Zach Gibson/Getty Images News

Berkshire Hathaway’s (NYSE:BRK.A) (NYSE:BRK.B) conglomerate nature means that any investors in the company need to work hard to value its independent components. Every so often, however, they get a golden nugget in that quest. As we’ll see throughout this article, Berkshire Hathaway Energy’s undervalue is a sign of overall value in the portfolio.

The Acquisition

Vice Chairman Greg Abel, the next leader of Berkshire Hathaway should Warren Buffett pass, originally started off at Berkshire Hathaway Energy (MidAmerican Energy) in 1992. He became MidAmerican’s chief in 2008 and has since moved up the ranks at Berkshire Hathaway. Throughout that time he got a personal 1% stake in Berkshire Hathaway Energy.

In the most recent quarter, Berkshire Hathaway purchased that 1% stake for $870 million from Greg Abel. Interestingly enough, the company took a $362 million charge, affected by the difference between the price it paid and the value in its books for the overall company at just over $50 billion. Putting this together, Berkshire Hathaway now owns a 92% stake.

The billionaire Walter Scott owns the remaining 8% stake. That stake moved to his family when he passed away September 2021. The acquisition implies that that stake is worth ~$7 billion and with the stake moving to his family, there’s a chance Berkshire Hathaway might move for full ownership. We’d love to see it happen.

There’s a takeaway though of how undervalued components of the conglomerate are. That $362 million charge implies a more than $30 billion discount on the company’s 92% stake versus what it’d be willing to pay for it today. That discount is a sign of the overall value to be found in the company’s substantial portfolio.

Berkshire Hathaway Energy Overview

Berkshire Hathaway Energy has long been one of our favorite components of the company, with significant potential.

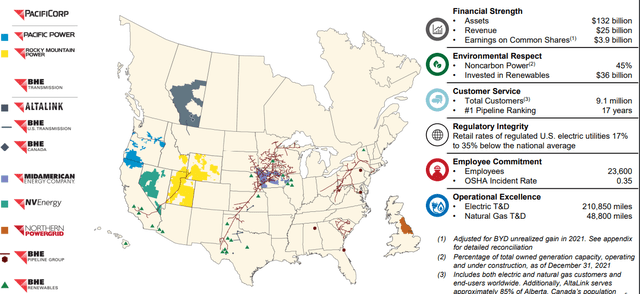

Berkshire Hathaway Energy Investor Presentation

Berkshire Hathaway Energy – Berkshire Hathaway Investor Presentation

Regardless of whether or not you pay attention to the evidence behind climate change, there’s no denying that the energy markets are changing. In many markets, such as the southwest United States, solar and wind are cheaper even counting the storage systems. That transition is expected to continue as prices go down.

At the same time, there’s massive energy investment that’s needed into the grid. Berkshire Hathaway Energy is leading that path. The business has $132 billion in assets, $25 billion in revenue, and $4 billion in earnings. The company’s annualized FCF is ~$6 billion, which in our view comfortably justifies a $87 billion valuation.

The company is planning to spend almost all of this capital on growth investments. The company took advantage of weakness in the crude markets to make several opportunist investments. If rising interest rates provide more weakness, we’d like to see the company take advantage. We felt PG&E was an opportunity, but the capital requirements were too high for comfort.

Regardless, Berkshire Hathaway Energy is an example, along with the company’s share buybacks, of how the company’s book value for assets is much less than their true value.

Berkshire Hathaway Earnings

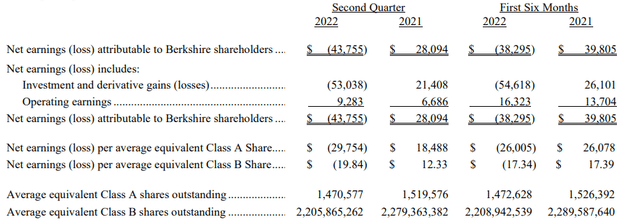

The company recently reported 2Q 2022 earnings, incredibly strong earnings for the company despite a tough market.

Berkshire Hathaway Earnings – Berkshire Hathaway Press Release

The company’s operating earnings were $9.3 billion although that includes $1.1 billion on non-U.S. denominated debt as a result of foreign currency changes. As a result, true earnings for comparison were roughly $8.1 billion, still a YoY increase of roughly 20%. That strength in earnings came across the board for the company in a variety of operating assets.

Annualized, the company’s true operating earnings are roughly $32 billion. That’s massive for a company with a $350 billion current portfolio value and just over $100 billion in cash trading at a $650 billion valuation. It means the company’s operating businesses are valued at roughly $200 billion or a P/E of roughly 7.

Our View

Berkshire Hathaway is back in business.

The company bought Alleghany Corporation in late-March in an almost $12 billion acquisition. That was the largest acquisition since 2016. The company still repurchased another $1 billion of shares in the quarter, and YoY the company’s outstanding shares is down almost 4%. That’s a number we’d like to see consistently come down.

The company currently has a 20% stake in Occidental Petroleum. As discussed here, we see high potential of an acquisition offer coming in, however, we think Berkshire Hathaway is playing in the volatility, hoping to come in at less than $60 / share. The non-owned stake of the company is more than $40 billion still, something it can comfortably afford.

The company made several opportunistic investment during the oil downturn and continues to have significant cash. Additional weakness in the markets is simply additional opportunity. Overall, we believe the company is significantly undervalued, as it continues to buyback shares, making it a valuable long-term investment.

The company is a great place to park your retirement cash, looking for long-term returns.

Thesis Risk

The largest risk to our thesis is that historically as far as conglomerates go, Berkshire Hathaway has been fairly concentrated. That’s evidenced in the company’s more than $40 billion official earnings for the quarter when taking into account earnings drops. Apple makes up 25% of the company’s entire valuation.

That means underperformance in these few component companies could hurt the company’s long-term performance.

Conclusion

Berkshire Hathaway just reported earnings, and in the midst of the company’s earnings report was the fact that the company increased its stake in Berkshire Hathaway Energy by 1% for $870 million. That acquisition showed that Berkshire Hathaway Energy was worth $30 billion more than it was listed on the company’s balance sheet.

Berkshire Hathaway Energy has the FCF to justify that valuation and the company has significant overall growth potential. Berkshire Hathaway as a whole has started making additional acquisitions to highlight its strength. We see Occidental Petroleum as a likely future one. Putting this together, we recommend investing in Berkshire Hathaway for the long run.

Be the first to comment