zim286

Investment Thesis

Leidos Holdings Inc. (NYSE:LDOS) has a consistently profitable top and bottom line profile that is maintained since 2013. It is also positive in cash flow. From this perspective, it suggests its profitability is sustainable over the long run.

The company’s balance sheet is also decent with a healthy level of cash and working capital since 2013 on an annual reported basis. However, the company is progressively accumulating huge amounts of debt, which is currently close to 4 times its EBITDA.

In terms of key financial comparisons with competitors, LDOS does not seem to have a competitive advantage even when compared to peers with comparable market capitalizations.

Qualitative comparisons of LDOS’s business do not suggest a compelling competitive advantage over other major military contractors.

The price is currently overvalued. Investors who are compelled to buy LDOS stock should wait for the price to retrace to the calculated intrinsic value of around $70 since this price was also technically tested in 2020 to be a strong horizontal support.

Company Overview

LDOS provides technical services and solutions to numerous government agencies and highly regulated businesses, including the British Ministry of Defense, the U.S. Department of Defense, and the Intelligence Community. The areas of focus are cybersecurity, complex logistics, energy, and health as well as intelligence and surveillance.

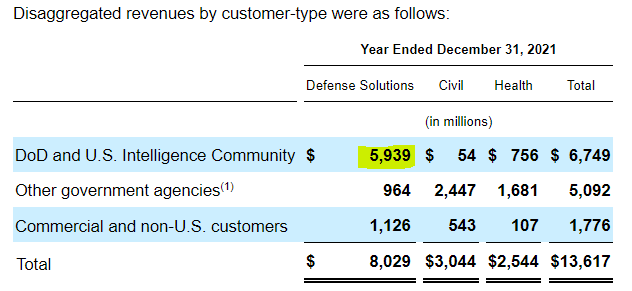

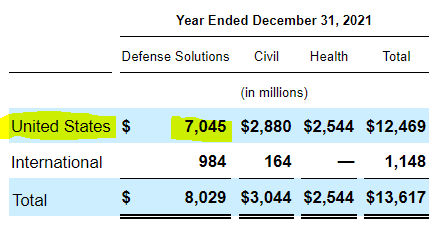

While the company has businesses in both the government and commercial segments, it derived most of its revenue by providing “Defense Solutions” to the Department of Defense and Intelligence community:

Revenue Segments (Annual Report)

These solutions are largely provided in the United States:

Revenue by Geography (Annual Report)

Income Statement Analysis

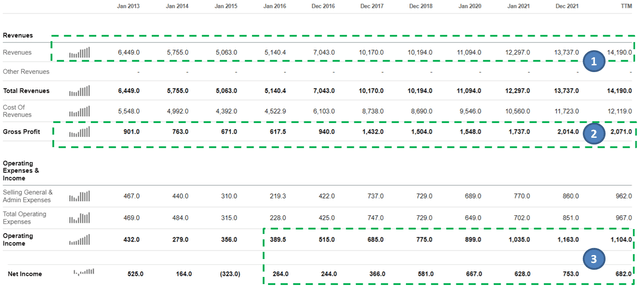

We will look at some key financial figures from Seeking Alpha’s Income Statement to get some insights:

Income Statement (Seeking Alpha)

Here are some observations:

- LDOS has had a favorable rising top line since 2016. The YoY growth is more than 10% in most years.

- The cost of revenue has been kept low enough for the top-line growth to trickle down to its gross profits, allowing the company to maintain a gross margin of 12% to 15%.

- Operating costs are also kept relatively low. The bottom line of operating and net income has been consistently profitable since 2016.

Overall, at one glance, quantitively, the company is running a very profitable business that looks likely to be sustainable.

Balance Sheet Analysis

We will look at some key financial figures from Seeking Alpha’s balance sheet.:

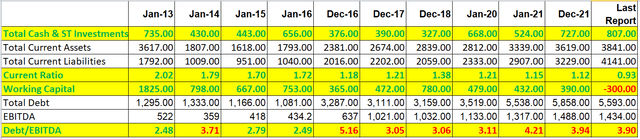

We can observe that:

- The LDOS has consistently maintained a positive amount of liquid assets (Cash and ST investment) since 2013.

- Its current ratio is greater than 1 since 2013 to the latest reported year of Dec-2021 meaning it has maintained a positive working capital, which is a good sign.

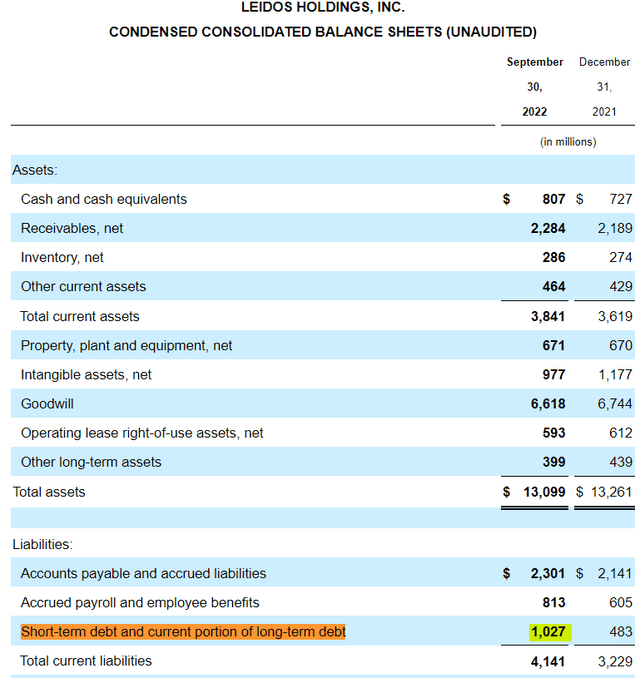

- Right now, we observed the working capital at the ‘Last Report’ period became negative for the first time due to a spike in total current liabilities.

If we infer from the latest quarterly report, this is due to a spike in short-term debt incurred in Q3 2022:

Balance Sheet (quarterly report)

The annual report for the whole financial year of 2022 has not been released yet. Investors need to observe whether the company will end the year 2022 with an overall positive working capital.

Generally, in terms of debt management, the company has been operating with increasing amounts of debt. But how much debt is considered too much? In the table, I benchmarked the Total Debt against its EBITDA and considers a debt level that is more than 3 times its EBITDA to be unacceptable in the long run. LDOS’s Debt/EBITDA has been higher than 3 in most years since 2014.

Investors need to consider whether this unhealthy level of debt is sustainable in the long run.

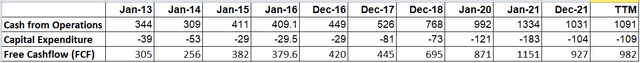

Cash Flow Analysis

From Seeking Alpha’s Cash flow statement, we can observe that the company has a very healthy free cash flow profile that is on a generally increasing trend.

Cash Flow Profile (Seeking Alpha)

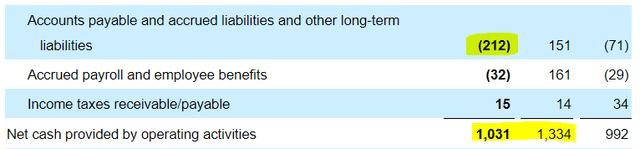

There is a decrease in the cash flow from operations (Jan-21 to Dec-21) due to a significant increase in accounts payable according to the latest annual report:

Account Payable (Annual Report)

Since the accounts payable are not consistently increasing and relatively small with respect to the amount of cash LDOS has on its balance sheet ($212M vs $727M), this is not a concern in terms of cash flow management.

Competition

The company has a significant number of competitors. From the latest annual report, these are the specific companies that the company stated that it competes with:

We believe that our principal competitors currently include the following companies: Amentum Services Inc., Booz Allen Hamilton Inc. (BAH), CACI International Inc. (CACI), General Dynamics Corporation (GD), Jacobs Engineering Group Inc. (J), KBR Inc. (KBR), L3Harris (LHX), Lockheed Martin Corporation (LMT), ManTech International Corporation (Acquired by Carlyle Group), Northrop Grumman Corporation (NOC), Raytheon Technologies Corporation (RTX), SAIC (SAIC) and Peraton.

Among the competitors, companies like LMT and RTX are by far the largest competitors with a market capitalization in the hundredths of billions range. LDOS is only about $13B in market capitalization.

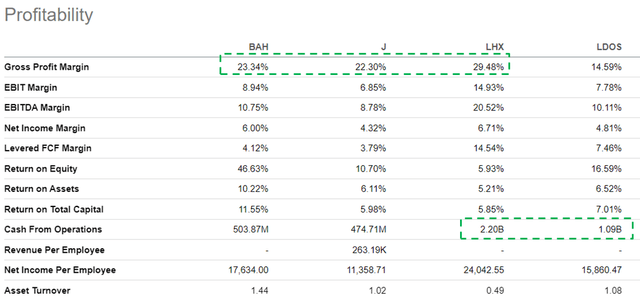

Hence we shall compare LDOS’s financials with competitors which are comparable in size:

- BAH – $12.45B in market capitalization

- J – $15.45B in market capitalization

- LHX – $36.74B in market capitalization

- LDOS – $13.06B in market capitalization

Profitability Figures (Seeking Alpha)

We can observe that:

- In terms of top-line gross margins, LDOS is visibly lagging behind its other 3 peers in the comparison list.

- As we drill down to the bottom line EBIT, EBITDA, and net income margins, LDOS is at most on par with other competitors. While it is not significantly lagging behind, there is no visible advantage that can be observed.

- LDOS’s cash flow from operation is $1.09B, which is significantly higher than BAH and J, although it is still dwarfed by LHX’s $2.20B.

Overall, in my opinion, LDOS’s competitive advantage with respect to its competitors is mild or non-existent.

No Distinctive Offerings Compared To Larger Competitors

The US department of defense (DoD) enlists a long list of contractors to help maintain its status as the strongest military in the world.

Wikipedia provides a list of the largest defense contractors working for the DoD, ranked by their “Revenue from Defense” in 2020. The Top 3 in the lists are clearly LMT, RTX, and BA. Their revenue from defense is more than $30B. As reported in the last annual report, LDOS’s revenue from providing defense solutions is just $7B.

In terms of products and services offering, LMT, RTX, and BA have easily identifiable products and/or services that are unlikely to be replaced:

According to BA’s company website the company owns key products of commercial jetliners for decades. Such products include the 737, 747, 767, 777, and 787 families of airplanes, including the Boeing Business Jet range. In terms of military assets, it also manufactures the A-10 Thunderbolt, F-18 fighter jets, and Apache assault helicopters that are highly sought after by the DoD and other US allies. These are high-profile military assets that are unlikely to be replaced by other competing companies in the near future.

For LMT, the most notable project is the highly anticipated development of the F-35 fifth-generation fighter jet, with a game-changing capability of taking off and landing on aircraft carriers and smaller terrains. According to this article by Forbes:

Some 20 years after their first appearance in the skies, fifth-generation fighters remain both the most advanced and rarest aircraft in service.

Only four models from three countries – the US’s F-22 and F-35, China’s J-20, and Russia’s Su-57 – have been officially introduced.

Since only a small handful of countries in the world have the technological capabilities to manufacture such forward-looking fifth-generation fighter jets, most of America’s allies will likely become long-term “buyers” from LMT instead of competing with it. This presents a very large addressable market that is unlikely to be replaced by foreseeable future competitors.

RTX is known for providing the DoD with the Patriot Missile. It is a widely used anti-aircraft system with limited capability against tactical ballistic missiles. It is also popular with America’s allies:

Patriot systems have been sold to the armed forces of the Netherlands, Poland, Germany, Japan, Israel, Saudi Arabia, Kuwait, Taiwan, Greece, Spain, the United Arab Emirates, Qatar, Romania and Sweden.

RTX also contributed significantly to the F-35’s development:

Raytheon Missiles & Defense makes the precision weapons it uses for air-to-air combat and air-to-ground strikes. And Raytheon Intelligence & Space makes a navigation system that helps it land on aircraft carriers and austere airfields.

In comparison, LDOS does not have a distinctive suite of products offering that the DoD cannot replace with other competitors. As this article from “FedSavvy Strategies” noted:

The company has made several acquisitions since its creation, the most consequential of which was their purchase of Lockheed Martin IS&GS business unit in 2016, which doubled the size of their business and created the core of Leidos as we know it today.

In my opinion, the main strategic significance of the acquisition of LMT’s IS&GS business unit in 2016 is to allow LMT to outsource this lower-valued business and focus more on its core ‘irreplaceable’ business offering (as described earlier). LDOS might have gained some benefits but in the long run, LMT will benefit more.

Instead of acquiring the capabilities to develop irreplaceable products and services that the DoD relies on, the LDOS appears to be serving larger peer companies to their long-term advantage.

Generally, in my opinion, the DoD depends on a few major military contractors to maintain and expand America’s global military dominance. These major contractors include LMT, BA, and RTX, among others. To ensure these major contractors can perform with maximum efficiency, these major contractors need to outsource their relatively lower-value operations to smaller, minor contractors.

LDOS appears to be one of these minor contractors that provides products and offerings that are easily replaceable by other minor contractors. As such, I do not perceive LDOS to have a significant competitive advantage.

Risk

LDOS may appear to have a relatively decent profitability and cash flow profile, but comparatively, when compared to peers of similar market capitalization, it does not seem to have a significant financial advantage.

The company acknowledged in its annual report that it also competes with much larger companies like LMT and RTX. Therefore, if it does not even have an edge against competitors that are similar in size, I have reservations about whether LDOS is able to compete effectively with other much larger players in the market.

The company appears to be consistently accumulating a large amount of debt with respect to its EBITDA. Investors should watch whether this debt level will go out of control in the long run.

Valuation

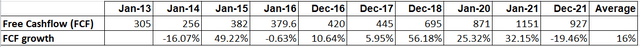

We will calculate the intrinsic value of the company using the Discounted Free Cashflow model. Also, as discussed in the earlier sections, I perceived LDOS to face significant competition from other larger peer companies with a minimal competitive advantage.

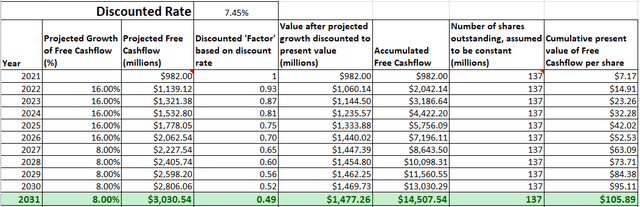

Hence, I will only use a 10-year timeframe (as opposed to the usual 20-year) in the calculation with the following assumptions and values:

- The last reported ‘Total Common Shares Outstanding‘ is 137M.

- The last reported ‘Total Cash & ST Investments’ is 807M.

- The last reported ‘Total Debt’ is 5,593M.

- The latest Free Cash Flow during the TTM period is 982M (as calculated in the “cash flow analysis” section.

- The discount rate is estimated to be 7.45%, taken from the WACC value.

- The company has been growing its FCF at an average of about 16% per year since 2013. We will assume that it can maintain this growth for at least the next 5 years:

Free Cash Flow (Seeking Alpha)

- For the next 5 years, we assume the company’s growth in FCF tapers to just half at 8%.

Intrinsic Value (Calculated by Author)

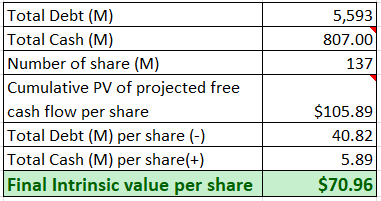

Based on the above inputs, the present value (“PV”) of the projected Free Cash Flow per share for LDOS is $105.89.

Taking into account the total debt and cash that the company is holding, the final intrinsic value is about $70.96.

Intrinsic Value (Calculated by Author)

At the current price of $96, LDOS’s share price is currently overvalued and selling at a premium of about 35% (96/70.96 -1).

Conclusion

In my opinion, LDOS is at most a decent investment (Not a compelling one). While it does has a proven track record of being consistently profitable, its margins pale in comparison to peers of similar size.

The company is also competing with much larger peers like LMT and RTX and so I would consider it a compelling investment only if it can demonstrate that it can at least rise above other smaller competitors in terms of margins. Right now, this is not happening yet.

The company is currently overvalued as discussed earlier with an intrinsic value of around $70. At this level, we can observe that it was tested and rebounded strongly in Mar 2020.

Hence investors who are compelled to buy LDOS as an investment should wait for the price to retrace to this support level before adding a position.

Be the first to comment