Elena Nechaeva/iStock via Getty Images

Investment summary

Since our last review on Beyond Air, Inc. (NASDAQ:XAIR) we’ve maintained our neutral position on the company’s stock price. XAIR advanced well in Q3, obtaining more clinical momentum in its LungFit segment. However, as it readies for the next stage of commercialization, cash burn grew to $10.4mm for the quarter. Hence, whilst XAIR continues to build momentum around its LungFit offering, we are happy waiting on the sidelines.

As a quick update, LungFit PH received FDA approval in June. This is XAIR’s first product, hence, it can potentially move the needle on its share price once in the field. We look forward to any updates on the segment, and this is a key upside risk to the thesis.

For a more extensive review on the LungFit PH Nitric Oxide generator, we suggest you check out our previous publication on XAIR:

Net-net, we continue to rate XAIR a hold, also re-rating our suggested price range to $5.10-$6.40.

Q3 developments: clinical momentum building

XAIR’s quarter was again marked with numerous clinical highlights. The LungFit PH launch continues to advance after receiving FDA approval in June this year. Management expects to progress to phase 2 of the launch curve by Q2 CY2023. Moreover, it has high expectations of receiving CE Mark for LungFit PH in Europe by the end of 2022.

Further breakdown of the LungFit Platform is observed in Exhibit 1.

Turning to clinical highlights, we’d point readers to readouts from the LunfFit GO at-home trial. The study investigated XAIR’s formula of ultra-high concentration inhaled nitric oxide (“UNO”) with patients with severe, treatment refractory, non-tuberculous mycobacteria (“NMT”). Findings showed HCIN was well tolerated with respiratory function maintained in the 12-week follow-up.

Consequently, there’s now good support indicating UNO in the treatment of NMT. We also believe it demonstrates how XAIR’s generator system is fit for purpose for at-home use, opening up the market for the company.

Exhibit 1. XAIR Lung-Fit platform breakdown

Data: XAIR Investor Presentation

We also point investors to these additional clinical updates for XAIR, in no particular order:

- Regarding the LungFit PH division, management noted it expects to submit a PMA supplement to the FDA for a cardiac label expansion on the unit. Expect completion before FY22 year-end, it says.

- Moving onto LungFit PRO, the company presented data from its study comparing UNO in treating Viral Community-Acquired Pneumonia (“VCAP”). This included Covid-19. We observed supportive evidence for UNO vs. the control group in the trial’s results.

- The final presentation worth noting was in XAIR’s solid tumour program. This actually occurred after the quarter ended. At the Society for Immunotherapy of Cancer’s Annual Meeting, it read pre-clinical data investigating UNO in combination with anti-PD1 over anti-PD1 monotherapy, with respect to tumor regression and survival. This could serve as an important anchor point for the company to reference further down the line.

- Speaking of, the company is seeking to initiate a pilot study in H2 FY23 examining LungFit GO in treating exacerbations of COPD from respiratory illness. So expect some movement here as a potential inflection point on the chart for late next year.

Exhibit 2. XAIR LungFit PRO and Beyond Cancer Pipeline

Data: XAIR Investor Presentation

Turning to the numbers briefly, we saw R&D investment lift to $4.5mm from $2.8mm the year prior, due to growth in investment in the UNO segment. It left the quarter with $72.5mm in cash on the balance sheet. Combined with liquid investments, that’s 2.8x cover over its short-term liabilities.

Net cash burn came to $10.4mm for the quarter, bringing FY22 YTD cash burn to $17.9mm. Hence, the majority of cash outflow occurred in the back end of the year so far.

Last time, we estimated the company’s cash runway to be around 10 quarters, based on Q2 financials. At the increased rate of cash burn, we now estimate it to be around 7 quarters with the $72.5mm on hand. Alas, we believe the coming 2-3 quarters will be pivotal for the company in its commercialization of the LungFit offering.

Valuation and conclusion

When seeking to value XAIR’s stock, where do we exactly start. Well, first of all, we know the company’s book value of equity has tightened by 18.6% YoY to $2.12 per share. It currently trades at 3x book value. This looks about fair in our estimation.

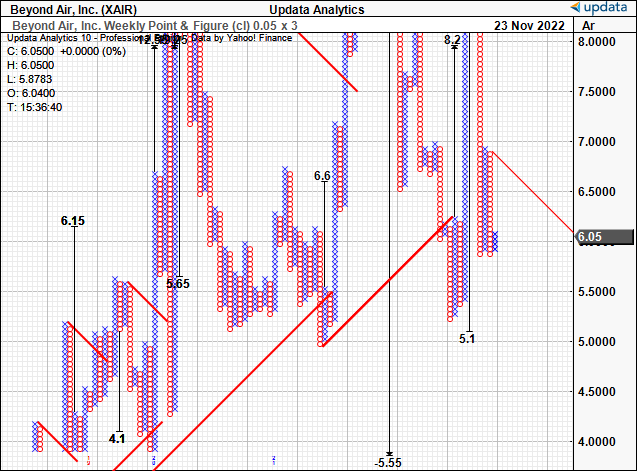

Second, technical price targets suggest a downside target to $5.10. These charts help remove the noise of time and examine price action instead. To date, they’ve served us well in guiding price visibility in this stock.

Last time we valued XAIR at a range of $$8.84-$9.22, or roughly 4-5x book value, but we’re revising this down today. Applying the current 3x multiple to the company’s book value derives a price target of $6.38 per share.

We believe XAIR will trade to a fair price range of $5.10-$6.38. These flat growth targets are supportive of our neutral view. However, we also advocate for investors to be ready for an opportunistic entry at these prices, or on updates around LungFit PRO.

Exhibit 3. Point and Figure charting (“P&F”) demonstrating resistance and potential downside price action.

- P&F is a terrific way to remove the noise of time and obtain objective price targets.

- We see downside target to $5.10. To date, these targets have served us well, hence justifying their use.

Data: Updata

Net-net, we continue to suggest investors sit tight with XAIR. We estimate the stock will push to a lower range of $5.10-$6.40, supporting this recommendation. There are lots to look forward to on the horizon with this company, and any update around the LungFit PRO segment could be a real short-term positive. So there’s also merit in watching closely from the sidelines. Rate hold.

Be the first to comment