cemagraphics

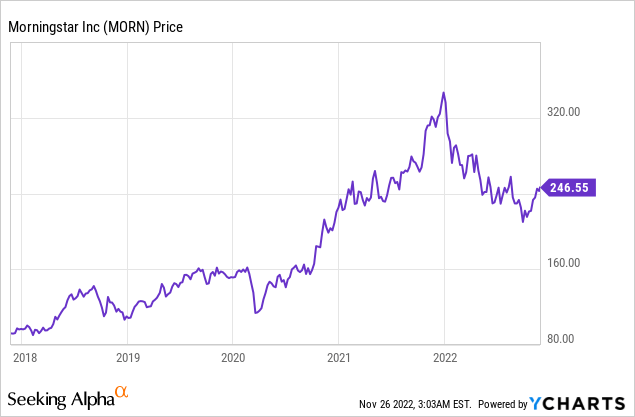

Morningstar (NASDAQ:MORN) is an iconic investment firm and financial data provider which provides services to both retail investors and institutional investors. The company has grown through acquisitions over the past few years. The stock price skyrocketed by ~200% from the lows in march 2020 to the high in late December 2021. However, since that point, the stock price has corrected down by over 27% which has mainly been driven by the macroeconomic environment. In this post I’m going to breakdown the company’s financials, and valuation, let’s dive in.

Third Quarter Financials

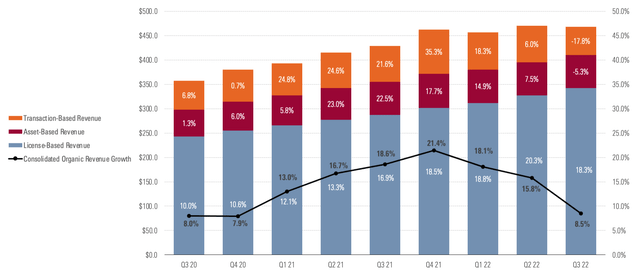

Morningstar reported solid financial results for the third quarter of 2022. Revenue was $468 million, which increased by 9% year over year.

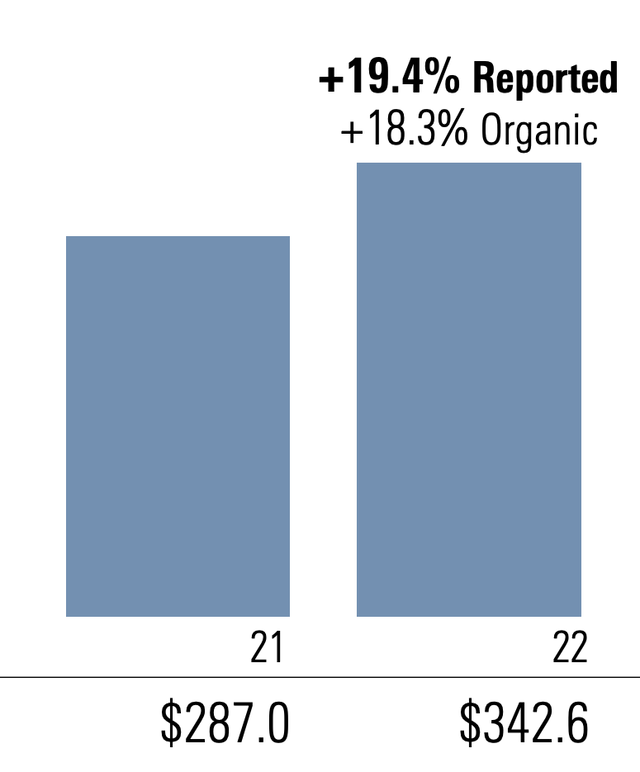

The majority of the company’s revenue was driven by strong growth in License Based Revenue which increased by a rapid 19.4% year over year to $342.6 million. License-based revenue makes up 74% of the revenue total. Growth in this segment was driven by PitchBook which was acquired in 2016 and is a Venture Capital and Private Market database. PitchBook revenue increased by a rapid 38.5% year over year. This is not a surprise given record VC funding occurred in 2020 and despite the macroeconomic environment the industry is forecasted to grow at a 16% compounded annual growth rate up until 2026. As someone who is well connected in the asset management industry, I know many firms are actively bolstering up their private market portfolios and releasing new products in this space similar to PitchBook, although I cannot disclose exact details due to NDAs.

Morningstar “Sustainalytics” which offers sustainability ratings for funds was also a key growth driver, with revenue increasing by a blistering 45.8% year over year. This growth is not surprising given that 33% of global assets under management are expected to have an ESG (Environmental, Social, Governance) mandate by 2025.

Morningstar Direct also reported solid growth increasing by 10% year over year. In addition, Morningstar Data increased by 9.6% year over year.

License based Revenue (Q3, 22 report)

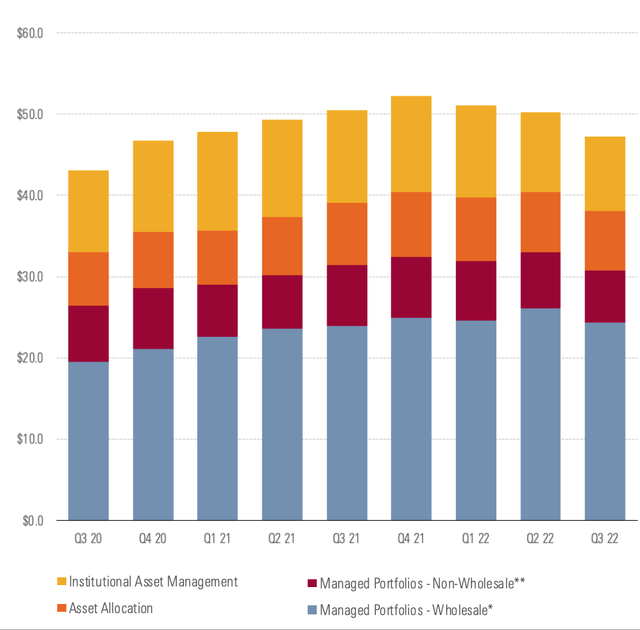

Morningstar’s second major revenue contributor/detractor is its “Asset Based” business. The company has ~$47 billion in assets under management, which declined by 6.5% year over year. This was driven primarily by the harsh macroeconomic environment which has been a catalyst for investors to sit on cash and not generate new inflows into the fund. The good news is growth in new investing products launched by Morningstar helped to offset some of these declines.

Assets Under Management (Q3,22 report)

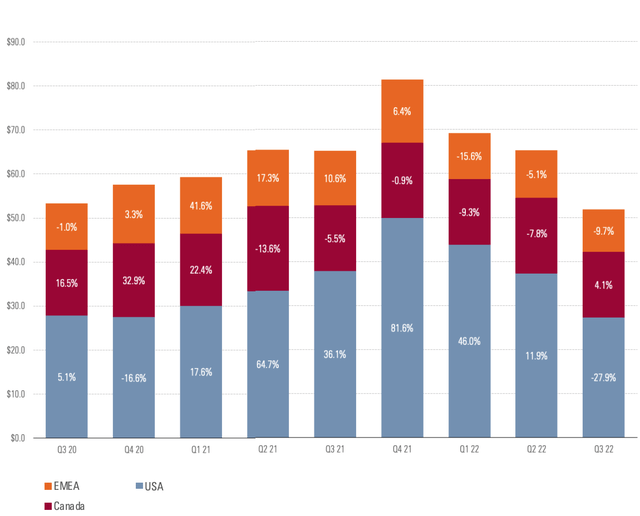

Morningstar’s third major revenue contributor/detractor is its Transaction Based revenue. This declined by 17.5% year over year due to slowing activity in the structured finance market.

Transaction Based revenue (Q3,22 report)

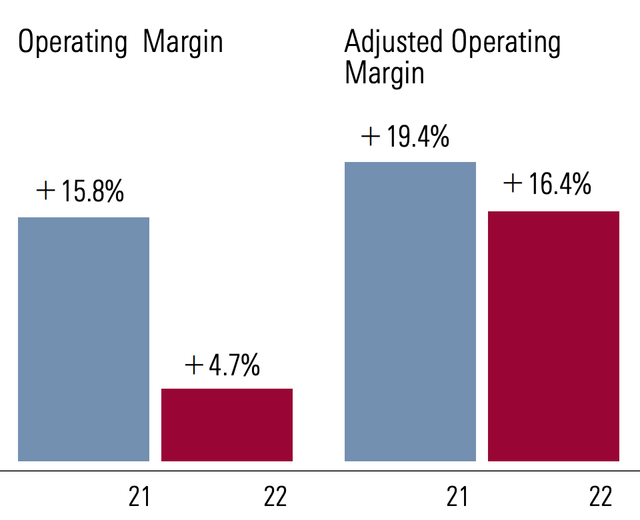

Profit Margins and Expenses

Morningstar’s operating margin was squeezed from 15.8% in 2021 to just 4.2% in the third quarter of 2022. This was driven by a $30.1 million expense related to its shift from China. In addition, to $26.3 million in severance costs related to employees let go in the China region. Headcount in the rest of the world continued to grow in its rapidly growing PitchBook and Sustainalytics divisions, this increased costs by $26.3 million. Overall stock-based compensation increased by $10.9 million due an increased bonus plan for employees of PitchBook. The good news is the majority of these expenses are one of costs or necessary expenses for the rapid growth of the company’s best-performing segments. Therefore, I believe long term we should see improvement in this profit margin. On an Adjusted basis, its Operating Margin only declined by 3% to 16.4%.

Operating Margin (Q3,22 report)

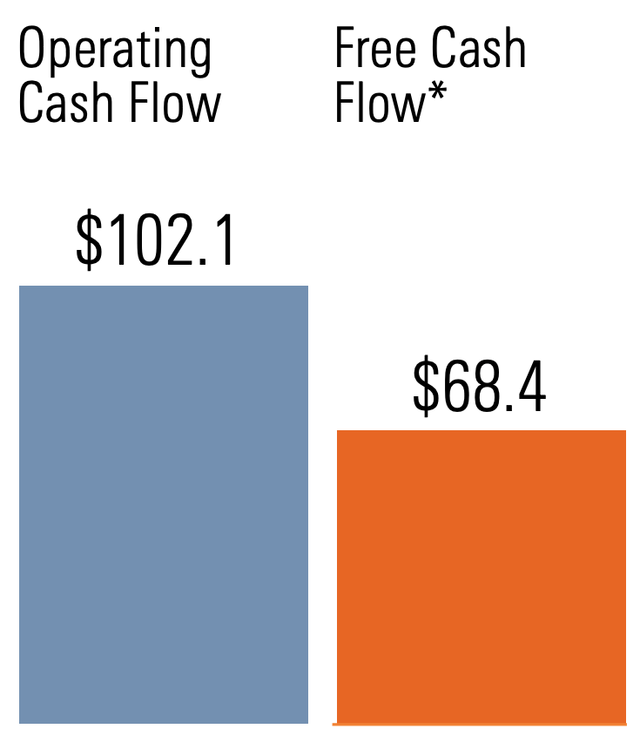

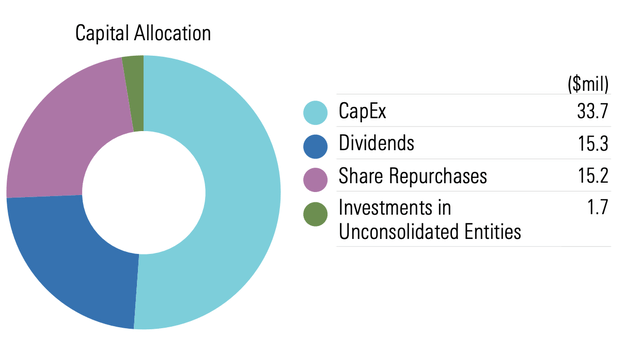

Morningstar reported solid operating cash flow of $102.1 million which increased by 49% sequentially but it was down 17% year over year. This is not a major worry as cash flow has had a tendency to fluctuate historically, with Capex investments which equated to $33.7 million in Q3,22 alone.

Morningstar has a solid balance sheet with $407.1 million in cash and short-term investments. It does have fairly high long-term debt of $1.125 billion but just $32.1 million of this is current debt, due within the next 2 years. The company also pays a 0.58% dividend and bought back $15.2 million worth of shares in the third quarter of 2022.

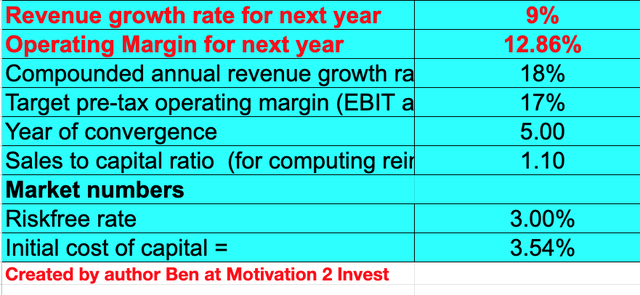

Advanced Valuation

In order to value Morningstar, I have plugged the latest financial metrics into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 9% revenue growth for next year which is the same as the prior year, as I forecast tough macroeconomic conditions to go into next year. However, in years 2 to 5, I have forecasted economic conditions to recover and revenue to increase by a rapid 18% per year.

Morningstar stock valuation 1 (created by author Ben at Motivation 2 Invest)

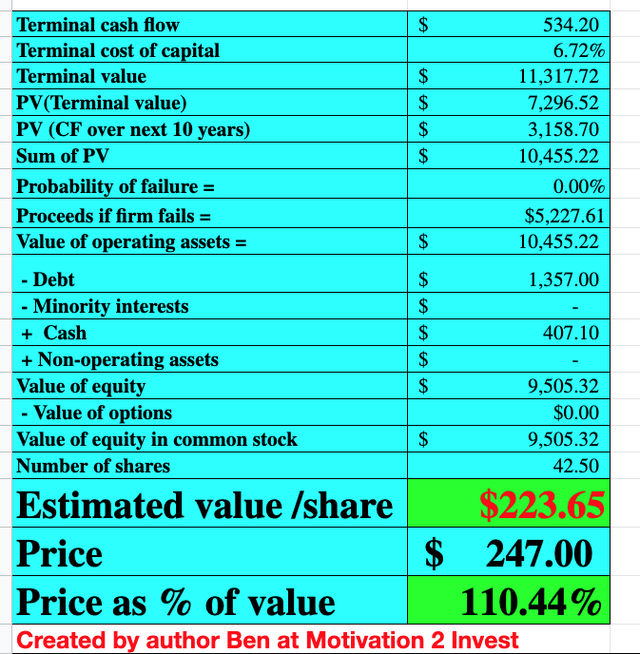

I have also forecasted Morningstar’s one off expenses highlighted previously to dissipate and its high-margin data products such as Pitchbook will continue to grow. Given these factors, I have forecasted the operating margin to increase to 17% in 5 years.

Morningstar stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $223.6 per share, given the stock trades at $247 per share at the time of writing I deem it to be slightly overvalued.

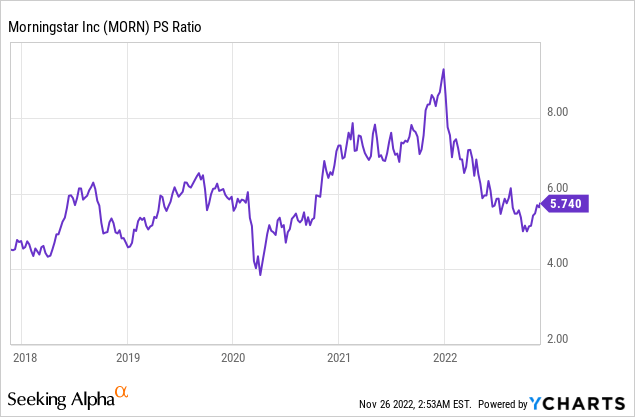

The good news is Morningstar trades at a Price to Sales ratio = 5.6 which is 5% cheaper than historic levels.

Risks

Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. This has been bad news for the public markets as many investors have been spooked out of the markets, which is bad news for asset management firms.

Final Thoughts

Morningstar is an iconic company in the asset management and financial data industry. The company’s VC-focused PitchBook and “Sustainalytics” products are both growing rapidly and I forecast this to continue into the future. Despite this the stock price looks to be a little overvalued at the time of writing and given the opportunities in the market, I will deem this stock as a “Hold”.

Be the first to comment