DNY59

The Federal Reserve raised the range for its policy rate of interest by 75 basis points this Wednesday, bringing the upper limit to the range up to 3.50 percent.

Economic projections coming out of the FOMC meeting indicate that the effective Federal Funds rate will be around 4.4 percent by the end of this year.

With two more meetings of the Federal Open Market Committee this year, the market expectation is for one more 75 basis point increase this year and one more 50 basis point increase.

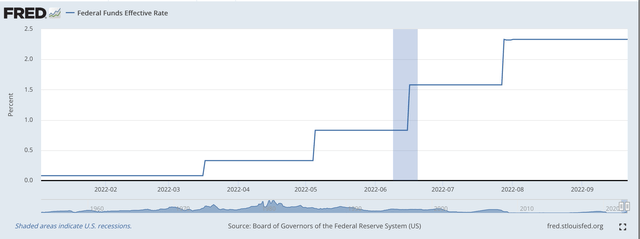

Here is the work that the FOMC has done this year up through Wednesday, September 21.

Effective Federal Funds Rate (Federal Reserve)

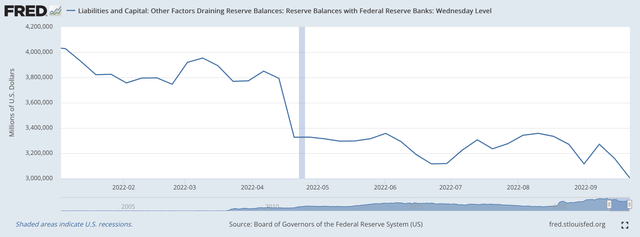

During this year, the Federal Reserve has overseen a reduction in the amount of “excess reserves” that commercial banks carry on their balance sheets. Here, excess reserves are measured by the amount of Reserve Balances with Commercial Banks, a line item on the balance sheet of the Federal Reserve, which can be found on the H.4.1 statistical release of the Federal Reserve.

Excess Reserves

In the following chart, we see that these “excess reserves” or Reserve Balances of Commercial Banks dropped through the year.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Although these excess reserves declined through the first part of the year, the decline was slow and was only modest in number.

While the Fed stopped its program to purchase $120.0 billion in securities outright in late 2021, the Fed spent the first three months of the year getting positioned to begin raising its policy rate of interest.

The first move came on March 16, 2022. The effective Federal Funds rate moved from 0.08 percent to 0.33 percent.

Moving into April, one can really see that the Federal Reserve was moving. Note the major drop in excess reserves in the month of May.

On May 5th the effective Federal Funds rate moved to 0.83 percent.

Excess reserves continued to drop, with some further acceleration taking place this month, in September.

In the meantime, further increases in the effective Federal Funds rate occurred on Thursday, June 16, and on Thursday, July 28.

So, during these Spring and Summer months, the Federal Reserve tightened up on the excess reserves held by the commercial banks and this supported the Fed’s effort to raise its policy rate of interest.

So far, so good.

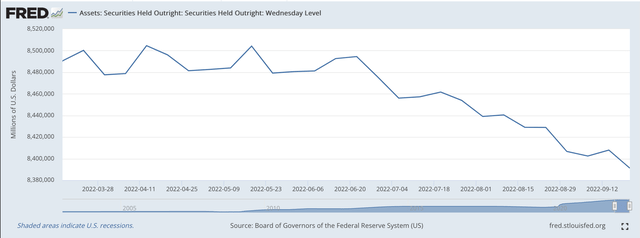

Securities Portfolio

The next part of the program is the securities portfolio.

March 16, 2022 was the date the Federal Reserve began raising its policy rate of interest. The securities portfolio reached its peak one week later, on March 23, 2022.

Securities Held Outright (Federal Reserve)

But, the securities portfolio really didn’t begin to decline until June 2022. This was about the time that the Fed had announced that it would begin the securities reduction program.

On June 22, 2022, the securities portfolio of the Fed closed the day at just under $8.5 trillion.

On September 21, 2022, the securities portfolio was right around $8.4 trillion. The decrease amounted to $103.3 billion.

Going forward, the plan is for the securities portfolio to decline by about $95.0 billion per month.

In the banking week ending September 21, 2022, securities were down by $16.7 billion, so the Fed seems to be moving at a faster pace than up to the present time.

In the future, we should see the decline to be closer to $28.0 billion per week, with a monthly total of approximately $95.0 billion.

The Big Question

Following this plan into the middle of 2024, the Fed will reduce its securities by about $2.4 trillion.

This is a pretty fairly substantial reduction in the securities portfolio.

The bigger question to me is whether or not this amount of reduction is sufficient to battle the inflationary situation the Fed is now facing.

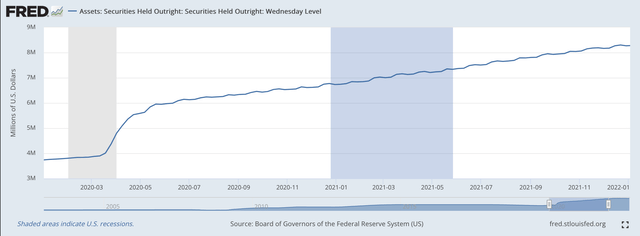

Look, for example, at what happened since the spread of the Covid-19 pandemic began.

On January 1, 2020, the Federal Reserve had a securities portfolio that amounted to $3,740.0 billion, or about $3.7 trillion.

As we saw above, in early January 2022, the securities portfolio totaled about $8.3 trillion, and the portfolio had grown by $4.6 trillion in the two-year period from the start of the pandemic to the time the Fed ceased its monthly purchases of $120.0 billion per month.

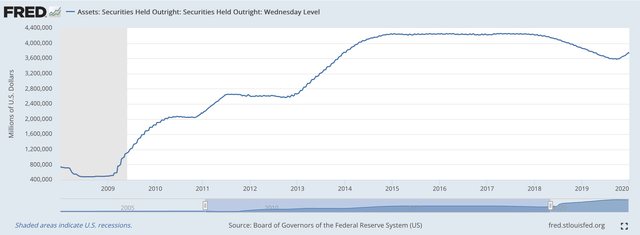

Here is the chart from that time period.

Securities Held Outright (Federal Reserve)

A lot of reserves were put into the banking system during this period of time.

But, this was not the only time period before our current one that experienced a substantial increase in the Fed’s securities portfolio.

Let’s look a little further, from the time of the Great Recession to the time the U.S. economy started to be hit by the Covid-19 pandemic.

Securities Held Outright (Federal Reserve)

Here we note that at the end of the year 2019, the securities portfolio amounted to $3,740.0 billion

We note from this chart that on December 31, 2008, the securities portfolio amounted to just $495.6 billion.

The rise between these two periods amounted to $2.745.4 billion…or about $2.7 trillion.

In other words, in the 2010s, the Federal Reserve increased its securities portfolio by around $7.3 trillion.

The excess reserves held by the commercial banking system rose from $855.6 billion, or, $0.9 billion to just over $4.0 trillion on January 5, 2022, to just over $3.0 trillion on September 21, 2022.

So, the big question!

Since December 31, 2008, the Federal Reserve has injected $7.3 trillion of reserves into the banking system, leaving the commercial banking system with about $3.0 trillion of excess reserves.

Are the Fed’s plans to fight inflation sufficient?

When one considers all the reserves that the Fed has pumped into the banking system, will a removal of only $2.4 trillion be sufficient to combat the inflationary pressures that exist within the economy?

The 2010s were a very prosperous period of time.

The real economy grew by only a compound annual rate of growth of 2.3 percent.

Consumer price inflation came in at around a 2.2 percent compound rate during this time period.

But, there were asset price bubbles all over the place.

Just look at the increase that happened in the stock market and all the new historical highs that were hit.

I referred to this period as a time of “credit inflation.”

But, now it looks as if we have moved on. Consumer price inflation is now the problem.

Just how much is the Federal Reserve going to have to do to bring this inflation under control?

Be the first to comment