Nina Shatirishvili

Investment Thesis

Gambling.com Group Limited (NASDAQ:GAMB) is in the advertising industry. They recently announced solid quarterly results. In this thesis, I will analyze their quarterly results and give my opinion on their future growth potential. They are currently trading at a discounted price 47% below their all-time high, providing us with a great buying opportunity.

About GAMB

GAMB is a marketing company that provides digital marketing services for sports betting and igaming. The company was founded in 2006 and is based in Jersey. They own and operate over 50 websites across 15 international markets covering all aspects of the gambling industry and sports betting. They have offices in the U.S., Ireland, and Malta, through which they operate their wide portfolio of websites like Bookies.com and RotoWire.com.

Financial Analysis

GAMB recently posted its Q3 FY22 results, and in my view, it’s pretty impressive. They beat the market revenue estimates by 13.4% and the market EPS estimate by a staggering 20%. The reported revenue for the Q3 FY22 was $19.6 million, an increase of 94% compared to the Q3 FY21. I think the main reason behind this increase was the launch of a new marketing website named Gambling.com for the North American market, due to which their revenue in North America rose by 300% year-over-year to $9.1 million, and overall, its new depositing customers grew by 152% in the Q3 FY22. The net income for the Q3 FY22 was $2.2 million, a decrease of 52% compared to the Q3 FY21. I think the main reasons behind this decrease are the company’s heavy spending on marketing, sales, and the development of the new websites. In my opinion, this heavy spending is paying off for them because not only did their revenue rose in the newly growing market of North America, but they also reported a record quarterly revenue in the mature markets of the U.K. and Ireland.

They reported adjusted EBITDA of $6.4 million for the Q3 FY22, an increase of 32% compared to the corresponding quarter of last year and the most impressive aspect of this quarter was the increase in the free cash flows the reported free cash flow for the Q3 FY22 was $4.89 million, an increase of 549% compared to the Q3 FY21. In my opinion, the financial performance of GAMB in Q3 FY22 has been excellent, and they are on the right growth trajectory.

Technical Analysis

GAMB is currently trading at the level of $9. After making an all-time high of 17$ in November 2021, the stock has been in a downtrend, and since then, the stock has been making lower highs and lower lows formation in a daily time frame. But it broke the structure in November 2022 and formed a new high, which indicates that there might be a trend change very soon. Now the stock is taking support from the 200 ema, and I think it is ready for a big move. In my view, the stock can rise up to 40% in three months’ time frame, and if it breaks the level of $13 in the daily time frame and if it sustains above, it then we can see the stock reaching its all-time high of $17.

Should One Invest In GAMB?

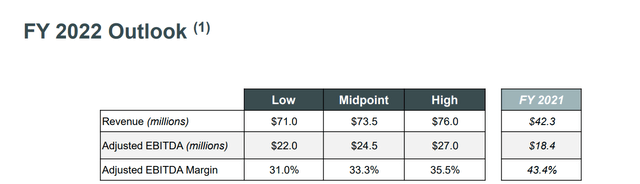

Above is the FY22 outlook; if we take the midpoint of the FY22 revenue estimate of $73.5 million and compare it to FY21 revenue, we can see an increase of 73.7%. The estimated adjusted EBITDA of FY22 is also 33% higher than the FY21 EBITDA. This shows the future growth potential of the Company. The management is very positive and confident that they will achieve their estimated targets and will continue to do better in the future. Elias Mark, CEO of GAMB, commented,

Our third quarter revenue and Adjusted EBITDA were ahead of analyst consensus estimates. We remain focused on investing in the business in a disciplined manner as we prioritize growth that delivers positive Free Cash Flow. The Company remains well capitalized and in a strong position to meet our 2022 full year outlook and to generate continued growth in 2023 and beyond.

I think they will achieve the given targets considering the steps taken by them like their successfully launched operations in Kansas, their websites like BonusFinder.com, RotoWire.com, and Gambling.com doing well, generating more revenues than expected, plus they saw a 20% rise in new depositing customers on a quarterly sequential basis.

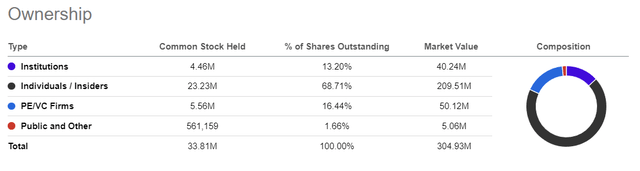

Now talking about the shareholding pattern of GAMB. The institutions hold only 13% of the stake in the company, which could be a matter of concern because, generally, companies where institutions hold the majority of the stake is considered safe for investment purpose. The majority of the stake in GAMB is owned by Individuals/Insiders. They own 68.7% of the shares in the company. But amidst all this, the board of directors have approved a share repurchase program. In this, they will purchase ordinary shares worth $10 million in open market transactions which is a positive sign which shows the management’s trust in the company.

They have a revenue growth (YOY) of 54.73% and revenue 3 year (CAGR) of 52.65%. The EPS diluted 3 year (CAGR) of 105%. The growth segment also looks decent. In my opinion, the company looks very promising considering all the aspects.

Risks

Reliance On Few Customers

They derive a majority of their revenues from its top ten customers. In 2021 the top ten customers accounted for 52% of their revenue. In 2020 and 2019, these numbers were 55% and 56%, respectively. This is a major cause of concern because the loss of these customers could severely impact the company’s revenues. The high dependence could affect the company’s financial performance in the future. They have managed this risk efficiently so far and are consistently expanding their client base to counter this risk.

Bottom Line

In my opinion, I think GAMB is a perfect buying opportunity right now. Improving financial performance with every quarter and management’s positive guidance for FY23 show their potential. The new depositing customers are also increasing every quarter, which will increase its revenue. After analyzing all the factors, I assign a buy rating on GAMB.

Be the first to comment