Justin Sullivan/Getty Images News

Since our last coverage on Tesla (NASDAQ:TSLA), which walked through some of the near-term risks and opportunities facing the underlying business, the stock has been blighted by a consistent slew of adverse headlines pointing to further weakness ahead. In the latest turn of events, Tesla shares are facing compounding headwinds as the electric vehicle (“EV”) pioneer grapples with the COVID drag in China, recalls, a third quarter delivery miss, indicators of slowing local demand, and a broader market rout. The stock has lost close to half of its value over the past two months, as sentiment continues to deteriorate with few positive catalysts left within sight that could stem the stock’s valuation premium to peers from further erosion.

In the following analysis, we will walk through said recent developments – which includes Tesla’s recent entry into unprecedented territory marked by its first appearance on TV ads, alongside the unusual price cuts that defy today’s industry norm, and a slew of surprise announcements (e.g. Semi deliveries, potential share buyback) – and gauge their specific implications on our near-term bearish thesis on the stock. We view Tesla’s recent undertakings as an indicator of pent-up urgency to reverse the consistent declines observed in its shares over the past several months. The efforts suggest growing pains for Tesla as it struggles to sustain its aggressive multi-year growth target of 50% – which it has already abandoned for the current year on deliveries due to logistics issues.

Additional costs of executing recent efforts in resuscitating growth acceleration will likely pressure Tesla’s operating margins further as well at a time when input costs are still elevated. The near-term operating challenges stemming from both a looming cyclical downturn and intensifying competition are threatening to setback optimism on Tesla’s growth narrative that has been priced into its still-lofty valuation today, which we believe could escalate the stock’s susceptibility to further downside risks in the near-term.

1. Marketing

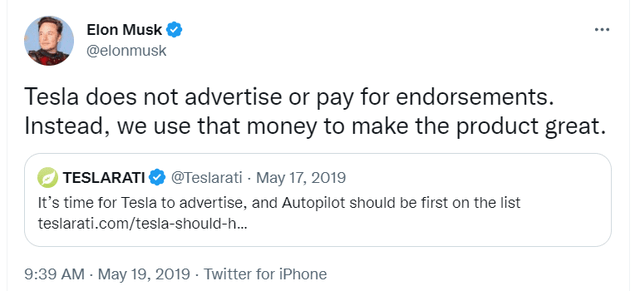

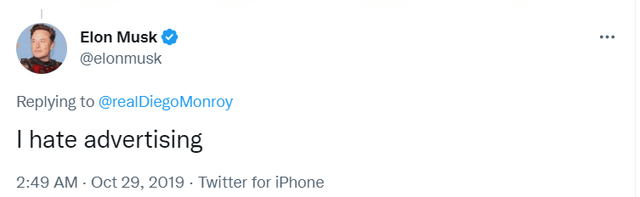

Tesla’s marketing strategy has long shunned traditional methods like TV and billboard ads, and favored “story selling” instead:

Elon Musk and Tesla’s Stance on Advertising (Twitter) Elon Musk and Tesla’s Stance on Advertising (Twitter)

Much of Twitter’s marketing spend embedded in its quarterly SG&A line item are attributed to its high-profile events, including Tesla Battery Day, Tesla AI Day, and other vehicle and new plant launches. Yet, the company has recently unleashed a slew of new marketing efforts aimed at shoring up demand in China – one of its core growth and most profitable markets – at a time when the region’s consumer sentiment softens and competition ramps up. In addition to insurance subsidies of up to RMB 8,000 ($1,100) for new Tesla vehicle buyers, and a user referral program, the EV pioneer has “even advertised on a local TV shopping channel”, defying its years of firm stance against actively selling its product to audiences on the small screen.

The unprecedented efforts come on the heels of Tesla’s third quarter delivery miss, warning of a “recession of sorts” in China, as well as a significant decrease in delivery wait times in the region from 22 weeks earlier in the year to now within a week after expanded capacity at its Shanghai facility came online in September. Paired with the extended impact of on-and-off COVID Zero mandated lockdowns across major cities in China, it is evident that “order intake for Tesla in China is insufficient”, especially as competition ramps up. Local EV makers currently account for more than 80% of China’s EV sales this year, with BYD (OTCPK: BYDDY / OTCPK: BYDDF) sales continuing to outpace Tesla’s by wide margins.

To some extent, Tesla’s recent step-up in advertising efforts in China mimics Netflix’s (NFLX) abrupt pivot to a similar strategy it has once shunned to stem the unprecedented pace of losses incurred across both its subscriber base and share price performance this year. Such a pivot illustrates a turn to the last resort in some sense, which potentially hints at a company’s peak susceptibility to operating challenges spanning global economic uncertainties and intensifying competition.

We believe Tesla China’s recent turn to TV ads, among other marketing incentives and efforts, is either reflective of CEO Elon Musk’s neglect of Tesla as he fills his hands with the Twitter debacle, or the EV titan’s growing urgency to claw-back momentum lost in recent months as the market climate nosedives, with previously resilient EV sales now also facing a growing drumbeat on demand risks in the coming months. Either way, said measures do not look good from a sentiment perspective, as it drives cautious optimism over Tesla’s near-term prospects, which is corroborated by recent share price declines. Meanwhile, on the fundamental front, Tesla China’s recent implementation of unprecedented marketing efforts also increases risks of further profit margin contraction in the near-term, compounding the weight of elevated input costs and additional plant ramp-up costs as previously discussed.

2. Price Cuts

To better appeal to the weakening Chinese market, Tesla has also turned to price cuts on its vehicles for the first time since 2020. Tesla vehicles in China have had their MSRPs slashed by as much as 9% in an effort to shore up demand as the region reels from economic instability stemming from a protracted property slump alongside activity-suppressing COVID Zero measures. The decision comes at a time when the broader industry is favouring price increases – which Tesla was part of just a few months ago – to compensate for surging raw material costs, as well as upcoming changes to a key EV purchase subsidy from the central government that is slated to end on December 31, 2022. It is not that Tesla does not face the same headwinds, but the recent decision to cut prices on its China deliveries is likely a strategic undertaking to undercut rivals for a bigger piece of the pie at a time of growing demand risks.

The pricing lever that Tesla has recently pulled is effectively a call for a pricing war, which risks further profit margin erosion in the near-term. Recall that Tesla’s vehicles made and sold in China currently boast the most attractive margins due to greater manufacturing efficiency at Giga Shanghai, as well as the lower cost of labor in the region relative to its plants in Europe and the U.S. And accelerated sales in the region in recent years have been a key contributor to Tesla’s industry-leading auto margins, which exceeded 30% (ex-credit sales) earlier in the year.

But new plant ramp-up costs, paired with inflationary pressures – particularly in Europe due to its energy crisis – have brought the figure back to the mid-20% range in recent quarters. The recent price cuts aimed at sustaining demand in China are likely to reduce Tesla’s ability to absorb the protracted cost headwinds as well in the coming months. Although lithium prices – a key component of EV batteries and driver of EV input costs – have recently moderated as a result of slowing demand in China, they remain near all-time highs due to tight supplies, making another cost pressure for Tesla within the foreseeable future. Growing uncertainties over China’s COVID Zero policy outlook also risks additional overhead costs in the region for Tesla, as it adheres to stringent prevention measures. And now, with China’s contribution to Tesla’s sales mix at risk of extended declines, the recent price cuts essentially puts hopes of a recovery on auto gross margins (ex-credits) further out of reach in our opinion, injecting more downside risks to the stock’s near-term prospects.

3. Bomb Drops

Musk has also orchestrated a string of abrupt surprise announcements since the final quarter of the calendar year began, including the sudden decision to start customer deliveries on the 2170-cell powered Semi on December 1, and a potential for up to $10 billion in share buybacks.

The sudden decision to start deliveries on Semi trucks was announced in early October after the President Biden signed the Inflation Reduction Act, which would offer eligible electric commercial vehicle buyers a tax credit of up to $40,000, into law. We view this as a strategic decision for Tesla to regain its seat in the front row on the electrification of commercial fleets. The first units are set to go to PepsiCo (PEP), which has an existing order for 100 Semis.

The EV titan is set to mark the Semi’s long-awaited launch with an event coming Thursday at Giga Nevada, which could potentially be a near-term catalyst for a much needed temporary boost to the stock and lift it out of its recent sluggishness based on historical observations:

Tesla shares dropped 15% over two days after its “Battery Day” in September, while its China debut in January 2020 was followed by a 9% jump in a couple of sessions.

Source: Bloomberg

But said expectations have failed to materialize meaningfully for Tesla following its most recent major events. For instance, last year’s launch of the Model S Plaid did little to lift the stock out of an early-June plateau while peers rallied. Meanwhile, the Cyber Rodeo in early April to commemorate the Austin plant’s opening was followed by a steep decline in Tesla shares, reversing a sharp rally from two weeks prior in response to celebrations for the opening of Giga Berlin.

This time around, with mounting operating challenges in addition to a broader risk-off market climate weighing on the stock, the upcoming Semi launch event may do little to divert investors’ attention from the dire situation at hand. Even if a follow-up rally materializes, it is unlikely to sustain in our opinion. The Semi trucks are unlikely to be a profitable product in the near-term, given it is still a long way out from scaled productions. This makes another factor that we believe will weigh on Tesla’s overall auto margins further in the near-term, which would bode unfavorably for the stock in today’s market climate. Ramp-up costs will also be high, and margins are unlikely to see meaningful expansion until the more economical 4680 cells start volume production, the timeline of which remains up in the air.

The timeline and viability of a share buyback anytime soon also remains a big question mark. While Musk has floated the idea during Tesla’s third quarter earnings call, which would be welcomed, investors should not lose focus on the rampant share sales that have already taken place this year and could continue in the near-term due to the risk-off market climate, which would risk placing a protracted adverse drag on the shares’ performance.

Musk has been known for his indirect influence on investors’ sentiment for the Tesla stock. He has “talked down” the Tesla share price in the past as much as he has been “bullish about its potential”, the latest of which being his claim that his EV company has potential to surpass the value of Apple (AAPL) and Saudi Aramco (ARMCO) combined, or more than $4 trillion, during the third quarter earnings call. Yet, he took to monetizing his stake in Tesla once again shortly after the remarks by cashing in $3.95 billion on the sale of 19.5 million shares.

With Tesla shares already under immense pressure in recent months, we believe the indirectly influential nature of Musk’s remarks on social media, as well as the increasing difficulty in distinguishing them from truth and his own speculation, continues to be another overhang that harbingers further volatility ahead of a wobbly market climate.

Potential Positive Near-Term Catalysts

While we believe risks are becoming increasingly skewed to the downside for Tesla, not all hope is lost. If the idea of a $5 billion to $10 billion share buyback program does get approved by Tesla’s board and executed within the near-term, it would be a big deal. Cumulative share buybacks of that size would essentially assuage investors’ concerns of unnecessary one-sided sell pressure on the shares’ outlook. And given Tesla’s reputation as a favorite among institutional and retail investors alike, we believe the approval of a share buyback program would also buoy sentiment and restore some of the recently lost confidence in the stock by replacing focus on near-term headwinds with the company’s longer-term growth advantage. This might be able to help Tesla’s still-lofty valuation premium dodge the looming risk of further wipe-out as financial conditions continue to deteriorate.

We believe pulling the “new product” lever is almost always an option for Tesla as well. Even bringing the development of a more price competitive mass market model – like the speculated Model 2 at the $25,000 price tag – back on the table would offer some near-term reprieve for the stock’s current slump. Specifically, announcing a better priced model would reinforce the possibility for Tesla to sell 2 million vehicles per year in the longer-term, as it would allow the EV pioneer to penetrate a greater addressable market ahead of accelerating EV adoption. Although the timeline on materialization would be something else to consider (cue the five-year wait for the Semi, and the three years and counting wait for the Cybertruck), we view the mere idea that a cheaper mass market product is back in development as likely sufficient to drive better confidence among analysts and investors on Tesla’s forward outlook. And Tesla’s latest decision to redesign the Model 3 with realizing further cost-efficiencies as the core driver of changes also foreshadows the possibility of more price-attractive mass market alternatives in the years ahead, making said near-term catalyst a very possible risk to our near-term bearish thesis on the stock.

Final Thoughts

TV ads, extended price cuts, and share buybacks are uncharted waters for Tesla. And the company’s latest decision to implement said undertakings likely underscores desperation in salvaging demand and investors’ confidence in our opinion, which provides indirect confirmation that the company is reeling from mounting macro and industry challenges ahead – just like all of its peers, legacy automakers and EV start-ups alike. As such, we believe Tesla’s risks are becoming increasingly skewed to the downside over coming months as evolving global macro uncertainties spanning tightening financial conditions across the U.S. and Europe, to China’s faltering economy continue to place a direct impact on its operations and demand environment.

Be the first to comment