Vladimir Zakharov

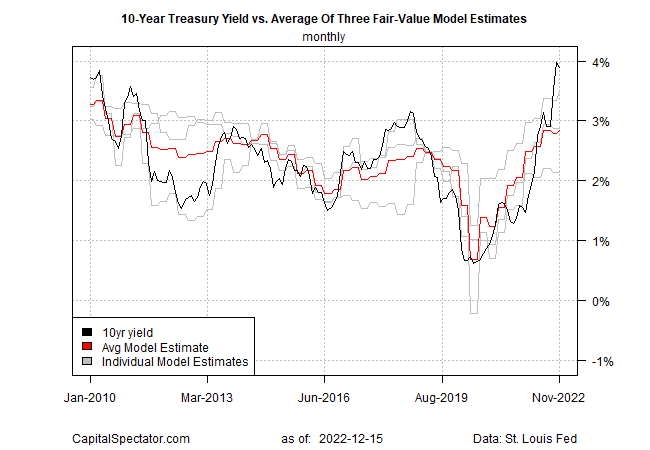

The US Treasury 10-year yield continues to look elevated relative to CapitalSpectator.com’s “fair value” estimate, which is based on the average of three models. That’s no assurance that the market will trim the benchmark yield, but current conditions still suggest that the odds appear skewed to a neutral/downside outlook for this rate.

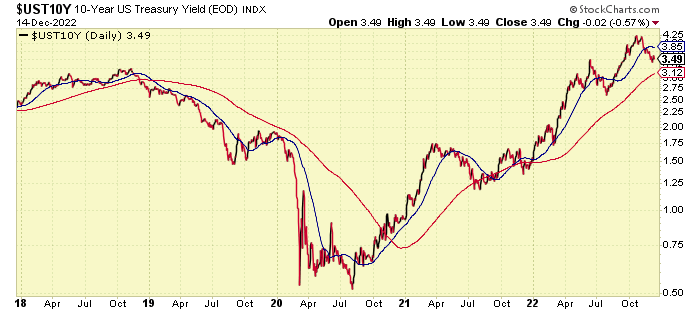

The recent slide in the 10-year yield offers support for thinking that we’ve seen the peak for this key rate for this cycle. The rate slipped to 3.49% in yesterday’s trading, close to the lowest level since the previous peak – 4.25% in late October. The subdued economic outlook for the US, with the possibility of a recession, is a factor weighing on yields.

But the future’s still uncertain, and so a critical question is whether markets are misjudging the Federal Reserve’s determination to raise interest rates for longer than the crowd expects. The central bank, following its 50 basis points rate hike yesterday, appears to be winding down its policy tightening efforts. The 1/2-point rise contrasts with the string of 75 basis points increase the Fed has implemented this year. But with the Fed’s inflation-fighting credibility on the line, it’s not unreasonable to wonder if the central bank will raise and hold interest rates higher for longer than expected.

“You hear the mantra, ‘Don’t fight the Fed,’ but at the moment, the market is willing to fight the Fed,” says Stephen Stanley, Chief Economist at Amherst Pierpont Securities. “It’s an interesting dissonance that creates a risk for the market.”

Nonetheless, today’s fair value estimate suggests that the outlook for the 10-year rate is flat to lower. That’s been the case for several months (see last month’s update, for example). Today’s revision shows the market rate, for a second straight month, is more than a percentage point above the fair value estimate, based on data through November.

In other words, the model is forecasting that the market yield will 1) decline, 2) macro conditions will adjust to lift the fair value estimate, or 3) some combination thereof. Alternatively, the model, which uses the average of three models, is wrong.

In fact, the average estimate is always “wrong” in some degree. The value here is that when the market rate swings relatively wide of the average estimate, there’s a stronger case for expecting the gap will close in the near term. That’s been true in the past, and it’s reasonable to assume a repeat performance is likely. The mystery, as always, is timing and the conditions that will lead to a smaller spread.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment