Gearstd/iStock via Getty Images

This article was coproduced with Cappuccino Finance.

During times of uncertainty, my favorite type of stock is one that offers dividend growth.

Actually, scratch that. Because it’s not entirely true.

You see, dividend growth stocks are my favorite investment category – no matter what kind of economic cycle we’re in. I can collect (or, better yet, reinvest) their payouts even when the market is going through volatility.

And when a bull market returns… I can enjoy some nice stock appreciation from these blue-chip stocks. It’s the best of both worlds.

I’ve talked about what makes a blue-chip company a blue-chip company before. Though I’ve also said more than once that there’s not necessarily a set definition or an exact set of qualifiers.

But here’s one characteristic that stands firm: They know how to protect their profits by keeping the competition at bay. In fact, they know how to protect their profits period.

As I’ll go on to explain in detail, the following three companies enjoy the protection of substantial economic moats. So their market shares and revenues won’t be heavily impacted by the current market cycle.

They’ll stay profitable during both inflationary and recessionary environments.

This should be great news for investors, especially the ones that are sick and tired of this year’s ongoing roller coaster.

Which might be just about everyone at this point.

Northrop Grumman

Let’s start with Northrop Grumman Corporation (NOC). It’s a leading global aerospace and defense company that you’ve probably heard of a time or two.

The business provides cutting-edge space systems, advanced aircraft, missile defense, advanced weapons, long-range firing capabilities, and mission systems. And it prides itself on its long track-record of success and highly decorated history involving those products.

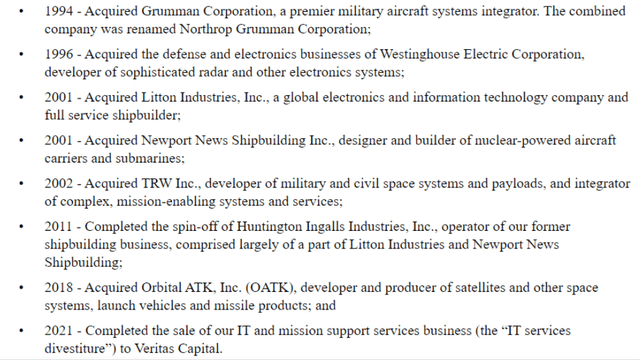

The company originally formed in 1939 as Northrop Aircraft Inc. as a much smaller entity. But a series of acquisitions from there allowed it to become what it is today: one of the largest defense contractors in the world.

Northrop Grumman has also been very effective at growing its business organically. Combining these two pathways together has put it at the forefront of the industry.

Here’s some of its more recent history worth noting:

Today, it operates multiple divisions that create and improve items governments are willing to spend big bucks on.

Take Northrop Grumman Aeronautics Systems. It’s a leader in the design, development, integration, and manufacturing of aircraft systems for U.S. military forces and international customers.

This particular segment consists of several arms itself.

- Autonomous systems provide unmanned autonomous aircraft like MQ-4C Triton, RQ-4 Global Hawk, and MQ-8B Fire Scout. Manned aircraft provides strategic long-range strike aircraft, tactical fighters, and air dominance aircraft.

- Defense systems develops, integrates, sustains, and modernizes weapons and mission systems like integrated air and missile defense battle command systems (IBCS), counter rockets, artillery, mortar (C-RAM), and precision guidance kits (PGK).

- Mission systems develops and manufactures systems like airborne multifunction sensors, maritime/land systems and sensors, and navigation and targeting systems.

- Space systems produces and delivers launch and strategic missiles, and integrated spacecraft systems.

All of which is important to keep the U.S. military properly equipped by today’s standards. And there are plenty of other valuable products it makes in other segments that keep it rolling through booms and busts alike.

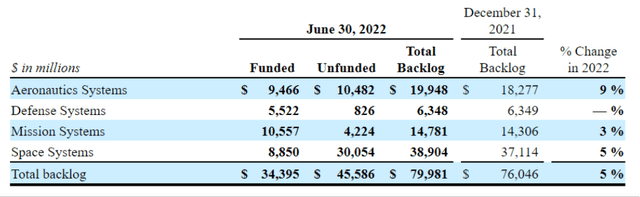

This wide range of products gives Northrop Grumman a substantial economic moat that’s provided strong business growth – with a five-year average of 8.15% – and a solid $80 billion backlog…

Which got even longer in 2022.

New contracts included $3.5 billion for F-35s, $2.1 billion for GEM63 solid rocket boosters, and $0.5 billion for Triton. In Q2, the company saw particularly strong across-the-board demand with a book-to-bill ratio of 1.48x.

In fact, all its segments were above 1 for the quarter. This drove 6% sequential growth in its backlog.

Also, Northrop Grumman announced it will be investing to incorporate digital manufacturing, automation, and modular work. This upgraded manufacturing will optimize product quality, reduce costs, and shorten cycle times.

It shouldn’t be surprising, then, that Northrop Grumman performed extremely well over the past 12 months. Its stock price rose almost 40% during the span despite the rest of the stock market careening out of control.

Yet its valuation is still slightly lower than its historical level, with a price-to-earnings (P/E) ratio of 13.49x. And its enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) ratio is 10.05x.

I expect Northrop Grumman to continue growing well into the future – and to keep rewarding shareholders as it does.

AbbVie

AbbVie Inc. (ABBV) is a global biopharmaceutical company that develops, manufactures, and distributes drugs in immunology, oncology, neuroscience, and aesthetics. Humira, AbbVie’s blockbuster drug, is one of the most profitable drugs in history.

The company has grabbed an absolute flood of cash from that product alone – a fact that hasn’t impressed everyone, admittedly.

Fortunately, it’s not resting on its laurels. Management is on a quest to break away from its “one trick pony” label. To that end, it’s investing in both internal development pipelines and new drug acquisitions.

AbbVie’s newer drugs, Skyrizi and Rinvoq, are doing great, with sales growing at 60%-70% per year. Management even expects their combined revenue to exceed Humira’s peak sales in the future.

AbbVie’s aesthetics business also continues to generate tons of cash.

Yet the market is still worrying about Humira’s upcoming patent expiration in 2023, leaving AbbVie’s stock undervalued. It has a P/E ratio of 15.5x and EV/ EBITDA of 9.5x, which are significantly lower than the sector median.

Given its leadership position and strong cash-generating ability, this is a clear case of mistaken pricing. I expect them to recover to at least on par with the sector… and likely beyond in the future.

AbbVie’s dividend yield is 4.20%, which is very attractive. With its strong cash generation from its core business and its diversified portfolio… the company shouldn’t have any problem meeting its dividend payouts in the future.

Its cash dividend payout ratio is at 43.5%. So, there’s a significant buffer between its operating cash flow and the dividend payout.

Skyrizi and Rinvoq should establish themselves further, and some of AbbVie’s late-stage drugs will be entering the market too. As that happens, investors will grow less nervous about AbbVie’s reliance on Humira. And then the stock price will recover.

The investor will enjoy nice stock price appreciation along with the strong dividend, capturing the best of two worlds.

L3Harris

L3Harris Technologies, Inc. (LHX) is a global aerospace and defense technology innovator. It provides advanced defense and commercial technologies across space, air, sea, and cyber categories through four segments:

- Integrated mission systems

- Space & airborne systems

- Communication systems

- Aviation systems.

During its latest earnings call, management mentioned that global defense budgets are shaping up favorably. A couple years ago, they were expected to be flat or lower. But now?

Now, the U.S., NATO, and other countries and organizations are projected to spend more again.

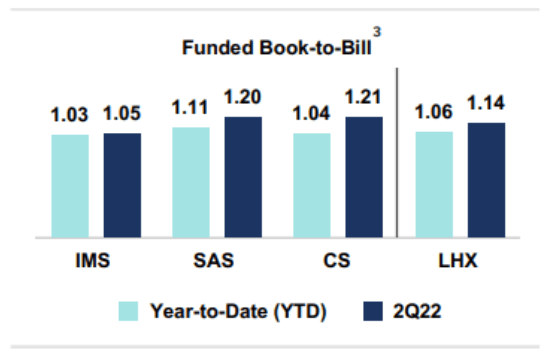

L3Harris had over $1 billion prime awards in July alone, and its overall quarterly book-to-bill ratio was 1.14x. Even with the supply chain, inflation, and labor market challenges, it posted strong results.

(Source: Investor Relations)

Additionally, L3 Harris has a strong balance sheet with ample liquidity. Its debt-to-equity ratio is 40.66%, which is at the lower end of its peer range. And liquidity measures such as its current ratio of 1.27x and quick ratio of 0.96x are at the higher end.

This strong balance sheet combined with its long backlog means it shouldn’t struggle with financial hardships anytime soon.

Its dividend is very safe and well-covered too. Its cash dividend payout ratio is at 47.42%, representing a substantial cushion between the cash flow and dividend payout.

Given its stable business and strong cash-generating capability, L3Harris should continue to offer both dividend and stock price appreciation – especially considering current valuation measures.

Its P/E ratio of 21.42x and EV/EBITDA of 13.44x are both lower than its historic average, suggesting it’s undervalued. In that case, it’s a great time for investors to grab L3Harris’ stock at a discounted rate.

In Conclusion…

No company is immune to market volatility, of course. Not even with strong economic moats, solid balance sheets, and large cash-generating capabilities.

So if – and probably when – the overall market goes down, these three companies may suffer as well. With the hawkish Federal Reserve and persistent inflation, any real bull market won’t return until inflation clearly shows a downtrend.

Until then, we expect the market to remain skittish at best.

Really, there is no end in sight for market volatility. Every time we think we see the light at the end of the tunnel, a new obstacle emerges to upset the marketplace.

It was recurring Covid variants for a while. And then inflation hit the global economy. By the time the central banks got on track – very belatedly, mind you – Russia had invaded Ukraine and caused geopolitical turmoil, an energy crisis, and further supply chain problems.

Seems like we just cannot catch a break.

However, the three companies listed here have products that aren’t easily replaceable. As such, they hold substantial pricing power, which should enable them to successfully maintain their profit margins.

Of course, if inflation and wage pressures don’t subside, their margins will likely suffer. This could certainly dampen their growth trajectory and negatively impact their stock appreciation in the future.

But during uncertain times, dividend growth stocks like these are a great place to put your money. Collect a dividend while the market goes through its volatility…

And then watch the stock rise when a bull market returns.

In short, these three companies have solid economic moats and balance sheets to carry them through any downturn. Shareholders of these stocks can sleep well at night and be rewarded in the long run.

Be the first to comment