stockcam

As risk appetite returns, investors have to be careful to be diligent about stock-picking. Yes, if the market rebounds at year-end you’ll do just fine by buying the S&P 500 – but in my view, huge gains are to be had by buying into beaten-down tech stocks that have been discarded since the start of the year.

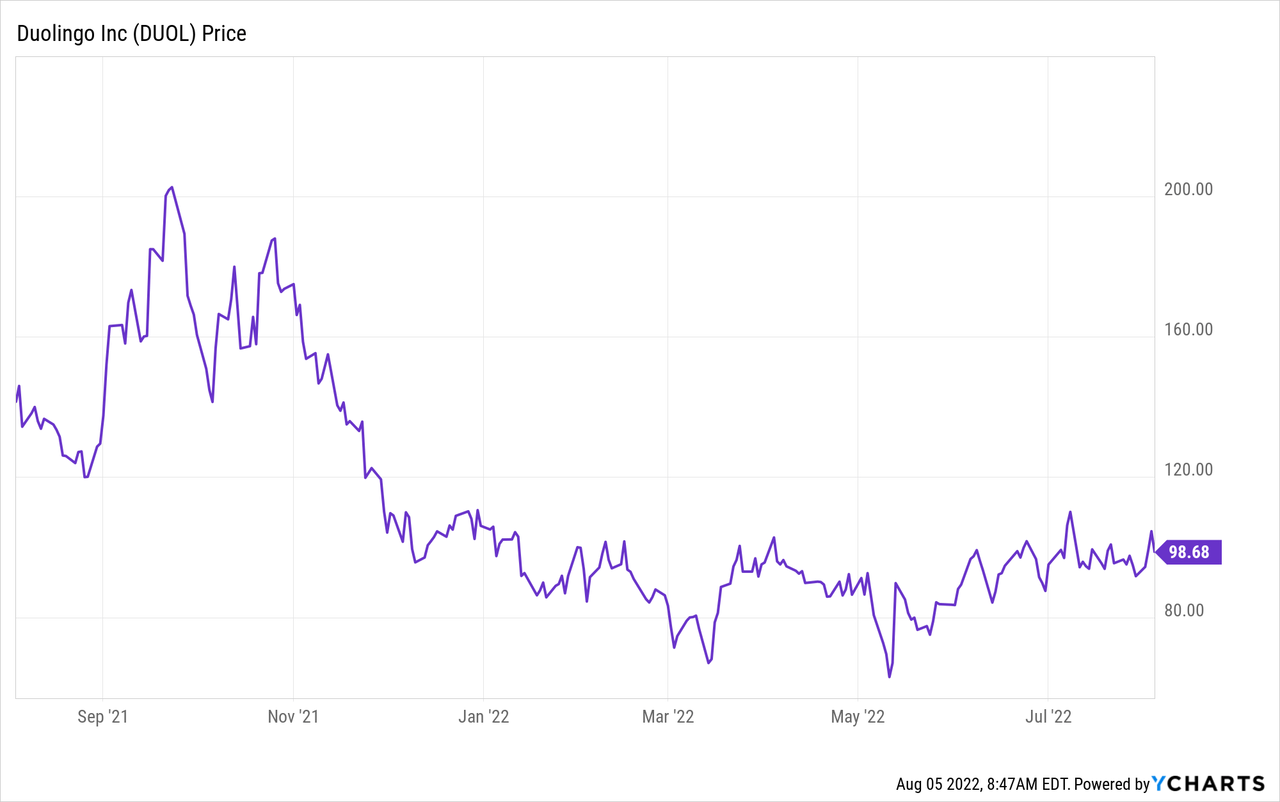

One tremendously attractive opportunity at the moment is Duolingo (NASDAQ:DUOL), the popular language-learning app. The company recently just posted incredibly strong Q2 results that help to put a question mark on the stock’s massive declines. Note that Duolingo stock started receding sharply far before most tech stocks; and relative to highs above $200 notched last November, the stock is still down more than 50%. With risk appetite returning and Duolingo’s valuation looking relatively reasonable, however, I think the tide is about to turn.

The bullish thesis for Duolingo revisited; recent growth drivers are powerful catalysts

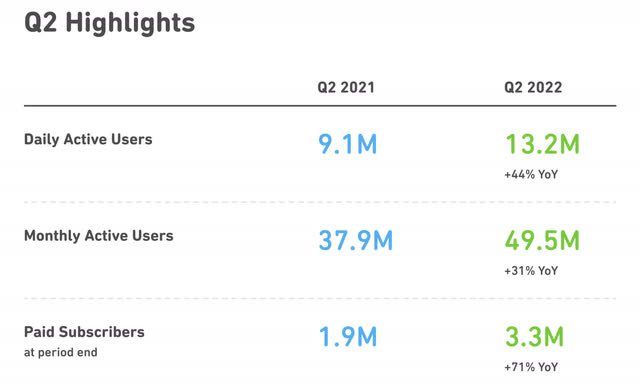

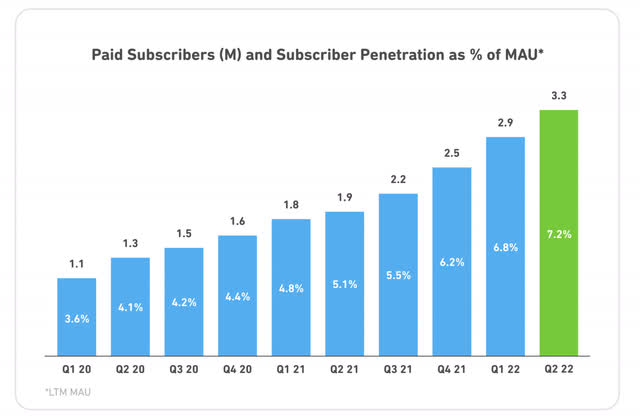

I remain bullish on Duolingo, especially after seeing the company’s latest quarterly results. I’m encouraged by the increased subscriber conversion that the company has been able to achieve (through a combination of A/B testing on its purchase screen which has lowered the psychic barrier to purchasing a Duolingo subscription, plus a rebranding of its subscription product to “Super Duolingo” from the more vanilla prior name of “Duolingo Plus”). Further gamification has also helped to boost Duolingo’s user counts (both DAUs and MAUs are up between 40-50% y/y), driven by the addition of new features like Quests and Side Quests that encourage daily participation. In addition, Duolingo’s potential as a credentialing provider remains vast, and the Duolingo English Test product is the company’s fastest-growing source of revenue.

As a reminder for investors who are newer to this stock, here are the key reasons to be bullish on Duolingo:

- Accelerating growth- Over the past few quarters, despite its own growing scale, Duolingo has seen bookings growth accelerate north of 50% y/y, driven both by increased monetization/conversion of free users into paid ones, as well as effective engagement across its marketing channels.

- Duolingo has an incredible product- I use Duolingo myself on a regular basis (and yes, I am among the ~7% of Duolingo’s user base who is a Super Duolingo subscriber), and am impressed by the way the company has condensed the difficulty of language learning into bite-sized, gamified lessons. The fact that Duolingo has stats to back up the notion that seven units on Duolingo (roughly the entirety of most of the languages in Duolingo’s catalog) gives users the same proficiency as five semester-long college courses only serves to highlight the immense value that Duolingo provides in its well-designed app.

- Travel is opening back up- One of the top reasons that people learn a language is to travel. With the post-COVID world continuing to normalize and with foreign borders opening up for tourism again, the resurgence in travel will likely also lead to a pickup in demand for Duolingo.

- Additional monetization opportunities- Duolingo has three revenue streams. On top of its Plus subscriptions, Duolingo makes money from advertising and from administering English proficiency tests. The latter, in my view, is a burgeoning market that could eventually see Duolingo turn into a language-accreditation service for languages other than English. New subject matter expansions like math should also serve to broaden Duolingo’s market potential.

- High gross margins- Right now, Duolingo is losing money because it’s focused on product development and growth. But its underlying ~70% pro forma gross margins give it ample room to scale profitably, like many other software and internet peers.

Valuation checkup

From a valuation perspective, I’ll acknowledge that Duolingo isn’t exactly cheap. At current share prices near $99, Duolingo trades at a market cap of $3.86 billion. After we net off the $591.2 million of cash on Duolingo’s most recent balance sheet, the company’s resulting enterprise value is $3.27 billion.

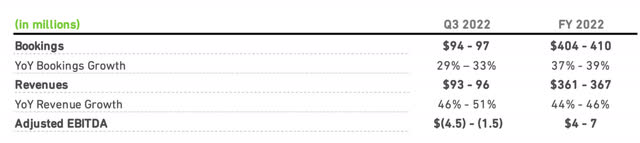

For the current fiscal year, meanwhile, Duolingo has guided to $361-$367 million in revenue, representing a stunning +44-46% y/y growth rate.

Duolingo outlook (Duolingo Q2 shareholder letter)

Against this outlook, Duolingo trades at 9.0x EV/FY22 revenue. And versus consensus expectations for FY23 revenue (currently at $449.3 million, or 23% y/y growth; data from Yahoo Finance), Duolingo trades at 7.3x EV/FY23 revenue.

While these aren’t blowout value multiples, I’d say that Duolingo is still trading at reasonably attractive prices for its current >50% y/y growth rates and the consistency of its execution, plus its commitment to hit breakeven full-year adjusted EBITDA.

To me, Duolingo is a great buy.

Q2 download

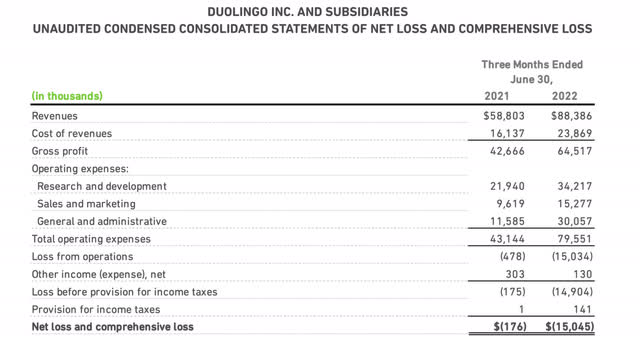

Let’s now go through Duolingo’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Duolingo Q2 results (Duolingo Q2 shareholder letter)

Duolingo’s revenue in Q2 grew at a 50% y/y pace to $88.4 million, quashing Wall Street’s expectations of $85.7 million (+46% y/y) by a four-point margin. We note as well that Duolingo’s revenue growth accelerated three points relative to 47% y/y growth in Q1. Note as well that bookings continued at a sharp growth pace, up 51% y/y to $97.5 million.

Duolingo’s outlook for Q3 does call for bookings growth to slow to 29-33% y/y, but this is likely a conservative outlook that the company won’t struggle to beat. From a revenue slicing standpoint, subscription revenue grew 50% y/y, advertising revenue grew 24% y/y, and revenue from the Duolingo English Test grew 66% y/y (though the latter only contributed $3.2 million to Duolingo’s top line, or only roughly 4%).

Duolingo showed incredibly strong user metrics in the quarter as well. DAUs jumped 44% y/y to 13.2 million, while MAUs grew 31% y/y (the sharper DAU growth rate continues to show how Duolingo’s increased gamification has led to boosted engagement).

Duolingo Q2 user metrics (Duolingo Q2 shareholder letter)

Paid subscribers, meanwhile, jumped 71% y/y to 3.3 million. And as can be seen in the chart below, the percentage of paid subscribers as a percentage of MAUs jumped to an all-time high of 7.2%:

Duolingo paid user conversion (Duolingo Q2 shareholder letter)

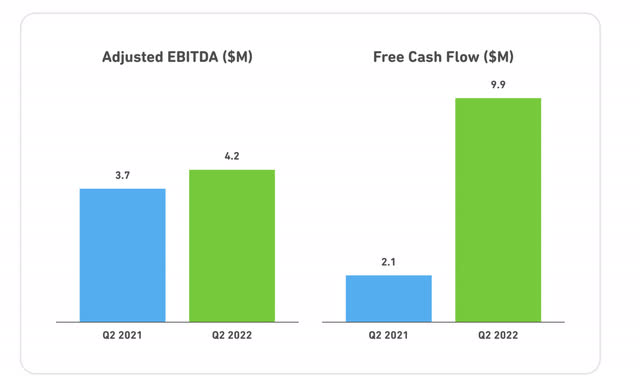

Aside from strong growth, the company also maintained expense discipline, and managed to grow both adjusted EBITDA and free cash flow in the quarter to $4.2 million and $9.9 million, respectively:

Duolingo bottom-line metrics (Duolingo Q2 shareholder letter)

Key takeaways

There’s a lot to like about Duolingo exiting Q2: strong user metrics, higher paid subscriber conversion, incredible revenue and bookings growth that so far has shown no signs of deceleration, and continued bottom-line expansion as well. Don’t miss the opportunity to buy Duolingo on the rebound.

Be the first to comment