Sean Gallup

Shopify Inc. (NYSE:SHOP) stock is down 73% this year as rising inflation and interest rates continue to weigh on its profitability. In the last couple of years, the company made noteworthy progress, aided by pandemic-related restrictions that pushed consumers in the way of e-commerce platforms while forcing business owners of every scale and size to cater to online shopping demands. When pandemic-related restrictions were lifted and in-store shopping habits returned to pre-pandemic levels, most e-commerce companies faced difficult YoY growth comparisons. In addition to this, the e-commerce market is having a difficult year with consumer spending slowing and costs rising. Given the current economic situation, Shopify may continue to struggle in the near term as its expenses rise at a time when consumers are limiting discretionary spending. In this analysis, Shopify’s business will be evaluated to determine whether investors should jump on board in light of certain strengths of Shopify that are coming to light.

Bulls will focus on Shopify’s business model

Although the e-commerce market is facing a bleak outlook due to macroeconomic challenges, global e-commerce sales are expected to reach $8.1 trillion by 2026. The popularity of online shopping and the importance of having an online presence for merchants is not going away anytime soon. Online stores enable merchants to sell products across borders, increasing their potential market opportunity exponentially. Setting up an e-commerce store, on the other hand, is a complicated and time-consuming process for the average merchant. Shopify assists merchants in starting an online store from the ground up by providing all the tools required to launch, market, and scale up their brand.

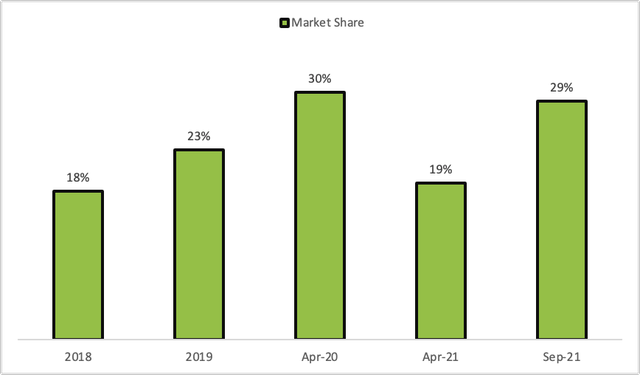

Despite a sluggish period of economic growth, Shopify continues to make tremendous progress by providing small business owners with various tools and services to create and manage online storefronts. The company is a powerful e-commerce builder, with a reported 29% market share of e-commerce sales software.

Exhibit 1: Market share of Shopify in the United States from 2018 to 2021

Shopify also has an advantage over large retailers such as Amazon.com, Inc. (AMZN) because it provides tools and services that enable businesses to engage consumers across multiple sales channels such as online marketplaces, brick-and-mortar stores, and direct-to-consumer websites, allowing businesses to build long-term relationships with their clients that are not limited to just one platform or product.

Shopify continues to look for partnerships that add value to their customers, which is a characteristic loved by Shopify users. The company’s strategy is to offer value-added services to enhance the user experience to a degree that helps the company enjoy long-lasting competitive advantages over its closest rivals. Shopify has partnered with Global-e Online, a provider of software solutions including payments, multi-lingual checkout, logistics and shipping, and local duty and tax calculation for cross-border e-commerce businesses. Shopify also took a 6.5% stake in Global-e Online before its initial public offering in mid-2021. The partnership benefits Shopify because merchants who build their storefronts on Shopify can now go international with the help of Global-e services, which removes many of the obstacles that come with international online retail.

Shopify reported third-quarter earnings on October 27, reporting a narrower-than-expected loss and revenue that exceeded Wall Street estimates, prompting a 17% increase in Shopify stock. The company’s revenue increased by 22% YoY to $1.37 billion, exceeding analyst expectations by $30 million, but the company stated that the strong US dollar hampered its sales. Meanwhile, the company reported a loss of 2 cents per share, compared to the expected loss of 7 cents. Revenue from Subscription Solutions increased 12% YoY to $376.3 million, while revenue from Merchant Solutions increased 26% to $989.9 million. Furthermore, gross merchandise volume (GMV), or the total value of orders processed on the platform, increased 11% to $46.2 billion, while gross payments volume (GPV), or GMV processed through Shopify Payments, increased to $25 billion, accounting for 54% of total GMV processed in the quarter. The growth was driven by the strong GMV penetration of Shopify Payments, as well as the contribution from Deliverr, an e-commerce shipping company that Shopify acquired earlier this year for $2.1 billion.

Shopify has been increasing its spending for new investments and acquisitions to improve its logistics network and expand globally. Concerns have been raised about the company’s growth strategies; however, these are likely to create value for long-term shareholders. Shopify Fulfillment Network aims to simplify logistics and will support two-day delivery across the United States, potentially increasing conversion rates by more than 30% for some merchants. SFN reported strong third-quarter momentum, with the number of merchants using at least one logistics service increasing 80% sequentially and fulfilled orders increasing 450% from the previous year across both Shopify and partner-run facilities. The company now intends to merge Deliverr and SFN, with the first SFN warehouse fully integrating Deliverr’s logistics software. With the addition of Deliverr, Shopify’s Fulfillment Network may attract more merchants. The number of merchants with inventory received into Deliverr cross-docks increased by 75% YoY in Q3 as well.

Shopify continued to bring adjacent services to new markets in Q3, introducing Shopify Markets Pro, which enables merchants to enter 150+ markets overnight by removing operational hassle to make easy entry and expansion in international markets. In Q3, Shopify Payments was launched in Finland, the Czech Republic, Switzerland, and Portugal, bringing the payment processing service to 22 countries. After launching Shopify Capital in Australia in Q3, the company extended financing in four countries and introduced its point-of-sale platform in Singapore and Finland, bringing the total number of countries where Shopify POS is available to 14.

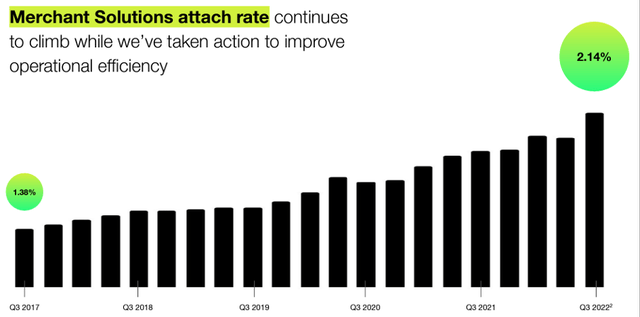

The attach rate for merchant solutions has been steadily increasing and is likely to continue to rise with the company improving its operational efficiency.

Exhibit 2: Merchant Solutions attach rate

Shopify still has room for growth, and if the company can keep costs under control, Shopify may find it possible to maintain its market leadership and return to profitability sooner than expected.

Bears will focus on rising costs

As of September 30, the company had $4.9 billion in cash, cash equivalents, and marketable securities. The company currently has enough cash to fuel its expansion; however, it still needs to improve its operations meaningfully to enjoy positive operating cash flows amid current challenges, which means future cash burn is likely.

Total operating expenses increased by more than 43% YoY in Q3, with the company ramping up its marketing budget while incurring higher R&D costs and administrative expenses. For years, Shopify has been reliant on aggressive marketing to lure and retain customers, which is nicely explained by fellow Seeking Alpha contributor Albert Lin, CFA in his recent article on the company. At a time when global economic growth is tipped to remain sluggish in the foreseeable future, Shopify’s return on marketing investments are likely to be lackluster, which paints a bleak outlook for what the short-term future holds for the company from an operating margin perspective.

The company anticipates that its operating expense growth rate will “sequentially decelerate” in the fourth quarter compared to the third quarter and that its GMV growth will outperform the broader U.S. retail market. Analysts anticipate that Shopify’s losses will narrow in 2023 as well.

Takeaway

Shopify has established itself as a market leader in the e-commerce software field, and its recent financial results indicate that it is well-positioned to grow. However, growth is contingent on consumer spending recovering. In terms of competition, the company’s platform has high switching costs because of the range of tools and services it provides to its customers. Shopify’s growth accelerated significantly in 2020 as retailers sought its services to sell products online; however, growth has slowed in 2022 as retailers struggle to deal with softening consumer demand amid an inflationary environment. Despite economic uncertainty, Shopify’s management has continued to invest in expansions. In the short run, continued investments including marketing spend is likely to negatively impact the company’s profitability, and thereby its market value. In the long run, however, strategic expansions and innovative product launches could help Shopify earn sustainable earnings.

Although Q3 earnings suggest Shopify could be turning a corner because of strong topline growth momentum in GMV growth, investors should be careful with Shopify because of the volatility in business that can be expected in the coming quarters. I’ve always found Shopify to be richly valued in the past, and despite losing more than 70% of its market value this year, I still do not believe the risk-reward profile is attractive enough for me to consider an investment in Shopify today.

Be the first to comment