mikkelwilliam

Netflix Vs The Gaming Industry

Netflix (NASDAQ:NFLX) is looking to enter the video game market by internally developing a AAA title, according to recent job listings. However, there are many issues that may arise with this decision. This article will lay down my view of the industry and how Netflix should pursue the development of a video game internally, particularly in regards to competition. I also suggest an acquisition of Valve Corporation will provide far more short-and-long-term synergies for Netflix. If the unlikely deal fails to occur, Netflix can still learn lessons about this nuanced and difficult to manage industry.

Some readers may actually be surprised to hear that Netflix already offers a small selection of games to play on their mobile app. The list includes mostly casual indie and children’s games so there is room for improvement. As reported by CNBC, usage as of August 2022 was only a blip on the radar: 23.3 million downloads and 1.7 million daily users compared to the 221 million or more subscribers. Essentially, Netflix’s current goals for their games are to integrate the current TV and movie intellectual property they have as either mobile or PC games.

CNBC

In my opinion, there aren’t currently, and unlikely to be any, blockbusters on the platform, whether in terms of subscriber growth or market value. This is due to the simple nature of the current offerings and games, popularity of the offerings, and competition with other video game peers. Will the addition of a AAA game to the mobile platform create a viable rate of return when competition is rife and success is a gamble?

Modern Gaming Trends

While expanded development will allow for a high-value gaming platform via rising popularity and sales, the economics of the first game must be optimized to create future cash flows to reinvest in the development pipeline. The game must take advantage of current gaming industry economics. To understand what Netflix needs to do I will discuss the present trends and influences.

Looking at the market, there are a few major segments to be aware of in the modern era:

-

The yearly or frequent release games: Call of Duty (ATVI), sports games (EA), Nintendo (OTCPK:NTDOY) series (Mario Kart, Super Mario Bros, Pokemon, etc.), etc. Value is derived from sales of the game, almost to the extent of a yearly subscription.

-

Esports: CSGO (Valve), League of Legends (OTCPK:TCEHY), Overwatch (ATVI), Dota (Valve), Fortnite (EPIC), etc. Value is derived from events, streaming, and in-game items, particularly cosmetic skins.

-

Mobile Games: Honor of Kings/Arena of Valor (OTCPK:TCEHY), Candy Crush (ATVI), Genshin Impact, Roblox (RBLX), etc. Value is derived from in-game sales and perpetual updates, especially with gambling via “gacha” mechanics.

-

AAA: Red Dead Redemption (TTWO), Resident Evil (OTCPK:CCOEY), Grand Theft Auto (TTWO), God of War (SONY), Assassin’s Creed (OTCPK:UBSFY), Diablo (ATVI), Borderlands, Dark Souls, Elder Scrolls, etc. While releases are infrequent, often 3 or more years apart, the lasting impact of these games allows for recurring cash flows over time. Most value lies in IP, but takes years to earn a leading position.

-

Indie Blockbusters: Minecraft (MSFT), Terraria, The Witcher 3 (OTCPK:OTGLY), Human Fall Flat, Castle Crashers, Among Us, etc. Netflix’s current offerings are indie, but the likelihood of reaching equal success is extremely low without more spending on marketing. Although, once established, an indie game can turn into a AAA series.

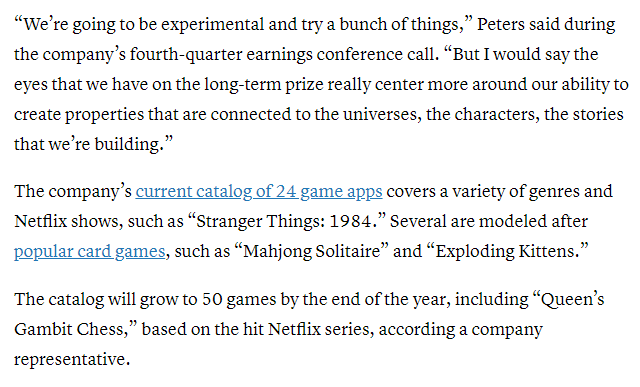

So, with Netflix looking to hire a team to build a “AAA PC game”, we have to predict what position the company will take. In 2021, the main theme was the dominance of the perpetual release category, particularly CoD and sports titles, and I do not see Netflix targeting this segment. In the image of the top 2021 games by sales below, I marked the annual titles in red, AAA titles in blue, and Minecraft in green. However, it is important to note that the data is only for PC and console copy sales, and does not include in-game sales, mobile games, and ecosystem revenues (Esports leagues, merchandise, advertisement, etc.).

The data suggests that Netflix has stiff competition in the AAA space and that even AAA titles have difficulty competing with the frequent release titles. It will take Netflix decades and billions in investments to reach that level, and current profitability will be pushed to the limit. However, Netflix is not a low-level indie developer doomed to earn less than $1 million in total earnings, as marketing with their current base will allow for at least a respectable return in most cases. Netflix has been successful in producing their own IP for TV and movies, but time will tell for their foray into gaming.

NPD

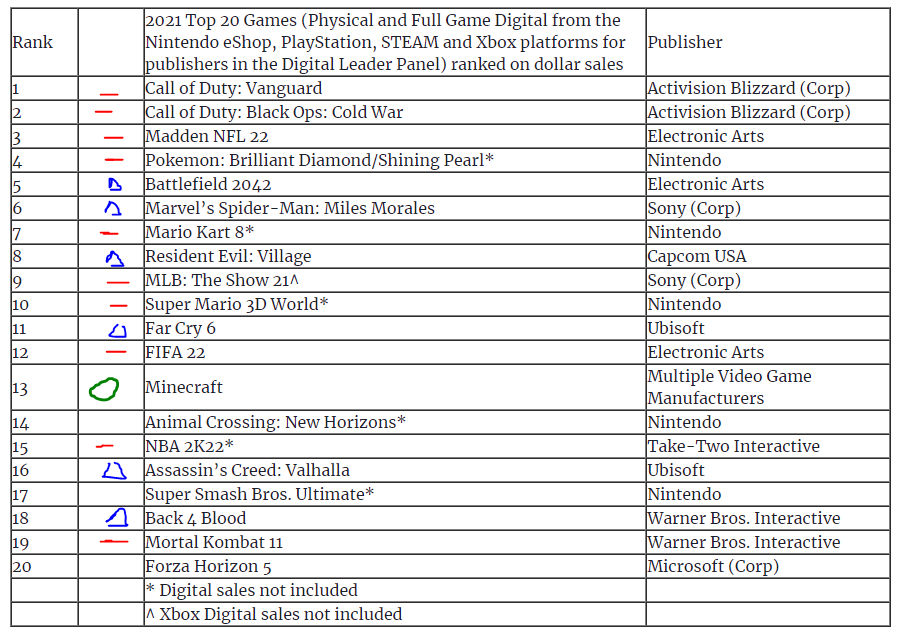

I believe the long-term sales data is better suited to suggest the difficulties that Netflix faces. Of the top 20 all-time sales, over 50% of the titles were released prior to 2010, and 20% were published prior to 2000. This indicates that one of the factors of success is longevity, and so Netflix has this challenge to face. Not to mention that apart from a few titles, most top 20 all-time games are from established players or are reiterations of earlier titles. Also, another consideration is the fact that many of these games are/were included in bundles or with the hardware (Wii Sports, console exclusives, etc.), and I find it unlikely that Netflix will release hardware or that competitors will allow for packages to include Netflix IP.

Wikipedia

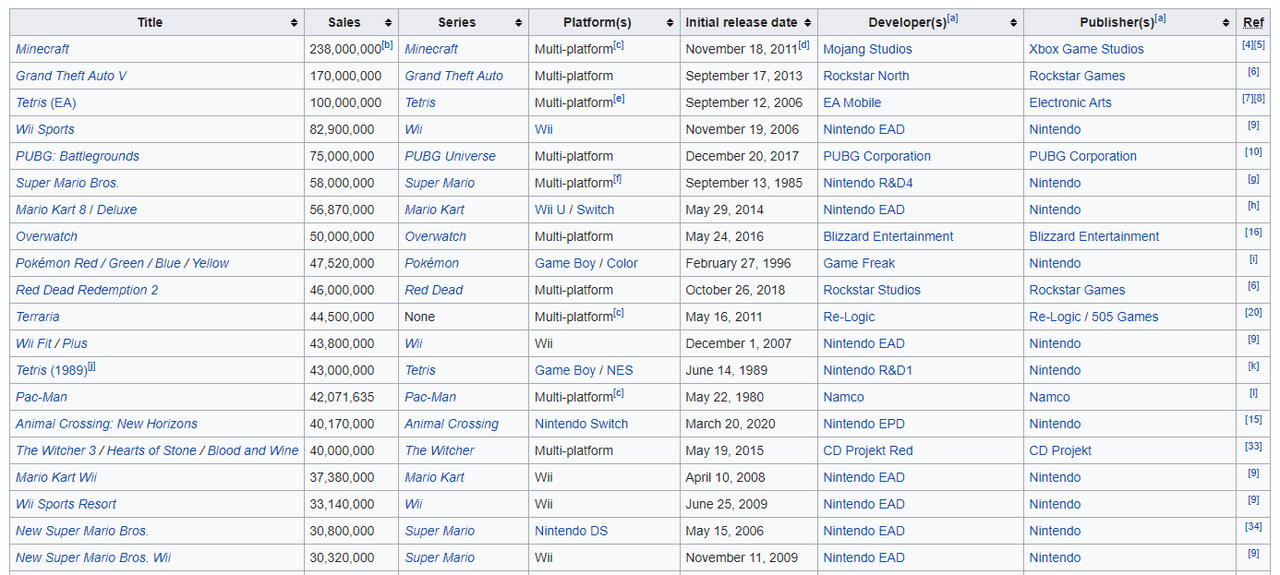

However, there is one area of the modern market that I find Netflix may be best suited to enter: mobile games with in-game purchases. Despite being only a decade or so old, data shows that the mobile game industry is quite profitable with eight titles earning over $5 billion in revenues to date (see below). Mobile games also come with benefits of scale, with most people having phones but not everyone owning a PC or console. The games are also less resource intensive, with simple games such as Candy Crush or other puzzle games. We can also see that competition is less intensive as the industry remains dominated by smaller entities apart from Tencent, and this may allow Netflix’s popularity, story-telling experience, and IP to shine.

One strategy that Netflix should follow is the case of Genshin Impact, developed and published by Shanghai-based Mihoyo. This small team has seen a rapid explosion in popularity over the past two years since release thanks to a game that has a continually expanded popular story, has gacha mechanics to drive revenues (a topic for another day, but can tie in with a Netflix subscription), and perhaps most importantly, is fun to play. This has allowed the team to earn an astounding average of $1 billion USD per six months, and these revenues are expanding worldwide, set to continue for years to come based on the story, and establishes a positive-feedback loop of spending thanks to the in-game content (free-to-play, but spending makes the game more fun).

Wikipedia

Perhaps Distribution Would be Better?

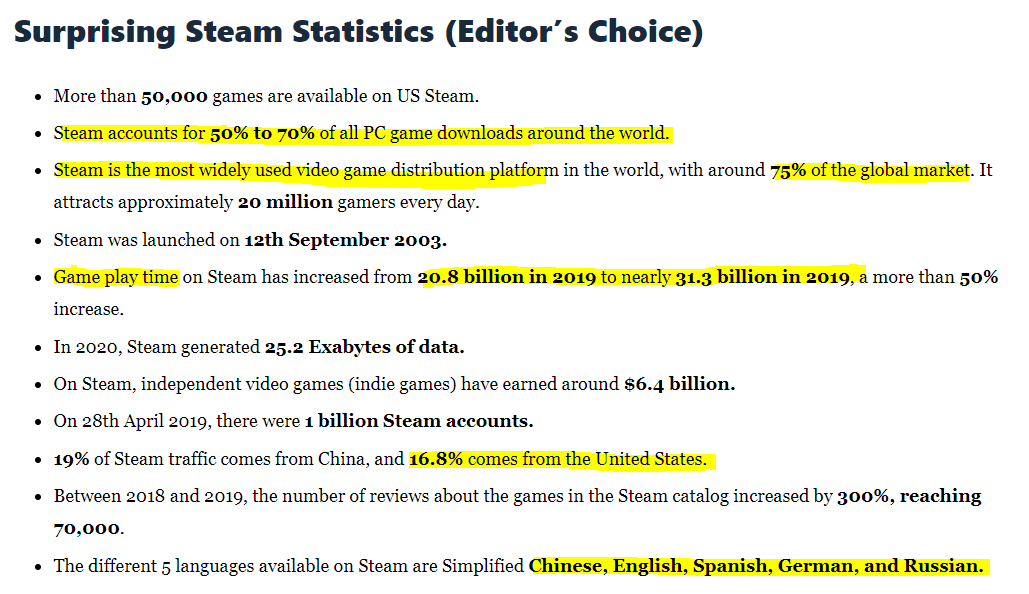

There is one glaring issue that I am sure has been addressed by management, but still remains unknown: since Netflix is a distribution platform, why not buy the leading video game platform, Steam? Steam is the leading PC game distribution platform by a huge margin. All major platforms concede to selling their games on the platform, allowing owner Valve to gain access to deriving value from a huge player base. One exception is Epic Games’ Fortnite, but the spending required to bring users to the Epic Games Store is immense. This includes $11.6 million on free games to gain 5 million subscribers and $146 million to keep Borderlands 3 and other games off of Steam. Despite the competition, Steam remains dominant, and I highlight some key data below.

Enterprise Apps Today

Other Valve benefits include the fact that Valve also has an extremely popular IP base that includes Counter Strike, Half Life, Left 4 Dead, Dota, and Portal. In particular, Half Life is a story-driven series that would benefit from a Netflix/Valve pairing thanks to expansion into TV or movie mediums. Also, Valve has just released their highly rated Steam Deck, a handheld console that allows users to play all their favorite Steam games away from the PC. Utilizing AMD (AMD) processor technology, the Steam Deck blows the Nintendo Switch out of the water in terms of performance, and may become a major competitor in the handheld segment.

Feasibility and Evidence

While it is likely a difficult task to work out the kinks in terms of competition and integration, I believe that a Valve and Netflix partnership or merger would benefit both sides. The major issue will be the subscription and I do not see Steam ever forcing one on users. However, I can see that a Netflix subscription could be used to access select games for free, similarly to PS Plus, XBOX Game Pass, and so forth The two entities could also continue to operate on their own, but the integration and expansion of IP between the two entities could provide enough synergies to make the deal worthwhile for both parties.

On the back of the relatively surprising Activision-Blizzard acquisition by Microsoft, the entire gaming industry is transforming rapidly. While 2020 and 2021 were stunning years for the industry, a pull-back in demand has allowed valuations to fall into 2022. This leads to opportunities for the large players to snatch up indie or mid-size intellectual property cheaply. While Netflix has acquired six indie game studios to date, none of them offer cash flows of a meaningful amount. It is clear that Netflix is just trying to gain experience and test the waters, but a major transaction may be looming. I do not expect the internal production of a AAA title will be the end of the line.

Imagine the returns on investment that would be possible if Netflix now acquires Valve and Steam and markets their small indie games in front of millions of users. I think the opportunity is incredible, albeit fairly risky in terms of antitrust and investor sentiment. However, I do see data that would suggest that there is a small possibility of a Valve acquisition occurring. First, Netflix had a fairly successful adaptation of Esport League of Legends via the show Arcane, but developer Riot Games is owned by Tencent. Then there was the Valve IP anime cross on Netflix, DOTA: Dragon’s Blood, which has already finished airing three seasons on the platform. Lastly, Netflix was even a sponsor for a CS:GO tournament in Denmark, the Blast Premier Fall Finals.

Conclusion

The evidence is clear that Netflix is rapidly moving into the gaming industry and is successful so far despite the small scale. It is also clear that Netflix is familiar with Valve, owner of the leading PC game marketplace Steam, and the value of the IP they hold. The millions of daily users and capabilities of the platform, along with IP synergies of moving across platforms would provide value beyond the current levels. As of May 2022, Valve was valued at $7.7 billion USD according to Bloomberg, or 1.5x current Netflix Net Income. As such, the purchase is feasible, would not add too much debt, and will be net positive after the transition period. The only major headwind I see is Valve Owner Gabe Newell’s reluctance to go public.

As such, I look forward to the possibility of this acquisition occurring. Despite that, I will remain on the sidelines in terms of an investment into Netflix. Although, the company is doing well to take a measured pace to operational improvements such as video game design and the almost 50% rise in share price over the past six months is clearly a result of stable operational performance. I will only become an investor if the discussed deal is announced or more information about the video game platform is released.

Thanks for reading.

Be the first to comment