marchmeena29

Following a nearly 2% rise in the S&P 500 in the prior week, major indexes began the week broadly lower, with losses led by the Nasdaq, down about 260 points at Monday close. Dragging the tech-focused index lower was an 11% decline in the shares of Twitter (TWTR) after Elon Musk filed a statement on Friday evening saying he was terminating his +$44B bid for the company. Other than individual-specific moves, investors were largely in anxious anticipation mode ahead of key earnings releases and the monthly inflation report.

Losses continued for another day on Tuesday as concerns of a global economic slowdown mounted. These worries spurned a rapid turnaround in oil prices, with the international benchmark tumbling 7.1%. The decline in-turn dragged the oil majors lower, with the sector down 2% at close.

The release of the monthly consumer inflation report on Wednesday showing the inflation rate at a four decade high of 9.1% sent the averages lower on the day, though not severely as one would expect, especially since some investors began pricing in a Fed hike of a full percentage point at their next meeting. Despite this possibility, both the S&P and Nasdaq were essentially little changed, while the DJIA finished 200 points lower.

Indexes tumbled lower on Thursday following a disappointing earnings release from JPMorgan (JPM) and Morgan Stanley (MS). In addition, economic data on producer prices showed an increase of 11.3% on a 12-month basis in June. With all 11 of the S&P’s sectors lower on the day, there were few places to shelter from the losses.

Though markets were generally quiet in early pre-market trading on Friday ahead of retail data and more bank earnings, indexes were still poised to end the week lower.

As inflationary pressures continue to erode household earnings, there are five laggards this week with attractive dividend payouts that can help cut the losses to real disposable income.

Fastenal Company (FAST)

FAST is a distributor of a wide range of industrial and construction products, with the sale of fasteners accounting for about a third of their total net sales. The company also has eight other major product lines.

In the most recent full year ended December 31, 2021, FAST generated +$6.0B in total net sales and earned $1.60/diluted share.

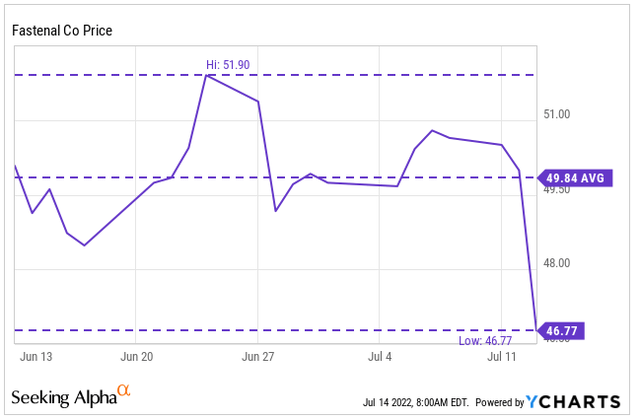

Though shares have benefited from a run higher following their 2020 lows, the stock has recently come under heavy selling pressure. Following their earnings release this week, shares dropped about 6%.

YCharts – FAST’s Recent Share Price History

Aside from a warning regarding a softening macro environment, FAST’s results were strong. Total revenues were up double-digits on higher volumes that were supported by favorable net pricing. In addition, margins remained largely intact, with operating income margins even higher than prior periods.

With double-digit revenue growth, in addition to a dividend that is growing at a five-year CAGR of nearly 14%, prospective investors could be rewarded with outsized returns in an eventual rebound. At 25x forward earnings, shares aren’t necessarily cheap, but at new 52-week lows, the stock is certainly worth a second look.

Walgreens Boots Alliance, Inc (WBA)

WBA is the largest retail pharmacy, health and daily living destination in the U.S. and Europe with a presence in nine countries and a workforce of over 300K people.

In the most recent quarter ended May 31, 2022, the company reported total net sales of +$32.6B. This was down about 4.2% from the same period last year but +$370M better than expected. Net earnings during the period also beat expectations, despite being weighed down by several factors, including their opioid settlement with the State of Florida, a decrease in U.S. pharmacy operating results, and negative impacts from COVID-19 vaccinations.

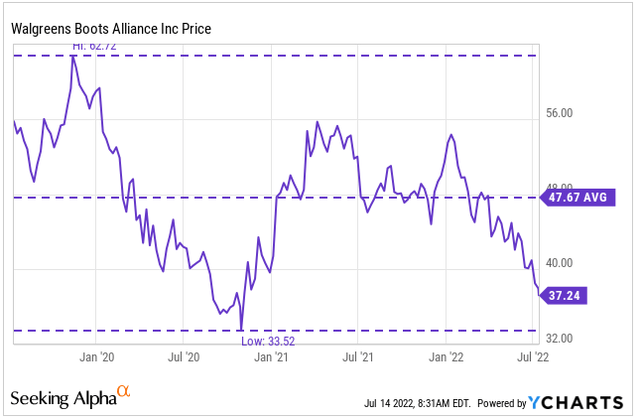

Shares traded lower following the release and are now down 8% for the month and are currently trading at new 52-week lows. Not only is WBA one of the worst performing components in the DJIA, but shares are also approaching lows last seen in late 2020.

YCharts – WBA’s Recent Share Price History

At current pricing, the stock’s dividend is yielding more than 5%, which is much higher than historical levels. To return to a more normalized yield, shares would need to return to about $43, which would indicate upside of over 15%. As one of the largest health-related companies, WBA is a stock with strong staying power and a promising outlook.

Dow, Inc (DOW)

DOW is one of the largest materials science companies in the world with a diverse portfolio of plastics, industrial intermediates, and other coatings-based products used in numerous market segments, such as packaging, infrastructure, mobility, and consumer applications. The company has over 100 manufacturing sites and operates in 31 countries with over 30k employees.

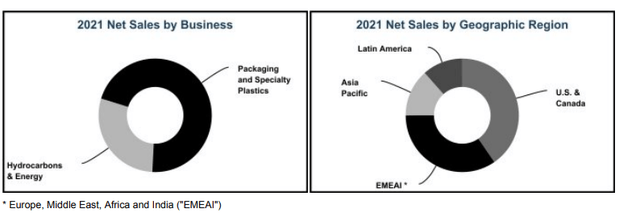

Though operations are conducted in six segments, the Packaging and Specialty Plastics division drives sales, with the unit accounting for over 50% of total net sales for the full year ended December 31, 2021. From a geographical perspective, exposure is concentrated primarily in the U.S. and the EMEA region.

FY2021 Form 10-K – Summary of Dow’s Net Sales by Business and Geographic Concentration

Ahead of earnings next week, DOW was recently cut to sell by analysts at Credit Suisse with a price target of $49 from $67 previously. Driving the cut was earnings pessimism as consumers shift their spending habits from goods to services. Following the update, shares came under immediate pressure.

While the concerns the valid, shares are still trading at just 6x forward earnings. Even when downgrading the earnings outlook, the multiple would still be far below the valuation of the broader S&P. A dividend yield of over 5.5% is further incentive for entry. For bargain hunters, DOW may be worth a deeper dive following their earnings release next week.

LyondellBasell Industries NV (LYB)

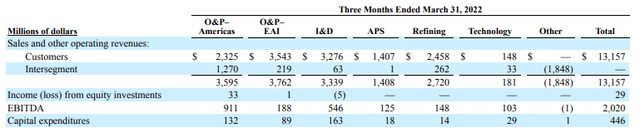

LYB is a global, independent chemical company that participates globally across the petrochemical value chain and is a leader in many of their product lines. Their operations are through six segments, with their largest segment, Olefins and Polyolefins (O&P), accounting for approximately 56% of total net sales as of the most recent filing period.

Though these segments accounted for the largest share of revenues in the current period, the Intermediates and Derivatives (I&D) segment took in the highest share of CAPEX at +$163M.

Q1FY22 Form 10-Q – Summary of LYB’s Results by Segment

Compared to last year, total sales were up 45%, driven primarily by higher average sales prices, which generally correlate with crude oil prices. Overall, the impact of pricing on revenues was approximately 31%, while higher volumes contributed 14%. Sequentially, revenues were also up 3% on higher pricing and volumes.

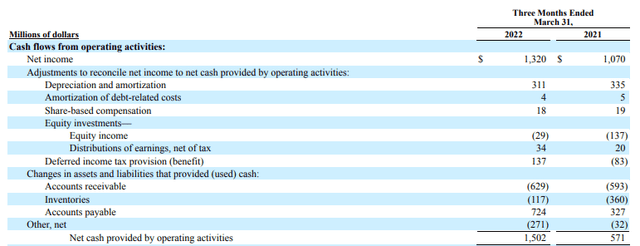

The company also generated strong cash flows of +$1.5B, driven by higher net income and favorable working capital impacts.

Q1FY22 Form 10-Q – LYB’s Partial Cash Flow Statement

The strong cash flows enabled the announcement of a special dividend of $5.20, in addition to a 5% increase in the quarterly payout. Excluding the special payout, the dividend currently yields 5.7%, which is on the high end of historical averages. As a stock correlated with crude oil prices, the pullback to new lows appears overdone and is worth further examination.

Simon Property Group (SPG)

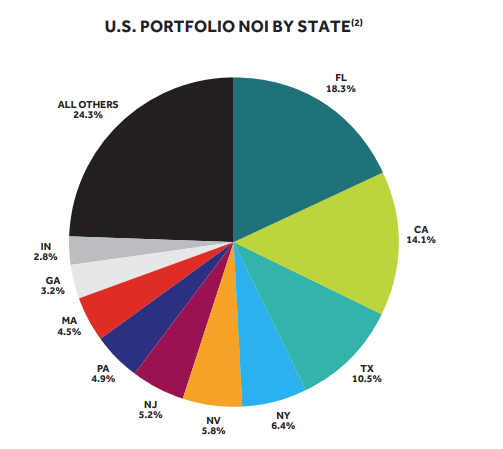

SPG is the largest U.S. mall operator with a portfolio of 199 income-producing properties in the U.S, which consists of 95 malls, 69 premium outlets, and other high quality mixed-used destinations. Given its significant presence across the country, there is a good chance you’ve been to one of their malls at some point in the past.

SPG Investor Presentation – NOI Concentration

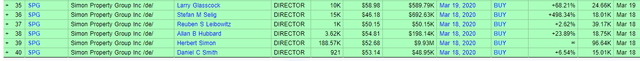

While there have been many previous discussions regarding disappearing malls, SPG has defied analysts time and time again. At the onset of the pandemic, shares declined to historical lows and that was met with significant insider buying. The stock has since rebounded as foot traffic has returned to more normalized levels.

Benzinga – SPG Insider Buying Summary During March 2020

As consumers shift their spending to services from goods, however, investors are again becoming bearish on retail-oriented stocks. In addition, the threat of a recession within the next several months is another concern at the top of many minds.

Despite these fears, SPG is well-positioned to weather any setbacks. The company has available liquidity of +$8B and is led by a top tier management team that is acutely skilled at responding to changing market conditions.

Though the dividend payout was reduced in 2020, it has been gradually increased from $5.20/share, post-cut, to its current level of $6.80/share, which represents a yield of 7% at current pricing.

For REIT investors, SPG is a staple portfolio holding that deserves further consideration as it hovers just above their 52-week low.

Conclusion

As households continue being squeezed by higher prices, real incomes are being drastically eroded. Overcoming this erosion has proved challenging, especially at a 9.1% inflation rate. While an investment in an I-Bond is certainly one way to go, it does come with its own drawbacks.

On this week’s laggard listing are four companies that have annual payouts that yield more than 5%. One, SPG, is even yielding over 7%. While the payouts don’t fully offset inflation, an investment in any one of these stocks would also come with significant upside potential, given the steep YTD pullback in their share prices.

For those seeking supplemental income to ride out the current macroeconomic uncertainties, perhaps there is a laggard this week that can provide the necessary bump to annual fixed earnings.

Be the first to comment