Marina113/iStock Editorial via Getty Images

Article Thesis

TotalEnergies (NYSE:TTE) is an underfollowed oil and gas supermajor that trades at an inexpensive valuation and that offers hefty shareholder payouts that could climb further going forward. Its American peers receive a lot more attention, but this French company could be a significantly better performer in the future.

TotalEnergies Benefits From A Strong Macro Environment

The world is experiencing an energy crisis. Many companies have cut back their investments since the 2015/2016 oil price crash, and especially so during the pandemic years. ESG mandates and government regulation have also made it more difficult for energy companies to grow their production. At the same time, demand for oil and natural gas continues to grow, despite the fact that many countries try to become “greener” and reduce their fossil fuel consumption. The EIA estimates that global oil consumption will hit a new record high next year with demand growing by around 2 million barrels per day versus 2022, as reported here on Seeking Alpha. With demand continuing to grow while supply is under pressure, oil prices will likely remain elevated, I believe. With China potentially opening up its economy again, and with SPR releases likely ending soon, there are factors that could drive oil prices to even higher levels going forward.

That makes for a great environment for energy companies, especially for those that are active across different sub-sectors, such as natural gas and LNG (to benefit from very elevated prices in Europe), and refining, as high crack spreads make refining an ultra-profitable business to operate in right now. That holds true for TotalEnergies and its supermajor peers BP (BP), Shell (SHEL), Chevron (CVX), and Exxon Mobil (XOM). TotalEnergies, based in France, is likely the least-followed among these five and does not receive a lot of attention, especially versus its two American peers CVX and XOM.

TotalEnergies: Strong Results, High Shareholder Returns, And A Great Balance Sheet

The macro environment allows TotalEnergies to operate extremely profitably, which was again showcased by the company’s very recent quarterly results. The company was able to grow its revenue by a compelling 32% year over year on the back of higher oil prices, higher natural gas prices, and higher refining spreads. Revenue growth, combined with operating leverage, as many costs are fixed, allowed TotalEnergies to see its profits and cash flow grow even more than that.

TotalEnergies’ cash flow from operations totaled a massive $17.8 billion during the period. Year to date, operating cash flows totaled $41.7 billion, which is equal to 56 billion annualized. Capital expenditures, both for growth and for maintenance, need to be subtracted from that to get us to free cash flows. Based on year-to-date capital expenditures of $12.5 billion, TotalEnergies is on track to deliver free cash flows of $39 billion this year.

This is cash that can be used in several ways. Acquisitions are a possibility, while shareholder returns via dividends and/or share repurchases are another way for companies to employ their free cash flows. Last but not least, free cash flows can also be utilized for debt reduction. TotalEnergies chose a mix between shareholder returns and debt reduction so far this year, and TotalEnergies also spent a smaller amount of cash on acquisitions ($1.7 billion in Q3, mainly due to the purchase of a 50% stake in Clearway Energy (CWEN)).

One year ago, TotalEnergies had a net debt position of $24.3 billion. At the end of the third quarter of the current year, that net debt position has shrunken to just $5.0 billion. That is equal to just 1.5 months worth of free cash flows, and pencils out to a leverage ratio (net debt to EBITDA) of just 0.07. That can be called a very conservative leverage ratio, meaning TotalEnergies has a great balance sheet. For comparison, its peers Chevron and Exxon Mobil have net debt to EBITDA ratios of 0.12 and 0.14. In other words, TotalEnergies employs just half the debt its American peers employ, and even those have pretty strong balance sheets already.

TotalEnergies might decide to reduce its net debt to zero, although that is not really necessary. But even if the company were to do that, that would require just one quarter, as TTE has been reducing its net debt by $4.8 billion per quarter over the last year. This brings up the question of what TotalEnergies might do one quarter from now, when its net debt will most likely be very close to zero, at which point further balance sheet strengthening does not seem very value-creating any longer.

Increased shareholder returns would be an obvious choice. Right now, TTE pays out €0.69 per share per quarter in dividends, which pencils out to a dividend yield of 4.8% at current prices. That dividend costs the company around $7.2 billion per year. TotalEnergies will likely generate free cash flows of $39 billion this year, assuming that 2023 will not be as strong, let’s go with $35 billion in free cash on a forward basis. With $7 billion needed for the dividend, TotalEnergies has thus $28 billion of surplus free cash flow. The company has spent $2 billion on buybacks in each of the last two quarters, which pencils out to $8 billion annualized — which makes for a solid 5%-6% buyback yield. But even if those buybacks are maintained, TTE would have $19 billion left over in additional free cash over the next year (already assuming that the next twelve months will not be as good as the last twelve months, as noted above). With just $5 billion needed to bring the net debt position to zero, TotalEnergies clearly has massive room for even higher shareholder returns, and/or for more M&A spending. As long as TTE can find attractive takeover targets, M&A could be a good idea. But it is far from guaranteed that compelling targets can be acquired, and spending cash on acquisitions without looking at valuation makes no sense. Thus TTE might be forced to spend more on buybacks. Since TotalEnergies’ shares can be acquired at a free cash flow yield of more than 20% today, buybacks seem like an opportune and value-creating way for TTE to deploy its surplus cash flows. Buybacks will also make the dividend more secure, as a lower total amount of dollars is needed to maintain the dividend at the current level when the share count keeps declining.

TotalEnergies: A Great Value Versus Its American Peers

Based on this year’s expected free cash flows of $39 billion, TotalEnergies is valued at just 3.8x FCF. That pencils out to a free cash flow yield of 26%. Even when we go with a reduced $35 billion FCF estimate, the free cash flow yield is still great, at 23%. TotalEnergies’ peers Chevron and Exxon Mobil trade at 2022 free cash flow yields of 11% and 13%, respectively, right now. In other words, TTE’s free cash flow yield is roughly twice as high as that of its American peers. And that holds true despite the fact that TotalEnergies has a stronger balance sheet, as noted above. Not surprisingly, TTE also offers the higher dividend yield, as its valuation is so low, at 4.8%, while XOM and CVX trade with dividend yields of slightly more than 3%.

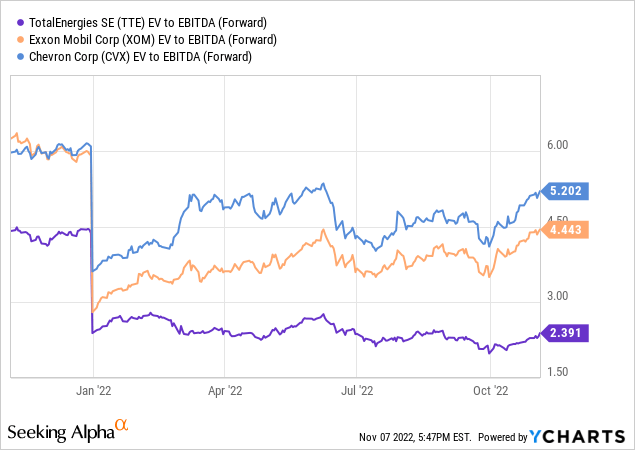

Last but not least, TotalEnergies also looks very inexpensive on a EV/EBITDA basis:

TotalEnergies could see its share price double, and it would still trade at a small discount compared to the average of Chevron and ExxonMobil. Both on an absolute basis and on a relative basis, TTE is valued extremely inexpensively right now. That is, I believe, to a large degree the result of it being a European company that does not receive as much attention as its American peers.

Risks To Consider

Every stock has some risks, which also holds true for TotalEnergies. The company could be subject to a windfall profit tax in France/Europe, although it should be noted that similar taxes could also be coming to the US, thus TotalEnergies’ American peers are not necessarily safe from such measures.

TotalEnergies also is the target of strikes from time to time, which leads to production declines at its refineries, for example. It should be noted that those strikes help keep crack spreads elevated, which is a tailwind for TTE. This is why the company has done very well in the last couple of quarters, despite strikes. There is no guarantee that this will hold true in the future as well, but it is at least worth noting that strikes are not necessarily resulting in major losses for the company.

Takeaway

The environment for energy companies is excellent. All energy companies benefit from that, but not all are attractively priced to the same degree. I believe that TotalEnergies is an outstanding value today among the supermajors. Not only does it trade at an extremely low valuation, but it also has the best balance sheet among them all, and its ability to return cash to its owners over the coming quarters is outstanding. It can make sense to take a look at international stocks instead of their American peers, and I believe TotalEnergies is one such choice at current prices.

Be the first to comment