Metaphortography/iStock via Getty Images

You Should Make A Bunch Of Portfolio Moves Before Midterms: False

Investors are clamoring to know how the US midterms will affect their portfolios. But for all the hype whipped up around the elections by stock market pundits, there’s not much substance. America’s founding fathers designed the legislative system to be in gridlock more often than not, and that is the most likely outcome of this election. Fox and CNN don’t take bets, but bookies like Ladbrokes do, and they have the odds of a Republican takeover of the House of Representatives at 90-95%. Similarly, PredictIt has the Republicans at a 90% chance to win the House. With a Democrat in the White House and Republicans in Congress, the most likely outcome is a whole lot of nothing for the next two years.

However, the hype train over midterms obscures the fact that less than 5% of S&P 500 (SPY) companies even mentioned the midterm elections on their Q3 earnings conference call. In 2020, the number of companies mentioning the election was 4-5x higher. While it’s possible that some bipartisan efforts to deal with the national debt and entitlement funding problems are made, it’s unlikely for now. Investors in healthcare stocks may want to monitor the rhetoric from both parties around the healthcare system. If it ever gets reformed, then Big Pharma and health insurance companies aren’t going to be as profitable.

Half the TV ads for NFL games these days seem to be for fast food, and the other half is for pharmaceuticals. This is not a coincidence! But other than a small chance of a big change in the healthcare system and some smallish tax hikes to help reduce deficits, large amounts of change are unlikely with a split government in the next two years. A decent tax hike for 2023 is already coming, which is restarting payments for millions of student loan borrowers after over two years. This will actually do more to combat inflation that anything the Fed can do in the short run. And, of course, this is unless they extend the pause for another two years under the pretense of the “pandemic” to try to win elections in 2024. Dysfunction in DC shouldn’t have a severe impact on corporate profits over the next two years, but if it does, you’ll get plenty of warning. There is no need to make any portfolio moves before midterms.

Earnings/Profit Margins Are Declining: True

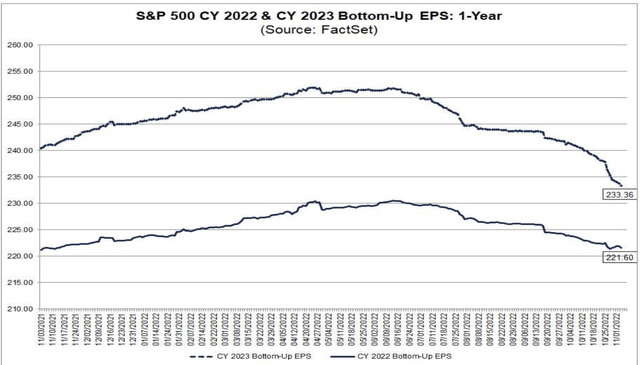

Remember the crazy high earnings estimates for 2023 that I’ve written about? They’re starting to collapse now. The median estimate from FactSet for Q4 2022 has fallen from an estimated 9% increase over Q4 2021 in July to a 1% decrease now. Yardeni Research is more bullish, but I expect them to revise their numbers down as well. Goldman Sachs analysts recently revised 2023 estimates for growth to 0%. This is the real news you should pay attention to.

A year ago, the net profit margin for companies was 12.9%. A quarter ago, it was 12.2%. Now it’s 11.9%. The 5-year average is 11.3%, and that’s where margins are about to go. It’s probable that margins go even lower in the years ahead as companies lose the benefit of a zero-interest rate policy on their debt and higher rates slowly eat their excess profit margins away. This is not to mention unions hitting back against companies like railroads and airlines with strike threats. Earnings estimates are being rapidly revised down as consumers have to spend what they earn rather than stimulus money. I’ve previously calculated that assuming normal profit margins and the increase of nominal GDP due to a bigger money supply, this implies earnings of around $190-$200 for 2023. That’s still 15% lower than analysts are expecting, but they’re slowly catching up. Earnings have held up decently with consumers spending on credit cards and blowing their accumulated savings from the pandemic, but that won’t last forever.

EPS Estimates for 2023 (FactSet)

Inflation Is Still Not Under Control: True

The most important person in the government for your portfolio is not an elected official but is actually an appointed official – the chair of the Federal Reserve. With political gridlock blocking any explicit redistribution of wealth by Congress, what Jerome Powell does is much more important to your portfolio than any of the drama in Congress. Powell has publicly committed to bringing inflation down to 2% per year, which calls for a continued campaign of interest rate hikes. Investors will get the latest report card on the Fed’s efforts on Thursday, November 10th-as always, at 8:30 AM Eastern.

Bloomberg reported that core inflation is expected to rise by 0.5% for the month. This seems about right. I’m going back to the well with my econometric model from the Cleveland Fed – that model is predicting core CPI to rise 0.54% for the month, so either 0.5% or 0.6%. Either number is really bad and indicates the need for more interest rate hikes, starting with a likely 75 bps hike in December. Overall CPI is expected to rise by 0.76% for the month, which is a really ugly number.

My other tactic here is to look at other countries’ CPI reports that report before the US to see how their numbers are coming in. Thailand came in as expected, Switzerland was less than expected, France was higher than expected, Netherlands’ core inflation increased month over month (their headline number is like 17%), and Poland came in higher than expected. I can’t discern much of a trend from the international numbers, but the European numbers are shocking in light of the fact that natural gas prices have actually fallen close to 70% since the panic in August.

Therefore, I think 0.5% core for the month is going to be on the money, so the market reaction will likely be muted this time around. The Fed may have a problem going forward, however, as oil continues to rise and the dollar starts to weaken. It’s hard for me to see how they’re not forced to go 75 bps again in December. 0.5% per month core inflation implies a core CPI of over 6% per year, and the 3.25% interest rate for October was not going to get that down. 5% now might do the trick with aggressive quantitative tightening, but the Fed can’t prematurely pivot, cut rates, and do more QE because it would run the risk of sending oil to $200 and the dollar down the drain. Higher interest rates for longer are the theme here.

The Valuation Math Is Still Brutal For Stocks

If you can get 5% or more in cash risk-free, why would you buy Coca-Cola (KO) for 24x earnings? How about Costco (COST) for 34x? Or Apple (AAPL) for 22x its inflated earnings estimates? Overall, you’re about to be able to get much higher returns just sitting in cash than you can by buying hundreds of popular, overvalued stocks. And that’s the point – the Fed wants to slow the economy down and pull money out of the stock market and into cash.

Overall, if we assume that the earnings estimates for next year are solid (they’re not), then the S&P 500 trades for about 17x earnings. If we assume that profit margins are coming off their cyclical high and will continue to decline from higher rates and labor troubles, then stocks are trading for closer to 20x earnings. Historically, stocks generally trade between 15-18x earnings. But that’s when interest rates are lower than they are now. You’re not really getting enough compensation in stocks to justify the risk now.

If you invert the PE ratio, 17-20x earnings is an earnings yield of 5% to 5.8%. If you can earn the same return by investing in cash (or municipal bonds) that you can by investing in businesses, then why bother? To this point, if you can do nothing and earn the same as buying a business, the businesses are probably overvalued. There’s some argument that inflation will increase earnings, but that argument spectacularly failed in the 1970s, when inflation was great at increasing revenue but terrible at increasing earnings. Then, stock prices fell well over 50% in real terms – not in a dramatic crash like 2008, but as death by a thousand cuts. Stagflation is a cruel mistress.

Bottom Line

A 5% interest rate on cash is not consistent with a PE ratio for stocks at the high end of their historical average. Cash looks good here. Intermediate-term Treasury bonds look a lot better than they did with rates continuing to press higher, but I think rates will go higher still. Investors in high tax brackets might look at municipal bonds for real return. Take a look at funds like Vanguard’s High-Yield Municipal Fund (VWALX), and/or think about parking some money in Treasury bills to avoid fighting the Fed. There will always be special situations where you can put a little money into, such as merger arbitrage like Activision (ATVI), or litigation plays like the Grayscale Bitcoin Trust (GBTC). And truth be told, some blue-chip companies like Google (GOOGL), Microsoft (MSFT), and Morgan Stanley (MS) are offering enough long-term compensation for investors at current prices. Alibaba (BABA) is a controversial punt you can make on an extremely cheap tech stock- I bit off some and all I have to show for it is tax losses. But for the market at large, and especially for the hundreds of companies that built their entire business model around 0% interest rates, it’s going to be a long couple of years. For companies that are outside of the S&P 500 and have a profitability screen like iShares mid-cap fund (IJH) and small-cap fund (IJR), the situation is better. You should own some stocks here, but I wouldn’t bet too much on them unless valuations come down. With interest rates on cash rapidly rising, why bother taking much risk?

Be the first to comment