Igor Kutyaev

Investment Thesis

When aiming to invest for your retirement, you should pay particular attention to dividend growth stocks. Having in your investment portfolio a diversified number of attractive dividend growth stocks allows you to significantly increase the dividend you receive from the companies year after year.

In this analysis, I have selected 10 attractive dividend growth stocks for you, that I consider to be particularly attractive when investing with a long-time horizon.

The companies I have selected have the following characteristics in common:

- High market capitalization

- Strong competitive advantages that help to build an economic moat over its competitors

- High financial strength

- High profitability

- Relatively high Dividend Growth Rate over the last 5 years

- A relatively low Dividend Payout Ratio to leave enough scope for future dividend enhancements

The 10 dividend growth stocks I have selected are as follows:

- Visa (NYSE:V)

- Apple (NASDAQ:AAPL)

- Nike (NYSE:NKE)

- Johnson & Johnson (NYSE:JNJ)

- McDonald’s (NYSE:MCD)

- Microsoft (NASDAQ:MSFT)

- Unilever (NYSE:UL)

- JPMorgan (NYSE:JPM)

- Allianz (OTCPK:ALIZF)

- LVMH (OTCPK:LVMHF, OTCPK:LVMUY)

Visa

In my previous analysis on Visa, I showed the large amount of competitive advantages the company has over its competitors: I mentioned its strong brand image, high number of credit and debit cards, reliable payments network, as well as its technological knowledge and strong network within the Financial Service Industry.

Over the last 10 years, Visa has shown a Dividend Growth Rate [CAGR] of 21.16%. In addition to that, the company has produced an Average EPS Diluted Growth [FWD] Rate of 16.29% over the last 5 years, thus strengthening my belief that it’s an excellent pick for dividend growth investors.

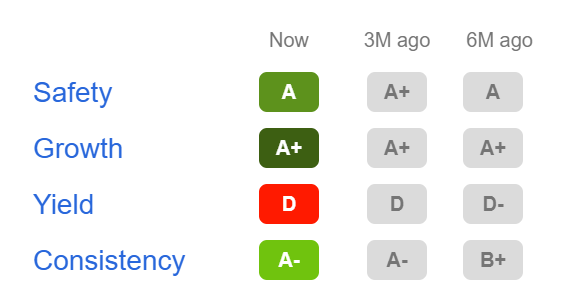

Taking into account the Seeking Alpha Dividend Grades, we get further evidence that Visa is a must have stock for dividend growth investors: for Dividend Safety, Visa receives an A rating, for Dividend Growth, an A+ and for Dividend Consistency, it gets an A-. These ratings once again underline my theory that the company is an excellent pick for dividend growth investors.

Visa according to the Seeking Alpha Dividend Grades

Source: Seeking Alpha

Apple

Apple is the largest position of my own investment portfolio and I consider the company to be an excellent pick for dividend growth investors. Apple has shown a Dividend Growth Rate [CAGR] of 17.00% over the last 10 years, indicating that the company is a very attractive dividend growth stock. It shows a Return on Equity of 175.46%, manifesting that the company is highly efficient in using shareholder’s equity in order to generate income.

In my previous analysis on Apple, I demonstrated the large number of competitive advantages the company has over its opponents: its own ecosystem, its strong brand image, customer loyalty and its broad and diversified product portfolio. I expect that these competitive advantages will contribute to the company being able to significantly raise its dividend in the years to come.

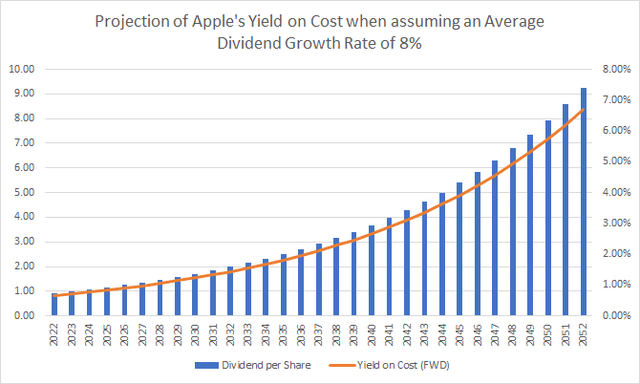

Below you can see the projection of Apple’s Yield on Cost when assuming that you would invest in the company at its current stock price and also assuming an Average Dividend Growth Rate of 8%:

Nike

The world’s leading sporting goods manufacturer Nike (in terms of market capitalization, revenue and brand value) has strong competitive advantages and a wide economic moat: its strong brand image and endorsements with the world’s most valuable athletes and sports teams are among the company’s competitive advantages that I expect to serve as growth drivers in the years to come.

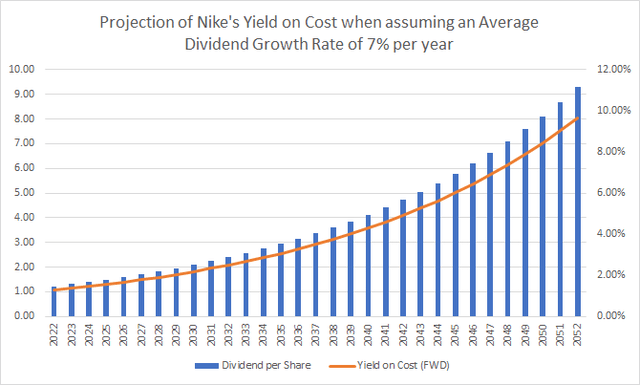

Nike has shown a Dividend Growth Rate [CAGR] of 12.98% over the last 10 years. Its EBIT Growth Rate [FWD] of 15.58% provides further evidence that the company is on track when it comes to growth.

Illustrated below is the Yield on Cost for Nike when assuming an Average Dividend Growth Rate of 7% per year for the company.

Johnson & Johnson

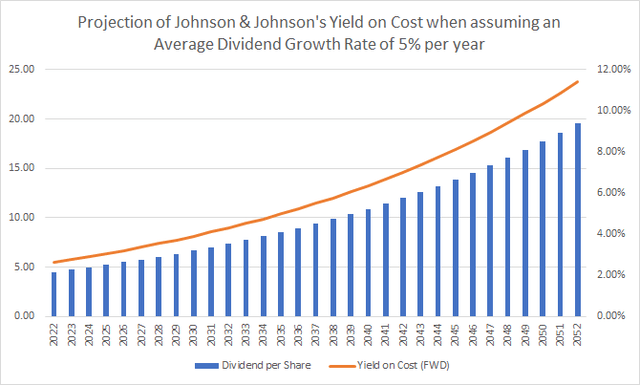

Johnson & Johnson is one of the world’s healthiest companies: it is rated with an Aaa credit rating by Moody’s and its Total Cash & ST Investments are currently $34,079M. The company has a Dividend Payout Ratio of only 44.06%, demonstrating that there is plenty of scope for future dividend enhancements.

In addition to that, it can be highlighted that Johnson & Johnson has raised its dividend for 59 years in a row, thus increasing my confidence that the company will be able to do the same over the next decade. With a P/E [FWD] Ratio of 21.59 (the P/E Ratio of the sector median is 23.92), I consider the valuation of Johnson & Johnson as attractive. Particularly when taking into account the company’s strong financials and its broad diversified product portfolio when compared to its competitors.

Johnson & Johnson has shown a Dividend Growth Rate [CAGR] of 6.38% over the last 10 years. Below you can find a projection of the company’s Yield on Cost when assuming an Average Dividend Growth Rate of 5% per year:

McDonald’s

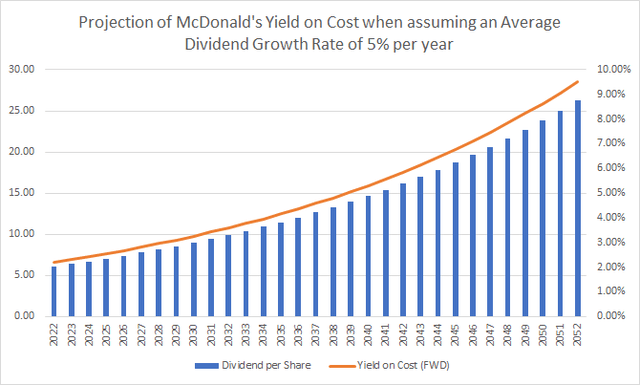

McDonald’s is ranked as the 36th most valuable brand in the world according to Brand Finance and the company’s enormous profitability is underlined by its EBIT Margin [TTM] of 37.41%. McDonald’s has shown a Dividend Growth Rate [CAGR] of 7.02% over the last 10 years, strengthening my belief that it’s an excellent pick for your retirement portfolio. Its strength in terms of growth is underlined by its Average EPS Diluted Growth Rate [FWD] of 10.00% over the last five years. It is also underlined by an Average Free Cash Flow Per Share Growth Rate [FWD] of 13.04% over the last five years.

Below you can find the projection of McDonald’s Yield on Cost when assuming an Average Dividend Growth Rate of 5% per year, demonstrating that the company can be considered an appealing choice for dividend growth investors:

Microsoft

In my analysis on Microsoft, I demonstrated why I currently consider the company to be a strong buy: Microsoft has strong competitive advantages, such as its broad and diversified product portfolio, strong brand image, growing cloud business as well as its own ecosystem and enormous financial strength. In addition to that, I consider Microsoft’s valuation to currently be attractive, particularly when taking into account its EBIT [FWD] Growth Rate of 16.77% over the past five years. At this moment in time, Microsoft has a P/E [FWD] Ratio of 23.18.

The company’s Dividend Payout Ratio of 27.37% shows that there is enough room for future dividend enhancements, proving that it’s an excellent pick for dividend growth investors. Furthermore, Microsoft has shown a Dividend Growth Rate [CAGR] of 11.98% over the last 10 years.

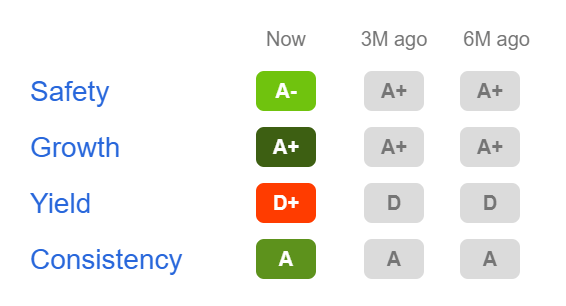

According to the Seeking Alpha Dividend Grades, Microsoft is rated with an A- rating in terms of Dividend Safety and an A+ for Dividend Growth. For Dividend Consistency, the company receives an A.

Microsoft According to the Seeking Alpha Dividend Grades

Source: Seeking Alpha

Microsoft’s excellent rating as according to the Seeking Alpha Dividend Grades strengthens my belief that the company is an excellent pick for dividend growth investors that aim to invest for their retirement.

Unilever

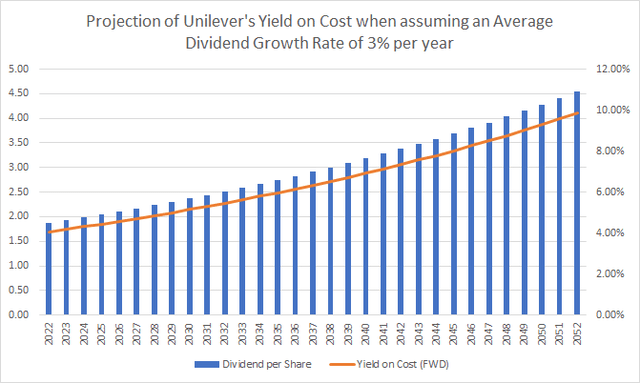

Unilever is one of the world’s leading consumer goods companies with a broad and diversified number of products in its portfolio. At this moment in time, Unilever has a dividend yield [TTM] of 4.05%. Furthermore, the company has shown a Dividend Growth Rate [CAGR] of 4.42% over the past 10 years. Its high EBIT Margin of 17.50% is far superior than its sector median (8.48%), suggesting the strong competitive position Unilever has in the Personal Products Industry.

When investing at Unilever’s current stock price and assuming an Average Dividend Growth Rate of 3% for the company in the following 30 years, the Yield on Cost would be the following:

JPMorgan

JPMorgan is one of the global leaders in financial services and, at the same time, among the world’s most valuable brands. The bank shows a Dividend Growth Rate [CAGR] of 13.28% over the last 10 years. JPMorgan’s strength in terms of growth is further underlined by the company’s Average EPS Diluted Growth [FWD] Rate of 10.15% over the last five years. At the time of writing, JPMorgan has a dividend yield [FWD] of 3.11% and a dividend payout ratio of just 33.78%, leaving plenty of room for future dividend enhancements.

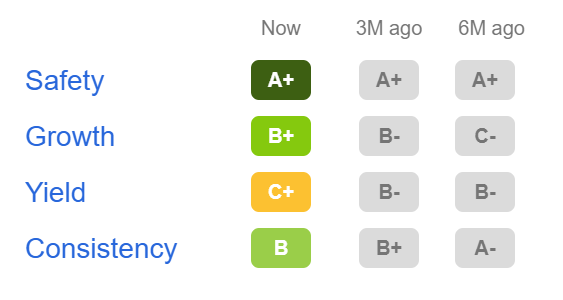

When taking into account the Seeking Alpha Dividend Grades, we get further evidence that JPMorgan is an excellent choice when investing for retirement: in terms of Dividend Safety, it is currently rated with an A+. For Dividend Growth, the bank gets a B+ rating and for Dividend Consistency, it gets a B.

JPMorgan according to the Seeking Alpha Dividend Grades

Source: Seeking Alpha

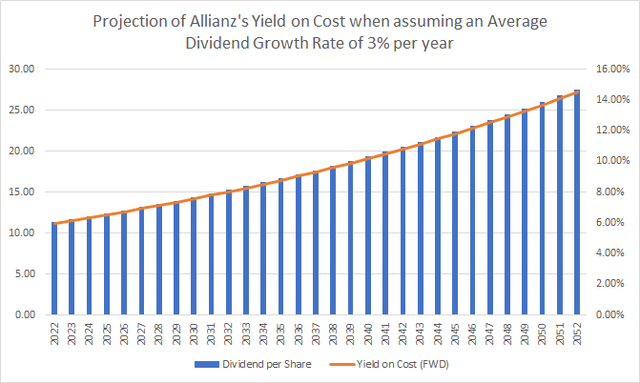

Allianz

Allianz is among the largest insurance companies in the world when considering market capitalization ($75.56B) and revenue ($112.35B). According to Brand Finance, the German insurance company is ranked as the 30th most valuable brand in the world.

I consider Allianz to be an excellent investment in terms of risk and reward due to the company’s strong competitive advantages (such as its strong brand image and global presence) and its financial strength (credit rating of Aa3 by Moody’s). Allianz has shown an EBIT Growth Rate [FWD] of 4.20% over the last five years, indicating that it is on track when it comes to growth. Additionally, the company shows a Dividend Growth Rate [CAGR] of 6.88% over the past 10 years.

In the graphic below you can see the company’s Yield on Cost when assuming an Average Dividend Growth Rate of 3% in the following 30 years:

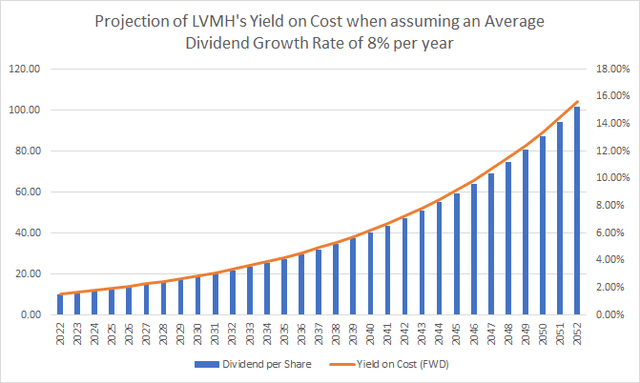

LVMH

LVMH is currently the largest apparel company in the world as according to the Forbes Global 2000 list. LVMH’s EBIT Margin of 27.29% is evidence of its strong competitive position within the Apparel, Accessories and Luxury Goods Industry. The company’s Return on Common Equity of 29.48% demonstrates the company’s efficiency to generate income from shareholder’s equity. LVMH has shown an EBIT Growth Rate [FWD] of 15.28% over the last five years, demonstrating that it’s on track in regards to growth. Furthermore, LVMH’s Dividend Growth Rate [CAGR] over the last 5 years has been 22.13%, underlying once again that the company is doing well in terms of growth.

In the graphic below you can see LVMH’s Yield on Cost when assuming a Dividend Growth Rate of 8%:

The graphic once again strengthens my belief that LVMH is a great pick for investors when looking for an attractive dividend growth stock and investing for retirement.

Conclusion

When investing with a long investment-horizon, it is important to carefully analyse and select the companies in which you aim to invest in. A company that is able to continuously raise its dividend will help you to significantly increase the dividend payments that you receive year over year.

In this analysis I have selected 10 companies for you that meet different criteria: the selected companies have a high market capitalization and strong competitive advantages. In addition to that, they have a high Dividend Growth Rate over the past five years as well as a relatively low Dividend Payout Ratio to leave enough scope for future dividend enhancements. This makes them attractive choices when investing for retirement, while having a long-investment horizon.

Be the first to comment