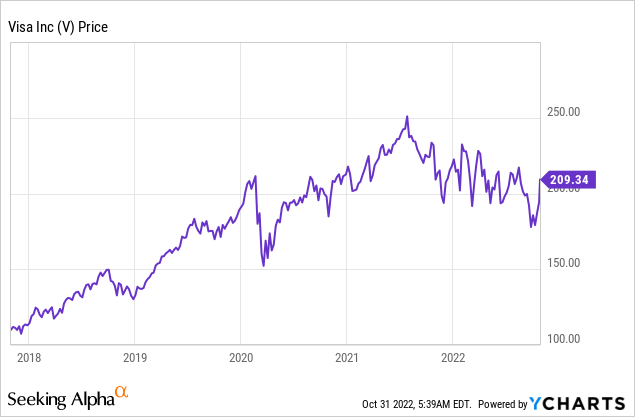

Visa generated strong financial results for the fourth quarter of fiscal year 2022. Revenue was $7.79 billion, up 19% year over year and beating analyst estimates by $232 million. This revenue growth was driven by strong international transaction revenue, which increased by 52% year over year. This was further driven by the strong rebound in travel and cross-border payments.

Service revenues popped by 11% year over year, with growth slightly offset by a strong dollar. Data Processing revenue increased by 10% year over year. This was offset by Visa’s exit from Russia, adjusted for this processing revenue increased by 15% year over year. Client Incentives made up 26.9% of gross revenue which was level with expectations.

Visa Revenue (Q4,F22)

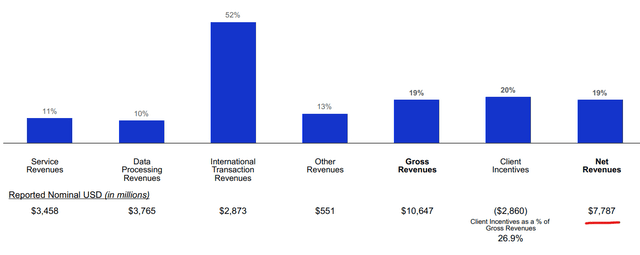

Visa focuses on three growth engines which include; Consumer Payments, New flows and Value added services. Each “engine/segment” grew revenue by ~20% on a constant currency basis which is solid. I discussed the “Consumer Payments” segment prior which was driven by strong travel demand and cross border transactions. Total payments volume was a staggering $2.9 trillion in the fourth quarter of F22, which increased by 10% year over year or a rapid 135% over the past three years. From the chart below it is clear to see that Visa is well diversified across the US and Internationally with ~50% between the two parts of the world. Credit was a strong growth driver as payment volume increased by 17% year over year, on a constant currency basis. Debit payment volume was flat on a nominal basis and up 4% on a constant currency basis.

Payment Volume Visa (Q4 Earnings)

New Flows

Visa’s “New flows” growth was driven by a recovery in B2B card-based transactions. Commercial card payment volume increased by 21% year over year or a rapid 43% since 2019. Its B2B business had approximately $1.5 trillion in payments volume for the full year which increased by 30% year over year. Its B2B strategy is driven by enabling card-based payments, cross-border payments and accounts receivable payments for businesses.

In the fourth quarter the company signed a number of new deals. This included a long term agreement with European payments as a service provider “Modulr” to issue Visa cards for its B2B travel customers. Visa also won the credit card portfolio of French bank Crédit du Nord.

The company scored a new fleet product partnership with Edenred a provider of employee loyalty cards and prepaid cards. In the cross border payment space, Visa partnered with TD Bank in Canada for a B2B Connect program. In September 2022, Visa signed a partnership with the first fintech bank in Switzerland (Alpian) for a metal debit card and renewed its partnership with Swiz bank UBS.

In the accounts receivables and payables industry, Visa scored a partnership with MineralTree a U.S automated invoice-to-payments provider.

Latin America is a key growth market for Visa, as the continent has relatively high levels of cash payments and a large unbanked population. Visa has expanded its processing penetration by over 20 points since 2019, with the most recent growth in Uruguay. In Mexico, Visa has more than doubled its acceptance rate since 2019 to ~3 million merchants. The company also renewed its relationship with Clip a payments facilitator which caters to small medium-sized merchants.

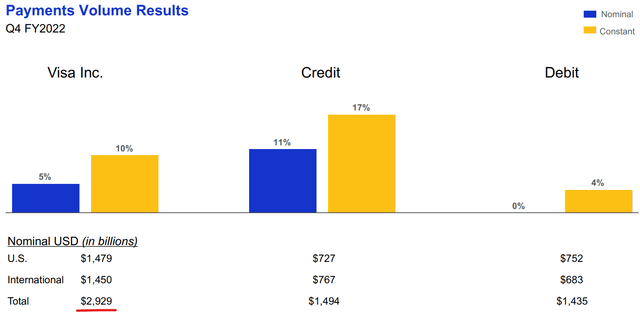

Crypto Tailwinds

Despite the recent declines in Crypto prices the industry is still on track for huge growth. According to one study, The global cryptocurrency market was valued at $826 billion in 2021 and is forecasted to grow at a compound annual growth rate of 11%, up until 2030, reaching a value of over $1.8 trillion by the end of the period. Visa is poised to benefit from this trend as the company has partnerships with over 60 crypto companies. In addition, Visa has recently filed 2 trademark applications related to Crypto and NFT wallets.

Visa Crypto Trademarks (Trademarks KondoudisLaw)

Visa Direct

Visa Direct is a service that enables companies to execute payments directly via Visa’s extensive network (VisaNet) through an API (Application Programming Interface). Popular use cases for this solution include cross border transactions, P2P payments and automated bill paying. Visa Direct transactions grew by a rapid 42% year over year to 1.7 billion transactions. Here are some notable partnerships in the fourth quarter;

- The company signed a deal with eBay to offer faster payouts for its sellers through Visa Direct in the U.S.

- Visa partnered with food delivery company GoPuff to provide delivery partners with the ability to cash out their earnings in real-time.

- Visa Direct partners with the China Construction Bank and Etisalat Egypt as it executes its international expansion strategy.

- Norwegian Mobile Payment application [Vipps] partnered with Visa direct for 4.3 million users, or 80% of Norway’s population.

- The company partnered with Thunes a Singapore payments platform which has a network of mobile wallets.

Payments giant Square (now Block)(SQ) increased its support for instant transfers in Canada. Visa acquired Currencycloud in 2021, a global platform that providers cross-border payment solutions to banks and fintech. This company signed 35 new partnerships in the quarter. The most notable is Paycent, an end to end platform with over 7 million customers and 17,000 small medium sized enterprises.

Profitability and Cash Flow

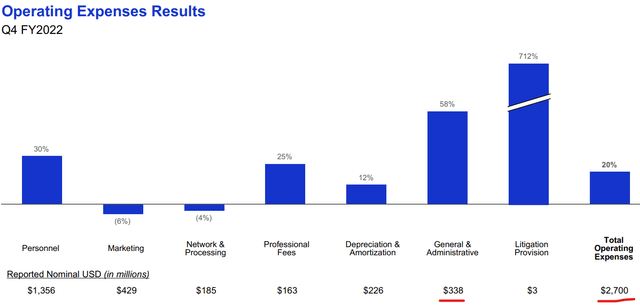

Back to the financials, Visa generated Earnings per share of $1.93 which increased by 19% year over year and beat analyst expectations by $0.06. This was despite a major increase in operating expenses which rose by an eye watering 20% year over year to $2.7 billion. This was mainly driven by higher Personnel expenses which increased by 30% year over year, as part of annual salary increase programs. Overall I don’t think this is a bad sign as well-paid employees are more likely to be retained and work harder. General and Administrative expenses increased by 58% year over year.

Visa Expenses (Q4 Earnings Report)

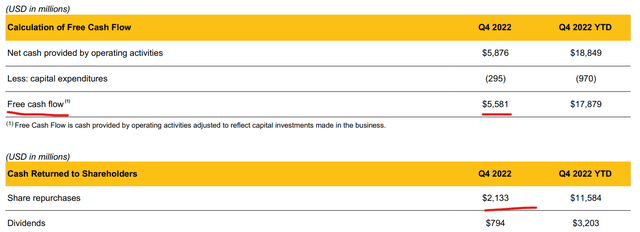

Visa generated $5.581 billion in free cash flow which was up from $3.1 billion in the equivalent quarter last year. Management showed confidence and announced $2.133 billion in share buybacks. Visa has a dividend yield of 0.86% which is extremely safe and consistent, despite being small. Visa has a solid balance sheet with $18.5 billion in cash and short-term investments. In addition, the business has fairly high total debt of $22.45 billion, but “just” $2.25 billion of this is in current debt (due within the next 2 years) and thus is manageable.

Free Cash Flow (Q4 Earnings)

Advanced Valuation

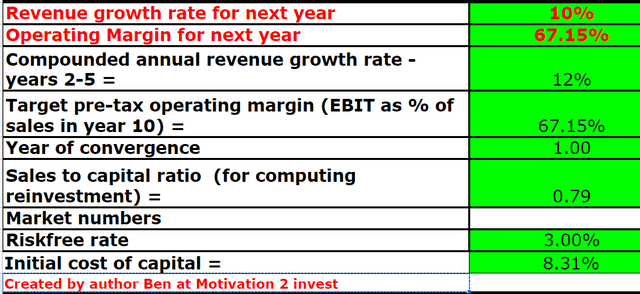

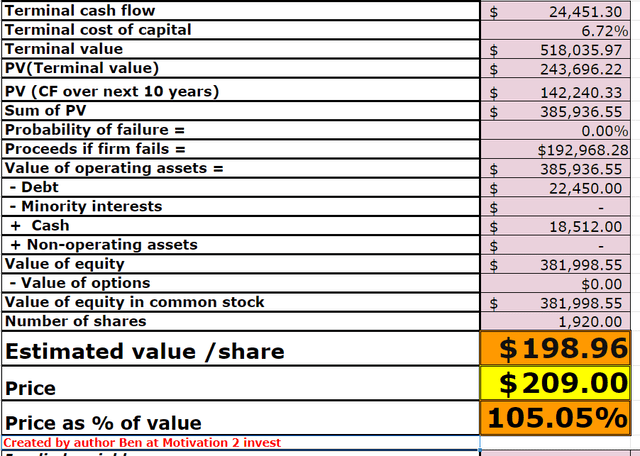

In order to value Visa, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 10% revenue growth for next year, as I suspect payment volumes to slow down given the high inflation environment (more details in the risk section). In addition, I have forecasted 12% revenue growth in years 2 to 5, as Visa continues to expand its Visa Direct offering, score Cryptocurrency partnerships, and further penetrate emerging markets

Visa stock valuation 1 (created by author Ben at Motivation 2 Invest)

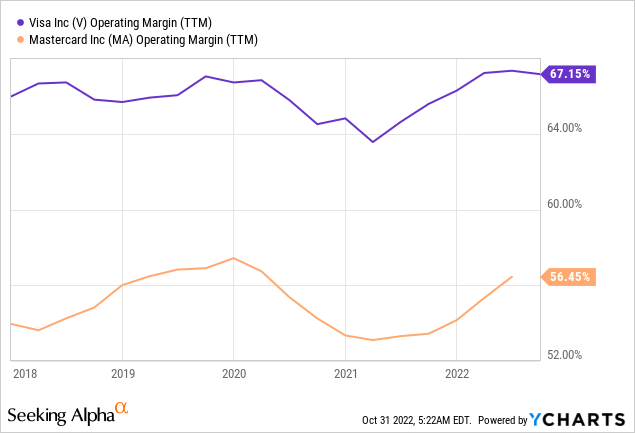

Visa has an industry-leading operating margin of ~67% which is simply incredible given the average operating margin for the software industry is 23% and much higher than the 19% average operating margin for the finance industry.

Visa has achieved a higher operating margin than close rival Mastercard historically which represents a slightly more efficient business model.

Visa stock valuation 2 (created by author Ben at Motivation 2 Invest)

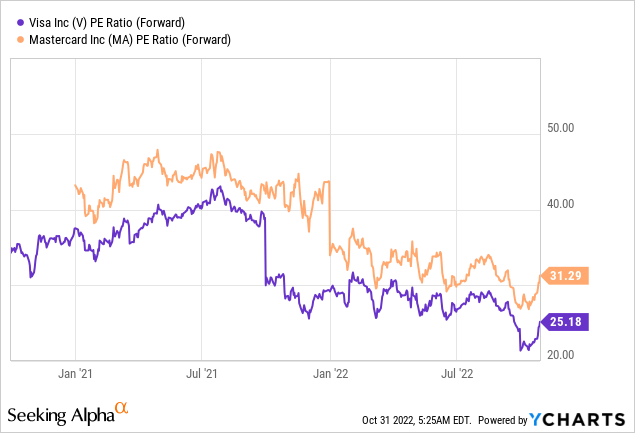

Given these factors I get a fair value of $198 per share, the stock is trading at $209 per share at the time of writing and is thus ~5% overvalued. As an extra datapoint Visa trades at a PE ratio = 25.4 which is ~21% cheaper than its 5 year average. The company also trades at a slightly cheaper multiple than Mastercard (MA) which trades at a PE ratio = 31.

Risks

Recession/Lower Payment Volume

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Given Visa makes its revenue from payment volume a slowdown in payments looks likely as the consumer chooses to save more and spend less. So far, we have not seen major signs of this but fourth quarter numbers have been skewed slightly by strong travel and cross border payments.

Final Thoughts

Visa is one of the greatest companies in history. The business has super high margins and has achieved consistent revenue growth for many decades. Its Return on Capital is over 20% and the company benefits from strong network effects. The stock is rarely undervalued and at this time I will deem the stock to be “fairly valued”, thus it could be a solid long-term investment.

Be the first to comment