Justin Sullivan

Wells Fargo (NYSE:WFC) recently reported its second quarter earnings and missed estimates for both revenue and earnings. Noninterest income decreased by 40% when compared to 2Q21 mainly caused by loan loss provisions seeing huge increases. On the other hand, net interest income rose 16% Y/Y due to rising rates increasing the bank’s net interest margin. Many of Wells Fargo’s segments saw higher revenue, including its investment banking division, because of interest rate hikes. Although these rising rates are causing mortgage originations to plummet, the bank’s large growth in net interest income may help offset it. Combine this with the stock’s current valuation, dividend, and buyback program, and Wells Fargo becomes an attractive pick for investors.

Rising Loan Loss Provisions are Hurting Wells Fargo’s Income

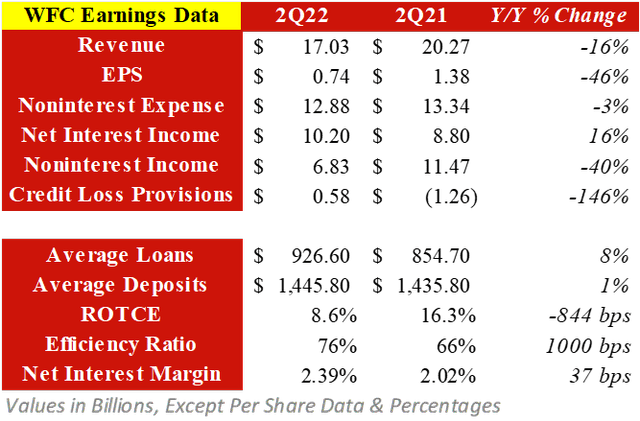

In Wells Fargo’s most recent quarterly earnings report on July 15, the bank missed expectations for both revenue and earnings. It generated revenue of $17.03 billion, down 16% Y/Y and missing estimates of $17.48 billion by 3%. EPS was reported to be $0.74 per share, down 46% Y/Y and missing estimates of $0.80 by 8%. This is mainly caused by the bank’s noninterest income decreasing 40% Y/Y and 18% Q/Q. The decline is partially due to a net loss from equity securities of -$615 million which earned $2.7 billion in the year prior. Mortgage banking income also is down 79% Y/Y and 59% Q/Q due to lower loan originations caused by higher interest rates.

On the other hand, net interest income increased by 16% Y/Y and 11% Q/Q because of Wells Fargo’s net interest margin increasing to 2.39%. This new margin is up 37 bps compared to 2Q21 and 23 bps compared to 1Q22. Currently, management expects FY22 net interest income to be about $42.96 billion, 20% higher than FY21. Noninterest expenses also were down 3% Y/Y and 7% Q/Q due to the bank’s personnel expense dropping 4% since last year and are expected to be $51.8 billion for the year.

WFC 2Q22 Key Earnings Data (Created by Author)

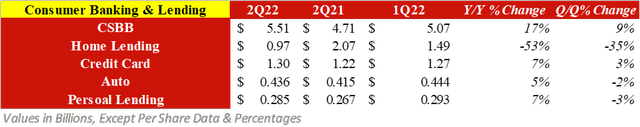

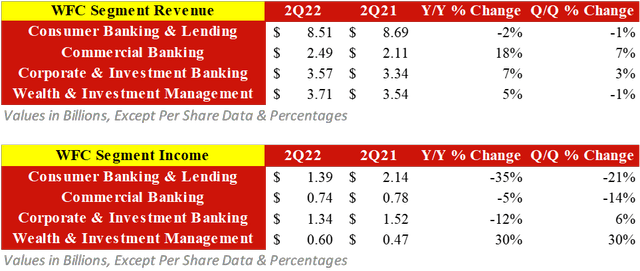

To clearly see how Wells Fargo performed in this quarter, we can break down each of its business segments for individual performance. Firstly, Consumer Banking & Lending generated the majority of the bank’s revenue at $8.51 billion, down 2% Y/Y and 1% Q/Q. The strongest aspect of this segment was Consumer and Small Business Banking which generated $5.51 billion in revenue. This calculates to an increase of 17% Y/Y and 9% Q/Q caused by higher interest rates and deposits.

Home lending generated $970 million in revenue, down 53% Y/Y and 35% Q/Q. This is due to mortgage originations dropping by 36% Y/Y. Conversely, auto lending generated $436 million in revenue which is up 5% Y/Y but down 2% Q/Q. The Q/Q drop is due to auto loan originations being down 35%.

Credit card revenue increased 7% Y/Y and 5% Q/Q to $1.3 billion. This was caused by higher POS volume compared to previous quarters. Personal lending increased 7% Y/Y but dropped 3% Q/Q. The overall drop in revenue combined with an increase of loan loss provisions to $613 million caused net income to fall 35% Y/Y and 21% Q/Q to $1.39 billion.

Consumer Banking & Lending Breakdown (Data from Company Report – Table by Author)

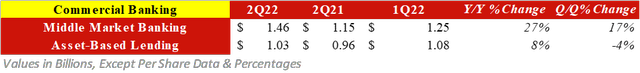

Similar to JPMorgan Chase’s (JPM) earnings, Wells Fargo’s Commercial Banking segment experienced great revenue growth. The segment increased its total revenue to $2.49 billion, up 18% Y/Y and 7% Q/Q. This is due to Middle Market Banking increasing its revenue to $1.46 billion, a Y/Y increase of 27% and Q/Q increase of 17%. Once again, this rise in revenue was caused by higher rates and loan balances. Asset-Based Lending and Leasing also increased on a Y/Y basis to $1.03 billion. However, it did decrease by 4% Q/Q. The segment experienced higher loan balances offset by lower gains in equity securities over the past period.

Despite this revenue increase, the segment’s net income was reported at $740 million, down 5% Y/Y and 14% Q/Q. This was caused by loan loss provisions rising to $21 million, compared to a benefit of $382 million in 2Q21 and $344 million in 1Q22.

Commercial Banking Breakdown (Data from Company Report – Table by Author)

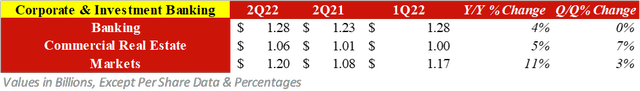

Unlike JPMorgan Chase, Wells Fargo’s revenue from Corporate and Investment Banking increased on a Y/Y and Q/Q basis. In the second quarter, the segment generated $3.57 billion in revenue mainly due to higher interest rates. Its Banking subsegment generated $1.28 billion in revenue, up 4% Y/Y due to strong treasury results from higher rates. Commercial Real Estate generated $1.06 billion and grew due to higher loans and rates. Its Markets subsegment rose the most by 11% Y/Y due to higher foreign exchange, commodity, equity, and MBS trading. However, the segment’s net income fell by 12% Y/Y due to its provision for credit benefits decreasing from $501 million to $62 million. On a quarterly basis, the segment’s net income rose by 6%.

Corporate & Investment Banking Breakdown (Data from Company Report – Table by Author)

Finally, Wealth and Investment Management generated $3.71 billion in revenue, higher by 5% Y/Y. This is due to net interest income increasing by 50% since 2Q21 caused by higher interest rates. However, noninterest income was down 5% Y/Y and 6% Q/Q due to lower asset-based fees and transactional activity. The segment’s income also increased by about 30% Y/Y due to lower personnel expenses.

WFC Segment Revenue & Earnings Summary (Data from Company Report – Table by Author)

Management’s Plan to Decrease Headcount is Working

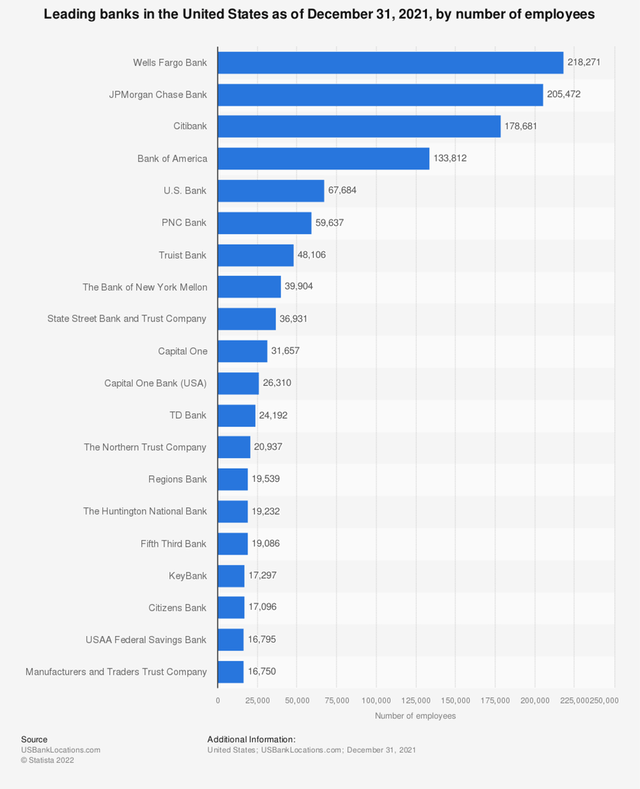

In my last article covering Wells Fargo, I discussed the bank’s terrible efficiency ratio and how it’s highest among the Big Four. The main reason for this is because its high noninterest expenses caused by large personnel expenses. From 2018-2020, the bank hired about 10,000 new employees and became the largest employer in the banking industry.

Banks by Number of Employees (Statista)

The reasoning for increasing its headcount so high was because of the rising number of mortgage originations and refinancing in that time period. In order to capitalize on this trend, Wells Fargo needed more staff to handle the influx of demand. Now that mortgage originations are cooling off due to rising rates, Wells Fargo has begun cutting its staff to improve its efficiency ratio.

This decision has been underway for multiple quarters now. The bank has cut its staff by 5.8% Y/Y and 1.2% Q/Q. This allowed personnel expense to fall from $8.8 billion to $8.4 billion since last year, as well as noninterest expenses dropping by 3.4%. As long as management continues to follow through with these plans, the bank will continue to improve its abysmal efficiency ratio.

Wells Fargo Raised its Dividend and Has a Strong Buyback Program

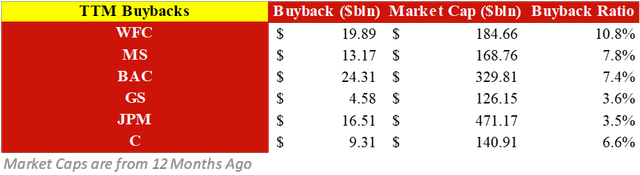

After the recent Stress Test, four of the biggest banks, including Wells Fargo, increased their dividends. The other three include Morgan Stanley (MS), Bank of America (BAC), and Goldman Sachs (GS). However, JPMorgan Chase and Citigroup (C) both left their dividends unchanged. Both of these stocks are highly attractive to investors since they have great dividend yields. The recent hike by Wells Fargo now makes it become relatively more competitive to its peers, making its stock more attractive overall. Now, the bank pays a quarterly dividend of $0.30 per share, up from $0.25 per share previously.

Wells Fargo Dividend Hike Data (Created by Author)

Wells Fargo also has one of the best buyback programs among all of its peers. Currently, the bank’s buyback ratio over the past 12 months sits at about 10.8%. This is the highest among its peers, with Morgan Stanley coming in second at 7.8% and Bank of America in third at 7.4%.

Banks’ Share Buyback Programs (Created by Author)

Valuation

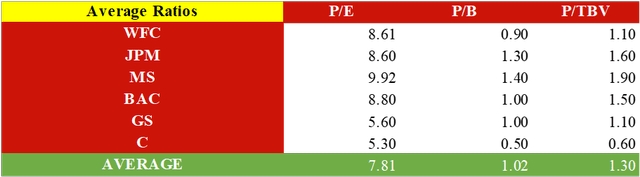

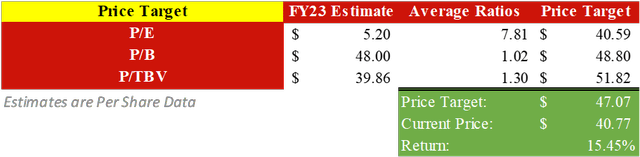

To find a price target for Wells Fargo stock, I created a relative valuation using average multiples. By multiplying consensus analyst estimates for FY23 by the average valuation multiples for P/E, P/B, and P/TBV of Wells Fargo and its competitors, a price target of $47.07 can be calculated. This implies an upside of 15.45%.

Average Multiples of Bank Stocks (Created by Author) Relative Valuation of WFC Stock (Created by Author)

What Does This Mean for Investors?

Wells Fargo recently reported its second quarter earnings and missed estimates for both revenue and EPS. This is largely due to its noninterest income decreasing by 40% Y/Y caused by loan loss provisions increasing massively. The increase in loan loss provisions reinforces many banks’ pessimistic view on the U.S. economy and likelihood of an upcoming recession. Despite this lower income, many of Wells Fargo’s segments saw higher revenue and even its investment banking division grew due to rising rates along with its net interest income increasing 16% since last year. Although rising rates are hurting mortgage originations, the bank’s strengthening net interest margin could help offset this. With all of this in mind, as well as its strong dividend and buyback program, I will apply a Buy rating to the stock.

Be the first to comment