bennymarty/iStock Editorial via Getty Images

Introduction

This is the fifth article of a series I am writing to cover the truck and buses industry. It all started by dealing with the three most recent spin-offs among European manufactures, to see the reason behind them and to begin considering the development of these companies. We saw that the main driver of these moves was to make these companies more focused on their own results, with the need to grow their margins. Daimler (OTC:DTRUY) showed that it currently is in the mid-range of the industry regarding margins and wants to reach the low double digits within 3 years. Lagging behind are Traton (OTCPK:TRATF) and, further back, Iveco (OTC:IVCGF), a strong European player that lacks worldwide scale and that I see as the most probable company to be bought by its peers or to undergo an M&A operation. Then we turned to Volvo Group (OTCPK:VOLVF) that proved to be quite ahead of its peers, with a management team that was able to forecast before other some of the current headwinds, thus taking decisions that made Volvo Group the company that has seen its margins constant. Now it’s time to look at the American manufacturer PACCAR (NASDAQ:PCAR), a company that designs and manufactures light, medium and heavy duty commercial vehicles sold worldwide under the Kenworth, Peterbilt and DAF brands.

A Look At The Past

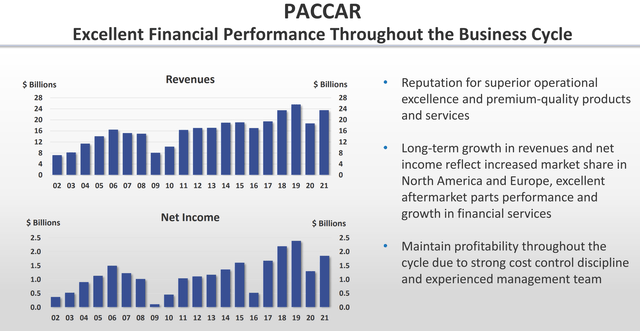

PACCAR proudly states that in the past 83 years it has achieved a net profit. Along with this, it is used to provide to investors charts and data that reach out far more into the past compared to what many other companies from this sector and others usually do. This helps investors have an overall idea of a business that is clearly cyclical and will have its ups and downs more or less when the economy either slows down or heats up.

Paccar 1Q 2022 Investor Presentation

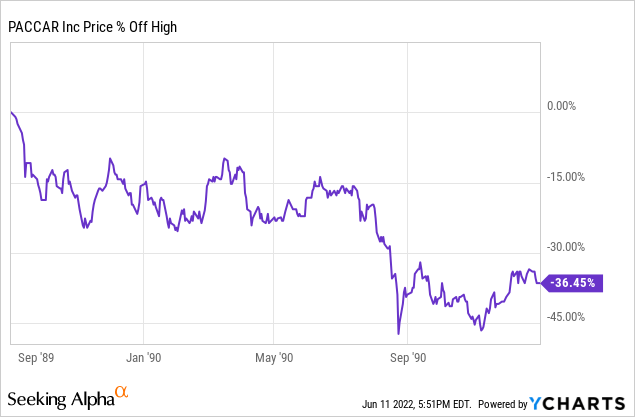

I checked to see if the stock price had a certain correlation with these charts and I found out something interesting. First of all, I took a look at what happened to the stock during the last two major US recessions apart from the 2020 one. In 1990 the stock fell as much as 45% from its highs.

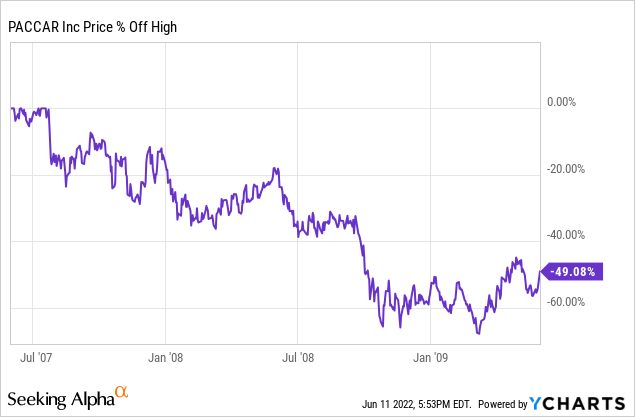

During the Great Recession that followed the financial crisis, the stock had a major downfall that brought it 60% down from its peak, following the trend of its revenue and its net income.

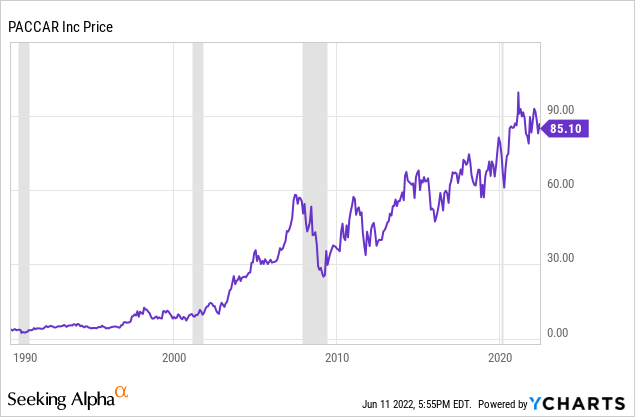

Let’s now zoom out and see how these two recessions look on the price chart. The first one is barely visible, the second one is still quite clear, as it is clear that PACCAR did recover and then grew another 50% from its highs before the 2008 recession. True, many stocks performed much better than this, but, given the industry PACCAR is in, its past performance suggests that the company’s growth keeps on driving the stock price, too. We can also notice that whenever net income drops, the stock price drops along with it, as it happened between 2015 and 2016 at the end of a difficult cycle for many industrials. It may sound a bit obvious, but in today’s market it is not as usual as before to see stock performance so clearly linked to their fundamentals.

Financials

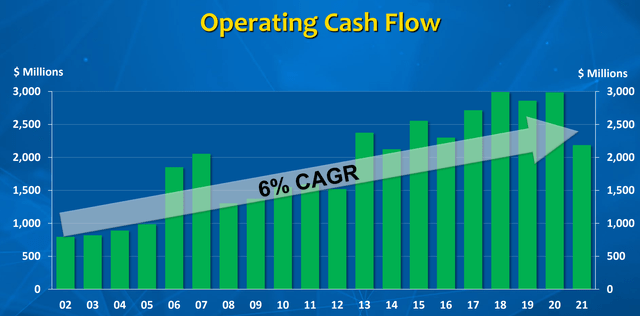

PACCAR’s fundamentals are solid, and they show a mature business that steadily keeps on improving and become more profitable at a stable place. If we look at PACCAR’s financial history through on Seeking Alpha we see, for example, that in the past 10 years its total revenues grew at a CAGR of 3.3% with operating income growing a bit more at a CAGR of 4% and net income increasing at a CAGR of 5.2%. These numbers show us that as revenues grow, the company was also able to manage its costs and its efficiency by becoming more profitable with a pace that is faster than its top line growth. This is a sign of good management. Finally, I would like to show a chart about PACCAR’s operating cash flow over the past ten years with an even better 6% CAGR. With capex decreasing over the past ten years at a CAGR of 1%, we have a company that year over year grows its free cash flow. Nowadays, with interest rates hikes and very volatile markets, companies that can assure stable and growing cash flow are deemed to be sought after by investors, who are turning away from companies with no profits and future prospects of growth to companies with lots of free cash flow.

Paccar 2022 Investor Conference Presentation

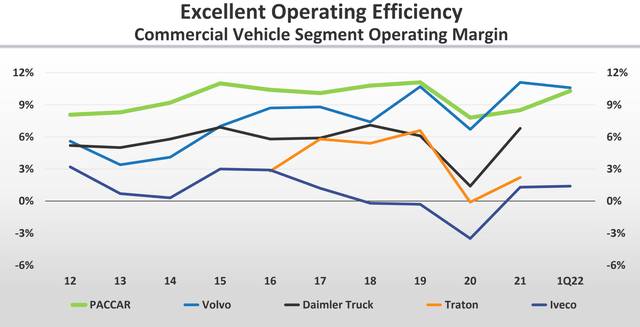

Free cash flow can’t be achieved without cost control. PACCAR itself highlights its operating efficiency through this chart that compares it to the other major player of the industry that I have already covered. Through our comparison we already knew the results, but this chart shows it clearly enabling us to highlight both PACCAR’s stable efficiency and Volvo’s efforts that led it to catch up with it and even surpass it from the pandemic onwards. We also see that truly Iveco still has real operating margin problems alongside with Traton, while Daimler seems to be somewhat in the middle and may actually be able to close the gap with the industry leaders in the next years.

Paccar 1Q 2022 Investor Presentation

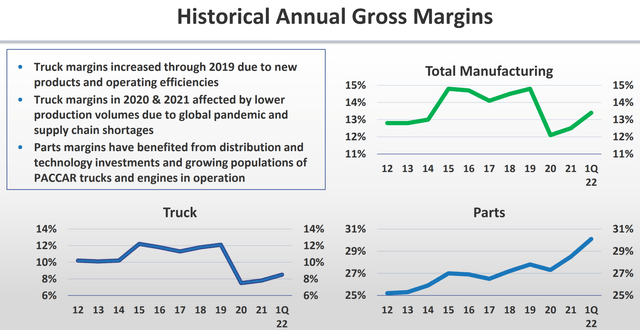

We can’t look at PACCAR without mentioning its outstanding results in the spare parts division, which, in fact, is driving higher the company’s profitability as a whole.

Paccar 1Q 2022 Investor Presentation

From the charts above, we see that as the trucks sold volume decreased during the pandemic, so did margins. However, spare parts kept on growing and actually saw demand and margins spike up in the past two years. With deliveries that can’t satisfy totally the great demand for trucks, I expect the truck fleet age to increase, which will lead to even greater demand for spare parts. PACCAR is poised to benefit greatly from this trend, as it has been investing constantly on building an efficient dealer and distribution network with high results in customer satisfaction regarding the availability of spare parts.

During the 1Q 2022 earnings release PACCAR showed that new deliveries in the U.S. decreased to 20,700 vs. 23,000 last year while Europe increased to 16,100 vs. 13,700 in 2021. The rest of the world totaled 5,500 vs. 6,200 in 2021. The total is 43,000 new deliveries vs. 42,200 in 1Q 2021. However, while deliveries grew by 1.9%, the revenue increased in every region for a total of $6.5 billion vs. $5.8 billion in 2021 for a 10.7% increase. This is a sign of PACCAR’s ability to increase prices without losing orders. Not by chance, gross margins increased to 13.4% during the quarter.

The guidance for the next quarter is between 44,000 and 48,000 deliveries. PACCAR’s backlog covers the rest of 2022 and the company is showing that it has its supply chain under control. In fact, as it reported during its 1Q 2022 earnings call it had about 3,000 unfinished trucks at the end of 2021, and it has now been able to deliver them, while ending the quarter with another 3,000 units to be finished. This shows some stability, and it can make us sure that the deliveries’ goal for 2Q will be reached.

One final note. PACCAR has no manufacturing debt (it does have other liabilities, though) which enables its credit ratings to be in the A+/A1 range.

What About Electric Trucks?

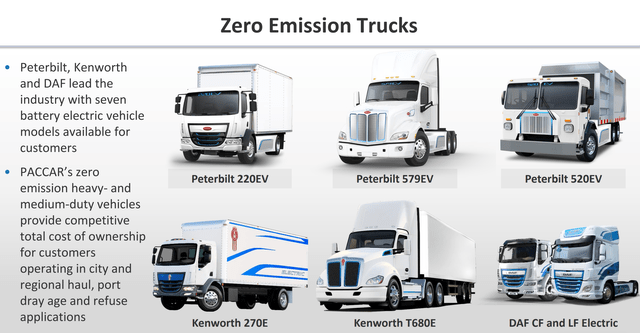

Together with the other major players, PACCAR is committed to producing zero emission trucks, which, with fuel prices soaring, are seeing ever-increasing demand. PACCAR already has a range of seven models that are already available for customers and will deliver them this year in the hundreds, expecting to reach the thousands by next year.

Paccar 1Q 2022 Investor Presentation

I think that the truck industry has not seen a disruptive move like Tesla’s (TSLA) in the auto industry, where it anticipated by about a decade the EV trend. Here, all the major players made themselves ready for these kinds of products and started building and selling them over the past two years, already guiding to deliver them in the thousands by 2023. These are real trucks that are on the road and that work, with companies behind them that have a long experience in the industry and know all the other aspects of it besides the kind of engine that moves the vehicles. In addition, the company is also one of the leaders in developing autonomous trucks.

Valuation

PACCAR trades at a premium compared to Volvo and Daimler, with a fwd PE of 11.83 vs. the 9.5 the other two have. Its fwd EV/EBITDA is, on the other side, quite higher than all the other competitors with a 12 compared to Volvo’s 6.9 and Daimler’s 7.1. I think the premium is due to two main reasons. First of all, PACCAR has a long history of reliability, the second one is that the company is well known in the U.S., attracting more investors than the European competitors. I see more opportunity in Volvo Group right now, since it has pretty much the same margins PACCAR has, but I still think PACCAR is a buy that will reward investors looking to earn profits from the current freight surge.

I ran my discounted cash flow model to reach a potential target price and I used the following parameters: a discount rate of 8% that I am using for a lot of industrials in this period, an expected perpetual growth rate of 2% over the next decade with margins conservatively expected to be around 10% (PACCAR is usually above this). In a base scenario, the price I reach is $115 which gives us around a 27% upside from today. In a bear scenario, the stock is still valued $91, a little above today’s current prices. Since we are in a bear market, I think the stock is proving to be quite stable and that it has a margin of safety that should be considered. I rate it a buy.

Conclusion

Long term freight growth, high industry margins, very strong and reliable revenues from spare parts, electric trucks already on the road, and a fair share price are all factors that make me rate PACCAR as a buy.

Be the first to comment