kot63/iStock via Getty Images

GOGL Stock Key Metrics

Golden Ocean Group Limited (NASDAQ:GOGL), is a mid-cap stock (market cap of $1.77bn) whose fortunes are tied to the ownership and operations of dry bulk vessels and the vagaries of the dry bulk commodity market. As of 9M-22, GOGL’s fleet consisted of 95 vessels (76 of which are owned by the company) with an aggregate capacity of ~13.6m dwt (deadweight tonnes). Of the 95 vessels, 10 vessels are under construction. Incidentally, GOGL is also considered to be the largest listed operator of Capesize vessels (63% of their existing completed fleet).

What Should Investors Know About Golden Ocean’s Dividend?

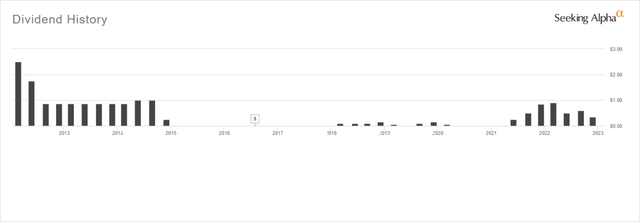

Golden Ocean has something of a patchy record when it comes to paying quarterly dividends, but this shouldn’t come as a huge surprise considering the cyclical nature of the industry it is involved in.

Seeking Alpha

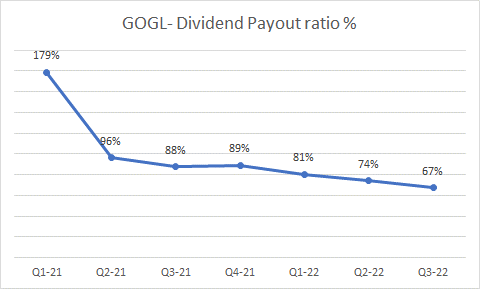

As you can see from the image above, over the last 10 years, payouts have been quite inconsistent with large gaps in between. In the most recent dividend-paying cycle which re-commenced in Q1-21, the payout stood at a hefty figure of 179%, but this has steadily dipped over time.

GOGL Quarterly Report

The Q1-21 payout outlier was likely driven by elevated cash on the books (cash on the books as a function of GOGL’s market cap was 23% back then, against a figure of just 7% currently). Besides, back then industry-level conditions were coalescing in such a manner that TCE (Time Charter Equivalent) rates were poised to trend up. Just for some context, between Q1-21 and Q4-21, GOGL’s reported TCE rates for its entire fleet had surged by 2.2x from $15886 per day to $35256 per day!

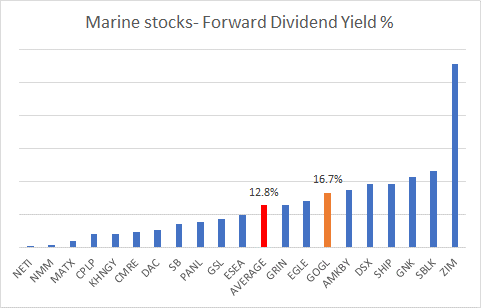

Prima facie, Golden Ocean’s current dividend yield should whet the appetite of dividend investors; at a forward yield of 16.7%, it is one of the highest amongst all the listed marine stocks, and also a good 400bps higher than the average of its peer-set (the median yield of marine stocks is even lower at 9.4%).

Seeking Alpha

GOGL may well continue to be one of the better dividend picks in this space, but those yields are at serious risks of getting compressed from the current levels, given the changing dynamics in the dry bulk spot market. The business remains particularly vulnerable to this weakness as roughly 90% of its owned, leased or chartered-in vessels, are likely employed in the spot market or are linked to short-term, or variable time rate charters. In fact GOGL’s management has posited that Q1 and Q2 2023 will most likely be “challenging”.

What could reverse sentiment? If China can pivot away from its zero-Covid policies and ensure a soft landing, this could do a world of good for steel production and iron ore trade, something that GOGL could exploit given its strong exposure to Capesize vessels.

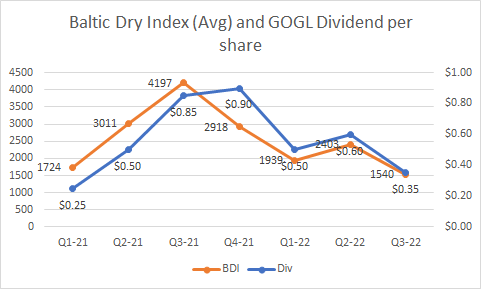

On the other hand, if the spot market continues to dwindle, could dividends be canceled altogether any time soon? You can’t rule out anything, but I don’t believe that will be the case, particularly as the management is recently on record stating that “Golden Ocean will continue to have dividends on top of the priority list when it comes to capital allocation”. The more likely scenario is a steady dip in the dividend per share, considering the subdued trajectory of the Baltic Dry Index. The image below reiterates the strong correlation and how the BDI tends to lead GOGL’s dividends.

Trading Economics and GOGL

Note that despite the BDI slumping below levels seen in Q1-21, the dividend paid by GOGL in Q3-22 was still higher than what it was back then. Some of this could be explained by the sizeable cash proceeds the company generated from the sale of its old vessels. In Q3-22 it was able to generate $61.7m of cash, selling two non-core Ultramax vessels, whereas, in Q1-21, the cash generated from sale proceeds only stood at $9.5m. It is questionable if GOGL will be able to generate the same level of divestment proceeds as conditions in the second-hand vessel market aren’t that alluring at the moment.

So far, coverage of the dividends by the free cash flow has been rather poor; for instance, in Q3, cash used to pay dividends ($0.60 per share) amounted to $121m, but GOGL was only able to generate only around $74m of free cash.

YCharts

Having said that, in Q4, the dividend outlay with be a lot lower ($0.35 per share will translate to $70m of cash outflows) and the TCEs on GOGL’s capsize vessels could be a little higher (estimated TCE of $23100 per day for 75% of capsize days vs $22568 per day in Q3). Given a rough $50m drop-off in the cash dividend outlays between Q3 and Q4, you’d hope they’d generate enough FCF to cover the dividend.

Is Golden Ocean A Good Long-Term Investment?

Notwithstanding the near-term outlook and the faltering dividend theme, Golden Ocean’s “long-term” prospects look promising, and the big-picture narrative here is primarily driven by what’s happening on the supply side, which could provide a fillip to freight rates over time.

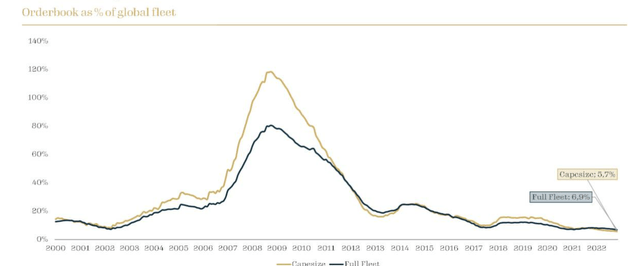

Note that in the recently concluded quarter, the industry level newbuild orders only came in at 3.4m dwt, the fourth successive sequential decline and also the lowest level of quarterly orders in 23 quarters! Over the last two decades, the order book share as a function of global fleet has typically averaged around 28%; in Q3 it came in at just 7.3%!

GOGL Q3 Presentation

Looking ahead, fleet growth levels will lag the historic trend; over the last 10 years, the global dry bulk fleet has been growing at ~4% on average, but in 2023 and 2024 this will only grow at 2.9% and 1.8% respectively tilting the supply side position even further.

Another major catalyst is the introduction of the Energy Efficiency Existing Ship Index (EEXI), by the International Maritime Organization (IMO) in 2023 which will call for more stringent energy efficiency standards. This is poised to be an encumbrance for a lot of vessels that were built before 2014, and unless they can reduce their sailing speeds, they will be retired. GOGL management believes that around 70-75% of the global fleet is not in compliance with IMO 2023, so you can imagine the scenario when a bulk of these ships go off the network.

GOGL looks very well-poised to exploit conditions here as it has been building up one of the youngest fleets in the industry. In 2020, the average age of its entire fleet stood at 7.4 years, now it is at 6.2 years. Meanwhile, dry bulk carriers in the industry typically have an average age of 11 years, extending up to 25 years.

Closing Thoughts- Is GOGL Stock A Buy, Sell, or Hold?

Over the last seven years or so, the price imprints on GOGL’s larger time frame chart point to a fairly consistent trading range, with notable pivot points around the $3 and $15 levels. In light of those price levels, the current price point offers decent risk-reward of 1.2x, for those considering a long position.

Investing

What may perhaps also aid the share price is likely higher buyback momentum at lower levels; during the Q3 results, the company announced a $100m buyback program (which translates to 5.6% of the current market cap) due to be carried out over the next 12 months (commencement date of Oct. 4), so the GOGL share could receive decent support on account of this.

However, before you get carried away, don’t forget that the near-term outlook in the dry bulk space, at least till H1-23 does not look great, and this also translates into some pretty unappealing consensus numbers for the whole of 2023. Average Sell-side research estimates currently show that GOGL’s FY23 EBITDA and EPS are poised to come off by 20% and 35% respectively, on an annual basis!

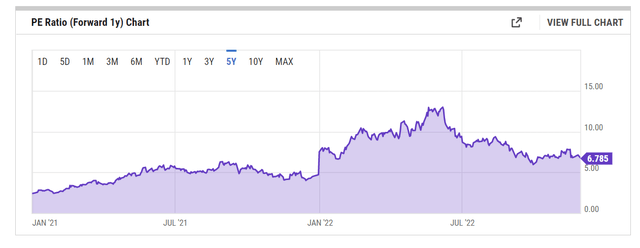

This means that despite the GOGL stock giving up half its value from the highs seen in June, it still appears a little pricey on a forward P/E basis; based on FY23 estimates, GOGL trades at 6.79x, above its 5-year forward P/E average of 6.58x.

YCharts

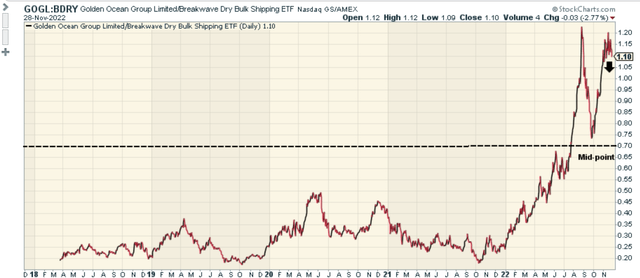

Finally, I’ll conclude by highlighting how elevated the GOGL stock still looks relative to the Breakwave Dry Bulk Shipping ETF (BDRY), a product that is designed to capture the price movements of near-dated dry bulk freight futures. The current relative strength ratio of GOGL and BDRY is around 57% higher than the mid-point of its long-term range, making GOGL an unappealing bet in this space.

Stockcharts

Given the relatively mixed dynamics on the dividend, valuation and technical fronts, we rate the GOGL stock as a HOLD.

Be the first to comment