Petmal/iStock via Getty Images

Investment Thesis

Energy Vault Holdings (NYSE:NRGV) innovative technology builds gravity-based energy storage systems, which are more cost-efficient than traditional energy storage methods (according to the company). Additionally, Energy Vault’s technology has the potential to be scaled up quickly and could be deployed in a variety of locations. In the best-case scenario, the technology is a game changer and has enormous potential; in the worst-case scenario, the company cannot prevail against the competition. The risk-reward ratio seems attractive to me, given the relatively low market capitalization and promising fixed contracts for 2023.

Company Overview

Energy Vault is a Swiss-based global energy storage company specializing in gravity and kinetic energy-based long-life energy storage solutions while reducing customer costs and minimizing environmental impact. Energy Vault went public in January 2022 through a SPAC merger and currently trades on the New York Stock Exchange.

The company distinguishes between long-duration storage (LDES) and short-duration storage (SDES) in its battery systems. LDES is based on a gravitational system that lifts 10-ton blocks with excess energy. The blocks are lowered again when energy is needed, and the kinetic energy is converted back to electrical power. On this page, there is a video visualizing the process.

LDES solutions are based on proprietary gravity energy technology and ideally deployed for use cases requiring 4 or more hours of storage capacity. Gravity Energy Storage System (GESS) solutions utilize a mechanical process of lifting and lowering composite blocks to store and dispatch electrical energy. Our proprietary technology offers LDES at a cost-competitive price to support grid reliability and enable renewable energy integration. GESS solutions can be deployed as stand-alone storage or paired with generation in a hybrid configuration.

However, the short-term storage systems are more like classical storage systems and are based on lithium-ion batteries. In addition, the company offers software solutions to interconnect and optimize several such systems above.

Advantages of the gravitation System

The building construction requires a steel frame, but the blocks weighing tons can be made of almost any material, including recycled ones. This also gives the system more security and locality in supply chain problems. This system does not lose capacity over time as lithium batteries do. Efficiency remains consistently stable for years. In addition, the system is very safe because parts are moved back and forth, but there is no risk of fire, such as with lithium batteries.

Our commitment to sustainability is reflected in our circular approach to production design which includes the use of locally sourced materials and repurposing of recycled waste, diverted from landfills.. Locally sourced materials, supply chain, and work force support sustainable construction design and create economic value within the local community.

Energy Vault provides expertise, design, and brainpower. When they get a contract to build a system, they hire a local construction company instead of having their own permanent workforce. This allows the company to keep running costs low; therefore, 74 full-time employees are currently sufficient.

Industry Overview

The market for energy storage solutions to support the power grid is still very young and is probably in the early stages of development. The tricky thing about the estimates is that there are many different energy storage solutions, and all the estimates I have found are generally for energy storage. Humanity will need buffer storage in the future, as it will be required to compensate for the main disadvantages of solar and wind.

The Europe energy storage market is expected to grow at a CAGR of approximately 16.3%, reaching 5.2 GW of installed capacity in 2027 from 1.6 GW in 2020. Factors such as the declining prices of lithium-ion batteries with increased application range and increased demand for uninterrupted power supply are expected to drive the European energy storage market.

Source: Mordor intelligence

Valuation

The company is currently valued at an enterprise value of $157M. The market cap is $405M, so there is no debt and about $250M cash. Since the company has no positive cash flow, a fundamental valuation of the share is difficult.

The current share price is $3, but the company has $1.8 cash per share. This sounds great, but remember that this cash will be used soon. In the trailing 12 months, the loss was $68M. With this or an even higher cash burn rate, the remaining money will not last very long. In such a case, one should rather look at the market capitalization and less at the enterprise value.

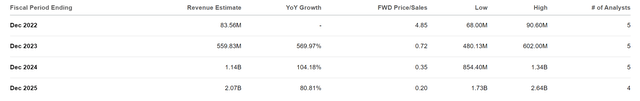

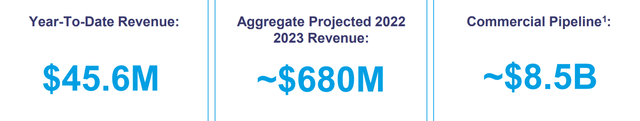

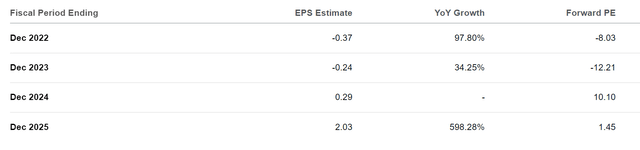

From a price/sales perspective, the company is estimated to generate $83M in revenue this year. In the three quarters of 2022, the company is at $47M, so the last quarter would have to add quite a bit to reach that revenue target. More important is how things will go anyway. The stock is currently tracked by five analysts who forecast explosive growth: over $1 billion in revenue and positive earnings per share in 2024.

What is this positive outlook based on?

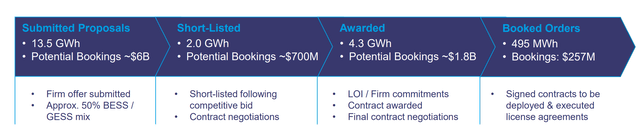

The promising estimates are based primarily on contracts already signed for the construction of new systems. According to the company, the booked orders are firm, and the awards are in final negotiations.

Ended the quarter with nearly 500 MWh of booked orders and 2 GWh of new awards. Total Signed Contracts & Awards are now approximately 4.8 GWh, representing ~$2B of potential revenue.

For example, just a few days ago, they announced an order from NV Energy (BESS means battery energy storage system).

The 220MW/440MWh grid-tied BESS will be deployed at a site located near Las Vegas. The 2-hour energy storage system is designed to store and dispatch excess renewable energy, including wind and solar power. The BESS will be charged and discharged on a daily basis and designed to dispatch stored renewable energy at peak consumption hours to help meet the high demand during Nevada’s peak load hours.

Therefore, the company gives quite accurate revenue estimates for the next year. The commercial pipeline corresponds to the potential generated from submitted proposals. This corresponds to potential sales in the following years. However, I don’t quite understand how this figure is calculated. The chart above says that the booked orders are worth $257M. Why, in 2023, $600M revenue should appear is not entirely clear to me.

But if these figures are correct, the P/S ratio will be below one already next year. And if the earnings per share figures for 2024 are accurate, this would be a P/E ratio of 10 on the current share price.

Risks

But we must remember that analysts’ estimates are not always accurate, that sometimes companies present their prospects more positively than they are, and that unexpected developments can always occur.

The company’s main risks are that the gravitational energy storage system may not be the best technology but that other solutions are better, more efficient, or cheaper. For the short-term lithium-based storage systems, there is more competition, and therefore there is also price competition. It is also unclear what the company’s profit margins will be.

Furthermore, there is a risk of further share dilution if next year´s costs rise significantly above this year’s level.

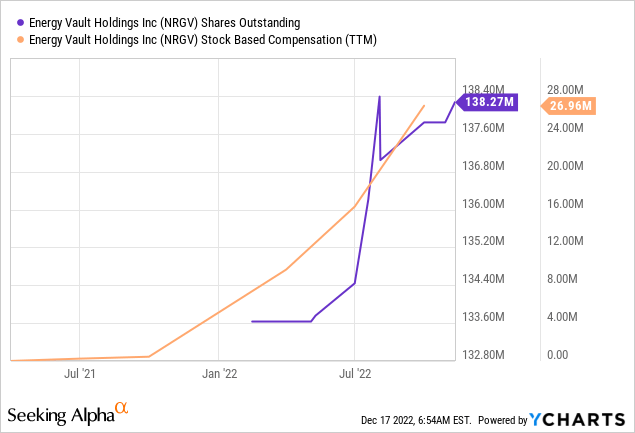

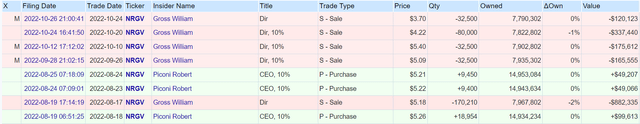

Share dilution and insider selling

One thing I always want to look at, especially with companies that are not yet profitable, is stock dilution and whether there is insider selling. In summary, there have been slight but nothing very spectacular in recent months.

Here we can see that since the IPO in January 2022, there has been about 4% share dilution. Stock-based compensation was $27M in the trailing twelve months. According to Seeking Alpha’s data, the company has only 74 employees, so compensation per employee would be 365K. So, definitely substantial numbers. I don’t mind proper compensation for employees, especially if they are experts. However, as a shareholder, I also don’t want to pay too much for it, so that is certainly a point to keep in mind for the future. But there is also a positive side to this: if employees own a lot of shares, they have an even greater interest in the success of the company and rising share prices.

Conclusion

Considering the fixed bookings and the general outlook in the market for storage solutions, the current market capitalization seems very low. Several orders have been announced this year, which shows that the company can make attractive offers to potential customers. The fixed bookings are also locally broadly diversified on four continents. The first completed gravity storage system is scheduled for completion in China in the first half of 2023.

I find the stock and technology very interesting and will keep an eye on it. I think that the world will be full of energy storage solutions in the future, as they will be necessary for the future energy mix and, therefore, essential for the entire system in order to avoid power outages.

This is a stock with high risk but also with great opportunities. Ultimately, everything is a question of price, and the current market capitalization is relatively low considering the prospects; I think the stock is a speculative buy for risk-conscious investors.

Be the first to comment