Sundry Photography

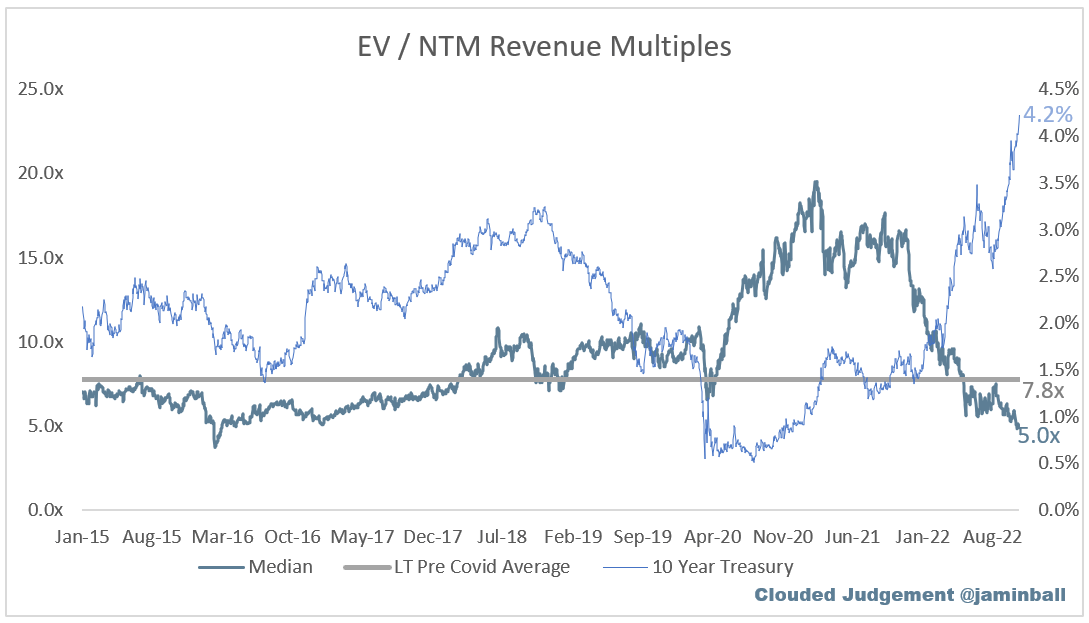

It hasn’t been a good year for software company investors. 2020 and the first part of 2021 saw unprecedented stock price advances for cloud software companies as significant growth was pulled forward due to the pandemic. Since that time, these companies have been crushed. Take a look at these valuations below, graph courtesy of Jamin Ball’s Clouded Judgement Substack:

Clouded Judgement Substack

Notice the gray line in the middle as the long term pre-covid average valuation for software-as-a-service cloud companies. The average company is now trading back below the average valuation before all of the craziness began.

The company I would like to highlight today is among the stalwarts of the cloud space, ServiceNow (NYSE:NYSE:NOW). This company is not necessarily as well known as many others, but is in the same league as Salesforce (NYSE:CRM), Adobe (NYSE:ADBE) and other similar large cap software names in my opinion.

The Business

NOW took many old-line companies by surprise when it was founded in 2004, like IBM (NYSE:IBM). It’s a similar story to other cloud companies that were able to accomplish the same or better job for an enterprise with little to no on-site infrastructure and thus lower cost. Additionally, cloud companies are able to onboard much more quickly, in general, and depending on the customer still provide similar personalization to the product.

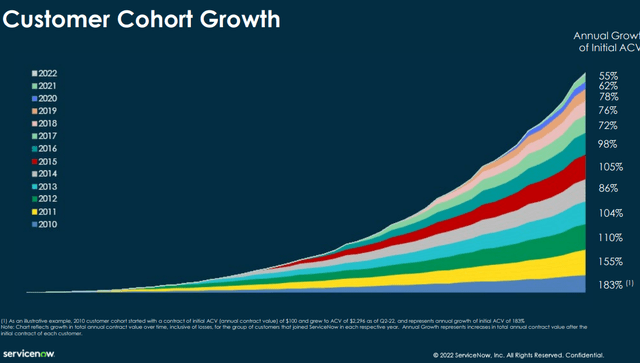

Cloud software is built on a land-and-expand model, where one product gets their foot in the door, and once the customer is well integrated, they subscribe to more and more over time. Take a look at the graph below, showing where NOW derives its revenue.

Notice customers from 2010 continue to grow their footprint in the company’s revenue breakdown. I’ll discuss what ACV is a little later in the article.

NOW started as basically a tech help desk function, automating employee’s IT needs and getting tickets to the right person in the IT department. From there, the company has ballooned its offerings across the enterprise. In IT, the company offers automation of workflows in both IT Services and Operations by providing visibility and reducing time on administrative tasks for its customers. Additionally, the company has grown with automation of HR onboarding for new employees, customer automation of front-end customer requests like password resets, etc., and created an app store allowing customers to generate their own low-code solutions inside the NOW platform.

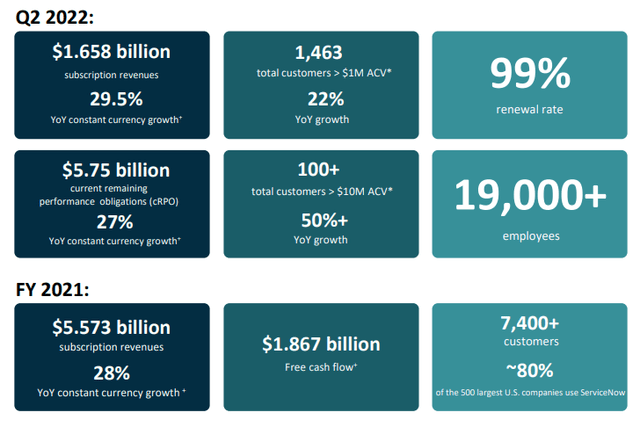

These solutions are very sticky, and NOW’s target audience among the largest companies in the world provides a significant stability to the company over the long-term as those companies are less likely to fail or want to change when something is working. NOW boasted a 99% customer retention in the most recent quarter, and has historically maintained a 97-99% figure over the long-term.

Over 75% of customers buy more than one product, and 85% of new business for the company comes from existing customers. Adding on to that, average contract value on average doubled in the last three years. These metrics show why SaaS companies have historically commanded the multiples they do, considering the revenues are predictable and grow quickly.

Tech buzzwords and industry specific performance metrics

One thing you may notice as you start looking at these SaaS companies is the love of industry-specific metrics and buzzwords. It drives me crazy at times, and not all companies define the metrics the same way. I am going to just define a few below from sources throughout the internet to aid you in looking at some of the data below.

ACV – Annual Contract Value – average annual contract value of your account subscription agreements. For companies that also charge one-time fees in conjunction with recurring fees, the first-year ACV might be higher than later-year ACVs in a multi-year contract.

ARR – Annual Recurring Revenue – the value of recurring revenue of a business’s term subscriptions normalized to a single calendar year.

RPO (C in front means current) – Remaining Performance Obligations – represents the total future performance obligations arising from contractual relationships. More specifically, RPO is the sum of the invoiced amount and the future amounts not yet invoiced for a contract with a customer.

I think that’s all that I want to cover here, but trust that there are more, and it’s important to look at disclosures whenever possible to understand what exactly the company is trying to show you.

Recent Company Performance

NOW’s most recent quarter showed little signs of slowing down for the company. Subscription revenue growth accelerated by 3% to 29.5% on a constant-currency basis. RPO grew 27% constant-currency, and customer counts were solid with 22% growth in customers over $1M ACV and 50% growth over $10M.

Projections from the most recent earnings call:

Primarily to reflect the incremental $87 million headwind we’re seeing from FX since the end of March, we now expect subscription revenues between $6.915 billion and $6.925 billion, representing 24% year-over-year growth. That’s 28% growth on a constant currency basis in line with the original outlook that we provided in January. We continue to expect subscription gross margin of 86%, up 100 basis points year-over-year. We continue to expect an operating margin of 25%, as we currently plan to offset an approximate one point impact from FX with operational efficiencies and disciplined spend management. We will continue to monitor FX rates over the next couple of quarters.

FX headwinds will continue to affect the company as the dollar maintains its strength, and there will likely be some recessionary pressure on contracts as companies potentially feel the pinch and may not choose to expand their offerings. Management is holding firm on projections for $11B in ARR by 2024 and $16B in 2026, which are solid goals considering a total of $5.5B in 2021.

One thing to consider as you look across the landscape in a bear market. NOW serves large companies across the entire landscape of the market. Although they may see some slippage in growth on broad pain in the economy, companies are typically loath to cut technology budgets. Once NOW is integrated with their workflows, switching or trying to build solutions in-house can cause considerable churn in lost productivity. This fact makes many of these B2B SaaS companies somewhat defensive and insulated heading into a time of market uncertainty.

Another thing to look for moving forward is increased competition. NOW competes with some of the heavyweights in the tech space, and as the company continues to expand its offerings, it could edge in further into competitor’s spaces. One spot in particular to monitor would be the customer segment, which is historically dominated by CRM.

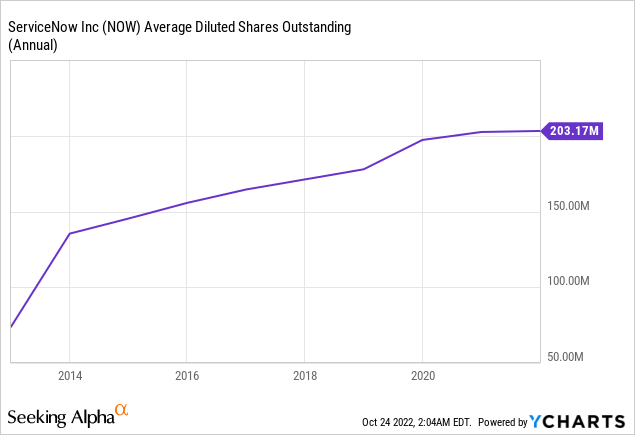

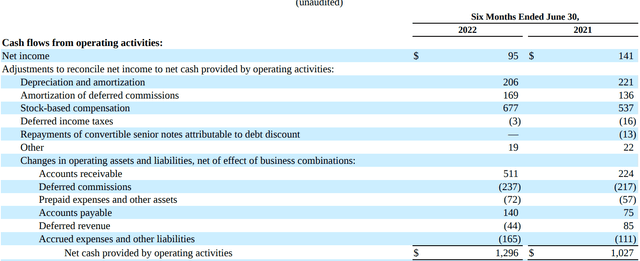

Many cloud companies caught up in the excitement have adopted some pretty poor shareholder practices, most notable significant stock-based compensation as a recurring expense clouding (no pun intended) profitability metrics for prospective investors. NOW’s share count has slowed its meteoric rise from its early days as a public company. I’ve captured the 10-Q below, and in the most recent 6 months ended June 2022, stock-based compensation was accounted for at $677M, with 1.4M shares issued and 600K from settlement of warrants. The company is currently carrying $5.4B in cash with $1.6B in debt on the balance sheet, and generates sufficient free cash flow with a projected margin of 30% to continue to fund growth.

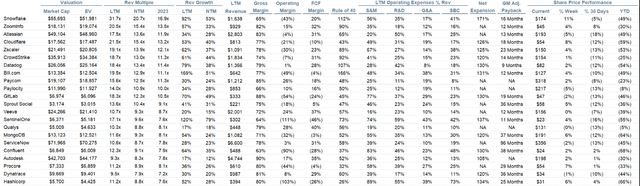

To put some perspective on the share based compensation, it’s not something I like to see, and it is rampant across the technology sector, more so with the high-flying unprofitable companies. Pulling again from the Clouded Judgement Substack, NOW’s SBC accounts for 19% of revenues. Snowflake (NYSE:SNOW) sits at 41%, Palantir (PLTR) is at 38%, ADBE only 8%. NOW’s SBC levels are right around the median of 22% for this stage of growth.

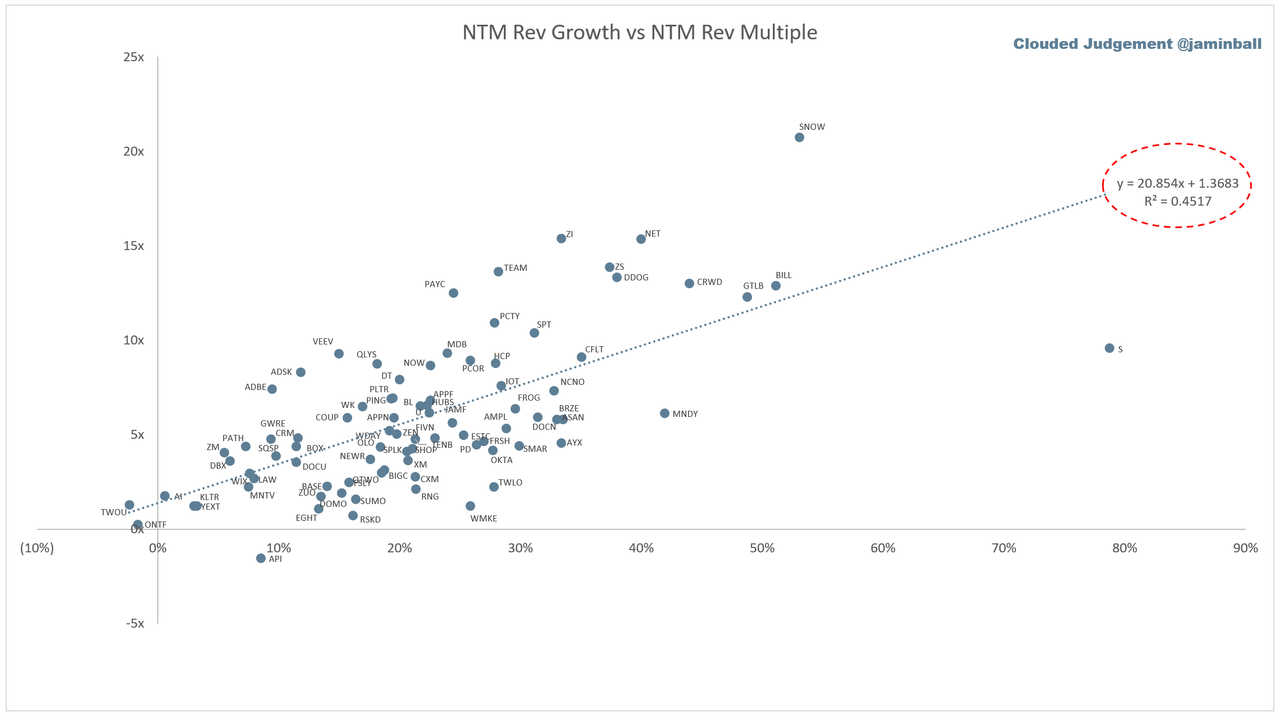

Clouded Judgement Substack

Looking across the landscape, I’ve attached a couple more useful metric comparisons from Clouded Judgement. NOW is sitting slightly above the median valuation when comparing revenue growth to the company’s price to revenue multiple. It’s similarly priced to ADBE and CRM, and I think it’s likely that the company’s profitability and relative stability garner a premium to some of the unprofitable names its compared to above.

Looking at the chart below, key metrics are listed against some peers. Note that NOW comfortably meets the Rule-of-40, and management has set their bar at the Rule-of-60, which is defined as the revenue growth rate added to the FCF margin greater than 40%.

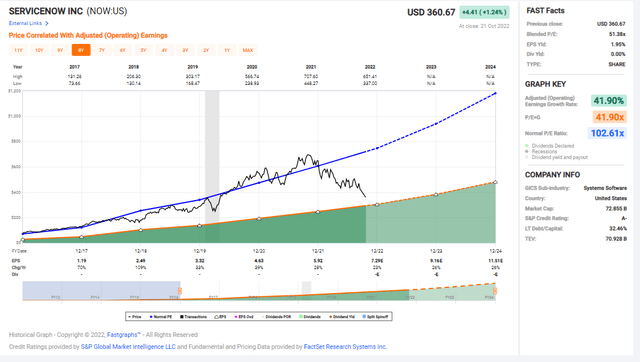

Clouded Judgement Substack FASTGRAPHS

Since the company is profitable, I’ll include the FAST graph here. Based on the company’s longer-term valuation, the company is trading well off. It’s approaching a multiple more in line with its actual earnings growth rate, and is currently right around 51X blended P/E. With these high-growth companies, there is a ton of uncertainty when applying a valuation. Looking at the cloud landscape, the companies are trading below their long-term mean from pre-COVID. NOW is trading relatively in-line with peers considering its growth rates, and is a strong defensive software company, well entrenched across the largest companies in the economy. Morningstar assigns a fair value estimate of $675 per share, putting the company at about 53% of fair value currently. I think the company may face some recessionary pressures in its growth rates, but it’s going to come out of this market stronger than it went in in my opinion. I’ve owned shares since 2018 and I am continuing to add here.

Disclaimer: This article is for informational purposes only and represents the author’s own opinions. It is not a formal recommendation to buy or sell any stock, as the author is not a registered investment advisor. Please do your own due diligence and/or consult a financial professional prior to making investment decisions. All investments carry risk, including loss of principal.

Be the first to comment