peterschreiber.media/iStock via Getty Images

Inflation, Banking, and Financials

Big banks are kicking off the earnings season. While some investors believe financials will see a drop in revenue compared to Q1 of 2021, we believe the short-term pain caused by spiking inflation will be overshadowed by the long-term benefits attributed to income on loans, low deposits rates, and diversified product offerings.

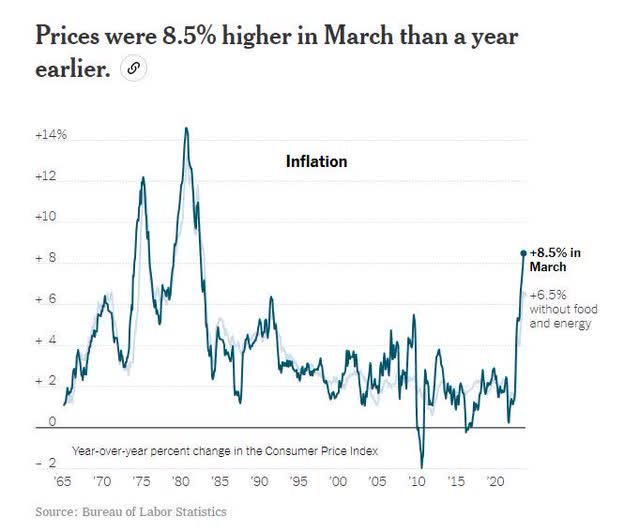

CPI Year over Year Changes (Bureau of Labor Statistics)

Reaching a 40-year high in March, intensified by spiking prices amid Russia‘s invasion of Ukraine and supply chain shortages, Consumer Price Inflation (CPI) is through the roof. “Inflation is not likely to roll over and begin to come down for several more months,” said Michael Gapen, Chief U.S. Economist at Barclays Plc. In addition, some financial institutions have slowed their share buybacks because of declines in excess capital following bond losses as yields rose. It‘s unclear how many banks and financial institutions are feeling the wrath of the bond market, but earnings season is sure to expose it all.

Generally, when interest rates rise, financials, particularly bank-oriented stocks, tend to perform well because banks can increase the rates at which they lend money. Increasing lending rates increases financials‘ net interest income, which is beneficial to their bottom line. The bank stocks and financial stocks that may experience difficulties in a rapidly rising interest rate environment would be those with significant consumer credit balance sheets, such as credit card payment companies like Capital One, Discover, and Citibank. Given the increase in borrowing over the last several months, when credit card companies increase the rate of interest charged, the consumers‘ probability of default and delinquencies increases, which can strain financials‘ balance sheets.

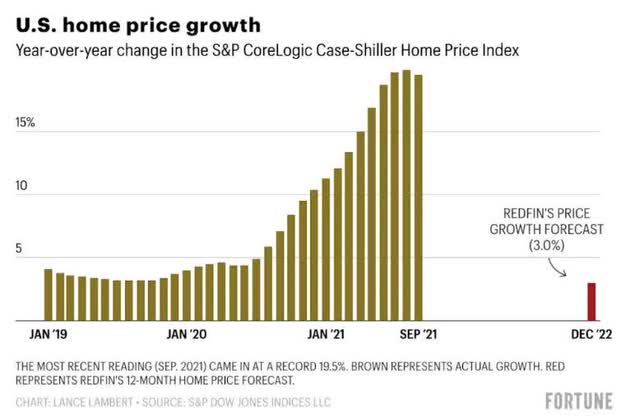

U.S. Home Price Changes (Lance Lambert – S&P Dow Jones Indices LLC)

“There is a cost to the Fed being gradual: Future inflation is best predicted by lagged values of past inflation, and a more gradual Fed now likely means a more aggressive Fed later,” said Bloomberg Economists Anna Wong and Andrew Husby. If the Fed is too aggressive in tightening and market interest rates continue to increase simultaneously, it could halt demand; the cost of leverage is too great to warrant investment from borrowers. Fewer borrowers may result in steam taken out of the housing market and home price deceleration. Because borrowers’ expected net present value may not be feasible, revenue generation for banks and lending is likely to result in less spending on credit.

Although inflation may peak in the coming months, consumers and investors still feel the pain, so we think the advantages of financials create strong buys in our three stock picks.

Investing in the Financial Sector

Banking and financial stocks have advantages that include long-term performance, where some have benefitted from dividend income and rising interest rates, which allow them to charge higher rates. Whether we experience another lockdown, recession, or economic downturn, these three stock picks are very diversified, allowing them to offset potential loss.

3 Best Financial/Bank Stocks to Buy for 2022

While I usually focus on less familiar names that possess great fundamentals and are attractive on value, growth, profitability, momentum, and EPS revisions, in the current economic climate, our top three banks and financials are some of the world‘s biggest names. Because they are well-diversified and therefore less susceptible to the downside, we believe them to be the likeliest to benefit from inflation and serve as inflation hedges.

1. Berkshire Hathaway Inc. (NYSE:BRK.B)

Berkshire Hathaway Inc. (BRK.B), a highly profitable, diversified financial company similar to an ETF or mutual fund but trades as a stock, is our first financial pick. Regularly in the headlines, BRK.B is one of the most well-respected companies run by industry titan Warren Buffett. With multi-sector holdings that include insurance operations, freight rail transportation, and worldwide utility businesses, this stock, known as a relatively conservative, continues its upward trajectory thanks to one of its largest tech holdings, 5.6% in Apple Inc (AAPL). In addition, some of its largest equity holdings include financials like American Express Company (AXP), Bank of America Corp (BAC), and U.S. Bancorp (USB), an indication that “I feel very good about the banks we own. They‘re very attractive compared to most other securities I see,” Buffett told CNBC, and despite some of the risks, banks are some of his largest holdings. Buffett has been quoted and is a firm believer in investing in good companies because “It‘s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Although past performance is not a guarantee of future results, Buffett‘s 50+ years of experience and success are enough to give his stock consideration.

YTD BRK.B‘s share price is +15%, one-year 30% (nearly twice the S&P 500), and its five-year is +112%. Despite a C- valuation grade, this stock is a collection of high-quality businesses worth considering for a portfolio.

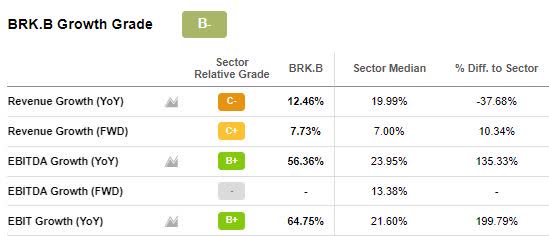

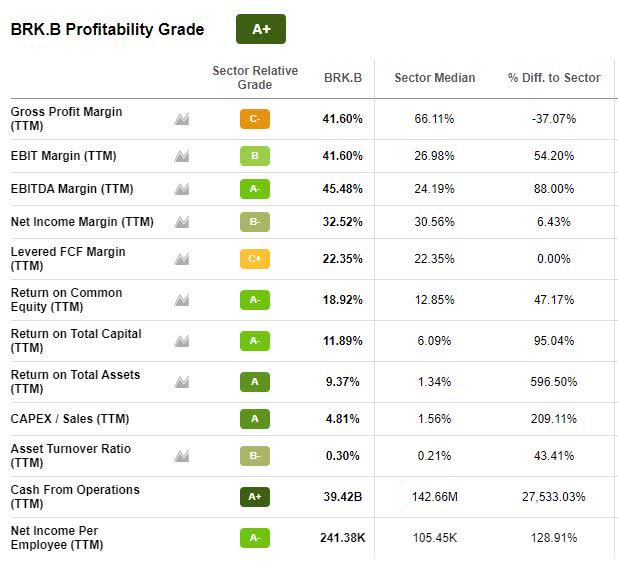

BRK.B Profitability and Growth

Cash flush with $39.42B Cash from Operations and 50 years as a profitable partnership, BRK.B continues to thrive. After a record $90B in net earnings for Q4 2021, Berkshire beat both top-and-bottom lines, with an EPS of 3.27 beating by $0.31 and revenue of $71.80B beating by $2.88B.

BRK.B Growth Grade (Seeking Alpha Premium)

Because Berkshire has a significant stake in the insurance business, where sales volume typically increases during economic growth and inflation, this product offering is unlikely to become obsolete. Overall profits for Q4 totaled $7.285B which made up Buffett‘s collection of businesses, an increase of nearly 45% from the previous year‘s profits.

BRK.B Profitability Grade (Seeking Alpha Premium)

Following the tremendous quarter, Berkshire used $6.9B to buy back its shares in Q4 2021 and continues its momentum. We believe there is no end in sight for this rallying company that greatly emphasizes diversifying its holdings while maintaining a substantial number of banks under its belt. We believe that the right banks can serve as inflation hedges, which brings me to my next stock.

2. HSBC Holdings plc (NYSE:HSBC)

Global banking and financial services company HSBC Holdings plc (HSBC) offers retail banking and wealth management products for a diversified portfolio and diverse demographic and geographic locations. Where rapidly rising interest rates may slow loan demand, which impacts revenue generation, institutions with trust and wealth management departments produce additional income streams through investment management fees. Further, financials that diversify into asset management and alternative investments fare even better with another added layer of income generation. As we look at HSBC’s quant grades, it’s evident why we believe this stock is a strong buy.

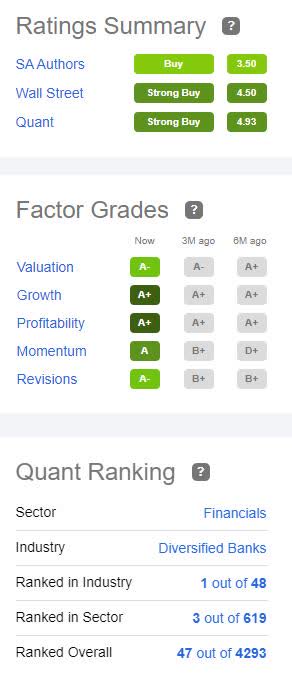

HSBC Quant Ratings and Factor Grades

HSBC Quant Ratings and Factor Grades (Seeking Alpha Premium)

HSBC Valuation

Although some underlying metrics are less than ideal, no company is perfect. HSBC has excellent ratings and factor grades across the board. Our factor grades give HSBC an overall A- Valuation Grade, and its P/E ratios are trading above sector peers. HSBC has a good current price to earnings growth ratio of 0.05x, nearly 75% below the sector, and an A- PEG ratio, a solid indicator of investors‘ and analysts‘ sentiment toward the stock. HSBC also has stable Price to Sales ratios, and its share price of $33.89 is +11% YTD and up nearly 14% over one year. Let us take a look at HSBC‘s growth and profitability.

HSBC Growth & Profitability

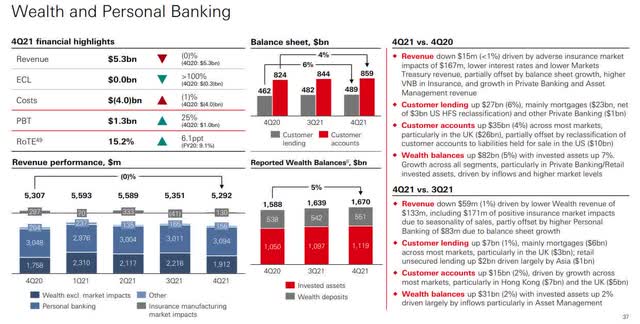

HSBC has demonstrated substantial strength in its U.K. and Hong Kong banking presence. Its Asian market is essential for its growing wealth management business. With a focus on restructuring, HSBC has exited some of its unprofitable markets, cut costs, and entered rapidly growing economies to ensure exposure to its various products and services, from deposits to wealth management.

For banks like HSBC, wealth management fees are additional income streams because they offer annual recurring revenue, a more stable income than loans, giving banks a higher probability of accurately forecasting AUM. In addition to an additional revenue stream, wealth management fees ensure that banks are not solely dependent on traditional banking, lending, and deposits. Asset management offerings give way to alternative investment capabilities to help diversify investment portfolios, so they aren’t as susceptible to the ups and downs of market volatility in both the stock and bond markets that we’re seeing today. As we look at some of HSBC’s Q421 wealth and personal banking highlights below, you better understand the diverse offerings and potential income streams that may see the effects of higher interest rates.

HSBC Q421 Wealth and Personal Banking Highlights

HSBC Q421 Wealth and Personal Banking Highlights (HSBC)

HSBC should see an increase to their net profits, once travel restrictions in some of their biggest regions of Asia are lifted. As Seeking Alpha Contributor Tudor Invest Holdings writes, “As usual, Asia delivered the bulk of the profits with USD 12.2 billion, including USD 1.1 billion from India. Europe contributed with USD 3.8 billion in profits, and they also saw USD 900 million profits from their U.S. operation which has gone through an extensive revamp. That brought profit for North America to USD 1.4 billion.”

HSBC Momentum Grades (Seeking Alpha Premium)

With HSBC‘s Q4 earnings in line with projections, and as we gear up for this month‘s April 26th Q1 release, HSBC is on a roll with great momentum, as showcased in the above momentum grades. “Underlying growth in key revenue streams came through strongly in Q4 to offset the drag effects of declining rates, resulting in reported revenue growth of 2% in the quarter, coupled with tailwinds from higher interest rates. This provides strong revenue momentum for the future,” said Noel Quinn, HSBC Group CEO, and we believe the future is bright for HSBC along with our next global bank, UBS.

3. UBS Group AG (NYSE:UBS)

Diversified capital markets firm UBS, a global wealth manager, offers personal and corporate banking and is my final pick in the financial sector. Recently declaring a $0.162/share and reporting excellent Q421 earnings, this stock comes at a discount.

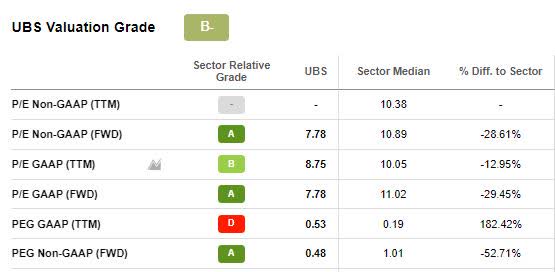

UBS Valuation

Possessing a B- overall Valuation grade and a forward P/E ratio of 7.78x, nearly 30% below the sector, this financial stock is a deal. The stock‘s price has been on an upward trend and over the last year is +15%; over five years, +35%.

UBS Valuation Grade (Seeking Alpha Premium)

UBS‘ diversified offerings include alternative investments and access to REITs. As I wrote in my last article, 3 Best REITs to Fight Inflation, alternative investments that include tangible assets can help protect against inflation. REITs were one of the top-performing sectors (+46.2%) last year and have historically benefited from inflation. REITs offer investors a total return investment and tax advantages.

UBS Growth and Profitability

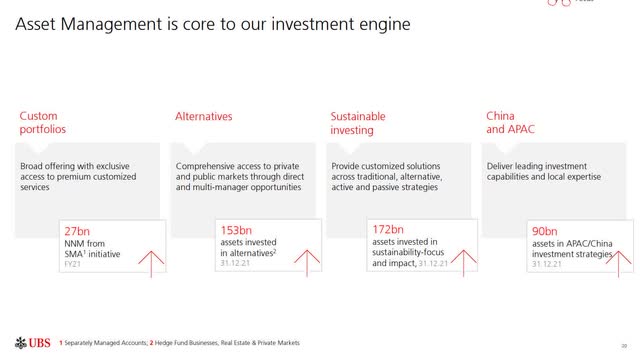

Because real returns adjust for inflation, to benefit or have any upside in fast-rising rate environments, those institutions that incorporate alternative investments are the likeliest to be resilient. UBS had excellent Q4 earnings, with an EPS of $0.39 beating by $0.12 and revenue of $8.79 beating by $340.48M (7.11% YoY). Because asset management is core to the UBS investing engine, their diversified offerings should help shield from declines in retail banking and lending.

UBS Core Asset Management Offerings

UBS Asset Management Core Offerings (UBS Q4 Financials)

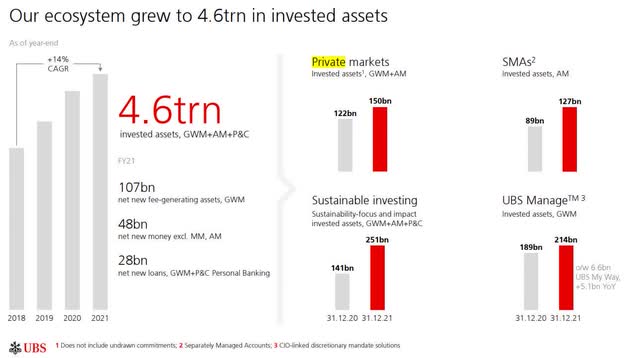

“Private markets add a big opportunity for our clients and for us as well. And by the end of the year, our clients had a $150 billion of drawn commitments invested in private markets. Secondly, SMAs. The continued growth we see here speaks to the demand for customization. It shows what a seamless offering can do for our clients but also to us. Last year, our Wealth Management clients drove $27 billion of inflows into these strategies,” said Ralph Hamers, UBS Group CEO on the Q4 Earnings Call.

UBS Q4 Asset Growth (UBS)

In addition to the demand for customized investment strategies, impacts of sustainable investments increased 78% during 2021, and UBS managed assets increased to $214B. It’s a great business model because the fees for alternatives can be exorbitant (e.g., 2% management fee plus 20% carried interest, etc.). These fees can offset potential declines in lending that we discussed above. In addition, these financials can generate revenue from trading activities.

Both HSBC and UBS offer portfolio management with access to securities trading. When volatility increases, there’s more trading activity, and therefore, stocks like UBS and HSBC can generate more revenue. In a highly volatile market like we’re experiencing now – especially on bonds – traders, especially fixed-income trading groups, can create additional revenue sources to offset any slowdown in loan demand.

UBS Momentum Grade (Seeking Alpha Premium)

On its current trajectory, UBS appears to be an excellent hedge against inflation. We look forward to the next earnings announcement, and as their CEO expressed during the Q4 earnings call, momentum is at its highest revenue since 2006. Given the above momentum grade of A- with continuing outperformance of its peers over the last year, this stock has great potential along with BRK.B and HSBC, with room to grow. We believe our 3 best financials and bank stocks are strong buys.

Financial Stocks Are Strong Buys if You Pick the Right Ones

With dominant market share and positions, BRK.B, HSBC, and UBS are strong buys at their current prices for any investor looking for increased exposure to the financial sector and potential inflationary hedge. The three stock picks have solid valuation, growth, and profitability grades and offer product diversification to shield from declines in income caused by the Fed tightening while offering alternative income streams.

Check out the Grades on your stocks, or we have many Top Financial Stocks for you to choose to help inflation-proof your portfolio. Our investment research tools help to ensure you are furnished with the best resources to make informed investment decisions.

Be the first to comment