RudyBalasko

Over the last couple of years, I have switched my investment strategy from mainly buying fast-growing tech companies to looking for dividend growth opportunities. While the first half of 2022 has been a rough stretch for investors, I know for a fact that I would be feeling much more pain if I hadn’t been buying income-focused investments for most of 2021 and 2022. One of these income investments that made its way onto my radar in the last year is VICI Properties (NYSE:VICI). VICI is a large casino REIT with a portfolio dominated by well-known Las Vegas casinos. This article will be an update on my coverage earlier this year in January.

Investment Thesis

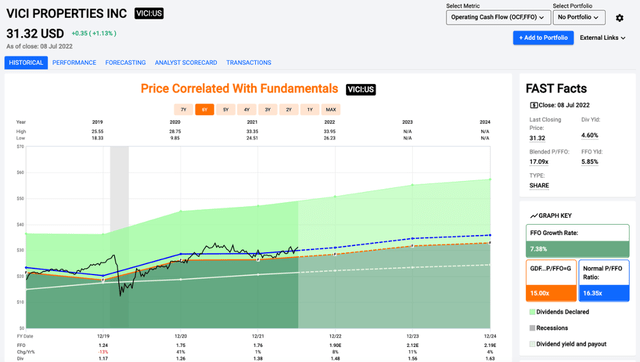

VICI is a unique REIT on the public markets. The company owns many well-known trophy assets on the Las Vegas strip, as well as regional properties around the US. Investors should be aware of tenant concentration, as Caesars (CZR) and MGM (MGM) make up nearly 80% of the rent roll. Shares are trading at or near fair value right now, with a price/FFO multiple of 17.1x. For investors looking to start a long position, I would be patient and look for a dip below $30 per share. Either way, investors can collect a 4.6% dividend that is set to grow for years to come.

A Brief Overview Of VICI

Most triple net REITs own properties that many of us visit on a weekly basis, from grocery stores to restaurants. VICI is playing a whole different ballgame and has bought up a good chunk of the Las Vegas strip. Since my last article, VICI closed the MGM Properties acquisition, adding to an already large portfolio of casinos.

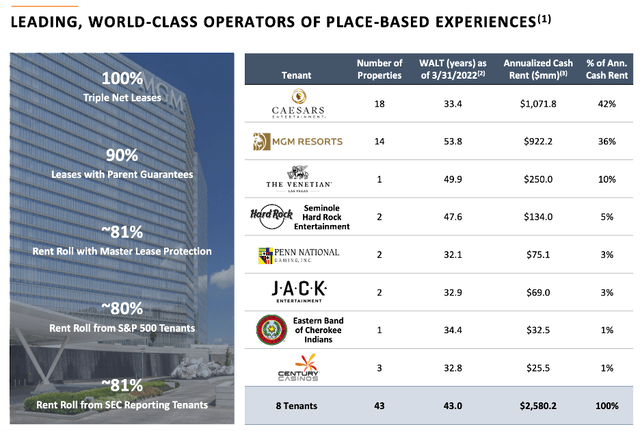

VICI Rent Roll (VICI Properties)

As you can see, VICI’s tenants are a who’s who list of the large operators of casino properties in the US. The portfolio is made up of approximately 45% Vegas properties and 55% regional assets. Caesars and MGM dominate the portfolio, with nearly 80% of rent coming from those two tenants. Investors should be aware of the tenant concentration, but VICI has a dominant presence in Las Vegas between those two groups and the Venetian, which is another 10% of rent.

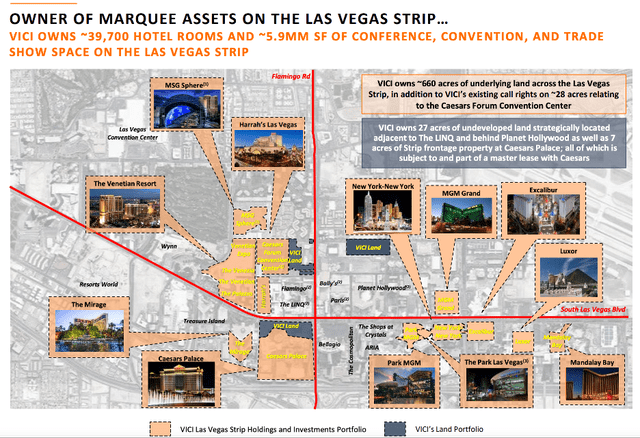

Viva Las Vegas (VICI Properties)

Digging a little deeper on VICI’s Las Vegas footprint shows several things. They say a picture is worth 1,000 words, and it certainly applies here when it comes to VICI’s dominance on the Las Vegas strip. If you have spent any time in a major casino in Vegas, you have probably spent time (and money) at one or more of VICI’s properties. On top of all the trophy assets, they also have some land on the strip that is prime real estate. You can get all of this at a decent valuation, but I think patient investors might be able to buy shares at a slightly cheaper price than you can get them today.

Valuation

Shares of VICI have spent most of the year bouncing around in between the high-20 and low-30 range. With shares above $31, the price/FFO is currently 17.1x, which is slightly above the 16.4x average multiple of the last couple of years. I think it is possible that we see multiple expansion over the longer term, but I’m not a buyer right now at current prices.

I think it’s entirely possible that shares head towards a 20x FFO multiple, but with market weakness in the short term, I think there could be a better entry point in the next couple of months. While the FFO multiple doesn’t show much undervaluation right now, investors in VICI have experienced solid dividend growth over the last couple of years.

An Incoming Dividend Hike

For a large REIT with a market cap just under $30B, VICI has had impressive dividend growth in the last couple of years. A big part of this is driven by the attractive lease terms, with solid cap rates and escalators tied to CPI. If the pattern of the last couple of years holds, VICI will be announcing a dividend hike with their next quarterly dividend in the fall. The last couple hikes have been high-single digit percentage increases, and I think that will likely be the case in a couple of months. Shares currently yield 4.6%, so investors are getting solid current income along with a rising dividend that should continue to grow for years to come.

Conclusion

For me, VICI shares are a hold right now. I’m no short-term trader, but because shares have bounced around in the high 20s to low 30s, I would be patient if you are looking to start a long position. If the broader markets sell-off, you could find a better entry point in the mid- to high-20 range, which means a wider margin of safety, better valuation, and larger yield.

Part of the reason I’m holding off is that I still have to make my Roth IRA contributions for 2022. All else being equal, REITs are a better investment for retirement accounts due to how the dividends are taxed. I will be looking for a selloff to start my position, but I think the long-term future for VICI is bright. With shares near fair value today, investors are still collecting a 4.6% that is set to grow for years. You’re also buying a piece of the Las Vegas strip and other large casinos around the US. VICI is a unique REIT, and I’ll be looking to start a position in the coming months. Shares are a hold, but if you have dry powder, I would be looking to buy if shares drop below $30.

Be the first to comment